Non-Performing Asset

It is a loan or advance that has stopped generating income for the lender, typically a bank

What is a Non-Performing Asset?

Non-Performing Asset, or NPA, is a crucial concept in the field of finance and banking. An NPA refers to a loan or advance that has stopped generating income for the lender, typically a bank.

When a borrower defaults on the principal amount or interest payment within a given period, it becomes a Non-Performing Asset.

The classification of an asset as non-performing is based on predefined criteria set by regulatory bodies. These criteria vary from country to country, but they generally consider the time duration of default and the status of interest payments.

Its classification is essential for banks as it helps them assess the health of their loan portfolio and the overall risk exposure. It measures the effectiveness of the bank's credit risk management and the quality of its assets.

By identifying non-performing assets, banks can take appropriate measures to mitigate risks and initiate recovery procedures.

Once an asset is classified as an NPA, the bank starts taking measures to recover the loan amount. These measures can include issuing reminders, contacting the borrower for repayment, and initiating legal proceedings if necessary.

The objective is to either return the loan to the performing category or minimize the losses associated with the default. Banks often try to resolve them through measures like loan restructuring, rescheduling, or even loan write-offs in extreme cases.

The existence of a high non-performing asset ratio is generally a matter of concern for banks and the economy as a whole. It indicates weaknesses in credit risk management, borrower default, and overall economic distress.

Efforts to minimize NPAs involve strengthening credit appraisal processes, implementing robust risk management frameworks, and ensuring timely monitoring and follow-up of loans.

Sound regulatory policies and effective supervision are also crucial in maintaining a healthy loan portfolio and reducing their incidence.

Non-performing assets occur when borrowers fail to repay their loans per the agreed terms. They have significant implications for banks, affecting their financial health, risk exposure, and lending capacity.

Timely identification, resolution, and prevention are vital for maintaining a stable and efficient banking system.

Key Takeaways

- A non-performing Asset is a loan or advance that has stopped generating income for the lender, typically a bank.

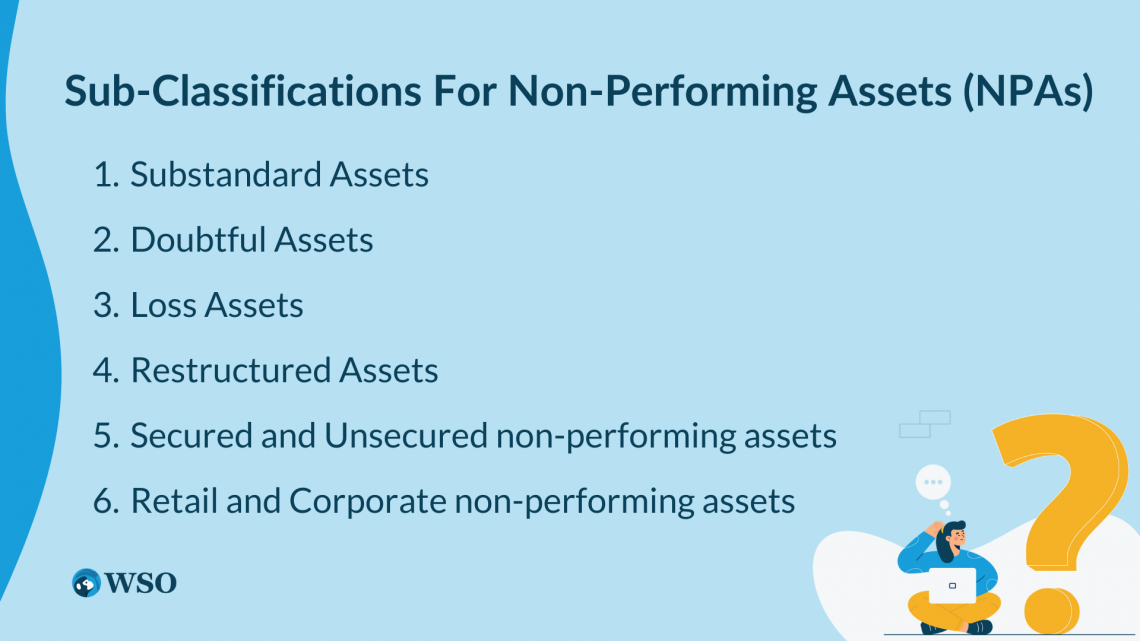

- Types of Non-Performing Assets include Substandard, doubtful, loss, restructures, secured, unsecured, retail, and corporate non-performing assets.

- Inadequate credit assessment, weak monitoring and follow-ups, willful default, and overdue payment are the common causes.

- Such assets affect the banks' profitability, stability, capital adequacy, and financial health of the banks.

- Banks often try to resolve non-performing assets through measures like loan restructuring, rescheduling, or even loan write-offs in extreme cases.

Sub-Classifications for Non-Performing Assets (NPAs)

Here are a few typical Non-Performing Assets types:

1. Substandard Assets

Substandard assets are those where the borrower has defaulted on interest or principal payments for 12 months or more. These assets pose a higher risk of default and require special attention from the lender to ensure recovery.

2. Doubtful Assets

Doubtful assets are those that have remained as substandard assets for a significant period, typically extending beyond 12 months. The chances of recovery from doubtful assets are low, and they require a higher provision to cover potential losses.

Note

Banks may initiate legal actions or recovery proceedings to salvage some value from these assets.

3. Loss Assets

Loss assets are those where the bank or financial institution has identified that the full amount of the asset is not recoverable. These assets are considered irrecoverable and written off the bank's balance sheet.

Note

Write-offs are typically done after all recovery efforts have been exhausted.

4. Restructured Assets

Loans that have been changed or restructured to give the borrower some relief concerning payments are referred to as restructured assets. This restructuring can involve changes in interest rates, tenure, or principal amounts.

Note

The restructuring aims to help the borrower pay off the debt, but if they don't follow the new repayment terms, it may lead to temporary or permanent non-performing assets.

5. Secured and Unsecured non-performing assets

Non-Performing Assets are also classified on the basis if they are backed by collateral or not. These types include secured and unsecured NPAs.

Secured NPAs are backed by collateral, such as property or assets, which can be liquidated to recover the outstanding loan amount. On the other hand, unsecured non-performing assets do not have any collateral, making recovery more challenging.

6. Retail and Corporate non-performing assets

They can be further classified into retail and corporate based on the nature of the borrowers. Retail ones are loans made to people for personal use. Conversely, corporations are loans provided to companies or businesses for their operations or expansion.

Note

Understanding the different types enables banks to effectively monitor and manage their loan portfolios, implement suitable recovery strategies, and ensure proper provisioning to safeguard their financial health.

Causes of Non-Performing Assets

Non-performing assets (NPAs) are loans or advances that have stopped generating income for the lender due to default in repayment or interest payment by the borrower. Several factors can contribute to the rise of NPAs in a financial system. Here are some of the key factors:

1. Economic Downturn

Recessions and financial crises are examples of economic downturns that can significantly affect borrowers' capacity to pay back their debts.

Note

During periods of economic distress, businesses may face reduced revenue, cash flow problems, and declining profitability, leading to defaults on loan payments and the classification of assets as non-performing.

2. Inadequate Credit Assessment

Non-performing loans may emerge as a result of inadequate credit evaluation and due diligence during the loan approval procedure.

Banks that do not thoroughly evaluate borrowers' creditworthiness and repayment capacity may end up granting loans to individuals or companies with a higher risk of default.

Note

Inaccurate assessment of collateral value can also lead to inadequate security against loans, making recovery difficult.

3. Weak Loan Monitoring and Follow-up

Inadequate loan monitoring and follow-up processes can result in the deterioration of loan accounts and the subsequent classification as NPAs.

Banks must have robust systems in place to track loan repayment schedules, identify early warning signals of potential default, and take timely corrective actions.

Note

Failure to monitor loans effectively can lead to delayed detection of non-payment and difficulties in recovering the outstanding amount.

4. Overdue or Non-payment of Interest and Principal

When borrowers fail to repay principal and interest amounts timely, loans can quickly become NPAs. Reasons for non-payment can vary, including business failures, cash flow problems, unforeseen events, or intentional defaults by borrowers.

Note

Any delay or non-payment of dues impacts banks' asset quality, increasing the number of non-performing assets.

5. Industry-specific Factors

Certain industries or sectors may be more prone to non-performing assets due to their specific challenges. For example, cyclical industries may experience downturns that impact the ability of borrowers in those sectors to repay loans.

Note

Changes in government policies, technological advancements, or shifts in consumer behavior can also impact certain sectors and contribute to NPAs.

6. Willful Default and Fraud

In some cases, borrowers intentionally default on loan payments, engaging in fraudulent activities to escape repayment obligations.

Willful defaulters may divert funds, inflate expenses, or engage in other unethical practices to avoid fulfilling their loan obligations.

Note

Fraudulent actions can lead to NPAs and pose significant challenges for banks in recovering the outstanding amount.

Impact of Non-Performing Assets on Banks

Non-performing assets (NPAs) can significantly impact banks' financial health, profitability, and overall stability. Here are some key impacts of NPAs on banks:

1. Financial Health and Stability

Non-performing assets directly impact the financial health and stability of banks. As NPAs increase, banks face a higher risk of capital erosion and reduced liquidity.

This can weaken their balance sheets and overall solvency, potentially leading to credit rating downgrades and loss of investor confidence. In severe cases, it can even threaten the viability of the bank, necessitating government intervention or bailouts.

2. Earnings and Profitability

Non-performing assets significantly impact the earnings and profitability of banks. When loans become non-performing, banks lose interest income and have to make provisions for potential losses.

Note

These provisions directly impact banks' profitability, reducing their net income and return on assets. In turn, this can hinder the ability of banks to generate sustainable profits, invest in growth, and distribute dividends to shareholders.

3. Capital Adequacy and Lending Capacity

The capital adequacy ratio, a gauge of a bank's capacity to withstand losses, can be damaged by the presence of a high number of NPAs.

Banks must maintain a minimum capital adequacy ratio to preserve financial stability and satisfy regulatory requirements.

As NPAs increase, banks may need to set aside more capital as provisions, reducing their lending capacity. This can restrict credit availability for businesses and individuals, hampering economic growth and development.

4. Asset Quality and Risk Management

NPAs indicate poor asset quality and ineffective risk management practices within banks.

High NPAs signal potential weaknesses in credit underwriting, loan monitoring, and recovery mechanisms. This prompts banks to reassess their risk management frameworks, revise credit policies, and strengthen internal controls.

Note

Failure to address these issues can result in a vicious cycle of accumulating NPAs and deteriorating asset quality.

5. Reputation and Investor Confidence

The presence of a significant number of NPAs can damage the reputation and credibility of banks. Stakeholders, including investors, depositors, and counterparties, closely monitor a bank's asset quality.

High NPAs raise concerns about the bank's lending practices, risk management, and governance standards. Loss of investor trust, withdrawal of deposits, restricted access to funding, and a detrimental effect on the bank's image in the financial market as a whole might result from this.

6. Regulatory Scrutiny and Compliance

Regulators closely monitor NPAs and impose stringent guidelines for their recognition, classification, and provisioning.

Note

Banks with high levels of NPAs may face increased regulatory scrutiny, including mandatory corrective actions, additional capital requirements, and restrictions on certain activities.

Compliance with regulatory standards becomes crucial to maintaining the trust of regulators, safeguarding the bank's operations, and avoiding potential penalties or sanctions.

Strategies for Non-Performing Asset Management

Following are some typical methods for managing NPAs:

1. Early Detection and Classification

Early detection and classification of NPAs are critical for effective management. Financial institutions must implement comprehensive risk assessment models and monitoring systems to identify assets showing signs of distress promptly.

This allows for timely action, including provisioning and appropriate allocation of resources for recovery efforts.

2. Proactive Risk Mitigation

A proactive approach to risk mitigation is essential for managing non-performing loans globally.

Financial institutions should prioritize preventive measures, such as strengthening credit appraisal processes, conducting thorough due diligence, and implementing robust risk management frameworks.

Note

By identifying potential risks and taking preventive actions, institutions can reduce the occurrence of non-performing assets.

3. Restructuring and Rehabilitation

Restructuring and rehabilitation strategies can be employed globally to address viable NPAs. Financial institutions should interact closely with borrowers to investigate possibilities like loan modification, extending repayment terms, or changing interest rates.

These measures aim to improve borrowers' repayment capacity and increase the chances of successful loan recovery.

4. Strengthening Recovery Mechanisms

To enhance NPA recovery globally, financial institutions should strengthen their recovery mechanisms. This includes establishing specialized recovery units, employing skilled recovery professionals, and leveraging legal and technological tools.

Note

Prompt legal action should be taken when necessary while ensuring compliance with relevant international regulations.

5. Utilizing Technology and Data Analytics

The global adoption of technology and data analytics has revolutionized non-performing loan management.

Financial institutions can leverage advanced technologies such as artificial intelligence, machine learning, and predictive analytics to enhance their non-performing asset management processes.

Note

These tools enable efficient data analysis, early detection of potential defaults, and effective decision-making in NPA resolution strategies.

6. Regulatory Compliance and Transparency

Maintaining regulatory compliance and transparency is crucial in non-performing asset management globally. Financial institutions must adhere to international standards and regulations while managing NPAs.

Transparent reporting and disclosure practices build trust among stakeholders and facilitate efficient resolution processes.

or Want to Sign up with your social account?