Climate Risk

The analysis of consequences, likelihoods, and responses to the impacts of climate change.

What is climate risk?

Climate risk is a risk caused by a changing climate. Nowadays, it is a fact that the warming of our planet due to the increased level of greenhouse gas emissions is causing climate change. A stable climate enabled humanity to develop its civilization.

On the other hand, changing climate is connected to severe risks to humanity. Those risks arising from climate change are called climate risks.

Looking back in history, the earliest academic research mentions the term in 1989 by John Opie. However, other terms, such as the risk of climate change, had been used explicitly even before (Richard Craig, 1988).

E.N. Foote implicitly mentioned this risk in her research published in the American Journal of Science and Arts in 1856. She described the risk of increased temperature as follows:

"An atmosphere of that gas [i.e., carbon dioxide] would give to our earth a high temperature; and if, as some suppose, at one period of its history the air had mixed with it a larger proportion than as present, an increased temperature from its action as well as from increased weight must have necessarily resulted."

Key Takeaways

- Climate risk is a consequence of our changing climate, primarily driven by increased greenhouse gas emissions. It encompasses various risks posed by these climate changes, from extreme weather events like hurricanes and heatwaves to longer-term shifts like rising sea levels.

- The concept of climate risk isn't new; it can be traced back to the 19th century. Early researchers like E.N. Foote in 1856 noted the potential risks of increased carbon dioxide levels and higher temperatures.

- Climate risk is fundamentally about uncertainty. It refers to the potential negative impacts that climate change can have on various objectives, such as economic, environmental, or social.

- Climate risk can be categorized into three main types. Physical risks relate to direct impacts of climate change like floods and wildfires. Transition risks arise from efforts to transition to a low-carbon economy, potentially causing stranded assets. Litigation risks involve legal actions against entities for their role in climate change.

- Measuring climate risk involves assessing its impact on financial and non-financial aspects. Carbon-related metrics, such as emissions and carbon intensity, quantify the environmental impact. Financial metrics like Climate Value-at-Risk (CVaR) evaluate the financial consequences.

Understanding Risk & Climate Risk

Nowadays, there are several terms and definitions used for Climate Risk. They differ depending on the purpose. First of all, it is necessary to understand what risk means.

The risk is an effect of uncertainty on objectives or a likelihood and impact of a hazard materializing. Similarly, in financial analysis, the risk is a function of the likelihood and impact of a hazardous event.

The Intergovernmental Panel on Climate Change defines risk as the potential for adverse consequences for human or ecological systems, recognizing the diversity of values and objectives associated with such systems.

Based on these risk definitions, this risk can be defined as

- an effect of uncertainty on objectives caused by climate change,

- a likelihood and impact of a climate change-related hazard materializing,

- potential for adverse consequences of climate-change-related events for human or ecological systems,

- A function of the probability and effect of a hazardous event caused by climate change.

As per Wikipedia, it refers to risk assessments based on a formal analysis of the consequences, likelihoods, and responses to the impacts of climate change and how societal constraints shape adaptation options.

The Climate & Disaster Screening Tool of the World Bank defines it as a combination of hazard exposure, sensitivity to impact, and adaptive capacity.

The term is often used in different variations, such as:

- risk related to climate change,

- sustainability and climate risk,

- climate-related risk,

- ESG risk,

- climate, environmental and social risks.

As Joel Makower says, there has been "an immutable march of memes — terms that rise and become popularized, often without agreed-upon definitions. Then, over time, they become used and overused, to the point where they lose much of their meaning." Climate risk is one of them.

Several terms are currently used in various related materials, such as reports, articles, guidelines, or certifications. The table below maps some of the used expressions and their source.

| Climate risk term | Used by |

|---|---|

| Climate risk |

IPCC European Commission OECD European Banking Authority (EBA) Bank of International Settlements BlackRock Investment Institute U.S. Commodity Futures Trading Commission International Institute for Applied Systems Analysis Network for Greening the Financial System (NGFS) Task Force on Climate-related Financial Disclosure (TCFD) |

| Climate-related risk |

International Institute for Applied Systems Analysis Network for Greening the Financial System (NGFS) Black Rock Investment Institute U.S. Commodity Futures Trading Commission European Central Bank/Banking Supervision (ECB) European Banking Authority (EBA) United Nations (UN) Task Force on Climate-related Financial Disclosure (TCFD) The coalition of Finance Ministries for Climate Action |

| Climate Change Risk |

OECD |

| Climate Change-related Risk |

IPCC |

| Climate-related risk drivers |

Bank for International Settlements (BIS) |

| Risk of climate change |

University of Cambridge IPCC |

| Sustainability and Climate risk |

GARP |

| Sustainability risk |

Eurosif |

| Climate, environmental and social risks |

China Banking Regulatory Commission (CBRC) |

| Climate-related and environmental risks |

European Central Bank (ECB) |

Organizations are inclined to synonymously use the terms climate-related risks, climate risks, or climate change risks. BIS also uses the name climate (-related) drivers interchangeably.

Some institutions use more broad terms, such as ESG or sustainability risks, or include environmental risks when addressing these types of risks.

On the other hand, even when using the same term, its definition may vary. Therefore it is crucial to ensure the correct understanding of a term's definition before undertaking any analysis or comparison.

What is the climate-related risk?

The term Climate-related risk is used mainly in the business and economic context. The climate-related risks are not new standalone risks. Instead, they are so-called 'transverse' risks and manifest themselves through other existing types of risk (both financial and non-financial).

Climate-related risk refers to an organization's potential negative impacts on climate change.

In the category of financial risks, climate-related risk is a financial risk posed by the exposure of institutions to counterparties that may contribute to or be affected by climate change.

Climate-related financial risks are potential risks that may arise from climate change or from efforts to mitigate climate change, their related impacts, and their economic and financial consequences.

Due to its transverse character, it is more appropriate to use the term climate-related risks instead of climate risks in the business and financial context.

ESG (Sustainability) risks

ESG risks are often referred to as Sustainability risks, and they have three dimensions:

- environmental,

- social, and

- governance.

Climate-related risks are closely related to ESG risks, as they are considered one of the environmental risk categories.

Environmental risks are risks with a negative financial impact on the institution from environmental factors' current and future effects on its counterparties or invested assets (EBA).

Another category of environmental risks is nature-related risks, which are also closely connected to climate-related risks.

Nature-related risks

Sustainability risks are complex and are an object of further studies and research. However, two sustainability risks, climate-related and nature-related, are closely related and must be assessed together.

As per Climate-related risks, there is already some understanding among the market participant. However, nature-related risks have yet to be focused on, and the framework for their understanding and reporting still needs to be developed.

In March 2022, a Task Force on Nature-related Financial Disclosure (TNFD) was established, and it will provide the relevant insides.

The relationship between climate and nature-based risks is twofold. On the one hand, ecosystems play a crucial role in emitting and sequestering greenhouse gas (GHG) emissions. But on the other hand, it helps mitigate and adapt to climate change.

For example, the GHGs are the forest serving as a carbon sink, absorbing around 15 % of the GHG emissions. On the other hand, a significant source of GHG emissions is deforestation.

On the other hand, climate change is one of the five drivers of nature change (biodiversity loss). The other drivers of nature loss are:

- Resource exploitation

- Change in the land and sea use

- Pollution

- Invasion of Alien species

What are the climate-related hazards?

Climate-related risks affect other risk types through pathways initiated by a climate hazard, also called a driver. A hazard describes the climatic driver of a threat. The definition of a hazard is anything that can cause harm.

Hazard is often referred to as a root cause in some enterprise risk management frameworks.

The World Bank's Climate & Disaster Risk Screening tool defines a climate hazard as a physical process or event (hydro-meteorological or oceanographic variables or phenomena) that can harm human health, livelihoods, or natural resources.

The pathways through which the climate change risk drivers impact the traditional risk categories are either micro or macroeconomic transition channels.

The table below provides examples of the effects of each risk type.

| Traditional Risk Type | Potential Effects Of Climate-Related Risk Drivers |

|---|---|

| Credit Risk | Change in borrowers' ability to repay and service debt (income effect) or banks' ability to fully recover the value of a loan in the event of default (wealth effect). |

| Market Risk | Change in financial asset value. |

| Liquidity Risk | Change in market conditions. |

| Operational Risk | Change in legal and regulatory compliance risk. |

| Reputational Risk | Changing market and consumers' preferences. |

What are the types of climate-related risks?

The three main types are, Physical risks, Transition risks, and Litigation (or/and Liability) risks.

Physical risks

Physical climate-related risks cover the economic effects of climate-related events and impacts on asset value. They could be:

- Acute risks (heat waves, floods, hurricanes, and wildfires)

- Chronic risks (rise in temperatures, sea-level rise, and changes in precipitation)

The negative effect of acute risks on the asset value can increase underwriting risk for insurers as well as the credit risk of a lender. The adverse effects of chronic risks will require both public and private investment for mitigation and adaptation.

Transition risks

Transition risks are related to the process of adjustment toward a low-carbon economy. They are connected to:

- introduction of a new policy,

- regulatory measures,

- developments in technology, and

- changing consumer preferences.

Transition risks affect the business's profitability and the households' wealth, creating financial risks for lenders and investors. Furthermore, they affect the economy through investment, productivity, and relative price channels, especially if the transition makes stranded assets.

An asset is "stranded," where infrastructure must be retired before the end of the asset's useful life to meet emission reduction targets.

The end of the asset's useful life leads to a fall in the value of the assets, resulting in losses to both capital and income for owners and increased market and credit risks for lenders and investors.

Some of the sources argue that litigation risk is a separate category. However, other sources claim that litigation risk is integrated into the legal transition risks.

Litigation and Liability Risks

In some cases, litigation or/and liability risks are considered a separate category in addition to physical and transition risks.

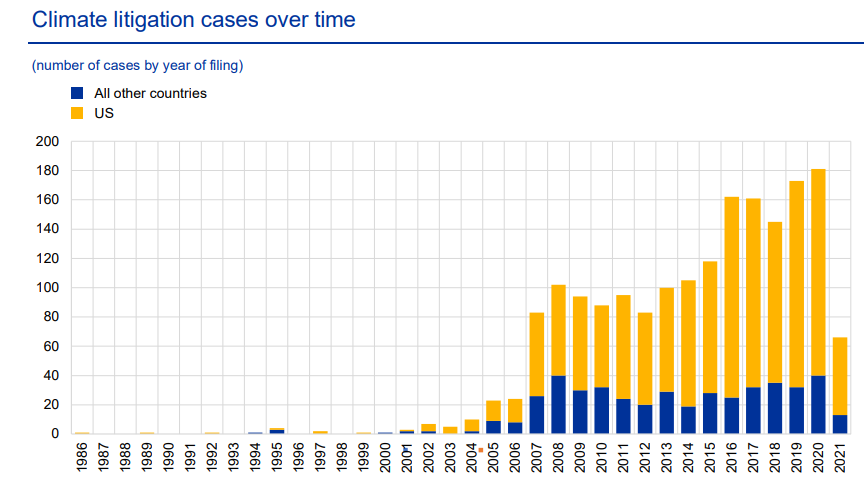

Litigation (liability) risk reflects potential financial losses from any lawsuit or legal claim related to climate change mitigation or adaptation. Climate-related litigation cases have been growing in the last 20 years.

However, 2021 was an exceptional year as both German and French national courts decided against the German and French governments not doing enough to fight climate change. The following chart represents the growth of climate litigation cases since 1986.

How is climate-related risk measured?

The financial impact of climate-related issues on organizations, households, and the economy is sometimes indirect or clear. Therefore, ensuring the material aspects of climate risks are being measured and targeted is challenging.

The tools and methodologies to assess climate-related risks are a developing field at an early stage. However, there have been two types of quantitative metrics used:

- carbon-related metrics (Greenhouse Gas emissions, carbon prices, etc.)

- financial metrics (financial risks exposure, forward-looking metrics, etc.)

In simple terms, the risk is calculated as a function of probability/likelihood and consequence/impact (European Commission).

risk = probability (likelihood) x consequence (impact)

The climate-related risks measurement in the financial or investment portfolio

The most commonly used method to quantify the environmental impact of the portfolio is calculating the following (Swiss Sustainable Finance, TCFD, and MSCI):

Carbon-related metrics:

- Total Carbon Emissions,

- Carbon Footprint,

- Carbon Intensity,

- Weighted average Carbon Intensity,

- Exposure to Carbon-Related Assets.

Financial metrics:

- Climate Value-at-Risk,

- Portfolio alignment to a climate scenario,

- Integrating climate-related risks measurement in credit risk assessment.

carbon-related metrics to measure climate-related risks

The different carbon-related metrics to measure the climate related risk are as mentioned below.

Total Carbon Emissions

Total Carbon Emissions measure the absolute greenhouse gas emissions associated with a portfolio, expressed in tons of CO2e.

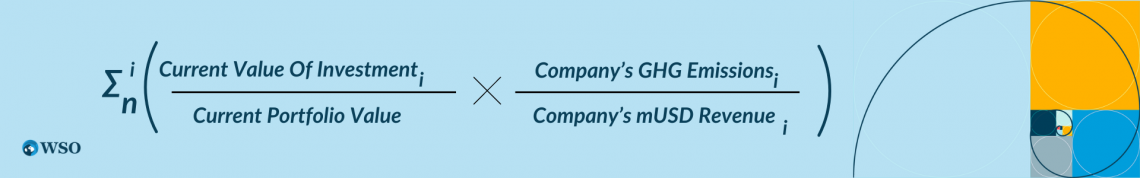

Carbon Footprint

Carbon Footprint represents carbon emissions for a portfolio normalized by the market value of the portfolio, expressed in tons CO2e / $M invested.

Carbon Intensity

Carbon Intensity measures the volume of carbon emissions per million dollars of revenue (carbon efficiency of a portfolio), expressed in tons CO2e / $M revenue.

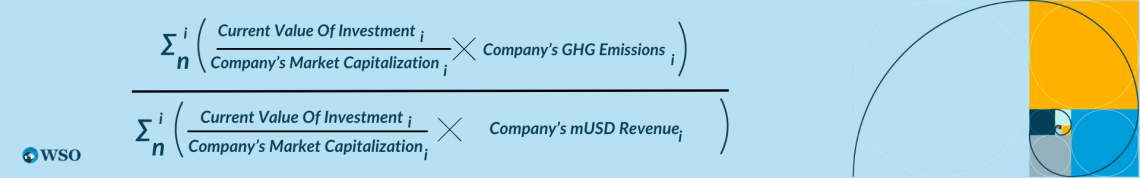

Weighted Average Carbon Intensity

Weighted Average Carbon Intensity measures the portfolio's exposure to carbon-intensive companies, expressed in tons CO2e / $M revenue.

In all of the above formulas, the current investment value is a market value of an amount of equity of a company I held in an investment portfolio.

The current portfolio value is the value of all the financial products in an investment portfolio. GHG emissions currently represent greenhouse gas emissions in Scope 1 and Scope 2 according to GHG protocol standards. However, it falls short of including the Scope 3 emissions in the measurement.

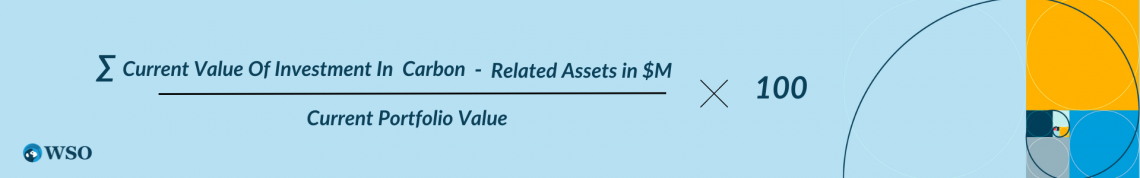

Exposure to Carbon-Related Assets

Exposure to Carbon Related Assets represents an amount or percentage of carbon-related assets in the portfolio, expressed in $M or a portion of the current portfolio value.

financial metrics to Measure climate-related Risks

The financial metrics to measure climate-related risk are explained below.

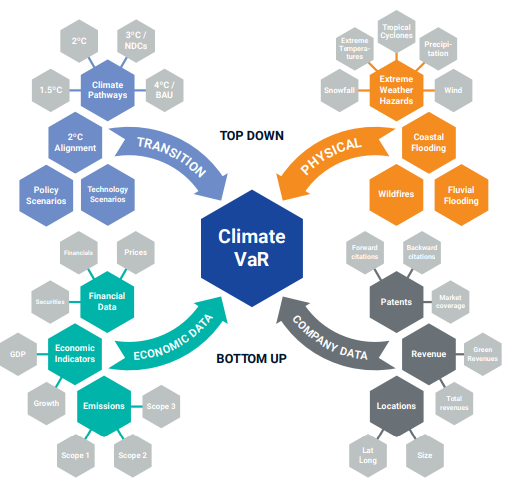

Climate VaR (CVaR)

A climate Value-at-risk (CVaR) can be calculated to make better investment decisions. CVaR is designed to provide a forward-looking and return-based valuation assessment to measure climate-related risks and opportunities in an investment portfolio.

Portfolio alignment to climate scenarios

Another way to measure a financial portfolio's climate risk (either investment or lending) is by estimating its alignment with climate scenarios. It is a forward-looking metric. The forward-looking analysis is especially important but challenging.

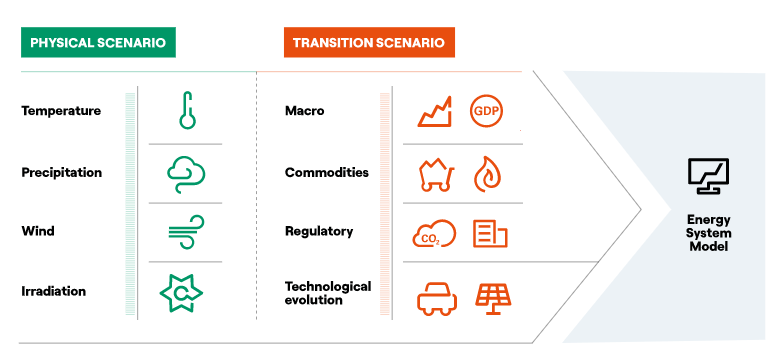

Several organizations have developed two types of climate change scenarios:

- Physical climate scenarios

- Transition scenarios

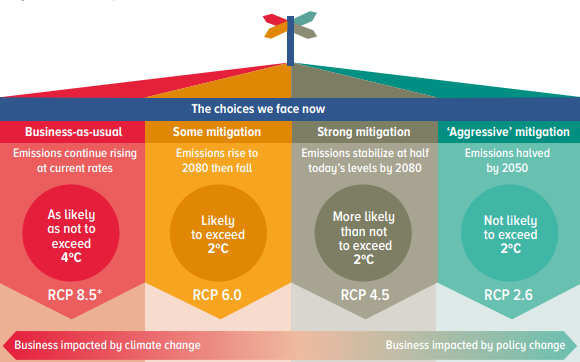

Physical climate scenarios typically present the results of global climate models that show the Earth's response to changes in atmospheric GHG concentration. The most relevant physical scenarios are the Representative Concentration Pathway (RCP) Scenarios developed by IPCC.

The picture represents the carbon crossroads based on the PCP scenarios.

Transition scenarios focus on the plausible assumptions about the development of climate policies and the use of new technologies to limit GHG emissions.

The World Energy Outlook scenarios developed by the International Energy Agency (IEA) are the most well-known and widely used scenarios for transition to a low-carbon economy.

An open-source online tool called Transition Monitor makes assessing portfolio alignment to climate scenarios easier and more practical.

It is widely used by financial institutions worldwide, supervisors, and central banks. On average, it assesses 600 portfolios a month.

Integrating climate-related risks measurement in credit risk assessment

Credit risk is a risk of financial loss resulting from a borrower's inability to repay part or all of his/her debt. Three dimensions play a crucial role in calculating credit risk:

- borrower's capacity to generate enough income to repay the loan (cash flow),

- capital (financial wealth),

- collateral.

Financial institutions follow a three-step approach to assess the impact of the risk drivers on credit risks. As a first step, they identify the relevant climate change scenario.

The climate change scenario provides a look into the possible impacts climate change has on economic variables in two ways. Firstly, the scenario will capture the impact of physical risks on economic activities. On the other hand, it will look into how the transition will mitigate these impacts.

The second step of the climate-related adjustment of the credit risk assessment involves estimating the direct and indirect financial and economic implications of climate change on the relevant actors. These impacts are translated into the cash flow and balance sheets.

In the last step, the financial institution integrates climate change-adjusted financial measures into its credit risk metrics (Council on Economic Policies, 2018).

Climate drivers affect all three dimensions and may thus lead to:

- higher probability of default,

- the higher loss gave default, and

- worse credit ratings.

metrics to Measure climate-related Risks for the non-financial industry

The above metrics and measurements are recommended and used by the financial sector, such as banks, insurance companies, asset owners, asset managers, and others.

The Taskforce on Climate-related Financial Disclosure also recommends metrics and measures for other industries, such as energy, transportation, materials and buildings, agriculture, food, and forest products.

Those metrics and measures are, for example:

- Estimated Scope 3 emissions

- Revenues/savings from investments in low-carbon alternatives

- Current carbon price or range of prices used.

- Percentage of water withdrawn in regions with high or extremely high baseline water stress

- Vehicle sales (historical, current, and projected) by category (e.g., gas vehicles, diesel vehicles, battery electric vehicles, plug-in hybrid electric vehicles, alternative-powered vehicles (LPG, CNG, fuel cells, compressed air)

- Total fuel consumed—percentage from coal, natural gas, oil, and renewable sources.

- Total energy intensity—by tons of product, amount of sales, and number of products depending on the informational value

- Building energy intensity (by occupants or square area)

- Area of buildings, plants, or properties located in designated flood hazard areas

- For each property type, the percentage is certified as sustainable.

- Non-mechanical (Scope 1): Emissions from biological processes

or Want to Sign up with your social account?