Acquisition Structure

Refers to the broad framework or arrangement on which the acquisition of a firm will be organized.

What is Acquisition Structure?

Acquisition Structure is the broad framework or arrangement on which the acquisition of a firm will be organized. This structure divides the company's enterprise value into non-cash and cash consideration components.

This structure specifies whether the transaction is of asset or stock, the assets that will be included and excluded, any stock options, post-purchase settlements, and any other factors that will affect the seller or buyer.

Depending on the parties' immediate and long-term aims, the buyout agreement structure may fluctuate and be planned in various ways.

Transaction related to shares means purchasing the entire company, including all current and future liabilities, debts, and receivables.

A sold entity may be merged at the closing date or continue to be a subsidiary or an owned subsidiary of an acquiring company.

Instead, asset acquisitions typically entail keeping the legal structure of the selling company while buying only the beneficial assets.

M&A believes in purchasing only active/running businesses with valuable assets such as physical goods, plants, customer databases, brands, patents, trademarks, product/trade names, real estate, and intangible assets.

mergers & acquisitions (M&A) deal structure

Mergers and acquisitions (M&A) are joining two or more businesses to form a single entity for economic, social, or other purposes. It is allowed only when both parties agree to a merger or acquisition.

An M&A transaction structure is the set of agreed-upon terms under which these parties are willing to unite. Deal structuring is a step in this process that must be completed before M&A is completed.

It is the process of prioritizing the goals of a buyout and ensuring that all parties' top priorities are met while also considering the amount of risk each party must face.

To begin the deal structuring process, all parties must agree to the following:

- Their position on the negotiations;

- Hidden dangers that can be seen and how they can be controlled;

- How much threat they are willing to take; and

- Situations under which the negotiations are cut to the chase.

Because of the numerous aspects like preferred funding methods, business plans, market conditions, accounting rules, and other considerations to consider, developing a proper M&A deal structure may be complicated.

Getting the correct financial, investment, and legal guidance can help make the process go more smoothly.

Types of Acquisition Structures

M&A is a broad phrase that refers to several types of financial transactions used to unite businesses.

In truth, there are still certain distinctions between Mergers and Acquisitions in terms of implementation, nature of the transaction, and all the legal implications after the deal is made.

An M&A deal can be structured in three ways:

- Acquisition of the selling business's assets (also known as the target company)

- Acquisition of shares (for joint-stock companies)

- Acquisition of capital contribution (for limited liability companies) or merging

The success of the M&A for both parties depends on selecting the optimal structure. After all, these transactions are frequently highly complicated, and a particular structure might favor one party over the other.

For these reasons, both parties must consider the relevant legal, tax, and business difficulties and create a transaction structure that will benefit both sides.

Finding the best M&A transaction structure is difficult as various factors drive it.

A quick description of the most popular transaction forms, including stock purchases, asset purchases, and negotiated mergers, is provided below, along with some of their benefits and drawbacks.

Asset purchase

In an asset purchase, the buyer only purchases the assets and liabilities mentioned in the purchase agreement.

Buyers prefer this structure because it allows them to pick and choose only the assets and liabilities they choose to take on.

When buyers want to acquire a specific business unit or division inside a corporation, they frequently use an asset purchase.

Due to the additional work required in locating and transferring only the specified assets, the process can be complicated and time-consuming.

In most cases, the buyer will buy most of the seller's assets for cash or exchange for its stock while ignoring the obligations associated with the assets.

On the other hand, buyers may lose essential non-transferable assets like permits or licenses.

Sellers do not choose the asset purchase method since it may result in negative tax repercussions if the purchase amount is allocated to the assets.

The selling entity will continue to exist legally after the sale. However, in many circumstances, it is seen that they shut down their operations as soon as the transaction is completed.

| Advantages | Disadvantages |

|---|---|

| 1. The buyer has complete control over acquiring assets from the seller. | 1. The buyer didn't have the control to acquire intangible assets like goodwill. |

| 2. After the sale, the selling business continues as a corporate body with unsold assets and liabilities. | 2. This deal implies a high tax rate, and it also takes a longer duration to settle. |

stock purchase

In a stock purchase deal, the target company's outstanding capital stock (or other ownership interests) are purchased by the buyer or a buyer's subsidiary.

Since its ownership is changing hands without needing further action from the target company, it may not be necessary to be a party to the transaction agreements.

A stock acquisition is when a buyer buys the target company's stock from its stockholders. The target company will continue to exist but under new leadership.

The buyer obtains a substantial portion of the seller's existing shares. In essence, the buyer now holds all of the seller's assets and liabilities.

To guarantee that the target firm is fully understood, the purchaser must discuss the representations and warranties regarding the assets and liabilities of the business.

Instead, the seller or sellers of the shares make statements and warranties concerning the stock and the target firm, commit to specific activities before closure, have the target company take specific actions, and offer indemnification following closing.

| Advantages | Disadvantages |

|---|---|

| 1. Taxes on the stock purchase are kept minimum, and all the costs associated with this purchase are less costly. | 1. Legal or financial consequences may accompany a stock purchase. |

| 2. As negotiations are less complicated, the deals have a smooth closure. | 2. Minority shareholders are less cooperative and might be a problem. |

merger

In a merger, two companies merge to establish a single combined legal entity, and the target company's shareholders receive cash, the buyer company's stock, or a mix of the two.

A merger is joining two distinct legal entities into one entity, one of which continues to exist while the other vanishes.

The surviving entity retains all ownership and other rights of the two constituent entities. Unlike stock and asset sales, nothing is truly transferred from the seller to the buyer.

Instead, the buyer or, more usually, a newly established, non-operating subsidiary of the buyer is granted permission by the target firm and its shareholders to merge the target company with them.

Typically, the buyer's subsidiary vanishes, leaving the target as the merger's surviving entity.

Either the seller's or buyer's company is rebuilt, or a new company is formed.

| Advantages | Disadvantages |

|---|---|

| 1. The merger depends on the approval of the majority of shareholders of the selling company. | 1. It's tough to estimate the target company's worth. |

| 2. Taking the existing market position advantage of the merged enterprises. | 2. Following the merger, there might be conflict and incompatibility between the internal management and companies work culture. |

| 3. The company's performance will improve. | 3. Conflicting viewpoints on mergers results in the turnover of potential shareholders. |

acquisition transaction process

This will outline the process of acquisition from start to finish. Let's discuss how the takeover process got a head start. Below are the steps to follow to have a smooth takeover:

1. Develop a purchase plan: A solid acquisition strategy starts with the acquirer having a clear notion of what they hope to gain from the acquisition, i.e., their business goal in acquiring the target firm.

2. Establish M&A selection parameters: Finding the most important criteria for identifying possible target companies (e.g., profit margins, locations, or customer base).

3. Searching for and analyzing possible takeover targets: The acquirer searches for and evaluates potential targets using their established input parameters.

4. Begin takeover planning: The acquirer contacts one or more firms that satisfy its search criteria and give good value; the initial dialogues aim to obtain additional information and determine whether the target company is open to a merger or acquisition.

5. Perform a valuation analysis: Assuming that the initial contact and conversations go well, the acquirer will ask the target company to provide significant information that will allow the acquirer to further evaluate the target as a standalone business and as a potential acquisition target.

6. Negotiations: The acquirer should have enough information to make a reasonable offer after developing numerous value models for the target company. Following the presentation of the initial offer, the two parties can further discuss the conditions.

7. Due diligence in M&A: Due diligence is a thorough examination and analysis of every aspect of the target company's operations, including financial indicators, balance sheets, customer base, human resources, and so on.

8. Buying and selling deal: Assuming that due diligence has been completed without major issues or concerns, the next stage is to execute a final contract for sale, in which the parties decide on the form of the purchase agreement, whether it is an asset purchase or a stock purchase.

9. The acquisition's financing plan: The acquirer will have looked into financing options for the transaction before signing the purchase and sale agreement. Still, the financing details usually come together after finalizing the buying and selling agreement.

10. Closing and integrating the transaction: The acquisition is completed, and the target and acquirer management teams collaborate on the merger process.

Types of Acquisition

Acquisition Strategies include Horizontal, Vertical, Conglomerate, and Congeneric Acquisitions.

These kinds of takeovers are part of the company's expansion strategy, and it's classified by product line, industry, and commercial activities.

These kinds of takeovers aid in identifying a new market, client base, and synergy gains. As a result, acquisitions are seen as the first step toward establishing market supremacy.

These are the four types of acquisitions prevailing in the market. Let us discuss them here:

1. What is Horizontal Acquisition?

The supply chain has nothing to do with a horizontal purchase. Instead, it refers to businesses acquiring other businesses in their field that provide comparable or identical items.

For example, it was a horizontal acquisition when Facebook bought Instagram. Both were social networking sites where users could interact, share, and advertising.

Horizontal purchases are frequently made to eliminate competition and gain market share swiftly.

If another company is making headlines and constitutes a threat to your business, you can eliminate the issue by purchasing it. By buying the entity, you can defeat the competitor.

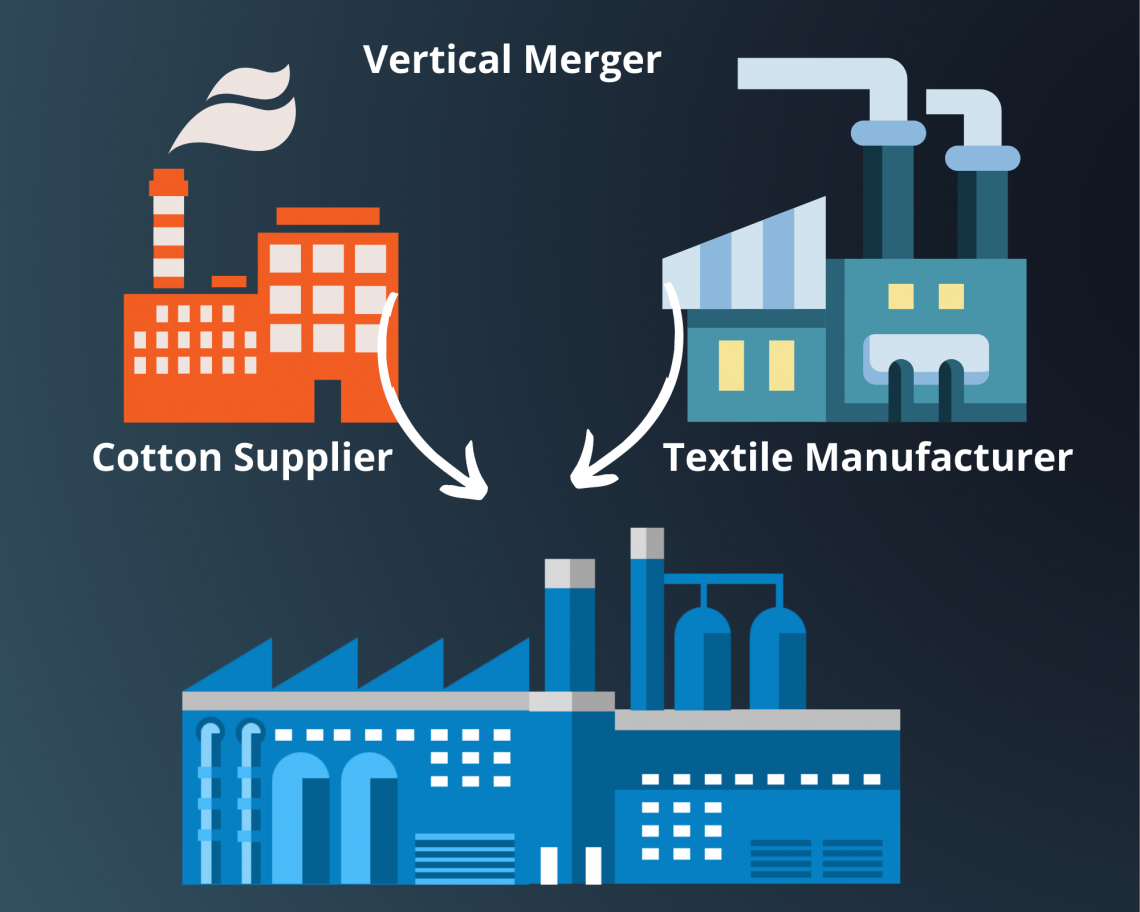

2. What is Vertical Acquisition?

In this situation, a business purchases another located at a different point in the supply chain. Because of the vertical reference, the deal will be for a company higher or lower in the production process.

When a firm buys a supplier of inputs, a distributor of its products, or the company to which it sells its products, it is referred to as a vertical purchase.

A clothing firm, for example, might purchase cotton from a farm. It is more efficient to buy from a farm than to depend on raw materials.

This is mostly done to gain greater control over the supply chain, which impacts the receipt of raw materials and product delivery and the time it takes to source input and delivers the product to the end-user.

Companies don't simply try to buy lower in the supply chain; they may also look to acquire further up in the production process so that they can earn from selling finished goods rather than just raw materials.

Because they don't have to rely on outside suppliers to create their products, vertical acquisitions allow corporations to be more independent of market trends and vendors.

3. What is Conglomerate Acquisition?

When one corporation buys another from a completely unrelated industry, it is known as a conglomerate acquisition. This is primarily done for the sake of diversity.

For example, a corporation in the food industry buying a company in the apparel industry is one. For example, Hamleys, a toy products manufacturer, was recently acquired by Reliance Industries in 2019.

Reliance is a large conglomerate that wants to diversify into the toy sector; thus, it purchased it by transferring 100% control to itself.

Companies typically merge to form conglomerates to insulate themselves against market swings.

It'st'sprobable that all of your firms will lose money at the same time if you own several. This type of acquisition also gives stability to small businesses.

4. What is Congeneric Acquisition?

In this acquisition, the two companies are in the same industry, and this option is similar to a horizontal merger. They are not rivals, though, because they operate in distinct markets.

This acquisition is frequently used to absorb competition before it becomes a serious threat. Instead of fighting with a brand attempting to enter your market, an acquisition can keep them away.

For example, Citi Group took the Travelers Insurance Co. when they realized their executives frequently travel for office work, and there is a need for travel insurance.

They acquired Travelers Insurance Co. and helped in providing travel insurance and serving their client's assurance services along with banking services, and that is how congeneric acquisition comes into the frame.

Congeneric purchases can enable organizations to enter new markets without competing with established brands from a proactive approach. They will also save time and money by not investing in brand recognition.

Putting together a great M&A deal structure

Aim for a winning situation in which both parties' interests are effectively reflected in the contract and risks are kept to a bare minimum to build a solid deal structure.

Win-win deal structures are more likely to result in a closed merger or acquisition deal and may even shorten the time it takes to complete the M&A process.

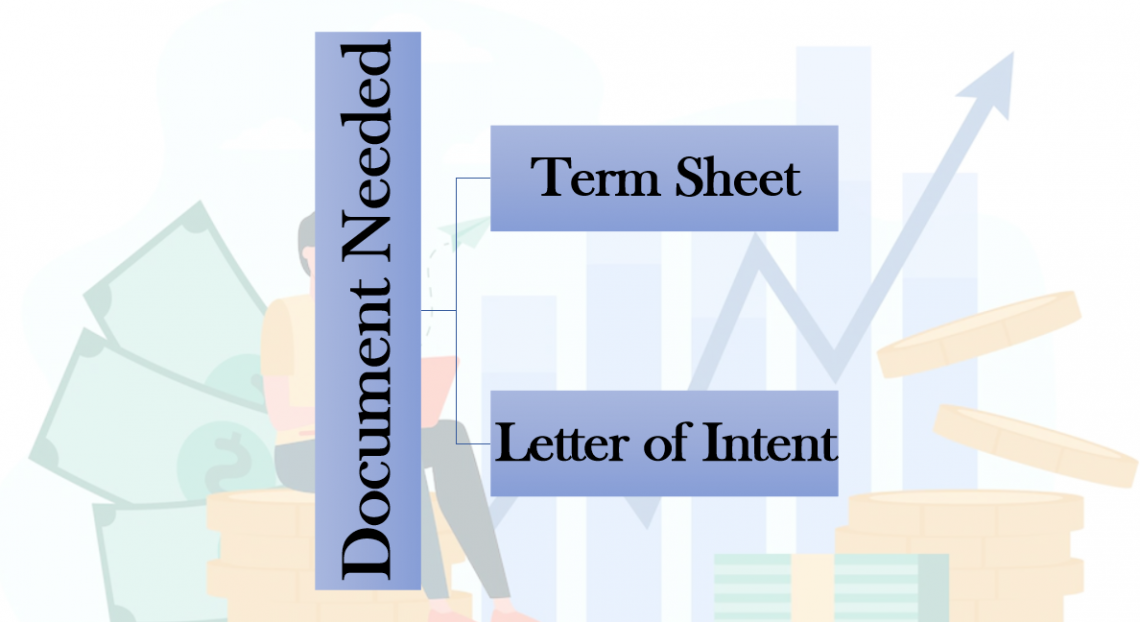

To clearly define the M&A transaction structuring process, two crucial documents are used, which are referred to as term sheets and letters of Intent.

Term Sheet: It is a document that outlines the terms and conditions of a proposed financial investment, such as a merger or acquisition. Term sheets are normally legally binding unless the parties expressly declare otherwise.

Letter of Intent (LOI): A Letter of Intent (LOI) is a document that outlines an agreement between two or more parties that will be formalized later in a legally binding agreement.

Except for the binding provisions stated in the document, an LOI is normally not meant to be legally binding, similar to the term sheet.

points to remember during M&A

Every M&A transaction is different, but they invariably include one or more of the three basic acquisition structures: asset purchase, company merger, or stock sale.

A stock sale entails purchasing the entire business entity, including potential loans, liabilities, and receivables.

Asset purchases usually consist of buying only the valuable assets, with the legal entity of the selling company remaining intact.

Each company contemplating a sale or purchase should be aware of the variations between the various forms of acquisition transactions. Making the wrong decision can result in tax penalties, difficulties in discussions, and possibly the deal's failure to close.

You need to take into consideration some things which are discussed below:

- M&A valuation can be agreed upon

- To market, negotiate, and close an M&A deal is very time-consuming.

- Sellers must prepare for the extensive due diligence the buyer will conduct.

- The buyer will thoroughly examine the seller's financial statements and projections.

- Multiple bidders will enable the seller to negotiate the best price

- You require a top-notch M&A attorney and M&A legal team

- Think about working with an investment banker

- The importance of intellectual property issues

- Avoid being stuck at the letter of intent phase

- It is vitally important that you read the definitive acquisition agreement

- Critical and sensitive employee and benefits issues

- Recognize the dynamics of negotiations before stepping into M&A dealings.

Acquisition Structure FAQs

A merger is a business transaction in which one company combines with another, losing its legal identity and becoming one firm in the eyes of the law. In contrast, both companies retain their legal entities in an acquisition deal, and the acquirer gains authority over the acquired company.

Amalgamation is a business transaction in which two firms unite to form a new company. Both entities' legal statuses are terminated, and a new legal entity in the form of a new corporation is formed.

The purchasing company drives the acquisition, with or without the consent of the acquired company, while Amalgamation is undertaken with equal enthusiasm by both companies.

A merger or acquisition deal can be structured in one of three ways:

- Purchase of stock. The buyer buys the equity of the target company from its stockholders.

- Asset purchase/sale Only assets and liabilities that are clearly stated in the purchase agreement are purchased by the buyer.

- Merger.

It is a procedure in which the acquirer investigates the target firm thoroughly to assess its strengths and flaws.

The purpose of a due diligence exercise is to identify any concerns relating to the counterparty's assets, liabilities, and operations, as well as to mitigate any potential risks that may occur in the future.

Representations and warranties help to mitigate the worries that arise during due diligence.

These are the four types of Acquisitions that you need to know:

- Vertical Acquisition

- Horizontal Acquisition

- Conglomerate Acquisition

- Congeneric Acquisition

Researched and authored by Himanshu Kanjani | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?