Famous Investors

The popular investors who made huge profits for the stock market.

Famous Investors: An Overview

Great Investors are the financial world's rock stars. The greatest investors have all amassed fortunes as a result of their success, and in many cases, they have assisted millions of others in achieving similar results.

These investors' strategies and philosophies differ greatly; some developed new and innovative ways to analyze their investments, while others chose securities almost entirely on instinct. Where these investors agree is in their ability to consistently outperform the market.

The following article profiles some of the most well-known investors in terms of their ability to generate returns. This list includes investors who have managed portfolios and developed new investment methods.

The financial industry's rock stars are excellent money managers. Millions of others have benefited from the success of these successful investors, who have amassed fortunes from their advice.

The approaches and ideologies that these investors used in their trading varied greatly. While some developed fresh and creative methods for analyzing their investments, others chose their stocks primarily based on gut feeling. The capacity of these investors to regularly outperform the market is one area in which they are similar.

Famous investors: Benjamin Graham

Benjamin Graham was an American economist, professor, and investor who was born in the United Kingdom. He is universally perceived as the "Father of Value Investing," and he co-wrote two basic texts in neoclassical investing: Security Analysis (1934) with David Dodd and The Intelligent Investor (1949).

His investment philosophy emphasized investor psychology, debt minimization, fundamental analysis, concentrated diversification, buying within the margin of safety, and contrarian thinking.

He began his career on Wall Street after graduating from Columbia University at the age of 20, eventually founding the Graham-Newman Partnership.

After hiring his former student Warren Buffett, he began teaching at his alma mater, then at UCLA Anderson School of Management at the University of California, Los Angeles.

Graham was born Benjamin Grossbaum to Jewish parents in London, England. He was the great-grandson of Rabbi Yaakov Gesundheit and a cousin of neuroscientist Ralph Waldo Gerard on his mother's side.

When he was one year old, his family relocated to New York City. To assimilate into American society and avoid anti-Semitic and anti-German sentiments, the family changed their name from Grossbaum to Graham.

Following his father's death, who owned and managed a successful furniture store, the family fell into poverty, which Graham claims influenced his investing theories by instilling an early appreciation for purchasing low-priced bargains.

Graham excelled in school, graduating as salutatorian of his class at Columbia. He chose to work on Wall Street, where he eventually established the Graham-Newman Partnership.

Benjamin’s Theory of Value Investing

According to Graham, value investing is determining a common stock's intrinsic value independent of its market price.

The intrinsic value of a stock can be calculated and compared to its market value using a company's factors such as assets, earnings, and dividend payouts.

If the intrinsic value exceeds the current price, the investor should purchase and hold until mean reversion occurs. The theory of mean reversion states that the market and intrinsic prices will converge over time until the stock price reflects its true value.

When an investor purchases an undervalued stock, he or she is effectively paying less for it and should sell when the price is trading at its intrinsic value.

Graham was a staunch supporter of efficient markets. If markets were not efficient, there would be no point in value investing because the fundamental principle of value investing is the ability of markets to eventually correct their intrinsic values.

Benjamin Graham observed that due to investor irrationality and other aspects such as the inability to predict the future and stock market fluctuations, buying undervalued or out-of-favor stocks is certain to provide the investor with a margin of safety.

The Benjamin Graham Formula for determining a stock's intrinsic value was:

V = [EPS*(8.5 + 2*g)*4.4] / Y

Where

V = Intrinsic value of the stock

EPS = Earnings per share of the company for the trailing 12 months

8.5 = Price-to-earnings for a zero-growth stock

g = Company’s long-term growth rate

4.4 = The average yield on high-quality corporate bonds in 1962

Y = the current rate of return on AAA corporate bonds

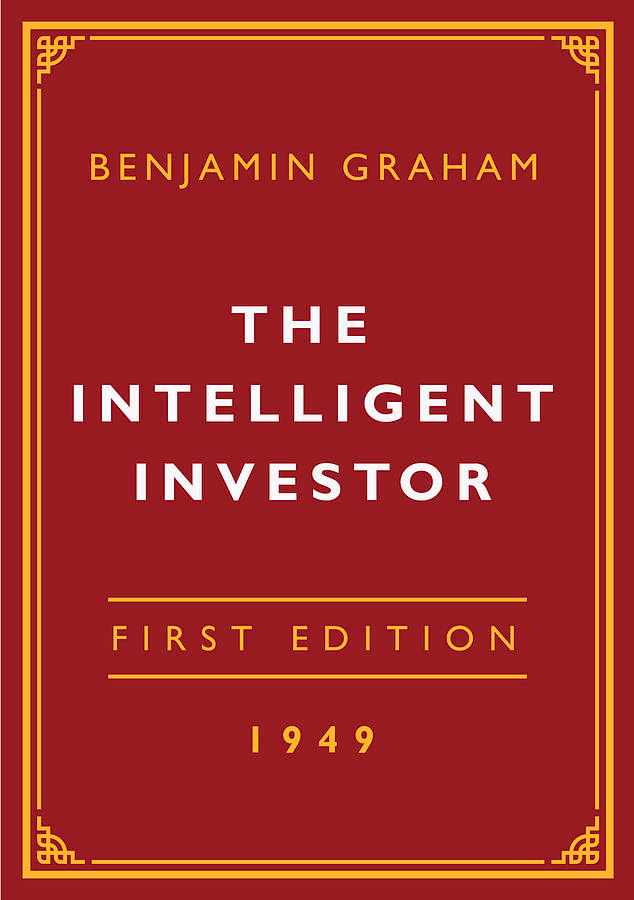

The Intelligent Investor

Graham published the acclaimed book "The Intelligent Investor: The Definitive Book on Value Investing" in 1949. "The Intelligent Investor," widely regarded as the bible of value investing, features a character known as Mr. Market, Graham's metaphor for market price mechanics.

Mr. Market is an investor's fictitious business partner who attempts to sell or buy shares from the investor daily. Mr. Market is frequently irrational, showing up at the investor's door with different prices on different days depending on how optimistic or pessimistic he is in his mood.

Naturally, the investor is under no obligation to accept any buy or sell offers. The intelligent investor, according to Graham, sells to optimists and buys from pessimists.

Due to price-value discrepancies caused by economic depressions, market crashes, one-time events, temporary negative publicity, and human errors, the investor should look for opportunities to buy low and sell high.

Warren Buffett, a student of Benjamin Graham's at Columbia University, is one of his most notable disciples. After graduation, Buffett worked for Graham's company, Graham-Newman Corporation, until Graham retired.

Buffett went on to become one of the most successful investors of all time, thanks to Graham's mentoring and value investing principles.

Famous Investors: Peter Lynch

Peter Lynch is one of the world's most successful and well-known investors. Lynch is the legendary former manager of the Magellan Fund at Fidelity Investments.

He took over the fund at the age of 33 in 1977 and ran it for 13 years. His success enabled him to retire at the age of 46 in 1990.

His investment style has been described as adaptable to the prevailing economic environment at the time, but Lynch has always stressed the importance of understanding what you own.

Peter Lynch was born in Newton, Massachusetts, on January 19, 1944. Lynch worked as a caddie in his early teens to help support his family.

Lynch used his savings as a sophomore at Boston College to purchase 100 shares of Flying Tiger Airlines at $8 per share. The stock would eventually rise to $80 per share, with profits helping to pay for his education.

Lynch graduated from Boston College (BC) in 1965 after studying history, psychology, and philosophy. In 1968, he received a Master of Business Administration from the University of Pennsylvania's Wharton School.

Investing Career

Lynch started his career as an intern at Fidelity Investments in 1966. He initially covered the paper, chemical, and publishing industries before being hired permanently in 1969 after returning from a two-year Army stint.

Lynch was further promoted to director of Fidelity’s research from 1974 to 1977. Lynch was appointed head of the then-obscure Magellan Fund, which had $18 million in assets, in 1977.

By the time Lynch stepped down as fund manager in 1990, the fund's assets had grown to more than $14 billion, with over 1,000 individual stock positions.

Lynch had no constraints on what assets he could buy when he took over Magellan when it was a small fund. From 1977 to 1990, the Magellan fund averaged a 29.2% annual return and had the best 20-year return of any mutual fund as of 2003.

Investment Principles

Lynch’s most famous investing principle is ‘Investing in known stocks’. This also promotes the economic concept of local knowledge. Lynch recommends this principle to investors as a starting point.

He has also stated on numerous occasions that an individual investor is potentially more capable of profiting from stocks than a fund manager because they can spot good investments in their daily lives before Wall Street.

Lynch made popular the stock investment strategy "GARP" (Growth At A Reasonable Price), which is a blended stock-picking approach that balances the potential for share-price increase of growth investing with the discipline of value investing to avoid purchasing overpriced stocks.

In a financial context, he also coined the term "ten-bagger." This is an investment worth ten times its original purchase price.

Famous Investors: Warren Buffett

Warren Edward Buffett is a business tycoon, investor, and philanthropist from the United States. He currently serves as Berkshire Hathaway's chairman and CEO. He is one of the world's most successful investors. He is the fifth wealthiest person in the world.

Buffett was born in Omaha, Nebraska, in 1930. Buffett wanted to skip college after finishing high school and finding success with his side entrepreneurial and investment ventures, but his father overruled him.

At a young age, he became interested in the entrepreneurial world and investing, including the stock market.

Buffett received his undergraduate degree in business administration from the University of Nebraska after beginning his education at the University of Pennsylvania's Wharton School.

Buffett later earned a master's degree in economics from Columbia Business School.

Entrepreneurial Journey

Buffett's early childhood years were filled with entrepreneurial endeavors. Buffett sold bubble gum, Coca-Cola bottles, and weekly magazines door to door in one of his early businesses. In addition, he was employed at his grandfather's grocery store.

He made money while still in high school by delivering newspapers, selling golf balls and stamps, and detailing cars, among other things.

As a high school sophomore in 1945, Buffett and his friend spent $25 on a used pinball machine installed in a local barbershop.

Within a few months, they had several machines in three different Omaha barber shops. Later that year, they sold the company to a war veteran for $1,200.

Buffett's interest in the stock market and investing dates back to his childhood when he spent time in the customers' lobby of a regional stock brokerage near his father's brokerage office.

Investing Journey

From 1951 to 1954, Buffett worked as an investment salesman at Buffett-Falk & Co.; from 1954 to 1956, as a securities analyst at Graham-Newman Corp.; from 1956 to 1969, as a general partner at Buffett Partnership, Ltd.; and beginning in 1970, chairman and CEO of Berkshire Hathaway Inc.

Buffett had three partnerships in 1957. Buffett met future partner Charlie Munger in 1959 when the company had grown to six partnerships.

Buffett had seven partnerships by 1960. Buffett revealed in 1961 that the Sanborn Map Company accounted for 35% of the partnership's assets.

He explained that while Sanborn stock was only $45 per share in 1958, the company's investment portfolio was valued at $65 per share. This meant that Sanborn's map business was worth "minus $20."

As an activist investor, Buffett eventually purchased 23 percent of the company's outstanding shares, gaining a seat on the board of directors, and allied with other disgruntled shareholders to control 44 percent of the shares.

In just two years, Buffett had achieved a 50% return on investment.

Buffett became a millionaire in 1962 as a result of his partnerships, which had an excess of $7,178,500 in January 1962, of which over $1,025,000 belonged to Buffett. He combined these collaborations into one.

Buffett invested in and eventually took control of Berkshire Hathaway, a textile manufacturing company. He began purchasing Berkshire shares from the company's owner, Seabury Stanton, whom he later fired. Buffett's partnerships started buying the stock at $7.60 per share.

When Buffett's partnerships began aggressively purchasing Berkshire in 1965, they paid $14.86 per share, while the company had a working capital of $19 per share. The value of fixed assets was not included.

At a board meeting, Buffett took control of Berkshire Hathaway and named a new president, Ken Chace, to lead the company.

Buffett closed the partnership to new money in 1966. Later, he stated that the textile industry was his worst trade. He then transitioned the company into the insurance industry, and in 1985, the last of Berkshire Hathaway's mills were sold.

Berkshire began purchasing stock in the Washington Post Company in 1973. Berkshire indirectly purchased the Buffalo Evening News for $32.5 million in 1977.

Berkshire Hathaway purchased a 12 percent stake in Salomon Inc. in 1987, making it the company's largest shareholder and Buffett, a director.

Buffett began purchasing The Coca-Cola Company stock in 1988, eventually purchasing up to 7% of the company for $1.02 billion. It would prove to be one of Berkshire's most profitable investments, which it still owns.

Buffett became a billionaire on May 29, 1990, when Berkshire Hathaway began selling class A shares for $7,175 per share. Then, in a difficult deal, he acquired General Re (Gen Re) as a subsidiary in 1998.

Buffett invested $11 billion in forwarding contracts to deliver US dollars against other currencies in 2002. By April 2006, his total profit from these contracts had surpassed $2 billion. During the subprime lending crisis of 2007 and 2008, Buffett faced criticism.

Berkshire Hathaway's earnings fell by 77% in the third quarter of 2008, and several of its later transactions suffered significant mark-to-market losses. Berkshire Hathaway purchased 10% of Goldman Sachs' perpetual preferred stock.

Buffett became the world's richest person in 2008, with an estimated net worth of $62 billion. Buffett purchased preferred stock in General Electric (GE) in October 2008. Buffett received a five-year option to purchase three billion shares of GE stock at $22.25 and a 10% dividend.

On March 18, 2011, the Federal Reserve approved Goldman Sachs' purchase of Berkshire Hathaway's preferred stock in Goldman. Buffett was hesitant to sell the stock, which paid out $1.4 million in dividends every day.

Buffett is a believer in index funds and appreciates them, for people are either not interested or don’t have time to manage their money. He is also a great supporter of reading. It is said that till now also he spends much of his time reading.

Famous Investors: Charlie Munger

Charles Thomas Munger is a billionaire investor, businessman, and former real estate attorney from the United States. He is Berkshire Hathaway's vice-chairman. From 1984 to 2011, Munger was the chairman of Wesco Financial Corporation.

He is also the chairman of the Los Angeles-based Daily Journal Corporation and a director of Costco Wholesale Corporation. Munger has been described as Buffett's closest partner and right-hand man.

Munger was born in the city of Omaha, Nebraska. As a teenager, he worked at Buffett & Son, Warren Buffett's grandfather's grocery store. Alfred Case Munger, his father, was a lawyer. His grandfather was Thomas Charles Munger, a U.S. district court judge and state representative.

He went to The University of Michigan and majored in mathematics. In early 1943, just a few days after his 19th birthday, he dropped out of college to join the United States Army Air Corps, where he rose to the rank of second lieutenant.

He was assigned to study meteorology at Caltech in Pasadena, California, after scoring well on the Army General Classification Test.

Munger went to Harvard Law School and excelled there. He graduated with distinction with a Junior Doctor degree in 1948. He was also a member of the Harvard legal aid bureau in college.

Investing Journey

Munger started his career by joining a law firm, Wright & Garrett when he moved to California with his family. Later he worked as a real estate attorney at Munger, Tolles & Olson LLP., which he founded in 1962.

He then left the practice of law to focus on investment management. He then formed Wheeler, Munger, and Company, an investment firm with a seat on the Pacific Coast Stock Exchange, with Jack Wheeler.

He closed Wheeler, Munger, and Co. in 1976, following losses of 32% in 1973 and 31% in 1974. From 1962 to 1975, he ran his investment firm.

During the 1962–75 period, Munger's investment cooperation generated compound annual returns of 19.8 percent, compared to the Dow's annual appreciation rate of 5.0 percent.

Charlie was the chairman of the Wesco Financial Cooperation, which started as a savings and loan organization but grew to control Precision Steel Corp., CORT Furniture Leasing, Kansas Bankers Surety Company, and other businesses.

Wesco Financial also had a $1.5 billion concentrated equity portfolio in companies like Coca-Cola, Wells Fargo, Procter & Gamble, Kraft Foods, US Bancorp, and Goldman Sachs.

Munger believes that holding a concentrated number of known stocks intimately will produce superior long-term returns.

Munger also serves as the chairman of the Daily Journal Corporation.

Investment Style

Munger firmly believes in ethics for the success of a business. He once said, “ Good businesses are ethical businesses. A business model that relies on trickery is doomed to fail.”

Munger defines the "Lollapalooza effect" as multiple biases, tendencies, or mental models acting in concert in the same direction at the same time.

The Lollapalooza effect, which is a mental model in and of itself, frequently produces extreme results due to the confluence of mental models, biases, or tendencies acting together, greatly increasing the likelihood of acting irrationally.

Munger is an outspoken critic of cryptocurrencies, describing Bitcoin in particular as "noxious poison."

Famous Investors: George Soros

George Soros is a Hungarian-American businessman and philanthropist with having net worth exceeding $8.5 Billion.

Soros was born in Budapest, Kingdom of Hungary, in 1930 to a wealthy non-observant Jewish family who, like many upper-middle-class Hungarian Jews at the moment, were unsatisfied with their roots. Soros was 13 years old when Nazi Germany occupied Hungary in March 1944.

Soros moved to England in 1947 and enrolled at the London School of Economics. Soros worked as a railway porter and waiter while studying philosophy with Karl Popper and once received £40 from a Quaker charity.

Soros earned a Bachelor of Science in philosophy in 1951 and a Master of Science in philosophy in 1954 from the London School of Economics.

Early Career

Soros began his financial career as a merchant bank Singer & Friedlander clerk in 1954. Later he joined the arbitrage department. From 1956 to 1959, he worked as an arbitrage trader for F.M. Mayor in New York City.

After specializing in European stocks, he moved to Wertheim & Co. in 1959. Until 1963, he worked as a European securities analyst.

During this time, Soros devised a theory of reflexivity to expand on the ideas of Karl Popper, his tutor at the London School of Economics.

According to reflexivity, market values are frequently driven by the fallible ideas of participants rather than just the economic fundamentals of the situation.

Ideas and events interact in reflexive feedback loops. In contrast to the equilibrium predictions of more traditional neoclassical economics, Soros argued that this process results in markets having procyclical "virtuous" or "vicious" cycles of boom and bust.

Soros's experience as a vice president at Arnhold and S. Bleichroeder resulted in little excitement for the job from 1963 to 1973; business was sluggish following the implementation of the Interest Equalization Tax, which undermined the viability of Soros's European trading.

From 1963 to 1966, his primary focus was the modification of his philosophy dissertation. Then, in 1966, he established a fund with $100,000 of the firm's funds to test his trading strategies.

Soros founded the Double Eagle hedge fund in 1969 with $4 million in investor capital, including $250,000 of his own.

The Double Eagle Fund had $12 million in 1973 and served as the foundation for the Soros Fund. Every year, George Soros and Jim Rogers received returns on their capital as well as 20% of the profits.

Own Venture

Soros founded and became chairman of Soros Fund Management in 1970. Soros resigned from the management of the Double Eagle Fund in 1973 due to perceived conflicts of interest that limited his ability to run the two funds.

He then established the Soros Fund and gave Double Eagle Fund investors the option of transferring to it. The Quantum Fund was later renamed after the physical theory of quantum mechanics.

By that point, the fund's value had risen to $12 million, only a small portion of which was Soros's own money.

By 1981, the fund had grown to $400 million, but a 22 percent loss that year, as well as substantial redemptions by some investors, reduced it to $200 million.

The Quantum Fund made $5.5 billion in 2013, making it the most successful hedge fund in history once more.

The fund has generated $40 billion since its inception in 1973. In 2015, the fund announced a $300 million investment to help finance the expansion of Fen Hotels, an Argentine hotel company.

Over the next three years, the funds will be used to build 5,000 rooms in various Latin American countries.

“The man who broke the Bank of England”

For months leading up to the Black Wednesday of September 1992, Soros had been building a massive short position in pounds sterling. Soros had recognized the United Kingdom's unfavorable position in the European Exchange Rate Mechanism.

According to Soros, the rate at which the United Kingdom was admitted to the European Exchange Rate Mechanism was far too high, their inflation was far too high, and British interest rates were harming asset prices.

By the day of Black Wednesday, September 16, 1992, Soros' fund had sold short well over $10 billion in pounds, getting the benefit of the UK government's unwillingness to either raise interest rates to levels comparable to those of other European Exchange Rate System countries or sail its currency.

Famous Investors: John Bogle

John Bogle founded the Vanguard Group and was a strong supporter of index investing. Bogle, also known as "Jack," revolutionized the mutual fund industry by inventing index investing, which enables investors to buy mutual funds that monitor the broader market.

He did this to make investing easier and less expensive for the average investor.

John Bogle was born in Montclair, New Jersey, on May 8, 1929. The Great Depression harmed his family. They lost money and had to lose their home, and his father became an alcoholic, resulting in his parent's divorce.

Bogle and his twin brother, David, went to Manasquan High School near the New Jersey coast for a while. Their academic performance there qualified them for work scholarships at Blair Academy.

Bogle excelled in mathematics at Blair, and he was fascinated by numbers and computations.

Bogle graduated from Blair Academy with honors in 1947 and was accepted to Princeton University, where he studied economics and investment. Bogle researched the mutual fund industry during his university years.

Investing Journey

Bogle sought a job in banking or investing after graduating from Princeton. Bogle was hired by Morgan at the Wellington Fund in 1955 and promoted to assistant manager, allowing him to analyze the company and its investment department.

Bogle persuaded Wellington's management to abandon its single-fund strategy and establish a new fund. He eventually succeeded, and the new fund marked a watershed moment in his career.

After successfully rising through the ranks, Bogle succeeded Morgan as chairman of Wellington in 1970 but was later fired for approving an "extremely unwise" merger. It was a bad decision that he later realized was his biggest mistake.

Bogle founded The Vanguard Group in 1974, which is now one of the most respected and successful investment firms in the world. Bogle was named "one of the four investment giants of the twentieth century" by Fortune magazine in 1999.

Bogle established the First Index Investment Trust in 1976 as the first index mutual fund available to the general public, influenced by the works of Paul Samuelson.

It was not well received at first by individuals or the investment industry, but it is now praised by investment legend Warren Buffett, among others.

Bogle left the company in 1999 due to a disagreement with Brennan and relocated to the Bogle Financial Markets Research Center, a small research institute not directly associated with Vanguard but located on the Vanguard campus.

Investing Style

Bogle believes that The main distinction between investment and guesswork is the time horizon and capital risk.

Investment is concerned with obtaining long-run returns with a lower risk of capital destruction. In contrast, speculation is associated with achieving returns in a short period with potentially destructive risk to investment.

The speculator is frequently only interested in the price of a security and not the underlying business as a whole, whereas the investor is interested in the underlying business and not the price of the security.

Even if a company's cash flow is consistent, the market quotations of its securities are anything but a result of speculative investors driving up and driving down prices based on hope, fear, and greed.

Bogle advocated for an approach to investing that was characterized by simplicity and common sense. His eight basic rules for investors are as follows:

- Choose low-cost funds.

- Consider the additional costs of advice carefully.

- Do not overestimate previous fund performance.

- Use previous performance to assess consistency and risk.

- Star mutual fund managers should be avoided

- Be cautious of asset size.

- Don't amass an excessive amount of money.

- Purchase your fund portfolio

Famous Investors: John Neff

John B. Neff, CFA, was a philanthropist and investor from the United States. He was well-known for his contrarian and value investing approaches and his leadership of Vanguard's Windsor Fund.

John Neff was born in Wauseon, Ohio, in 1931. He went to the University of Toledo and graduated with honors in 1955.

He then started working at the National City Bank of Cleveland before joining Case Western Reserve University for business, where he graduated in 1958.

Investing Journey

Neff started his career as a sub-advisor in Wellington Management Company in 1964. He was promoted to portfolio manager of the Windsor, Gemini, and Qualified Dividend funds after three years with the firm. He left the company in 1995.

Neff used to invest in companies having a low price-to-earnings ratio. He also used to select companies emphasizing their management and analyzing the books.

Similar to other famous investors, he also focused on return on equity (ROE). However, he differs from many investors as he used to predict the future earnings of the company and preferred the companies having very high dividend yields.

Famous Investors: John Templeton

Sir John Marks Templeton was a British investor, banker, investment manager, and philanthropist of American origin.

John Marks Templeton was born in the Tennessee town of Winchester and went to Yale University, where he worked as an assistant business manager for the campus humor magazine Yale Record.

He graduated near the top of his class in 1934. As a Rhodes Scholar, he attended Oxford University's Balliol College and earned an M.A. in law. He held a CFA charter. He was also a student of Benjamin Graham, the father of value investing.

Investment Journey

John started his career in 1939 by purchasing 100 shares, each of 104 companies trading below a price of $1 on the NYSE. He later made lots of money with his strategy when U.S. markets picked up after World War 2.

He launched his own Templeton Growth Fund Ltd. in 1954 and soon became a billionaire with remarkable success in the mutual fund world. His fund was the first to invest in Japan in the 1960s.

By 1959, he had five public funds having $66 million of funds under management.

Investing Style

John always preferred fundamental analysis over technical analysis for stock picks. He was a growth investor but rather followed value investing principles.

He and his colleagues developed some quantitative finance methods that are now widely known as Shiller P/E, rebalancing, and Tobin's q.

He usually bought stocks that were very comfortably below their fair market price and used to hold assets for an average period of four years. He referred to buying stocks trading above their fair market value as speculation, not investing.

By emphasizing overlooked or unpopular stocks, Templeton became known for his "ignoring the herd" and "buy when there's blood in the streets" philosophy to capitalize on market turmoil. He was indeed known for profiting when aspirations were high.

He was one of the first American investors to devote significant attention to investment opportunities in previously neglected foreign markets such as Asia and Eastern Europe.

He angled out of Japanese stocks as they became more fashionable in the 1970s and decided to turn to US stocks when they were at historic lows, always watchful for bargain-priced stocks and hoping to avoid expensive stocks.

or Want to Sign up with your social account?