Resume Help Needed

Hi Everyone!

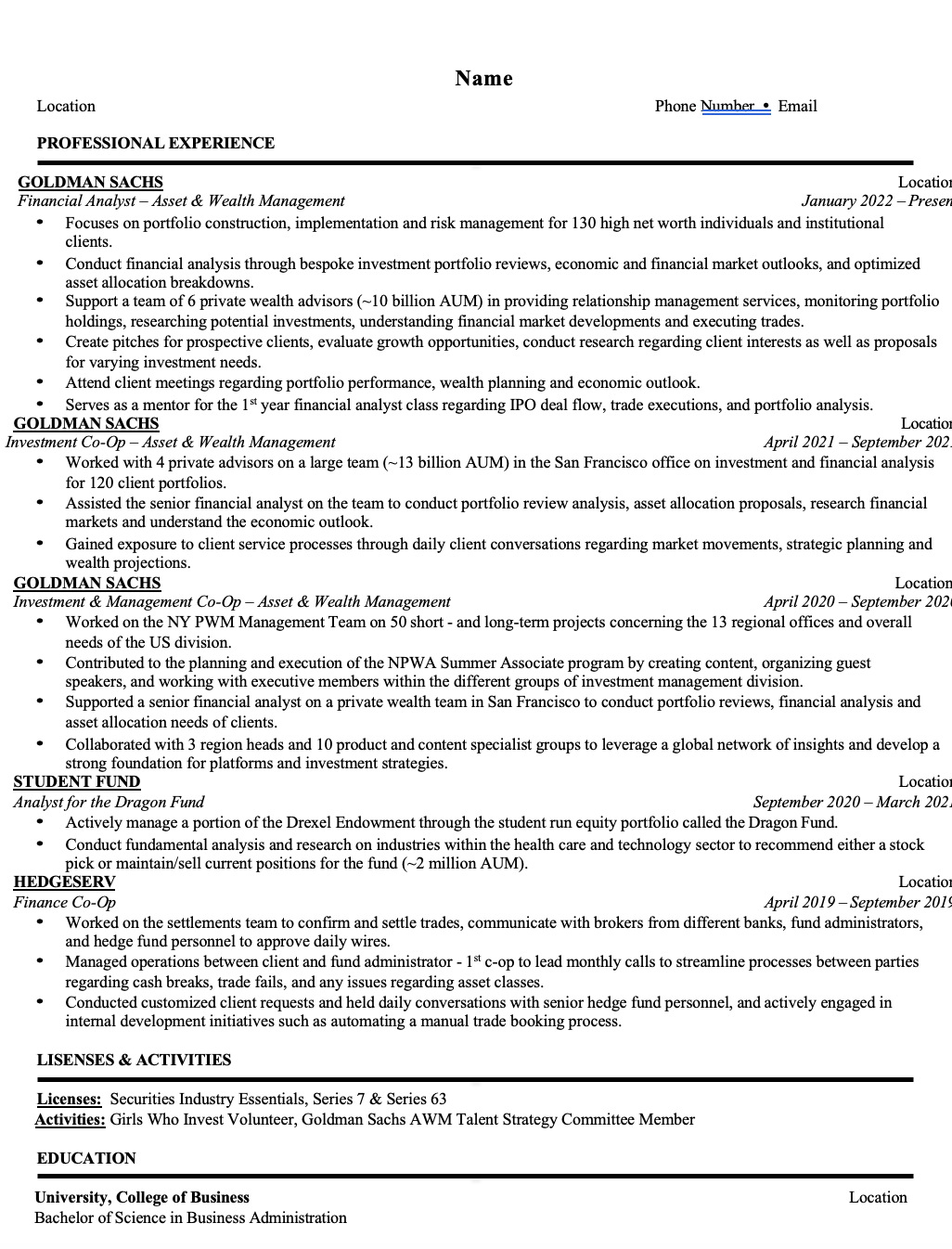

I am looking for advice with my resume. I am getting ready to apply to different roles. I have two years of experience in the Investment Management industry and looking to make a shift into investor relations, pe/vc (tricky without IB experience), or stay in investment management. I am also open to other roles!

Also my GPA in college was 3.91 (should I include that?)

Thanks in Advance!

Ah, swinging from the investment management vines to the investor relations or PE/VC trees, are we? A 3.91 GPA is like a shiny banana in the bunch – definitely worth flaunting on your resume! Here's why:

Now, for the shift you're considering, here's a bunch of advice:

Remember, your resume is your ticket to the interview. Make it count! If you need more personalized advice, consider the WSO Resume Review service where professionals can give your resume the polish it needs. Good luck!

Sources: Should I include my GPA in my resume if it is not ideal?, GPA on Resume?

Ah, the classic conundrum of whether to flaunt that GPA or not! With a stellar 3.91, you should absolutely include it on your resume. It's a testament to your academic prowess and can give you a competitive edge, especially when you're aiming to transition into investor relations or venture into private equity/venture capital. Here's why:

Now, let's talk strategy for your pivot:

Remember, your resume is your personal pitch. It should not only reflect your past achievements but also your future potential. Good luck with your applications!

Sources: Should I include my GPA in my resume if it is not ideal?, GPA on Resume?

Culpa mollitia maiores provident ex provident ipsum non. Et perferendis perspiciatis optio quo optio sit impedit itaque.

Quisquam excepturi commodi omnis alias nulla corporis. Dignissimos omnis et alias velit aliquid. Iure fugiat est aut repellendus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...