Greenwashing

It's the advertising practices used to convince consumers that the products and policies of a company are environmentally friendly

What Is Greenwashing?

Greenwashing is a term used to describe advertising practices used to convince consumers that the products and policies of a company are environmentally friendly. It is becoming increasingly common due to the push towards environmental, social, and governmental (ESG) investing.

As every year passes, addressing climate change becomes more of a focus for governments, businesses, and citizens.

We have moved on from the original dogma proposed by Economist Milton Friedman

“There is one and only one social responsibility of business–to use its resources and engage in activities designed to increase its profits”

To a new ideology adopted by many businesses in the present day, best articulated by the CEO of Salesforce Marc Benioff

“Suggesting that companies must choose between doing well and doing good is a false choice. Successful businesses can and must do both”

This radical change has acted as the catalyst for many new corporate initiatives, foundations/nonprofits, and an entirely new way of investing and rating companies known as ESG. With this change, many positives have come about in our society, though unfortunately, some negatives as well.

What if a company chooses to falsify information or promote a false advertisement with the sole purpose of increasing brand awareness and increasing revenue?

Unfortunately, this is what many companies are choosing to do instead of making changes to address the concerns of the population.

Key Takeaways

- Greenwashing is when companies falsely portray themselves as environmentally friendly to attract consumers, often in response to the rise of ESG investing.

- Businesses have transitioned from prioritizing only profits to also considering social and environmental impact, leading to ESG initiatives and new investing approaches.

- ESG encompasses Environmental, Social, and Governance criteria used to assess a company's sustainability and societal contributions.

- ESG investing can be concessional (social impact-focused) or non-concessional (balanced impact and profit). Ratings like MSCI help evaluate companies' ESG performance.

How does greenwashing work?

Greenwashing is a form of false advertising that builds up consumer confidence regarding a company's impact on ESG factors (Environmental, Social, and Governance).

It can occur in the form of television commercials, a branded product, or even through an asset manager claiming to only invest in a company’s equity or bond only if it has a high ESG rating.

The general goal is to convince customers that a company cares and is actively implementing policies and procedures to assist in the fight against climate change, all the while behind the scenes having very little to no change.

Image from Terrachoice (acquired by ul.com)

Why would a company use greenwashing?

There are many reasons why a company would want to appear environmentally friendly and socially responsible.

A few of them are listed below.

- Consumers appreciate a product or service that is environmentally friendly.

- People want to feel that their purchases are having a positive impact.

- Customers want to see companies emphasize social good alongside profit.

- People want to purchase a product or invest in a company that shares similar values and social/environmental goals.

Some businesses perceive this demand and take advantage of it.

For example, a company may choose to initiate environmental programs and allocate a certain amount of capital annually towards them while investing far more capital in advertisements that promote those very initiatives to the public.

Or a company may be required by law to implement specific environmental measures which it then chooses to market to customers as actions taken out of civic responsibility.

What is ESG?

As society grows conscious of the broader impact that organizations have on the environment, community, and governance, a concept known as ESG has come to the forefront.

ESG stands for Environmental, Social, and Governance.

- Environmental: Factors that directly affect climate change and ecological sustainability.

- Social: Factors that impact equality, equitability, diversity, and civil rights.

- Governance: Corporate factors such as political lobbying, board of director goals/values, and executive compensation.

Image taken from MSCI website

Impact investing can be traced back to the mid to late 1900s when investors began removing equities and bonds from their portfolios that related to big tobacco and apartheid in South Africa.

More recently, in 2004, the term ESG was coined by Kofi Annan, the Secretary-General of the United Nations from 1997 to 2006. The term was used in an essay he wrote to over 50 CEOs from financial institutions across the world.

In it, he advocated for incorporating ESG into financial markets with the goal of creating a more equitable and prosperous society. In 2006 Kofi Annan founded an organization backed by the United Nations called Principles for Responsible Investment.

It brought together a global community of investors who believed in integrating ESG into business and investing.

The organization follows six principles:

- Include ESG in the investment analysis process

- Integrate ESG into ownership policies and practices

- Seek out proper disclosures from companies prior to investing

- Advocate for ESG throughout the investment industry

- Work together to better apply the principles

- Report to the organization on progress toward implementing the principles

Types of ESG Investing

ESG investing, which focuses on a company's Environmental, Social, and Governance practices, offers a pathway to achieve this alignment. Rather than pursuing profits in isolation, ESG investing aims to create a positive societal impact alongside financial returns.

Let us take a look at different types of ESG:

Concessionary and Non-Concessionary

1. Concessionary

An investment in which the main goal is to make a positive impact on society with the secondary benefit of profit. In this process, the monetary result is given less emphasis.

This type of ESG investing offers investors the opportunity to use the process of investing as a vehicle for social good. The construction of this particular type of portfolio mirrors a charitable contribution with the additional benefit of potential capital gains.

2. Non-Concessionary

An investment in which the main goal is to both generate a monetary gain and a positive impact on society equally. Neither is given more emphasis, and the investor or asset manager thoroughly believes that both can be accomplished without having to sacrifice one or the other.

This type of ESG investing offers the investor the opportunity to simultaneously use investing as a force for social good and as a vehicle for capital gains.

Exclusionary and Inclusionary

1. Exclusionary

A portfolio is constructed with the additional criteria of shutting out companies that act as negative forces on social and environmental good. This process includes preventing and eliminating equities and bonds issued by companies related to fossil fuels, tobacco, chemical waste, etc.

2. Inclusionary

A portfolio constructed with the goal of adding companies with high ESG ratings. Prior to the creation of the portfolio, criteria are set for defining what ESG companies qualify. This process includes emphasizing additions of equities and bonds issued by companies related to clean energy, biotechnology, and sustainability.

A great way to take part in ESG investing can be through the purchase of an Exchange Traded Fund (ETF). Through this kind of financial instrument, an investor can take part in ESG investing while retaining a healthy level of diversification.

C) Vanguard’s Social Index Fund (VFTAX)

This ETF tracks the FTSE Russell index called “FTSE4Good Index Series”. The index excludes companies that are tied to fossil fuels, nuclear power, tobacco, alcohol, weapons, and unacceptable diversity practices.

D) iShares MSCI USA ESG Select ETF (SUSA)

This ETF created by Blackrock tracks an index created by MSCI called “MSCI USA Extended ESG Select Index”. The index as well excludes companies related to nuclear power, tobacco, alcohol, and weapons. The five-year return on this ETF currently is 20.3%.

MSCI Ratings

MSCI is a public company located in New York City that provides various indexes based on equities, fixed income, and real estate. They as well provide analysis tools and ESG ratings. It is the most respected company for providing ESG ratings within the financial market.

MSCI is a part of the S&P 500 and is listed on the New York Stock Exchange.

The company began as Capital International and was later acquired by Morgan Stanley, which is how the name MSCI came about (Morgan Stanley Capital International). Morgan Stanley divested in 2009 in order to raise capital during the global financial crisis.

MSCI offers ESG ratings through three broad categories. The categories include Leader, Average, and Laggard.

- Leader (AAA / AA): This category is reserved for companies at the forefront of ESG. For example, companies that have already integrated clean energy into daily operations.

- Average (A / BBB / BB): This category is for companies that have made positive strides toward implementing ESG initiatives, though still have a ways to go. For example, a company that has publicly announced plans for becoming net zero in carbon emissions in the future.

- Laggard (B / CCC): This category is reserved for companies that are lagging behind the ESG movement and are specifically exposed to various ESG risks. For example, companies that specifically deal with fossil fuels or tobacco.

MSCI Company Rating Search Engine allows you to search any public company and be provided with an ESG rating and a full breakdown of how that rating was found.

The goal of the search tool is to provide investors with more ESG-related transparency and data to assist in the process of equity analysis. An investor can research over 2,900 companies.

Of these companies, an investor can review ESG rating history, a company’s decarbonization plan, and how the company compares to competitors in its relevant industry.

Company / Rating

ESG Subjectivity

ESG has brought about many new opportunities within the investing community. It has created passionate advocates as well as many skeptical investors.

- Some believe the movement indicates a fundamental societal change. From their perspective, the past philosophy of emphasizing profits led to negative social consequences. In this new ideology, investors and businesses have the opportunity to pursue both environmental and social progress alongside profitability.

- Others categorize the ESG movement as idealistic and divergent from economic reality. They argue that ESG progress and capital gains cannot be accomplished simultaneously. They believe that within all individuals, there is a subconscious drive for profit that trumps any desire to allocate capital towards social good.

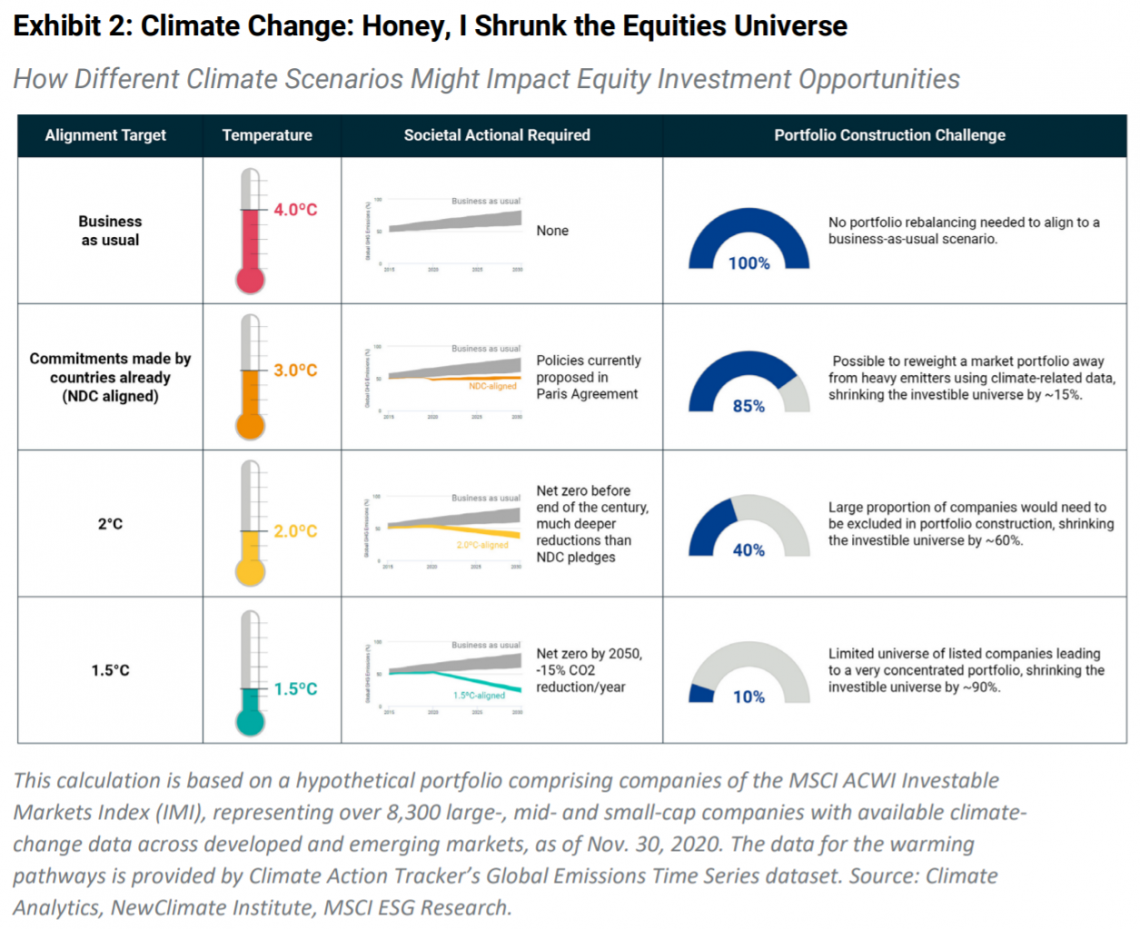

An unfortunate reality is that ESG can often be subjective. There are no unanimously agreed upon social or environmental movements. No international agreements on what can be considered sustainable.

For example:

- Country A may believe a reduction of 50% of 2005 emission levels by 2030 is moral, while anything less is unacceptable.

- Country B may believe a 20% reduction by 2030 is satisfactory and that a 50% reduction would require government funds to be spent on unnecessary programs.

What is difficult about this particular situation is that neither country is necessarily right or wrong due to the subjective nature of both politics and morality.

In the same way that our domestic and international politics struggle to agree upon what is right, investors will struggle to agree upon what is right to invest in for creating a positive impact. The Vanguard’s Social Index Fund (VFTAX) excludes companies involved in nuclear power, fossil fuels, and alcohol.

What if an investor believes in advocating for a societal transformation towards clean energy but has no issue with society’s current level of alcohol consumption? This example highlights the trouble that can derive from subjectivity within the space of ESG.

Worrisome ESG Scenarios

Aswath Damodaran professor of finance at New York University, has proposed three potential scenarios for how ESG investing could play out.

- Companies doing social good could increase revenue via consumers perceiving them to be moral and motivate other companies to participate in the ESG movement. They may also offer a lower RoR to investors and lenders because of the supplemental benefit of investing in a socially upstanding business.

- Companies that are perceived by investors to be immoral will need to offer a higher rate of return. Lenders may even decide to charge these companies higher interest rates. Consumers may stop using a company’s products or services, which will lead to a decline in revenue.

- Immoral companies will be more successful. These types of companies will have higher margins and lower costs because their only focus is financial gain and not a combination of profit and social good. Strong financials will lead to more investors and more growth.

If scenario #1 is to become true, it will lead to more and more businesses wanting to be perceived by customers and investors as altruistic.

The greatest danger here is that a company may choose to forego tangible actions towards ESG policies and instead opt for continuing business as usual while advertising to the public a morally virtuous brand.

Image taken from MSCI website

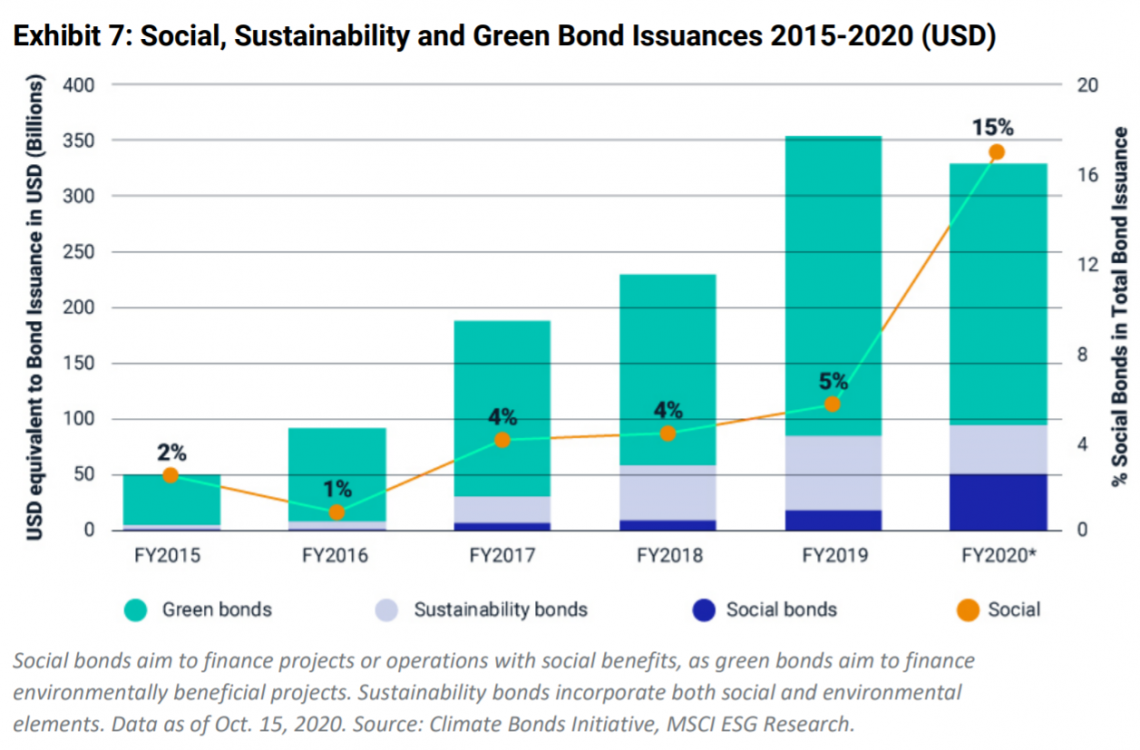

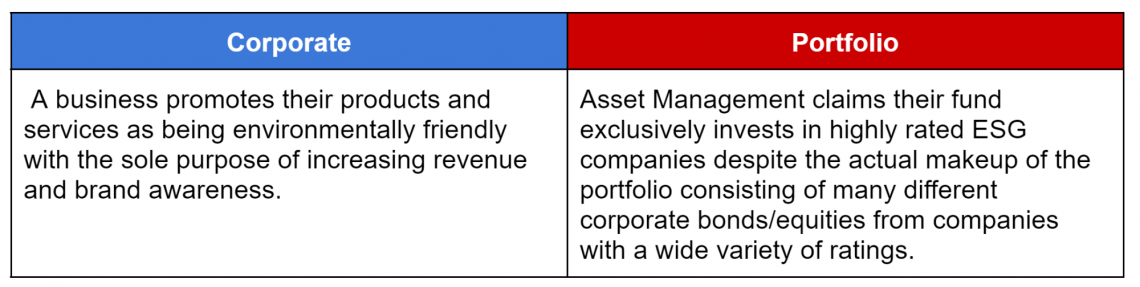

Types of Greenwashing

Greenwashing occurs through two mediums. The first is on the corporate level between a company and consumers, and the second takes place between asset management and investors.

Both processes involve deception and disinformation in the pursuit of increasing financial returns. Both processes involve communications or advertisements that incorporate misleading information to garner business from prospective customers or clients.

Corporate Greenwashing

Occurs when a company wishes to increase profitability via brand awareness based upon having consumers perceive the company as morally virtuous and eco-friendly. The strong consumer demand for products produced by companies with high moral standards has increased YoY since the inception of ESG.

Many companies see this as an exploitable opportunity. For example, a company may use commercials to advertise social and ecological projects despite the exclusive motivation for undertaking these projects being the intention of increasing monetary gain.

Portfolio Greenwashing

Occurs when an asset manager or investment company develops a portfolio branded to be compliant with ESG standards. In reality, the portfolio may consist of low-rated ESG companies.

Asset management then promotes and advertises to potential investors the opportunity to make positive social and environmental impacts alongside high returns.

This process allows asset managers to increase funding based on investor demand for ESG while behind the scenes using non-ESG-related equities to increase their overall return.

This deceptive act enriches both the asset manager and the investors. Throughout this process, the investors continue to believe their capital gains were produced solely from the equities of highly rated ESG companies.

Greenwashing Campaigns

As governments, organizations, and individuals prioritize sustainability, some companies have capitalized on this trend, employing clever marketing techniques that superficially promote eco-friendliness without substantial commitment.

The rise of Greenwashing Campaigns erodes public trust and undermines genuine efforts to protect the planet.

In this section, we look at a couple of examples of some of the biggest companies employing greenwashing as part of their advertising campaigns.

Chevron

In the 1980s, Chevron began an advertising campaign called “People Do” The intent of the campaign was to spread awareness of recent environmentally friendly policies and procedures that had been implemented and various environmental habitats that Chevron had begun funding and maintaining.

These various environmental projects included a butterfly preserve and manmade fox holes (built for foxes to hide from coyotes).

The unfortunate aspect of this campaign is that most of the policies and procedures put into place were required by law and were not initiated based on Chevron's own will.

Meanwhile, it was estimated that a single butterfly preserve cost $5,000 a year to maintain while the company spent millions of dollars a year in advertising so that people would know they were funding these kinds of projects.

Coca Cola

In 2013 Coca Cola Life was introduced. This new product used Stevia and significantly less sugar compared to regular Coca-Cola. The logo was a leaf, and the color of the packaging was green as opposed to red. The bottle of the product was made with 30% plant-based materials, and it was fully recyclable.

A large amount of the advertising was garnered around promoting that the bottle was recyclable and promoting that Coca-Cola Life was more healthy than regular Coke. The campaign brought about criticism for greenwashing, and the product was discontinued in 2019/2020.

DWS Group ESG Scandal

In 2021 on August 25th, news broke through the Wall Street Journal that DWS Group had been overstating the degree to which its assets under management (AUM) were integrated with ESG guidelines. DWS had initially claimed that half of its $900 Billion AUM was in line with ESG credentials.

The former Global Head of Sustainability, Desiree Fixler, had leaked DWS internal documents to the Securities and Exchange Commission (SEC), the Federal Financial Supervisory Authority (BaFin), and the Wall Street Journal. Both BaFin and the SEC immediately initiated an investigation.

DWS’s stock proceeded to fall 13% by the next day, on August 26th, 2021.

Image taken from google finance

Word of warning on ESG and Greenwashing

In 2021 Tariq Fancy, former Chief Investment Officer of Sustainable Investing for Blackrock, published three articles on his fears for ESG going forward.

The articles were entitled “The Secret Diary of a Sustainable Investor”. In his writings, he highlighted the dangers of greenwashing and recounted various inconsistencies that he saw throughout his time as CIO.

- “We argued that companies that embrace sustainability early create more profit for shareholders over the longer term, which is a bit like saying that good sportsmanship on the court is linked with eventually scoring more points as a result.”

- “Immediately after leaving BlackRock, I had reached the conclusion that our work in sustainable investing was like selling wheatgrass to a cancer patient. There’s no evidence that wheatgrass will do anything to stop the spread of cancer, but it’s tempting to believe it, especially when the doctor is advising chemotherapy.

- Unfortunately, I now realize that it’s worse than I originally thought: the evidence around the deadly distraction made it clear that we weren’t just selling the public a wheatgrass placebo as a solution to the onset of cancer.

- Worse, our lofty and misleading marketing messages were also delaying the patient from undergoing chemotherapy. And all the while, the cancer continues to spread.”

SEC Risk Alert on Greenwashing

On April 9th, 2021, the SEC issued a Risk Alert highlighting increased demand for ESG products and services and the various risks that they posed to investors. The SEC specifically pointed towards portfolio managers advertising themselves as ESG funds despite those funds' lack of ability to follow ESG guidelines and credentials.

They as well touched on poor communication on the part of portfolio managers. It is the responsibility of an asset manager to properly and transparently communicate the intention and portfolio makeup of a fund to investors.

The SEC said, “The variability and imprecision of industry ESG definitions and terms can create confusion among investors if investment advisers and funds have not clearly and consistently articulated how they define ESG and how they use ESG-related terms, especially when offering products or services to retail investors.”

What should I look out for?

- Buzzwords: scientific, environmental, and social terms

- Graphics: videos and pictures of lush mountain ranges, waterfalls, clear blue skies

- Claims: best in the world, #1 in the industry, 100% organic or recyclable, misleading statistics

- Vagueness: commercials that talk about change and action without highlighting the specific measures that are being implemented

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?