Amortization of Intangible Assets

Refers to writing off non-physical (intangible) asset(s) over their useful life

What is the Amortization of Intangible Assets?

Amortization of Intangible Assets refers to writing off non-physical (intangible) assets over their useful life. It accounts for the consumption by the company that leads to a reduction in the value of assets over time. Amortization is an accounting technique used to reflect this decrease in value on a company's financial statements.

Both amortization of Intangible Assets and depreciation are non-cash expenses but differ in their application to the type of asset involved. Depreciation writes off the value of fixed (tangible) assets over time, such as Property, Plant, and Equipment, whereas amortization writes off intangible assets, such as Patents, Licenses, Goodwill, etc.

Earnings before interest, tax, depreciation, and amortization is often used as a gauge to measure a company's performance. The amount or the percentage of amortization is subjective due to the involvement of management and can vary in accounting and tax calculations.

The entire accounting, recognition, disclosure, and disposal of intangible assets except for goodwill generated during business combination falls under the International Financial Reporting Standards or IAS 38 - Intangible Assets.

These accounting standards were developed by the International Accounting Standards Board.

The goodwill that was generated internally is part of IAS 38 but is not recognized as an intangible asset as it is not a recognizable resource. In order to understand more about amortization, it is important to know what exactly an intangible asset is.

Key Takeaways

- Amortization gradually reduces the value of intangible assets over time.

- Depreciation applies to tangible assets, while amortization is for intangible assets.

- EBITDA includes amortization expenses in evaluating company performance.

- Intangible assets lack physical form and include patents, trademarks, and copyrights.

- Recognition criteria for intangible assets are strict and often exclude internally generated assets.

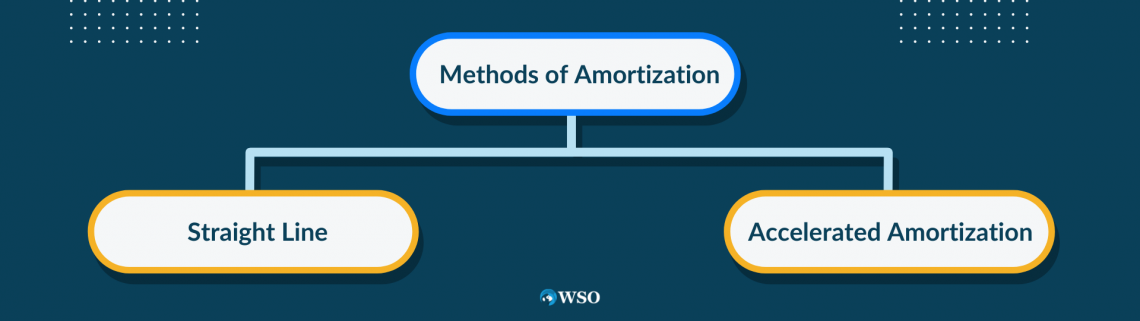

- Amortization methods include straight-line and accelerated, based on economic benefit patterns.

- Changing the useful life mid-use requires prospective adjustments in amortization.

Understanding the Amortization of Intangibles

An intangible asset is an asset without a material and solid form. According to IFRS, they are defined as identifiable monetary assets without physical substance and are identifiable when they are separable or arise from contractual or legal rights.

Though they cannot be touched or seen, these assets are of substantial value to a business. Some common examples are:

-

Licenses

-

Copyrights

-

Trademarks

-

Computer Software

-

Films

-

Import Quotas

Expenditure on these assets is recognized as an expense in the income statement unless it meets the criteria of IAS 38 for the recognition of intangible assets. The criteria are:

-

Firms can reliably measure their cost

-

Future economic benefits will flow to the entity as a result of ownership of the asset

It's worth noting that calculating the cost of internally generated intangible assets can be complex because of uncertainty about the economic benefits they will bring.

IAS 38- Intangible assets recognize that research and development expenses are accounted for in different ways by different firms. Research expenses, particularly those related to building internal brands, are usually treated as costs on the income statement. Development expenses, if they meet specific criteria, can be recognized as intangible assets; otherwise, they are expensed.

Internally generated assets like brands, customer lists, and goodwill are generally not recognized as intangible assets.

For companies involved in research and development, the end product is primarily a patent or license that will provide the company with a competitive edge. Costs incurred during the R&D phase are part of COGS (Cost of Goods Sold) on the income statement.

In accounting, when an intangible asset is first recorded, it's listed on the balance sheet at its initial cost. Over time, as the asset is used, it's recorded as "cost less amortization." In some cases, if there's a market for the asset, it can also be measured at its fair value.

Intangible assets with a defined lifespan are subject to amortization, which means their value decreases gradually over their useful life. Companies must also conduct annual impairment tests to ensure the assets' values are still justified.

Assets with an indefinite lifespan, on the other hand, are not subject to amortization but are still evaluated for impairment annually. If an asset is considered impaired, it means it no longer holds any future economic benefit.

Amortization Methods

An intangible asset can be classified in two ways:

1. Having an indefinite life:

An asset with an indefinite life is not amortized but checked for impairment annually. The best example of this is goodwill.

2. Having a definite life

Assets with a finite life go through amortization. For instance, if a company acquires a license with a 5-year usefulness, it amortizes the cost in the profit and loss account over those 5 years.

Calculating amortization involves three key factors:

1. Cost of the Asset:

The asset's cost in the balance sheet includes all direct expenses to prepare it for use. For instance, when purchasing a license, you add the purchase cost and transaction expenses. Internally generated assets also capitalize development costs meeting specific criteria per IAS 38.

2. Useful Life of the asset:

Determining an asset's useful life involves considering factors like:

- How often the asset will be used (daily, monthly, etc.)

- Lifespan of similar assets in similar industry

- Technical and commercial obsolescence

- How long the firm controls the asset (if there's a contract)

- Industry stability

- Expected changes in product demand and competitors' actions

- Maintenance costs to keep the asset operational (e.g., broadcasting rights)

3. Residual Value of the asset:

This represents the estimated value of the asset at the end of its useful life. It helps determine the annual amortization expense. The residual value of an intangible asset is usually assumed to be zero unless there is an agreement at the end of its useful life for repurchase by another firm. It is also sometimes referred to as the salvage value.

We can also determine the residual value by evaluating the transactions done by the firm holding similar assets in an active market or how much other firms are buying it for.

There are two primary methods of accounting for amortization:

1. Straight Line Method

2. Accelerated Method or Reducing Balance Method

Now let's take a look at the two methods and some examples that explain them.

Straight Line Method of Amortization

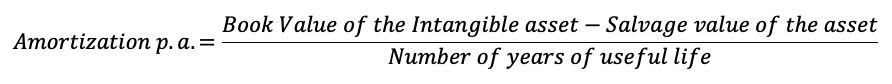

The straight-line method amortizes the intangible asset at a constant rate over its useful life. We assume that the organization is deriving equally distributed benefits over each year of consumption.

The amortization amount is equal each year, making this the simplest method for accounting for the asset's consumption. By dividing the cost of the asset minus the salvage value by the useful life in years, we get the amortization amount for each year.

Although companies prefer to follow this method because of its simplicity, it does not depict the annual variation in the economic benefits that the firm derives.

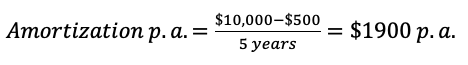

For example, a patent purchased on 1st Jan 2015 for $10,000 has a useful life of five years with a salvage value of $500 at the end of the 5th year. To calculate the amortization, we use the following formula:

Putting the values in the above formula from the example, we get:

$1,900 per annum (annually) would be the amortization amount to be expensed in the profit and loss account.

The straight-line method of amortization is the same as the straight-line method of depreciation; the only difference is amortization here is for intangible assets rather than tangible assets. The above example can be better illustrated in the below table.

| Year | Book Value at the beginning of the year | Amortization | Book Value of the end of the year |

|---|---|---|---|

| 1st | $10,000 | $1900 | $8100 |

| 2nd | $8100 | $1900 | $6200 |

| 3rd | $6200 | $1900 | $4300 |

| 4th | $4300 | $1900 | $2400 |

| 5th | $2400 | $1900 | $500 |

As we can see from the table above, we have amortized the asset for five years, and at the end of the 5th year, the book value stands at $500. The company can now sell this asset, and the profit or loss arising from the sale is transferred to the income statement.

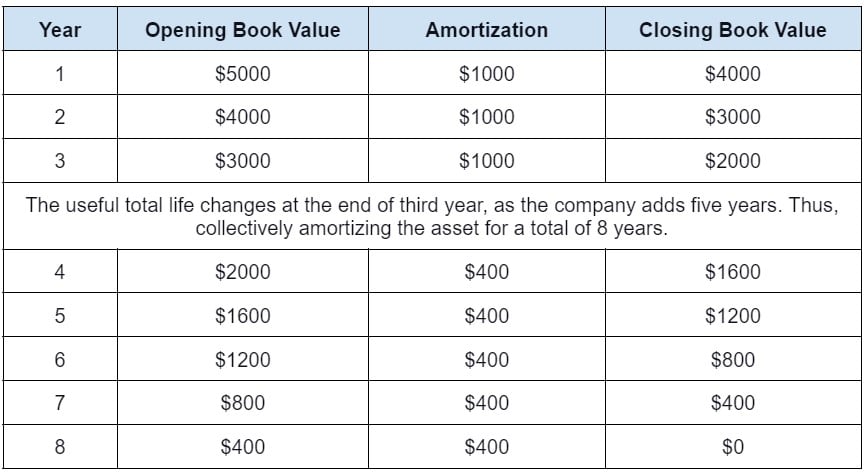

What happens when the useful life changes mid-use?

When the useful life of an asset changes mid-use, the opening book value is assumed to be a new cost. It is a change in accounting estimates, and the entity carries out a prospective change in the amortization amount for future years.

This change in the estimate will result in a new amount of amortization for the current year and upcoming years.

For example, an asset was purchased for $5000 with a useful life of 5 years. After accounting for amortization for three years, now management estimates the remaining useful life to be five more years.

For the first three years, the amortization would have been $1000 each year, giving us the book value of $2000 at the end of the third year. Now, the book value of $2000 would be divided by 5, giving us $400 as an amortization amount for the next five years.

Let us look at the table below to understand better.

Accelerated Method or Reducing Balance Method of Amortization

The accelerated method assumes that the company is consuming more of the intangible asset earlier than in later years. The amount amortized in the earlier years is more than the amount amortized at the end of the asset's life. Thus, differentiating itself from the straight-line method.

The reducing-balance method or declining-balance method are terms used interchangeably to refer to this method. Higher recognition of the amortization amount in the earlier years helps the company in tax accounting purposes. This helps create a deferred tax liability, which is beneficial to firms as revenue tends to be low in the beginning years.

There are two methods to find the rate for this amortization method:

-

Double declining balance method

-

Sum of the year's digit method

Method 1 - Double Declining Balance

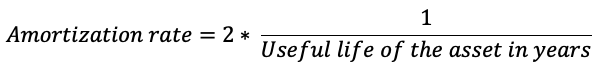

To determine the rate of amortization for an asset, we first determine the length of its useful life. Let's say, for example, a license has a life of 10 years.

The multiplicative inverse of 10 is 1/10. That gives us an effective rate of 10%. However, as the name suggests, we now multiply this rate by two or double it to arrive at our final answer, i.e., 20%.

The book value multiplies with the rate determined above to arrive at the amortization amount for the year.

![]()

Method 2 - Sum of the Year's Digit

As the name suggests, the number of years of useful life are added together to arrive at a base. For example, A license with a seven-year life will have the years1 2, 3, 4, 5, 6, and 7. Adding these numbers would give us the number 28.

This 28 is the base or denominator of the fraction in the year of amortization, with the highest digit being the numerator in the first year. Take a look at the table below to understand better:

| Year | Opening book value of the asset | Applicable Percentage | Amortization Calculation | Amortization Amount | Closing book value of the asset |

|---|---|---|---|---|---|

| 1 | $10,000 | 7/28=25% | $10,000 * 25% | $2,500 | $7,500 |

| 2 | $7,500 | 6/28=21.43% | $7,500 * 21.43% | $1,607 | $5,893 |

| 3 | $5,893 | 5/28=17.86% | $5893 * 17.86% | $1,052 | $4,841 |

| 4 | $4,841 | 4/28=14.28% | $4,841 * 14.28% | $691 | $4,150 |

| 5 | $4,150 | 3/28=10.71% | $4,150 * 10.71% | $444 | $3,706 |

| 6 | $3,706 | 2/28=7.14% | $3,706 * 7.41% | $265 | $3,441 |

| 7 | $3441 | 1/28=3.57% | $3,441 * 3.57% | $123 | $3,318 |

The book value at the end of the seventh year is $3,318, and the company can plan to dispose of the asset accordingly.

or Want to Sign up with your social account?