Sustainable Development Goals SDG

Goals set by the UN as global advocacy to end poverty, protect the planet, and ensure that all humans enjoy peace and prosperity

What Are Sustainable Development Goals (SDG)?

The Sustainable Development Goals (SDGs or the Global Goals) are goals set by the United Nations General Assembly (UN-GA) in 2015. They are planned to be achieved by 2030 as global advocacy:

- to end poverty,

- to protect the planet, and

- to ensure that all humans enjoy peace and prosperity.

Governments in developing and developed countries are expected to translate the SDGs into national action plans, policies, and initiatives, depending on the realities and capacities of their countries.

Apart from targeting the governments, the sustainable development goals are designed to call for a wide range of global organizations to shape priorities and form aspirations for sustainable development under the standard framework.

How Many Sustainable Development Goals Are There In Total?

In total, there are 17 goals:

1. No Poverty

2. Zero hunger

3. Good health and well-being

4. Quality Education

5. Gender equality

6. Clean water and sanitation

7. Affordable and clean energy

8. Decent work and economic growth

9. Industry, innovation, and infrastructure

10. Reduced inequalities

11. Sustainable cities and communities

12. Reasonable consumption and production

13. Climate action

14. Life below water

15. Life on land

16. Peace, justice and strong institutions, and

17. Partnerships for the goals

These 17 goals are interconnected—taking action in one area will impact other sites, and that development must consider social, economic, and environmental sustainability.

Creativity, awareness, technology, and financial resources from society are essential to achieve the goals.

To monitor the progress, a wide range of tools are created to keep track and visualize the progress towards goals and are intended to make the data more accessible. For example, SDG Tracker, completed in June 2018, provides available data among the indicators.

Key Takeaways

- The SDGs, established by the United Nations in 2015, aim to end poverty, protect the planet, and ensure peace and prosperity by 2030.

- There are 17 SDGs, including addressing poverty, hunger, health, education, gender equality, climate action, and partnerships for the goals.

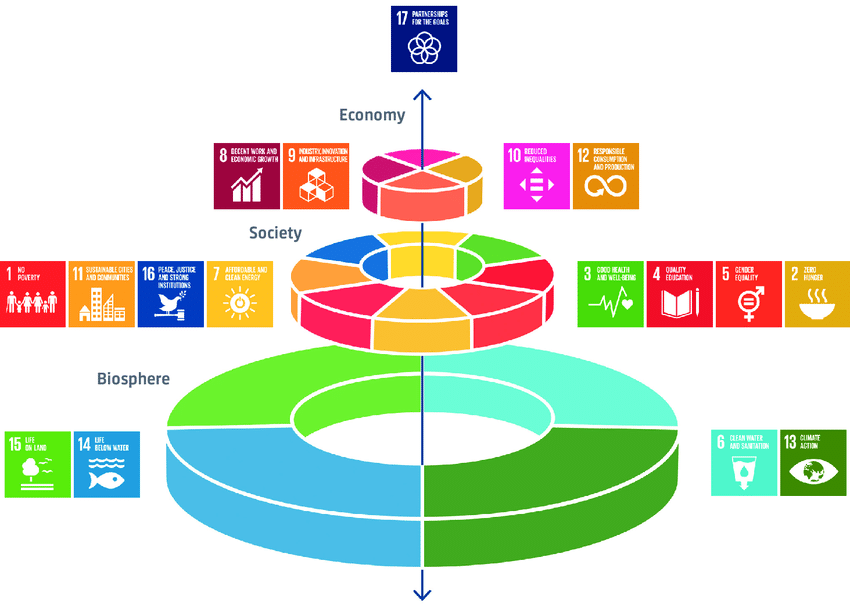

- The Wedding Cake Model presents a hierarchical view of the goals, emphasizing the biosphere as the foundation, followed by societies, economies, and partnerships.

- SDG investing involves private sector investment in projects aligned with the 17 goals, contributing to global sustainable development.

The SDGs Wedding Cake Model

The wedding cake model (also known as the SDGs wedding cake model), developed by the Stockholm Resilience, is a systematic hierarchy of the Sustainable Development Goals.

Given that the 17 sustainable goals are interconnected and influential to each other, it is challenging to tackle the goals separately.

The wedding cake model presents a new way of viewing the Goals by dividing the goals into a systematic hierarchy where the biosphere is the foundation of economies and societies:

- The biosphere is the foundation where life exists and is sustained. It has environmental limits. For instance, the number of natural resources is finite;

- Societies consist of artificial institutional conditions;

- Economies represent the goals that organize change;

- Partnerships are at the top of the hierarchy due to their importance in transformational change.

The biosphere is the model's base, providing a stimulating environment for all living beings. Societies are included in the biosphere as they are only built on the solid base of thriving environments. Economies are formed in communities and are built on the ground of constitutions.

Goals under the context of the biosphere:

- Goal number 6 Clean water and sanitation

- Goal number 13 Climate action,

- Goal number 14 Life below water

- Goal number 15 Life on land

Goals under the context of societies:

- Goal number 1 No Poverty

- Goal number 2 Zero hunger

- Goal number 3 Good health and well-being

- Goal number 4 Quality Education

- Goal number 5 Gender equality

- Goal number 7 Affordable and clean energy

- Goal number 11 Sustainable cities and communities

- Goal number 16 Peace, justice, and strong institutions

Goals under the context of economies:

- Goal number 8 Decent work and economic growth

- Goal number 9 Industry, innovation, and infrastructure

- Goal number 10 Reduced inequalities

- Goal number 12 Reasonable consumption and production

SDGs Investing Definition

SDG investing is an investment option for the private sector to participate in development finance through investing in projects aligned with the 17 Sustainable Development Goals.

In other words, it is a type of investment that focuses on providing resources for materializing projects that solve the long-term needs of the global community. In addition, SDG investing is about creating a positive impact and earning attractive returns.

For example, it could be investing in teachers:

"Goal 4: to ensure inclusive and equitable quality education that promotes lifelong learning and all children by age 10 must know how to read and solve numeracy."

SDG investing is gaining its place in the financial market as more investors are interested in encouraging global sustainable development.

It is estimated that dozens of trillions of dollars will be invested from the private sector to developing countries to help achieve the goals.

Monetary returns are one of many considerations for investors in SDG investing. Creating positive impacts on the environment, society, and governance (ESG) should also be emphasized.

But the question comes along: why are SDGs important for businesses when the traditional way of investing has already been making profits? Why bother to change? The next part will provide some hints to the question.

SDGs and Businesses

Sustainable Development Goals address the problems shared by the world that require efforts from various parties.

These goals can help to connect various business strategies with a global perspective. Corporations can utilize the goals as a layout to form, amend, communicate and report their plans, objectives, and activities, allowing them to capitalize on a variety of benefits:

- Identifying future business opportunities

- Enhancing the value of corporate sustainability

- Strengthening stakeholder relations and keeping pace with policy developments

- Stabilizing societies and markets

- Using a common language and shared purpose

These goals are estimated to provide a market growth of $12 trillion annually, a lucrative opportunity.

A large number of long-term investors and corporations choose sustainable investment to park cash due to the following reasons:

- Given the defined trend of climate mitigation, investors have a greater certainty to predict the changes and find a potential niche as an investment opportunity.

- Early sustainable investment in a company that has a unique product and service that fits the climate agenda enjoys the perks of realizing huge gains before the company becomes popular.

- Unlike exploitative business approaches, sustainable investing involves a great deal of money flowing in the developing world, which assists in finding more equitable solutions for investors and developing countries.

- Sustainable investing offers environmental and ethical advantages, which is where future attention goes. In this sense, lucrative cash returns are expected in the long term.

Sustainable investment benefits the planet and companies' financial assets, making it a win-win situation for investors and the world.

It offers decent, long-term benefits beyond the monetary returns that can be factored into reports on ESG or corporate social responsibility (CSR).

How To Get Into SDGs Investment?

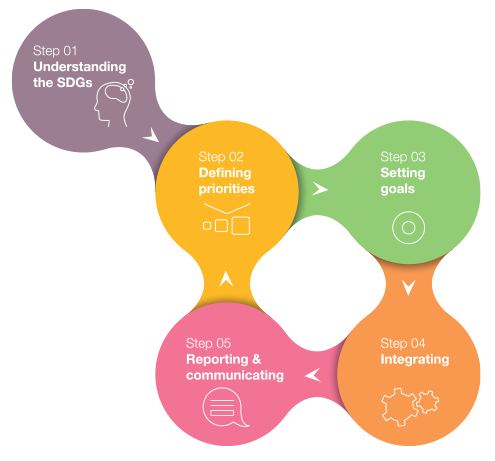

SDG Compass is a guide for businesses to advance Sustainable Development Goals. It guides companies in aligning their business strategies and measuring and managing their contribution to realizing the goals.

According to the Compass, there are five steps for companies to advance their goals:

- Understanding the Sustainable Development Goals

- Defining priorities

- Setting goals

- Integrating

- Reporting and communicating (repeating step 2)

Sustainable investing is a developing solution to environmental problems and requires time to prove itself. This elicits potential risks for any investor if there are few guidelines to understand the subject.

To better understand a sustainable investment, the Principles for Responsible Investment (PRI) would be an excellent place to start.

What Are UN Principles for Responsible Investment (PRI)?

The PRI was developed by investors and launched by the United Nations (UN) in April 2006. Over 2700 financial institutions are participating as signatories in August 2021.

The principles are set to:

- Explore the factors in the environment, society, and governance (ESG) under the context of investment.

- To build an international network to support investor signatories for taking corporate actions with the consideration of ESG factors.

- To establish a more impartial market in the finance field and eventually develop an equitable society.

There are six principles for Responsible Investment:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress toward implementing the Principle

PRI represents an ideal starting point for sustainable investing. So, what’s next?

Signing PRI As A Commitment To Sustainable Investing

Signing the PRIs represents a commitment for the companies:

- to adopt and implement the PRIs

- to evaluate the effectiveness

- in improving the Principles

By signing the PRI, the companies are believed to commit to achieving sustainable goals by aligning their business strategies with consideration of ESG.

Example of PRI: The Russian invasion of Ukraine in 2022 has further emphasized the importance of PRI as it exacerbates the shift from dependency on Russian gas to renewable energy.

The European Commission has proposed a plan to ask the European Union to be independent of Russian fossil fuels by 2030 by investing more funds in renewable energy.

In March 2020, Germany announced an additional €200 billion in investment into renewable energy by 2026.

Why Should You Follow PRI? PRI provides guidelines for a company to measure its efforts in advancing Sustainable goals, which has become a vital consideration in investment strategy and asset allocation in recent years.

It is gaining importance on its own and is no longer being marketed as a secondary activity for boosting the company's image.

There is an increasing number of investors who have a strong will to create a greater impact on the ESG goals by entering the directing boards and putting more emphasis on ESG considerations when making decisions.

In short, PRI is becoming an indicator of how well a company will be in creating an impact in the future.

Sustainable Development Goals (SDG) FAQs

The Sustainable Development Goals are goals set by the UN in 2015 and are planned to be achieved by 2030 as global advocacy to end poverty, protect the planet, and ensure that all humans enjoy peace and prosperity.

Due to the increasing awareness of climate change, an increasing number of investors are making promises to invest in companies that align their business with the considerations of the environmental, social, and governmental impact.

These goals serve as a blueprint to guide companies in dealing with climate change.

The Principles for Responsible Investment (PRI) would be a good place to start. It provides a guideline to measure if a company contributes toward a sustainable goal.

In addition, SDG Compass provides a blueprint of how a company can advance SDGs.

The tools are:

- SDG Tracker

This tracker provides various types of data and information regarding the advancements toward sustainable goals.

It gathers global data from all the available indicators from the UN and other international organizations through Our World in Data, based at the University of Oxford. - SDG Compass

The Compass serves as a guidebook for companies to adapt their strategies to align with Sustainable Development Goals and measure their efforts. It also provides a business toolset for companies to develop their corporate development plans.

The World Business Council for Sustainable Development (WBCSD) developed the Compass. - Your lifetime carbon budget

This tool calculates the lifetime carbon budget to better understand one’s carbon emission. This calculator was developed by ‘Carbon Brief’ and Dr. Ben Caldecott, based at the University of Oxford. - PWC SDG selector

It’s an accessible tool that helps provide valuable support to companies that are looking at which sustainable goals are most relevant for their business.

Companies can filter results to see which goals are most directly linked to their businesses by choosing from impact, opportunity, territory, and themes. - Business and the Sustainable Development Goals: a Framework for Effective Corporate Involvement

This is a book written by Professor Rob van Tulder of Erasmus University. It introduces a foundation framework for constructing strategies for achieving Sustainable Development Goals.

Researched and authored by Ka Chun CHIU | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?