Asset-Based Loans

It allow firms to borrow money by pledging present assets as security.

Asset-based loans allow firms to get funds by using existing assets as security. Companies with substantial assets that do not match the tight standards of regular lending institutions or need help accessing other kinds of finance frequently seek these loans.

Unlike traditional loans, which are primarily concerned with the borrower's creditworthiness and cash flow, asset-based loans are concerned with the underlying collateral promised by the borrower.

Collateral assets include accounts receivable, inventory, equipment, real estate, and other valuable items owned by the corporation.

Businesses may acquire the funds they need to maintain their operations, engage in development prospects, or handle temporary cash flow difficulties by using these assets.

One of the primary benefits of it is their ability to provide firms with increased borrowing capacity. Because physical assets back the loan, lenders are frequently ready to provide higher credit limits than unsecured loans.

They can be especially advantageous for organizations with considerable assets locked up in accounts receivable or inventory since they allow them to turn these assets into immediate operating capital.

Key Takeaways

- Asset-based loans are financing that allow firms to borrow money by pledging present assets as security.

- These loans are sought by enterprises with considerable assets that may not meet the requirements of traditional lenders or may have trouble acquiring other kinds of finance.

- Unlike traditional loans, which emphasize the borrower's creditworthiness and cash flow, asset-based loans favor the borrower's underlying collateral.

- These loans provide companies with the necessary funds to support their operations, pursue growth opportunities, or address temporary cash flow challenges by leveraging their assets.

- One of the key advantages of asset-based loans is their ability to provide businesses with increased borrowing capacity. By leveraging their valuable assets, companies can unlock the potential for greater funding and flexibility in their financing options.

- These loans can be especially beneficial for businesses with considerable assets in accounts receivable or inventories.

Understanding Asset-Based Financing: What You Should Know!

These are often used when traditional methods of raising funds, such as the capital markets and conventional unsecured or mortgage-secured banking, are ineffective.

This is frequently done to meet the need for more immediate funds to meet project finance requirements. The interest rate charged is thus lower.

Additionally, the interest rate demanded and perceived riskiness of the loan are lower the more liquid the asset is.

Small and mid-sized businesses typically use asset-based finance to address their short-term liquidity needs. A mix of asset-based loan arrangements, maybe in addition to a cash flow loan, may be available to some businesses.

The structure of your credit facilities ultimately has a greater impact on the company's freedom to pursue expansion projects than their interest rate. Institutions like Citi, J.P., and Sachs are among the financial institutions that offer services to them.

NOTE

In 2008, Europe issued bonds totaling more than 710 billion euros, most of which were secured by asset-based loans, including mortgages and car loans.

How Asset-based Financing Works?

To satisfy their regular cash flow demands, businesses must take out loans. If a corporation can't show enough cash assets to support a loan, the lender may offer to sanction the loan using the company's physical assets as collateral.

The nature and value of the assets supplied as security determine the terms and conditions of an asset-based loan.

Because accounts receivables are more liquid and simpler to convert into cash rapidly, an asset-based loan secured by accounts receivables is typically considered safer than a loan secured by the property.

Furthermore, appropriately assessing property and navigating market circumstances add to property-backed loan complexity and potential dangers.

NOTE

The applicant's credit history, cash flow, and length of time in business all influence interest rates.

Assume a company needs a $300,000 loan to develop its services. If the firm pledges the highly liquid marketable securities as security on its balance sheet, the lender may issue a loan equal to 80% of their face value.

If the firm's securities are valued at a certain level, the lender's willingness to lend may alter. The lender may be more cautious if the firm decides to pledge less liquid assets such as real estate or equipment.

This smaller loan amount reflects the projected difficulties and probable delays in selling less liquid assets in the case of default.

Determining the Loan Amount

In asset-based lending, determining the loan amount entails determining the value of the collateral assets pledged by the borrower. Lenders usually perform a detailed review of the assets to establish their market worth and liquidity.

Using the loan-to-value ratio, asset-based loans are routinely decided.

Loan to value (LTV) = Loan Amount / Appraised Property value

To account for future defaults or payment delays, the lender may add a discount rate to the accounts receivable.

In the case of inventory, the lender may consider criteria such as market demand, inventory condition, and turnover rate. A discount rate may be added to the inventory value to represent potential hazards.

Typically, equipment and machinery are rated based on their appraised worth, which considers criteria such as age, condition, and market demand for comparable equipment.

Real estate assets are valued based on their market worth, considering aspects such as location, condition, and appreciation potential.

Lenders frequently use a cautious strategy to manage possible risks and guarantee there is enough margin for repayment in the event of asset value changes or unanticipated occurrences.

Calculating the loan amount in asset-based lending entails a thorough evaluation of the collateral assets' worth and market circumstances, allowing lenders to determine a suitable loan-to-value ratio that is compatible with their risk tolerance.

Use of Loan-to-Value Ratio

Suppose a borrower requires a $100,000 loan and has the following assets:

- Market Securities worth $105,000 with an LTV of 80%

- Machinery worth $250,000 with an LTV of 40%

Account Receivable worth $120,000 with LTV of 70%

In case the borrower can use one asset to secure the loan, in that case, the borrower must use the asset type, which helps secure the maximum loan amount.

- Marketable securities = $105,000 x 80% = $84,000 maximum loan amount

- Machinery = $250,000 x 40% = $100,000 maximum loan amount

- Accounts receivable = $120,000 x 70% = $84,000 maximum loan amount.

The borrower should use machinery to secure the maximum loan.

Lenders use the LTV ratio as a risk management tool to ensure that the loan amount remains within a reasonable range compared to the value of the assets securing the loan.

The LTV ratio is calculated by dividing the loan amount by the collateral assets' appraised value or estimated market value.

Purposes of LTC Ratio

The LTV ratio serves several purposes:

1. Risk Mitigation

Lenders lower the risk of future losses by restricting the loan amount to a percentage of the asset value. In the event of default, the lender can seize and sell the collateral assets to recover a significant portion of the loan amount.

Setting the LTV ratio below 100% provides a margin of safety for the lender. It assures that even if the asset value varies or drops, there is still enough collateral value to satisfy the existing loan amount.

3. Loan Affordability

The LTV ratio helps ensure that the borrower can comfortably repay the loan without undue financial strain.

4. Competitive Rates

Lenders often adjust interest rates and terms based on the LTV ratio. Lower LTV ratios may result in more favorable borrowing terms, such as lower interest rates or longer repayment periods, as they signify lower risk for the lender.

NOTE

It's important to note that different types of collateral assets may have varying LTV ratios. For example, accounts receivable might have a higher LTV ratio compared to equipment or real estate due to differences in liquidity and volatility.

The loan-to-value ratio is an important instrument in asset-based lending since it guarantees a balance between borrower loan affordability and lender risk reduction.

By setting an appropriate LTV ratio, lenders can determine the maximum loan amount while safeguarding their interests and providing financing options to businesses based on the value of their collateral assets.

Types of Asset Classes Involved in ABL

Lenders can underwrite various asset classes, including the following:

1. Machinery & Equipment

M&E loans are among the simplest to get due to the relative simplicity with which the assets may be valued.

2. Accounts Receivables

The Lender calculates eligible AR and applies an advance rate to the revolving pool. The billed vs. unbilled status of an AR, as well as the duration the AR has been outstanding, influence its eligibility.

3. Inventory

Lenders will calculate the inventory's net orderly liquidation value (NOLV) and issue an advance rate based on that figure.

4. Real Estate

Lenders will request a real estate evaluation and use the loan-to-value ratio to establish the loan amount.

NOTE

Many lenders favor owner-occupied real estate, in which the running firm owns the property and operations from it.

5. Purchase Orders

Some non-bank asset-based lenders consider POs to be an asset. If the customers are significant creditworthy firms, they can provide an advance rate against the purchase order value.

6. Intellectual property

A company's intellectual property (IP) may occasionally be viewed as an asset. analyze the litigation worth of the IP portfolio and make a loan against such assets; however, this is less typical and more unusual.

Large corporations often rely on asset-based loans as a routine financing option to address immediate financial needs.

These loans allow them to leverage their valuable assets, such as accounts receivables or inventory, to secure the necessary capital quickly.

NOTE

By utilizing asset-based loans, large corporations can effectively manage pressing demands while optimizing their working capital and maintaining ongoing operations.

Large firms frequently use asset-based loans as a normal financing option to meet short-term financial demands.

These loans enable businesses to quickly acquire the capital they want by leveraging valued assets such as accounts receivables or inventories.

Large firms may efficiently address pressing needs while maximizing their working capital and continuing operations by implementing asset-based loans.

Features of Asset-Based Loans

These loans are typically used by businesses to secure capital for various purposes. Here are some key features of asset-based loans:

1. Collateral

These loans require the borrower to pledge specific assets as collateral.

2. Loan Amount

The loan amount in asset-based lending is determined by the value of the collateral. Lenders usually provide a portion of the assets' appraised worth.

3. Revolving Line of Credit

Revolving lines of credit, which let the borrower borrow, pay back, and reborrow money as needed under a defined credit limit, are a common kind of asset-based loans. This flexibility allows businesses to manage their working capital requirements more effectively.

4. Creditworthiness

While traditional loans heavily rely on the borrower's credit history and financial ratios,it prioritize the value and quality of the collateral. This makes asset-based loans more accessible for businesses with less-than-perfect credit scores or limited financial track records.

5. Monitoring and Auditing

Lenders offering asset-based loans typically require regular monitoring of the collateral and financial reporting from the borrower. This includes audits of the collateral, accounts receivable aging reports, and other relevant financial documents to ensure the value and quality of the collateral remain intact.

6. Higher Interest Rates

As contrast to conventional loans, these loans sometimes have higher interest rates.

NOTE

The increased risk associated with using collateral as security justifies the higher cost of borrowing.

7. Faster Approval Process

These loans can have a quicker approval process compared to traditional loans, as the focus is primarily on the collateral rather than extensive financial analysis. This can be beneficial for businesses in need of immediate funding or facing time-sensitive opportunities.

8. Working Capital Financing

These loans are commonly used to finance working capital needs, such as purchasing inventory, covering payroll, managing cash flow gaps, or funding business expansion initiatives.

The revolving nature of the loan allows businesses to access funds as needed, providing greater flexibility. It’s advisable to consult with financial professionals or lenders to get detailed information and assess the suitability of these loans for a particular situation.

A subset of Asset-Based Loans

Whenever obtaining a short-term loan from a bank or other financial institution is not viable, both accounts receivable finance and inventory financing are widely utilized.

Both are employed to raise working capital or cash for ongoing business operations.

Accounts receivable finance from banks and financial institutions often carries higher interest rates due to the additional risk involved. Both methods have their considerations and implications for project financing.

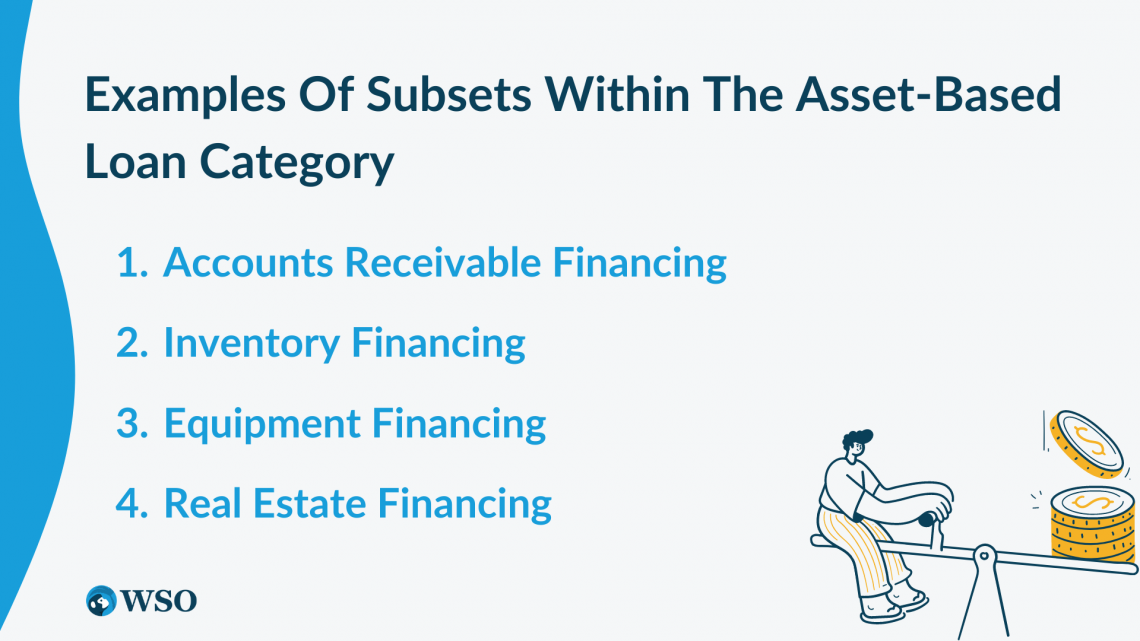

A subset of asset-based loans refers to a specific category or variation within the broader concept of asset-based lending. It represents a specialized form of financing that focuses on a particular aspect or characteristic of asset-based loans.

Here are a few examples of subsets within the asset-based loan category:

1. Accounts Receivable Financing

This subset involves leveraging accounts receivable as collateral to secure financing. Businesses can obtain funds based on the value of their outstanding invoices.

Lenders typically advance a percentage of the accounts receivable balance and collect payments directly from the customers.

2. Inventory Financing

This subset centers around using inventory as collateral to secure a loan. Businesses can borrow funds based on the value of their inventory. To determine the loan amount, lenders evaluate the inventory's quality, marketability, and liquidity.

Inventory financing can particularly benefit businesses with seasonal or cyclical inventory fluctuations.

3. Equipment Financing

This subset focuses on utilizing equipment or machinery as collateral to secure financing. Businesses can borrow funds based on the equipment's appraised or market value.

NOTE

Lenders consider factors such as age, condition, and market demand for the equipment when determining the loan amount. Equipment financing can be useful for businesses acquiring or upgrading their machinery.

4. Real Estate Financing

This subset involves using real estate properties as collateral to secure a loan. Real estate financing can benefit businesses that own commercial or industrial properties and need capital for expansion, renovation, or other purposes.

These subsets demonstrate how asset-based loans can be tailored to specific types of collateral assets or industries, providing businesses with financing options that align with their specific needs and circumstances.

Each subset focuses on leveraging a particular asset or set of assets to secure the loan, offering businesses flexibility and access to capital based on their unique asset profile.

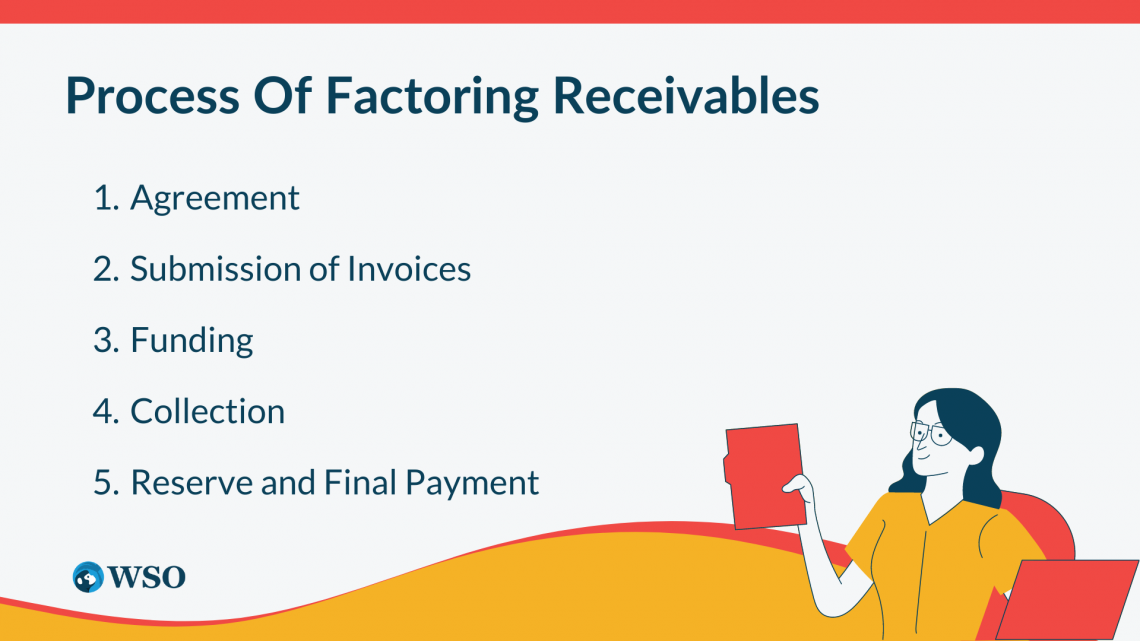

Factoring Receivables

Factoring receivables is a financial transaction in which a firm sells its accounts receivable (unpaid bills) to a third-party finance company called a factor for a reduced price.

Instead of waiting for consumers to pay in full, the company may turn its accounts receivable into instant cash. Here's how the process of factoring receivables typically works:

1. Agreement

The business and the factor enter into a factoring agreement, which outlines the terms and conditions of the arrangement. This covers the discount rate, the agreement's length, and any other pertinent parameters.

2. Submission of Invoices

The business submits its outstanding invoices to the factory for verification. The factor reviews the invoices to ensure they are valid and collectible.

3. Funding

Once the factor approves the invoices, it provides an advance payment to the business, typically ranging from 70% to 90% of the invoice value. The actual advance percentage depends on factors such as the creditworthiness of the customers and the industry risk.

4. Collection

The factor takes over the responsibility of collecting customer payments. The customers are notified to make their payments directly to the element instead of the business.

5. Reserve and Final Payment

After collecting the full payment from the customers, the factor deducts its fees and the discount rate agreed upon in the factoring agreement. The remaining amount, known as the reserve, is then paid to the business.

NOTE

The reserve amount is typically in the range of 10% to 30% of the invoice value, and it represents the factor's earnings.

Factoring Receivables Benefits

Factoring receivables offers several benefits to businesses:

1. Improved Cash Flow

Factoring provides immediate cash flow by converting unpaid invoices into cash. This helps businesses meet their operational expenses, pay suppliers, and invest in growth opportunities without waiting for customers to make full payments.

2. Reduced Credit Risk

The factor assumes the credit risk associated with the receivables. They perform credit checks on the customers and handle the collections process, relieving the business of the burden of chasing payments and mitigating the risk of bad debts.

3. Financing Availability

Factoring is accessible to businesses with limited credit history or poor credit ratings. Factors primarily evaluate the creditworthiness of the business's customers rather than the business itself.

4. Outsourced Accounts Receivable Management

Businesses can save time and resources by outsourcing their accounts receivable management to the factor. This allows them to focus on core operations and reduce administrative tasks associated with collections.

NOTE

However, it's important to note that factoring receivables involves a cost, as the factor deducts fees and a discount rate for providing the financing.

Businesses should carefully consider the costs and weigh them against the benefits before opting for factoring as a financing solution.

Pledging Receivables

Pledging of receivables or an assignment of receivables as collateral for the debt is another subset of asset-based loans. When receivables are pledged as security, they are transferred to the lender in certain cases.

When deciding which accounts receivables to accept as collateral, a lender looks at the maturing schedule of the company's receivables.

Generally, the lender will only accept receivables that are not overdue. Accounts that are past due don't constitute excellent collateral.

Also, if a borrower is given credit terms that the lender believes are too lengthy, the lender may refuse to take those receivables.

After looking over a company's receivables for delinquent accounts and conditions the lender doesn't like, the lender decides how much of the receivables they will take.

Often, the lender will lend 75-85% of the amount requested. If the small business fails to repay the loan, the lender seizes the company's accounts receivables and collects the debts.

or Want to Sign up with your social account?