Asset Retirement Obligation (ARO)

It is a legal and accounting requirement related to the retirement of a tangible, long-lived asset.

What is Asset Retirement Obligation (ARO)?

ARO is a legal and accounting requirement related to the retirement of a tangible, long-lived asset.

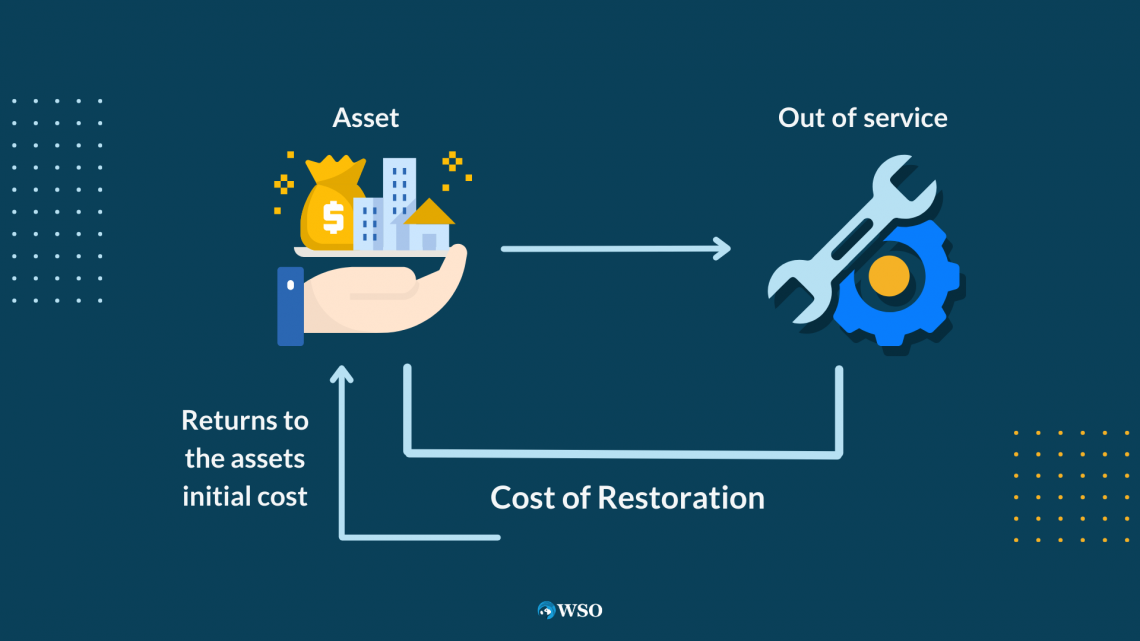

When a corporation acquires or develops an asset that will eventually require removal, dismantlement, or closure at the end of its useful life, the future expenses associated with its retirement must be accounted for.

These charges often involve cleanup, site restoration, and disposal. Estimating these future expenses is critical, and businesses must record a liability for the expected cost when the asset is acquired or created.

The liability is updated over time to reflect changes in the expected retirement cost, and this adjustment is recorded in the income statement as an expense.

For example, in industries such as mining, oil, and utilities, where assets have a finite life and require decommissioning or cleanup at the end of their use, AROs are particularly relevant.

Accounting for these obligations ensures that companies accurately represent their financial commitments and comply with regulatory requirements.

Key Takeaways

- Asset Retirement Obligation is a crucial financial concept requiring companies to estimate and account for future liabilities associated with the retirement of long-term assets.

- It serves environmental and financial purposes, ensuring companies are prepared for the costs related to dismantling and retiring assets at the end of their useful lives.

- It is recognized and measured in financial statements, with companies estimating the present value of expected retirement costs, often factoring in environmental remediation expenses.

- Accounting for ARO is subject to standards like GAAP and IFRS, with specific guidelines dictating how companies should report these obligations for transparency and compliance.

- Numerous industries, from oil and gas to manufacturing, grapple with substantial ARO obligations, impacting financial statements and influencing strategic decision-making.

Purpose of Asset Retirement Obligation

Asset Retirement Obligation (ARO) serves a dual purpose, including financial prudence and environmental responsibility, playing a crucial role in developing a company's overall strategy.

Let's understand the purpose below:

- Financial Preparedness: It involves financial planning and accountability for long-term assets, ensuring companies are financially prepared for asset disposal, removal, or cleanup, and recognizing and estimating retirement costs.

- Environmental Stewardship: It is increasingly linked to environmental considerations. Companies are tasked with mitigating long-term environmental impacts following asset retirement. This aspect promotes responsible business practices and contributes to global environmental responsibility, aligning with the growing emphasis on sustainability.

- Regulatory Compliance: Governments and regulatory bodies prioritize environmental conservation and responsible business practices. It ensures companies comply with regulations, mitigating legal and reputational risks and demonstrating ethical conduct.

- Long-Term Financial Health: It is a strategic tool for assessing a company's long-term financial health, assessing foresight, risk management, and sustainability commitment, and building trust among investors through transparent financial statements.

- Risk Mitigation: Acknowledging and accounting for ARO is a proactive approach to financial risk management, ensuring companies anticipate and effectively manage unexpected financial burdens associated with asset retirement. This proactive stance enhances overall risk mitigation strategies and bolsters the company's ability to navigate unforeseen challenges.

Recognition and Measurement of Asset Retirement

Asset Retirement Obligations necessitate a careful process of recognition and measurement within the financial framework of a company.

Let's look at the obligations involved in estimating and recording the present value of expected retirement costs associated with long-term assets:

- Estimation Process: It estimates future asset retirement costs, including dismantling, removal, and environmental remediation. Expert assessments, historical data, engineering studies, and environmental impact assessments form the basis of this process, ensuring a comprehensive evaluation.

- Present Value Calculation: The discount rate used to calculate the present value of retirement costs accurately represents the risks and uncertainties associated with future cash outflows, ensuring a realistic representation of the financial impact over time.

- Initial Recognition and Subsequent Adjustments: The estimated ARO is recorded as a liability on the balance sheet, adjusted over time to represent the current retirement obligation estimation accurately.

- Use of Assumptions and Uncertainties: ARO estimation is subject to uncertainties due to factors like technical improvements, legislative changes, market conditions, and retirement strategy, which can be mitigated through regular evaluations.

- Disclosure and Transparency: Financial reporting standards like GAAP and IFRS require companies to disclose significant assumptions, methodologies, and uncertainties surrounding ARO estimates, ensuring transparency and understanding among stakeholders.

- Impact on Financial Statements: It significantly impacts a company's balance sheet and income statement, increasing liability over time and potentially affecting profitability through increased expenses.

Accounting Standards for Asset Retirement Obligations

ARO is specifically guided by the GAAP in the US and IFRS globally. These standards provide frameworks for recognizing, measuring, and disclosing ARO in financial statements, ensuring consistency and comparability across companies.

Let’s look at the various accounting standards for asset retirement obligations:

1.GAAP (Generally Accepted Accounting Principles)

GAAP in the US mandates companies to capitalize ARO for long-term obligations at retirement. FASB provides guidance in ASC Topic 410-20, estimating and recording future retirement costs.

2. IFRS (International Financial Reporting Standards)

IFRS, developed by IASB, sets accounting standards worldwide for ARO, requiring companies to recognize legal or constructive obligations arising from long-term asset acquisition, construction, development, or normal operation.

- Key Differences:

While GAAP and IFRS aim to achieve comparable financial reporting objectives, they differ in how they handle ARO. For example:- GAAP includes specific guidance for ARO under ASC 410, whereas IFRS addresses ARO within the broader context of provisions under IAS 37.

- GAAP allows entities to record the liability's fair value initially, while IFRS requires the use of the present value of estimated future cash flows.

- The discount rate used to calculate the present value may differ between GAAP and IFRS.

- Disclosure Requirements

GAAP and IFRS emphasize transparency in financial reporting, requiring companies to disclose significant assumptions, uncertainties, and changes in ARO estimates for stakeholders' assessment. - Compliance and Impact on Financial Statements

Compliance with accounting standards for ARO is crucial for financial reporting consistency, impacting a company's balance sheet, income statement, and cash flow statement, influencing recognition, measurement, and settlement.

Challenges and Controversies Surrounding Asset Retirement Obligations

Challenges in estimation, accounting, and disclosure associated with Asset Retirement Obligations (ARO) can lead to financial uncertainties.

Let’s look at the challenges associated with Asset Retirement Obligations:

- Estimation Uncertainties: Estimating ARO involves projecting future costs and uncertainties like retirement obligations and is complicated by technological advancements, regulatory changes, and market fluctuations.

- Environmental Factors and Remediation Costs: The environmental aspect of ARO is complex, causing uncertainty in determining costs due to factors like environmental impact, regulatory landscape, and cost assessment methodologies.

- Changes in Assumptions and Regulations: Its estimates are subject to revisions, affecting financial statements. Companies must regularly reassess estimates, which can be administratively burdensome and create volatility.

- Disagreements in Valuation: Discount rates and methodologies for estimating future retirement costs can cause stakeholder disagreements, impacting recorded liability, financial ratios, and performance metrics.

- Legal and Regulatory Scrutiny: Regulatory bodies and auditors scrutinize ARO accounting. Inadequate disclosure or misjudgments in accounting practices may lead to legal repercussions, penalties, or audits, emphasizing the need for meticulous compliance.

- Impact on Financial Statements and Investor Perception: Changes in ARO estimates can affect a company's financial statements, potentially reducing investor confidence or misinterpreting its financial position, as investors and analysts closely monitor them.

- Controversies in Interpretation and Application: Interpretations and applications of accounting standards, particularly in ARO, can lead to controversies involving disagreements over valuation methods, disclosure requirements, and cost treatment among professionals and industry experts.

Future Trends and Evolving Dynamics in Asset Retirement Obligations

Emerging trends and developments are transforming how companies manage Asset Retirement Obligations in response to evolving business landscapes, regulatory environments, and societal expectations.

Let’s have a look at the future trends and developments in Asset Retirement Obligation:

- Sustainable Practices and ESG Integration: Environmental, Social, and Governance (ESG) integration in business strategies is gaining momentum, with companies aligning ARO with sustainability goals, focusing on responsible asset retirement and minimizing environmental impacts.

- Technological Advancements and Impact on Estimates: Advancements in technology, such as data analytics and predictive tools, enhance ARO estimations' accuracy and precision, thereby reducing uncertainties.

- Regulatory Changes and Compliance Requirements: Changes in regulatory frameworks, particularly in environmental regulations, are expected to affect ARO calculations, leading to increased scrutiny and higher obligations for companies to remediate environmental impacts.

- Enhanced Disclosure and Transparency: The focus is on increased transparency and disclosure of ARO estimates, assumptions, methodologies, and associated risks, with stakeholders demanding more detailed and comprehensive information.

- Rise of Scenario Planning and Risk Management: Companies increasingly incorporate scenario planning and robust risk management frameworks into ARO assessments. This proactive approach allows businesses to anticipate and mitigate uncertainties related to future retirement costs, enhancing overall strategic decision-making.

- Technology-Driven Reporting and Compliance Solutions: Financial reporting technologies and compliance solutions enhance accuracy, reduce administrative burdens, and ensure compliance with accounting standards in ARO accounting processes.

Conclusion

Asset retirement obligations are complex financial obligations that require a holistic approach, ethical responsibility, and environmental consciousness to manage and contribute to a sustainable business environment effectively.

These obligations are crucial for long-term company strategy and reporting, requiring a proactive, adaptable approach to business and societal expectations.

It signifies a company's responsibility towards stakeholders and the environment, demonstrating foresight, ethical conduct, and sustainability by preparing for future retirement costs.

Sustainability, technology, regulatory changes, and stakeholder expectations influence ARO's future. Companies that adapt, integrate ESG principles and address uncertainties will thrive.

Strategic planning incorporating ARO considerations aligns with long-term sustainability goals, enhancing environmental stewardship, risk management, and sustainable value creation for resilient and responsible growth.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?