Deferred Acquisition Costs (DAC)

An accounting method used to account for acquisition costs in financial statements in the insurance industry

What Are Deferred Acquisition Costs (DAC)?

Deferred Acquisition Costs (DAC) are an accounting method used to account for acquisition costs in financial statements. This method is used primarily in the insurance industry. It allows insurance firms to amortize the acquisition costs of new policyholders for the period of their contracts.

Before we dig into how this method works, it is crucial to understand how the insurance industry works and why it is vital to use DAC to account for acquisition costs on insurance firms’ financial statements.

As we all know, insurance firms promise to limit the financial impact of crises individuals and organizations may experience.

They do this by compensating their clients for the costs they incur, at least partially, to recover from an unfortunate event. Such events can include:

- Thefts

- Illnesses

- Accidents

- Bankruptcies

In exchange, clients pay their insurance firms premium payments on their services. Insurers and beneficiaries sign a contract stating the premium payment per period and the number of periods of the insurance product.

Payments are paid on a monthly or yearly basis by beneficiaries. So, the main revenue stream of insurance firms is the premium payments spread over a certain number of months or years.

Moving to the cost structure of insurance firms, they incur many expenses related to acquiring new customers. Such expenses include but are not limited to:

- Commissions for brokers

- Marketing expenses

- Underwriting costs

All the mentioned costs are incurred in the first period of the contract. If all acquisition expenses are accounted for in the first period, the net income generated during that period will show an extremely negative pattern. Then, income in the following years will hike and show profits.

Thus, to limit insurance companies’ income fluctuations, the Federal Accounting Standards Board allowed insurance firms to amortize acquisition expenses over a contract period.

Key Takeaways

- Deferred Acquisition Costs (DAC) is an insurance accounting method for spreading acquisition expenses over contract periods.

- DAC prevents extreme income fluctuations, providing insurance firms with steadier earnings patterns.

- Acquisition costs are recorded as assets, then divided by contract periods for amortization on income statements.

- DAC components differ based on accounting standards like GAAP and IFRS, impacting the calculation.

Understanding deferred acquisition cost (DAC)

DAC works by recording acquisition costs as an intangible asset on the balance sheet, then amortizing them throughout the contract. In other words, it works by capitalizing on the acquisition expense and straight-lining it to zero when the contract terminates.

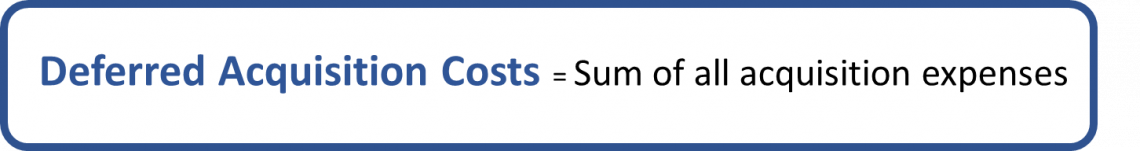

Thus, insurers accumulate all the costs they incur to acquire a new customer in an asset account called Deferred Acquisition Costs.

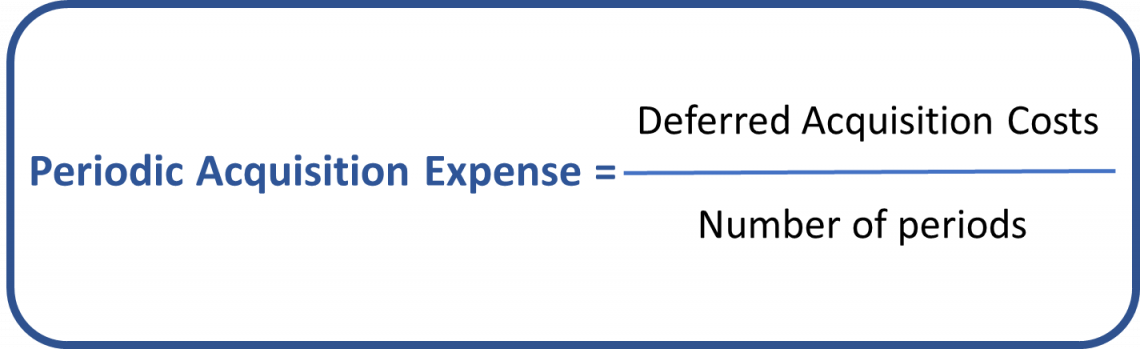

Then, to get to the periodic amortization expense, they divide the acquisition costs by the number of contract periods. Each period, they expense the amortization on the periodic income statement.

Acquisition costs included in DAC differ according to the accounting standards used. As a result, cost drivers included in DAC differ on whether an insurance firm is complying with GAAP or IFRS standards. IFRS has more conservative acquisition cost considerations than GAAP.

Generally, acquisition costs include all acquisition expenses of a new client and a portion of the office expenses incurred by the insurance firm.

Practical example of deferred acquisition cost (DAC)

You are an accounting intern at Savers Insurance Group, and you were asked to account for the projected income of Mr. Smith, a newly acquired customer, over the contract periods.

Mr. Smith signed a contract with your firm for a health insurance product over twelve months. You agreed upon a monthly premium payment of $400.

DAC will include the following costs:

- Acquiring costs: $1,500

- Office expenses: $500

For simplicity, let’s assume the only cost driver is the acquisition cost of Mr. Smith.

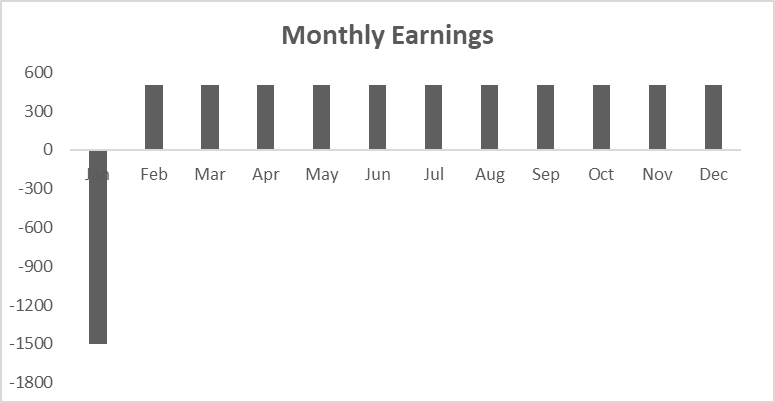

At first, you mistakenly expensed the full amount in the first period, leading to the following income chart:

As you can observe, the first month contributes extreme losses, whereas income increases by 400% in the following months, leading to major fluctuations in the firm’s net income.

You realized, after conducting research, that you can amortize the acquisition costs for the entire year by applying the following steps:

- Record all acquisition costs in the balance sheet as DAC under the assets section

- Calculate the monthly amortization expense using the formula mentioned above: deferred acquisition costs/number of periods = $2000/12= $167

- Expense DAC amortization from revenues in the balance sheet monthly.

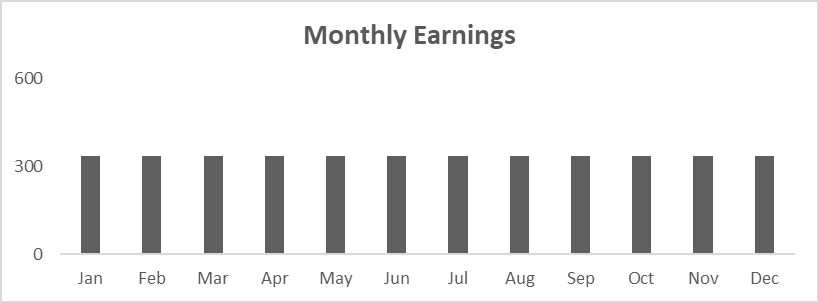

The following diagram shows the spread of income generated from Mr. Smith’s acquisition using the correct method to account for acquisition costs:

As you can observe, acquisition expenses are now more evenly spread over the contract, leading to stable earnings.

Other Considerations for deferred acquisition cost (DAC)

To fully calculate the profits contributed by acquiring Mr. Smith, you can deduct the acquisition costs from total revenues: $4,800 - $2,000= $1,800.

However, this is a simplified case with a one-year contract. Usually, insurance contracts cover more than one year, leading to multi-year contracts.

In this case, you need to account for the time value of money when calculating the total income projected from an acquisition.

You can do so by discounting the income contributed each year to the beginning year, then adding all the discounted earnings. This approach leads you to the net present value of your earnings over a specific period.

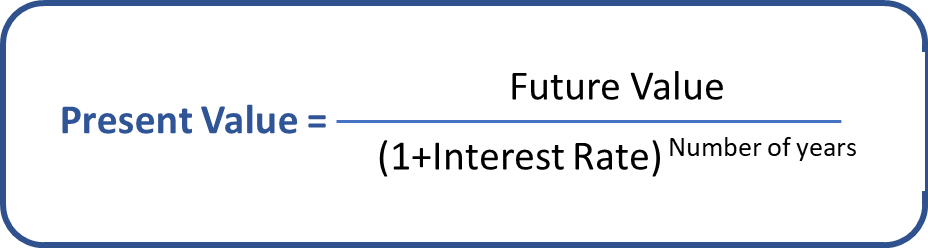

You can discount a future payment to the present mathematically using the following formula:

Now, let’s assume Mr. Smith signed a contract of 3 years that would contribute $2,000 in income yearly. We assume that income is generated at the end of each year. We also assume a discount rate of 10%.

You would calculate the present value of income generated over the periods of the contract as follows:

- PV1= 2000/(1.1)^1= $1,818

- PV2= 2000/(1.1)^2= $1,653

- PV3= 2000/(1.1)^3= $1,503

Thus, the total income at the beginning of the acquisition year would be $4,974.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?