Green Bond

They are bonds that finance eligible green projects.

Green bonds are bonds (fixed-income securities) that finance eligible green projects.

These bonds belong to a broader category of sustainability-related bonds. It is a fixed-income financial instrument whose proceeds only finance eligible green projects. This investment instrument is suitable for investors who want to impact the environment positively.

The most comprehensive definition describes these green fixed-income instruments as "any type of bond instrument where the proceeds or an equal amount will be exclusively applied to finance or refinance, in part or in full, new and/or existing eligible Green Projects" (The International Capital Market Association (ICMA)).

The definition of these green-themed bonds is well established. However, the situation gets tricky once the 'green' activity or project needs to be identified.

In general, there needs to be more standardization on what green activity is. Countries and international institutions are trying to handle this issue by preparing their local Sustainability Taxonomies.

The most common eligible green activities are:

-

Renewable energy, including production, transition, appliances, and products

-

Energy efficiency with a focus on energy storage or refurbishment of old buildings

-

Green transportation, such as electric vehicles or hydrogen vehicles

-

Reduction of greenhouse gas emissions (GHGs)

-

Waste management and recycling

-

Circular economy

-

Environmental sustainable management of natural resources and land use could be focused on sustainable agriculture, farming, or reforestation.

-

Biodiversity projects related to aquatic biodiversity conservation

-

Climate change adaptation can focus, for example, on funding early warning systems.

Blue bond

Green bonds focusing on projects related to aquatic biodiversity protection have developed further as a subcategory called blue bonds.

Blue bonds are a relatively new form of sustainability-related bonds. A blue bond's proceeds are directed toward protecting the ocean and supporting the blue economy. Examples of blue projects are:

-

Wastewater and sanitation projects

-

Marine renewable energy projects

-

Promotion of sustainable fishing

-

Ecosystem management and restoration, such as coral protection projects

-

Solid waste management and others

The picture below shows which projects are eligible for blue bond funding.

Other Types of Sustainability-Related Bonds

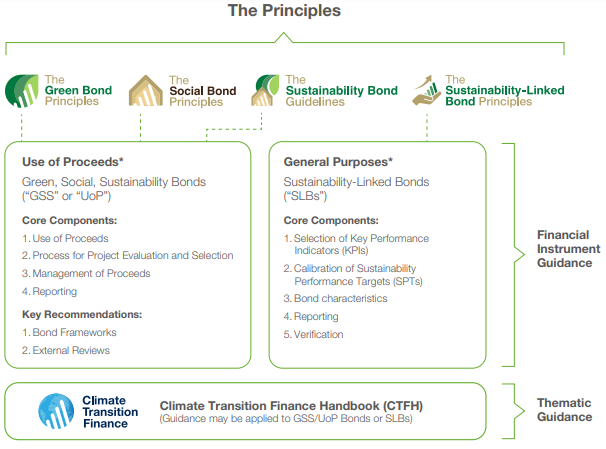

There are other types of sustainability-related or sustainability-themed bonds available on the market. They can take the form of use-of-proceed bonds, such as green or social bonds. Those instruments are used only to finance sustainability-related projects or activities.

In the absence of a specific sustainability-related project or activity, these bonds could be issued as general-purpose bonds with some special commitment toward sustainability-related performance indicators.

Other sustainability-related bonds are:

-

Climate-aligned bonds

-

Low carbon transition bonds

-

-

Social bonds

-

Sustainability bonds

-

Sustainability-linked bonds

-

SDG bonds

-

SDG accelerator bonds

Climate-aligned bonds

Climate-aligned bonds are issued by an entity whose revenues are from climate-aligned activities. A specific type of climate-aligned bond is a low-carbon transition bond. For example, China is issuing low-carbon transition bonds to supplement its sustainability bonds.

Social bonds

Social bonds are issued to finance eligible social projects. The issuance of social bonds is governed by the Social Bonds Principles (SBP). Social project categories include, for example:

-

Affordable basic infrastructures, such as clean water, sanitation, transportation, or energy

-

Access to essential services, such as healthcare and education

-

Food security and sustainable food systems

-

Reduction of inequality

Sustainability bonds

If a project financed by the bond combines social and green projects, we are talking about a sustainability bond. Sustainability bond guidelines provide instructions for the issuance of this type of bond.

Sustainability-linked bonds

Sustainability-linked bonds are an example of general-purpose bonds. Their relationship with sustainability is not based on how the proceeds are used. Instead, these bonds can finance any project or activity.

The achievement of selected sustainability objectives will incentivize the issuer. Guidelines for issuing these bonds are stated in the Sustainability-linked Bonds Principles.

The relationship between the green, social, sustainability, and sustainability-linked bonds guidelines is illustrated below.

SDG and SDG Accelerator bonds

SDG bonds, also called SDG-related bonds or SDG-themed bonds, are a broader category of sustainability-related bonds connected to Sustainable Development Goals (SDGs).

The UN developed the 17 Sustainable Development Goals to tackle the challenges faced by the world, such as poverty, climate change, and decreasing biodiversity.

SDG bonds can be considered a broader category of sustainability-related bonds, including green, social, and sustainability bonds.

A new type of SDG bond, the SDG Accelerator bond, is proposed by the Asian Development Bank (ADB). These new instruments should incorporate some credit enhancement structures with incentives to help countries meet SDG targets.

What are the Taxonomies for Sustainable Activities?

The definition of green fixed-income instruments is relatively uniform. However, defining green projects and activities makes it difficult to standardize these instruments. Therefore, the decision about what is and what is not a green activity is based on the taxonomy for sustainable activities.

Taxonomy for sustainable activities is a classification tool that should help distinguish between the activities classified as green and those not. This categorization allows investors and companies to make informed decisions about sustainable economic activities and helps cut greenwashing.

There are over 40 taxonomies worldwide, led by the EU taxonomy, Chinese taxonomy, and the Climate bond Initiative taxonomy. A report published by the International Platform on Sustainable Finance in 2022 compares the existing taxonomies.

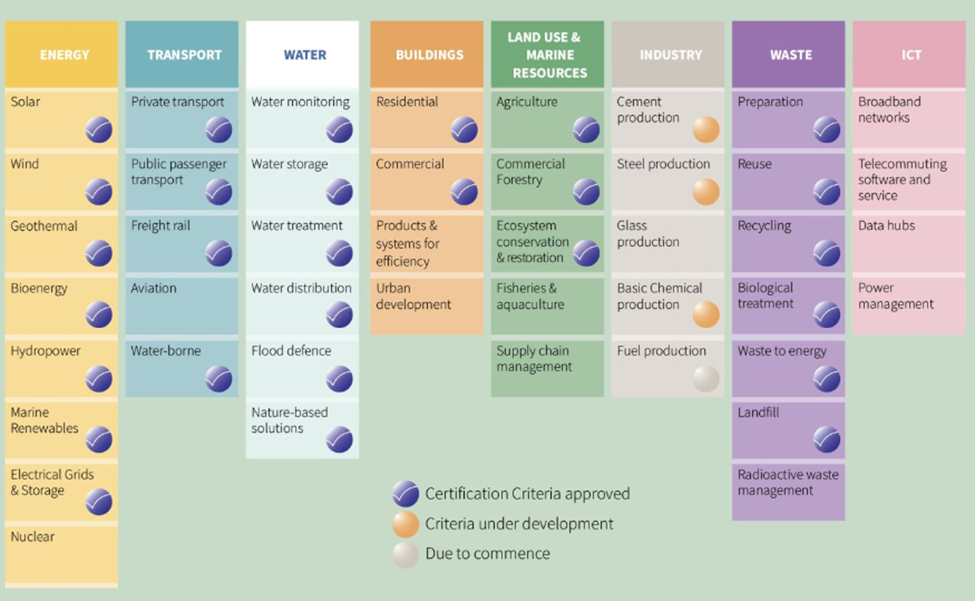

The picture below illustrates the Climate Bond Initiative Taxonomy classification of sustainable activities in eight different groups:

- Energy

- Transport

- Water

- Buildings

- Land use & marine resources

- Industry

- Waste

- ICT

The list of existing taxonomies published by countries around the world and those in progress is in the table below:

| Name of the taxonomy document | Year | Country/ Jurisdiction |

|---|---|---|

| Green Bond Endorsed Project Catalogue | 2021 | China |

| The EU Taxonomy for Sustainable Activities | 2022 | EU |

| Work in progress | UK | |

| Work in progress | New Zealand | |

| Taxonomy | Work in progress | Australia |

| Green Asset Taxonomy | Work in progress | Canada |

| Basic Guidelines on Climate Transition Finance | 2021 | Japan |

| Green Finance Taxonomy | 2022 | South Africa |

| Green Finance Guidelines | 2021 | Russia |

| The New Environmental Code | 2021 | Kazakhstan |

| K-Taxonomy | 2021 | Korea |

| Mongolian Green Taxonomy | 2019 | Mongolia |

| Work in progress | India | |

| The Sri Lanka Green Finance Taxonomy | 2022 | Sri Lanka |

| Sustainable Finance Policy for Banks and Financial Institutions | 2020 | Bangladesh |

| Green Bond taxonomy | draft | Bangladesh |

| ASEAN taxonomy for sustainable finance | 2021 | The Association of Southeast Asian Nations (ASEAN) Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam |

| Green Taxonomy of Columbia | 2022 | Columbia |

| Taxonomy Chile | Work in progress | Chile |

| Work in progress | Mexico | |

| Dominican Republic Green Taxonomy | Work in progress | Dominican Republic |

What are the Frameworks Setting the Standard for these Bonds?

Setting a standard for what is green activity and what is not will help standardize the said bond market. However, not only the unification of the concept but standardization of the procedures will support the global growth of these themed financial instruments.

The standardization of the process of issuance and management of these instruments takes a top-down approach. This approach is moving from establishing generic principles to specific guidelines.

There have been several types of guidelines developed in the market to date. In addition, international institutions, associations, independent initiatives, governments, and investors are developing frameworks based on their principles and standards.

The most common guidelines are:

-

Principles

-

Green Bond Principles (GBP)

-

-

Standards

-

ASEAN Green, Social, and Sustainability Bond Standards by the ACMF in 2017

-

The EU Green Bond Standards Regulation (GBSR)

-

-

Frameworks

-

Asian Development Bank's Green and Blue Bond Framework

-

International Finance Corporation's (World Bank) Green Bond Framework (GBF)

-

Government of Canada's GBF

-

GBP

The International Capital Market Association (ICMA) developed GBP. These principles define the green fixed-income instruments and set guidelines for better transparency in the issuance of these instruments. They were first published in 2014, and they are regularly updated.

The GBP is widely used to develop national frameworks and standards issued globally. Most of the designed guidelines and standards are based on these principles:

-

Recommending transparency and disclosure.

-

Promoting integrity in the development of the market with green fixed-income instruments.

-

Clarifying the approach for issuance of the green fixed-income instruments.

The bonds need to be aligned with all four components:

1. Use of Proceeds

2. Process for Project Evaluation and Selection

3. Management of Proceeds

4. Reporting

Use of Proceeds

The critical feature of these instruments is the use of their proceeds. The proceeds must be used only on financing or refinancing eligible green projects with clear environmental benefits. This information has to be outlined in the legal documentation of the bond.

The definition of green projects and activities is critical for the issuance of this instrument. Thus, it depends on how green activities are defined, which might differ in different jurisdictions.

Over 40 different taxonomies on sustainable activities are published or prepared worldwide.

Process for Project Evaluation and Selection

The project's activities and risk management must be documented for investors to identify, evaluate, and select the proper green fixed-income instrument.

Management of Proceeds

The proceeds could be managed on a bond-by-bond or aggregated level as a portfolio approach. The profits should be correctly documented internally. However, it is recommended that an external party reviews the allocation independently.

The review can be done by:

-

Consultant (as a second opinion)

-

Verification (against own standards)

-

Certification (against third-party standards, such as the one offered by Climate Bonds Initiative)

-

Rating (by rating agencies)

The GBP was initially supported by the voluntary coalition of underwriters, issuers, and investors, started in January 2014 by four banks. As of August 2016, it has 122 members and 75 observers.

ASEAN Green, Social, and Sustainability Bond Standards

The ASEAN Capital Markets Forum (ACMF) created the regional standards for green, social, and sustainability bonds in 2017. The ASEAN is the association of Southeast Asian nations, such as Indonesia, Malaysia, the Philippines, and Singapore. The regional green bond standards are based on the globally accepted GBP.

The label of ASEAN Green bonds means that the bonds or Sukuks issued to follow the ASEAN Standards. The proceeds shall be exclusively used to finance or refinance, in part or complete, new and existing eligible green projects.

In the case of Islamic bonds or Sukuk, it must also comply with the relevant laws and requirements for issuing Islamic bonds or Sukuk. If those instruments comply with Islamic laws and bond standards, they can use the label ASEAN Green Sukuk.

The ASEAN Standards provide objectives, criteria, and guidance based on the four components of the GBP. Those are:

-

Use of Proceeds

-

Process for Project Evaluation and Selection

-

Management of Proceeds

-

Reporting for these Bonds

The EU Green Bond Standards Regulation

In June 2018, the European Commission established a specialized technical group of experts on sustainable finance to prepare the Standards for these Bonds.

These were created primarily as a standard for the European green bond market, with an ambition to expand and become a worldwide standard.

Exactly a year later, in June 2019, this EU Technical Expert Group on Sustainable Finance presented a final report on the EU Green Bond Standards. The group prepared the standards on the previously established EU taxonomy for sustainable activities.

The report had to follow the traditional procedures of the European Union to become a legally valid regulation.

The European Commission proposed the regulation in July 2021, and the European Parliament approved it in May 2022. However, the individual EU member states must further support it to become valid.

The ambition of the EU Standards to set a worldwide standard is facing some difficulties. The issue with achieving its wide acceptance is the focus on the EU taxonomy. As the taxonomy is EU-centric, it might need to be more adaptable and accepted in other jurisdictions.

Green Bond Frameworks

Several international financial institutions, governments, and investors published detailed frameworks for issuing green financing instruments to benefit the existing bond principles and standards. All of the individual frameworks are aligned with GBP.

The Asian Development Bank presented the Green and Blue Bond Framework to support the developing members. The bank finances projects that are ambitious to deliver environmentally sustainable growth, fight poverty, and improve the quality of life of the people in the region.

The International Finance Corporation was one of the first issuers of these bonds and helped the market expand. It also issued a framework for its bonds programs to support the assessment and selection of eligible projects for bond investments.

Also, the Government of Canada recognizes the importance of sustainable finance for accelerating the transition to a cleaner economy. Therefore, the government is applying its green bond framework to support projects that help Canada meet its 2030 emissions reduction target and achieve net-zero emissions by 2050.

How well is the green bond market developing?

The markets with green fixed-income instruments have grown fast in size and coverage since the first green fixed-income instrument was issued in 2007 by the European Investment Bank (EIB).

It was followed by the World Bank's issuance in 2008, setting an example for others to issue similar fixed-income instruments.

The market is growing internationally, even though standardization is still a work in progress. Even though the GBP and the Climate Bonds Initiative certification are available, the decision of what green activity is in the hands of individual jurisdictions.

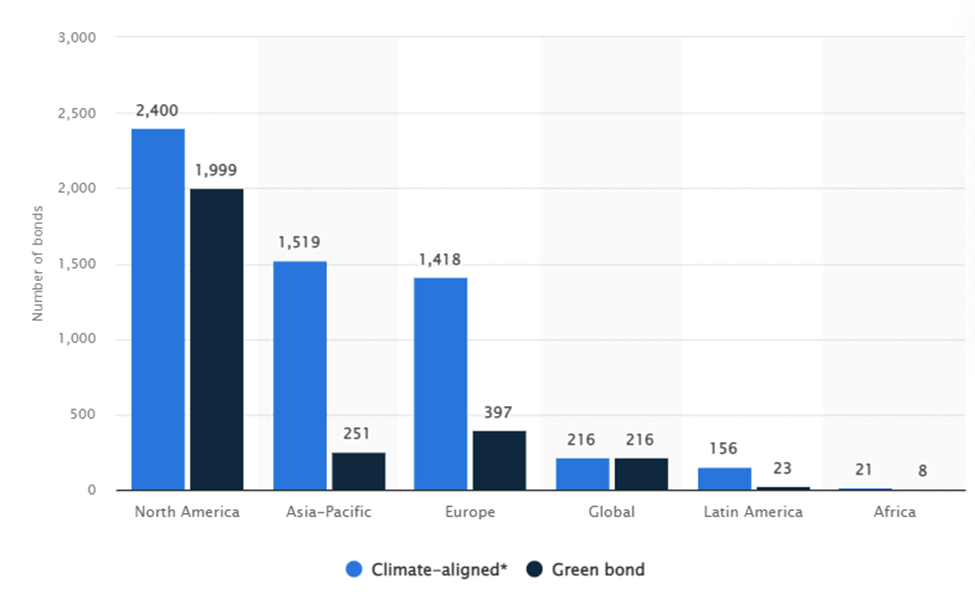

The green fixed-income instruments market expanded with an average growth above 50 % over the last five years. The total market had a value of 265 billion USD in 2021, according to Statista. The chart below demonstrates the number of green and climate-aligned bonds issued by the region in 2018.

The market witnessed a significant jump in the volume of issuances between 2020 and 2021. Europe is a leading region, issuing half of the 2021 green-themed bonds market volume worldwide.

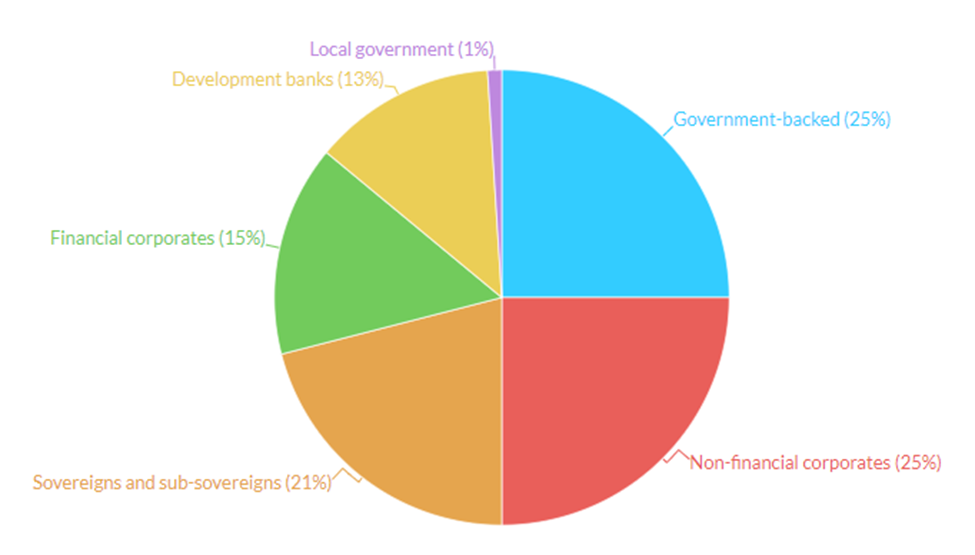

Half of the European green fixed-income instruments market is divided equally between government-backed bonds and bonds issued by non-financial institutions in 2020.

These green-themed instruments are also attractive to financial institutions, governments, and development banks. The chart below represents the market share per type of issuer in the European green fixed-income instruments market in 2020.

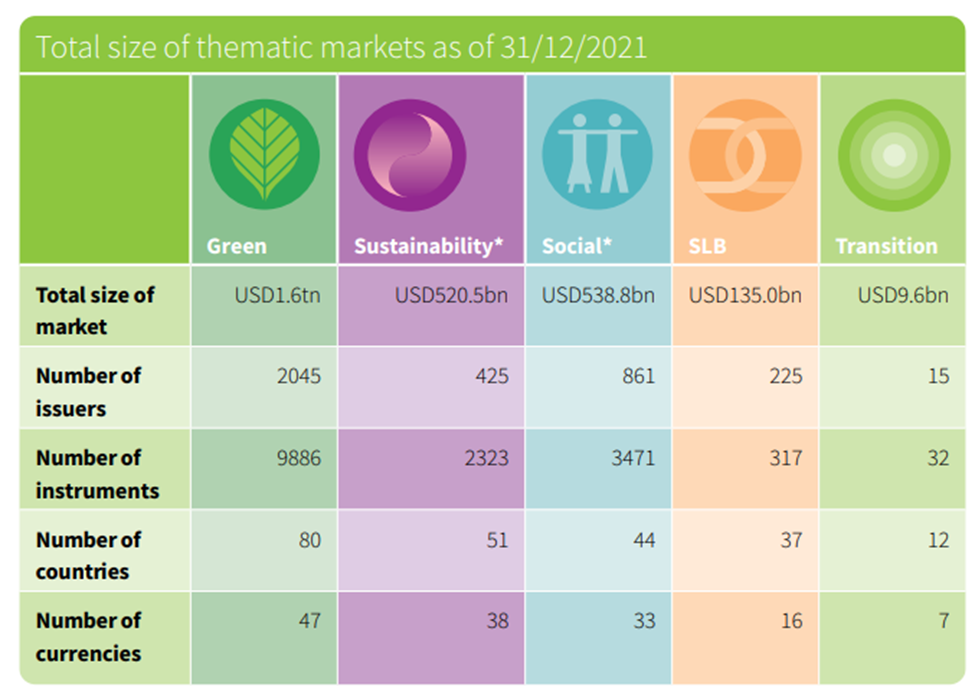

The market size of all sustainability-related bonds is described in the chart below. The green-themed bond market is by far the most developed among similar bond markets, with a total of 1.6 trillion USD and almost 10 000 issued instruments.

The Climate Bonds Initiative provides a comprehensive overview of the state of the green fixed-income instruments market, with the perspective of the other related markets, such as sustainability-linked bonds, social bonds, and others, in 2021.

At the end of 2021, climate bonds recorded more than 16,000 sustainability-related debt instruments with a cumulative volume of 2.8 trillion USD. Green-themed bonds were the most attractive of all the sustainability-related bonds.

or Want to Sign up with your social account?