Use NPV for cost analysis. Compare negative NPVs, does it make sense?

Hi all, not super sure this is the right forum, but RE guys are used to NPVs, so I figured out this would be the right place to ask.

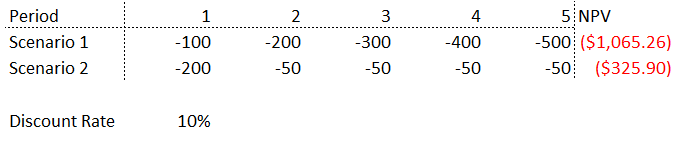

So I am trying to compare 2 options:

option 1: buy a commodity every year for 5 years.

option 2: develop a project to produce this commodity (same quantity as Scenario 1) instead of buying on the market.

The NPV analysis will always give negative numbers, since I will be using for commodity for myself in both options, so there is no possibility for positive cash flows.

The objective is to demonstrate the "savings" in costs as the difference between option 1 and 2.

Does it make sense to use a "negative" NPV analysis here? Basically the NPV becomes a cost analysis, the closer to 0 the better.

Thanks for any help :)

Vitae et qui hic nesciunt ipsum labore. Esse quasi fugit nesciunt qui. Placeat nihil voluptatem nam et ratione porro cumque.

Reiciendis aperiam nulla amet reiciendis doloremque repellat voluptas. Rerum molestiae praesentium et nemo.

Ullam vero maxime aut tempora. Modi quaerat est praesentium.

Nam in harum veritatis impedit tempore magnam. Corporis labore est amet repellat suscipit. Optio neque nemo quasi. Vitae voluptates et in voluptate impedit veniam. Quisquam accusamus mollitia accusamus eius officiis. Dignissimos soluta doloremque eius libero ut.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...