Assumable Mortgage

A transaction in which the present owner transfers an outstanding mortgage and its terms to a buyer

What Is an Assumable Mortgage?

A transaction in which the present owner transfers an outstanding mortgage and its terms to a buyer is an assumable mortgage. The buyer can avoid having their mortgage by taking on the previous owner's residual debt.

Different types of loans might be labeled as 'assessable,' but there are several key differences to keep in mind. A home loan permits you to assume the interest rate on the seller's original mortgage.

This type of financing is common in markets with relatively high mortgage interest rates. Buyers may obtain a lower interest rate than the current market rate by taking over someone else's mortgage.

Purchasing a home usually necessitates the application for a new mortgage loan. In some cases, though, buyers may be able to acquire finance without having to start from scratch.

There are several types of mortgages to choose from, each with benefits based on your needs as a borrower. In addition, a buyer can "assume" the seller's mortgage sometimes.

Although the process is complicated, buyers and sellers should understand this mortgage. A mortgage can save a buyer hundreds of dollars in interest and closing costs. However, a significant down payment may be necessary.

Understanding Assumable Mortgages

Many homebuyers obtain a mortgage from a lending institution to finance the purchase of a home or property. If the homeowner decides to sell their home, the mortgage may be transferred to the new homeowner.

In this case, the original mortgage can be assumed. This allows a buyer to absorb the existing principal balance, interest rate, repayment time, and other contractual features of the seller's mortgage.

This type of mortgage is a home loan in which the buyer takes the prior owner's loan. However, buying a property this way isn't always the most excellent option, mainly because not all mortgages are assumable.

It is most prevalent when the conditions available to a buyer are less appealing than those previously offered to the seller.

The most significant possible benefit for the buyer is that the terms of the seller's mortgage may be more appealing than the terms given on a new mortgage. The new borrower – the one 'taking' the loan — is in the same situation as the person who passed it on.

It's essentially substituting one borrower's name for another on the mortgage agreement. A house loan is an assumable mortgage. The seller transfers their current mortgage to the buyer, eliminating the need for the buyer to apply for a new mortgage.

As the buyer, you will accept the seller's conditions, including the interest rate and term duration. However, your down payment must cover the difference between the sale price and the amount due.

A homebuyer can assume the current principal balance, interest rate, repayment duration, and other contractual parameters of the seller's mortgage with this type of mortgage.

If current interest rates are greater than the interest rate on the assumable loan, there may be a cost-saving advantage. A mortgage calculator can help you budget for the monthly cost of your mortgage payment.

This type of mortgage allows a buyer to identify a home they wish to buy and take over the seller's current mortgage without applying for a new loan.

This implies that the loan's remaining balance, interest rate, payback duration, and other parameters remain unchanged, but the obligation is transferred to the buyer.

It also plays a role in divorce scenarios, such as when the spouse who obtains the house is on the title but not initially on loan. This type of mortgage allows a new borrower to assume the current borrower's existing debt.

Typically, this comprises a house buyer taking over the mortgage of the home seller. They will have the same terms and conditions, interest rate, and payback period.

To get a mortgage, you must fulfill specific requirements, such as a minimum credit score and a maximum debt-to-income ratio.

How Does Assumable Mortgage Work?

Mortgage assumption is classified into two types: simple premise and novation.

A simple assumption allows a buyer to assume the original loan balance and terms. If the house's value has increased, the buyer will need to make up the difference with cash or another loan.

Buyers should still conduct a home inspection to look for evidence of property maintenance difficulties. However, in a basic assumption, the transfer of mortgage liability from the seller to the buyer is private.

The mortgage lender participates in and agrees to the entire transfer of liabilities from the seller to the buyer innovation. In addition, because the lender can put the buyer through the underwriting procedure, it is ready to relieve the seller from any future mortgage payment responsibilities.

Because the mortgage lender is not aware of this transfer, the buyer is not subjected to the underwriting procedure. However, the buyer and seller are responsible if the buyer fails to make payments or breaks the mortgage contract with the lender.

Taking on an assumable loan might have significant advantages in the proper scenario. However, this method will not work for everyone; therefore, weighing the benefits and drawbacks before committing is critical.

Not all mortgage loans, for example, are assumable, but FHA and VA loans are. A down payment is usually required, and it may be greater than planned.

The function of this mortgage is similar to a regular house loan, except that the buyer is limited to financing via the seller's lender. In addition, if the home's purchase price exceeds the outstanding mortgage balance, the buyer must make a down payment.

A home equity loan is a frequent second mortgage option for purchasers who are assuming a mortgage but do not want to – or are unable to – put down cash to cover the equity. If you take over someone else's current mortgage, the terms and interest rate remain the same.

If you take over the mortgage, you'll have to pay off the seller's equity and utilize another loan. Although the interest rate on this second loan will most likely be more significant, the principal amount will be far smaller than that required for a "first" mortgage.

Three things purchasers should understand about how assumable loans work:

-

Not all mortgage loans can be taken. Conventional loans, for example, cannot be assumed, but FHA and VA loans may.

-

Simply no one can accept a current mortgage. You must still apply to the lender and get approved for the loan.

-

A down payment is usually required when taking out a mortgage, which may be more than planned.

Remember that when you take a mortgage, you assume the homeowner's remaining debt balance. In most situations, this will not cover the entire purchase price of the property; therefore, a down payment will be required to make up the difference.

Do I need a down payment when assuming a mortgage?

When you assume a mortgage, you take over the remaining principal balance of the homeowner. The home's worth may have improved after it was acquired. As a result, there will be a 'difference' between the loan amount and the purchase price.

Your down payment is the difference. It may also be greater than the down payment required for a new loan. For example, assume the seller obtained a $200,000 mortgage at a rate of 2.6 % in January 2021.

It's now January 2023, and you want to take over the mortgage. The initial borrower made a $7,500 3.5 % FHA down payment on a $207,500 house. And, due to housing price inflation, the market worth is now maybe $220,000.

Calculating Down Payment

Because the homeowner paid all of their monthly payments over the last two years, the mortgage debt was decreased to roughly $190,900. For example, assume you're purchasing a $220,000 property with a $29,100 down payment.

The minimal down payment for a VA or FHA loan is 0 % or 3.5 %, respectively. So you're putting down a lot more money than you would on a new mortgage. However, you also obtain a far cheaper interest rate than you would typically receive.

Funding Your Down Payment With A Home Equity Loan

A home equity loan can be used to augment the down payment on an assumable loan, which is one option for property purchasers. Second mortgages are permitted with FHA, VA, and USDA loans.

These authorities have the authority to refuse a second mortgage if they disagree with the conditions. So is it worthwhile to use the second mortgage strategy? Again, it's a matter of crunching the data.

You may calculate how much you'll save with cheaper interest (about $2,700 per year) and a home equity loan. This method may be appropriate if your home equity costs are less than your total savings.

Your second mortgage will almost certainly come from a different lender than the one that owns the first. Likewise, your second mortgage will most likely be obtained from a lender other than the one that holds the mortgage you're taking.

To qualify for a home equity loan, you need to have a credit score of 680 or above.

When Is An Assumable Mortgage Used, And How Common Are They?

These mortgages let homeowners take over an existing mortgage at the same interest rate and term. Assumed mortgages become more common when interest rates are low; when rates are high, they fall out of favor.

As interest rates rise, it may gain popularity. As a result, some homeowners may decide to take on someone else's mortgage rather than file for a new one.

What Loans Can Be Assumed

Some of the most popular types of mortgages are assumable:

-

Federal Housing Authority (FHA) - The Federal Housing Administration backs it up.

-

Veterans Affairs (VA) - The Department of Veterans Affairs backs it up.

-

U.S. Department of Agriculture (USDA) - The United States Department backs it up.

Buyers who desire to assume a mortgage from a seller must fulfill specific standards and obtain clearance from the mortgage's sponsoring organization. Conventional mortgages are not often assumable.

Buyers are permitted to take government-guaranteed or insured mortgages but not other forms of house loans.

How Much Does It Cost To Assume A Mortgage?

The size of your down payment partially determines the cost of taking out a mortgage. You must pay the difference between what the house is worth and how much the seller still owes. Lenders are limited in how much they may charge.

In the first half of 2021, the average mortgage closing cost was $3,836 without taxes and $6,837 with taxes. So if you're thinking about getting an assumable loan, be sure you understand the upfront charges.

Depending on the outstanding loan debt and the current valuation of the house, you may be required to make a substantial down payment.

Assumption Under Assumable Mortgages

There are two sorts of mortgages that the buyer can get without engaging the lender:

1. The first is a 'simple assumption,' in which the buyer takes over mortgage payments.

The issue with a simple assumption is that the original borrower retains the entire obligation for the mortgage; if the buyer falls behind on payments, the seller's credit and bank balance suffer.

2. Most mortgages are 'novations,' in which the buyer agrees to take on a new mortgage with the lender's approval but without going through the same underwriting procedure as any other new borrower.

The original borrower walks away from their debt entirely free and clear with a novation. Once the transaction is final, whatever happens to the loan is between the lender and the new borrowers.

Top most assumable mortgages

1. FHA

As long as the lender accepts the transaction, FHA loans are typically assumable. Buyers must confirm that the FHA loan is assumable before applying for an individual FHA mortgage. FHA mortgages are thought to be more accessible to purchasers with less-than-perfect credit.

Newer FHA loans demand that both the buyer and seller fulfill stringent FHA financing standards. The buyer will absorb the mortgage if it is authorized. Sellers must dwell in the house as their primary residence for a specified period.

Purchasers must put in a 3.5% down payment, making it more affordable for first-time buyers. In addition, FHA loans can be assumed if both parties fulfill the standards for the assumption.

If you are the buyer of an FHA loan, you must meet the lender's requirements for a Federal Housing Administration (FHA) mortgage. In addition, a 3.5 % down payment, a credit score of at least 580, and a debt-to-income ratio of 43 % or less are required.

The lender must accept a sale by assumption for loans originating on or after December 15, 1989, as long as the buyer is proven to be creditworthy.

2. VA

Mortgages are available from the Department of Veterans Affairs to qualifying service veterans and military spouses. Buyers may easily assume the VA debt for loans originated before March 1, 1988.

A buyer who is not a member of the military or a service member may apply for a VA loan assumption. Sellers in this category are exempt from obtaining lender clearance. The United States government offers VA loans.

Veterans Affairs Department Borrowers must be active-duty military, veterans, or qualified surviving spouses to qualify for a VA loan. The individual assuming the debt is not necessary to be a military member in the circumstances of assumption.

You will still be charged a 0.5 % financing fee. Although all VA loans are assumable, some additional requirements and standards govern how:

-

If the lender approves, the buyer is regarded as creditworthy, and a processing fee is paid; loans issued after March 1, 1988, are assumable.

-

Loans originated before March 1, 1988, are "freely assumable," which means they do not require permission from anybody.

3. USDA

Mortgages through the United States Department of Agriculture (USDA) are available to purchasers with low-to-moderate income who purchase a home in a rural location.

A USDA mortgage usually requires a minimum credit score of 620 and meeting income constraints and geography standards. It is important to note that a USDA loan is usually assumed with a new rate and terms.

USDA loans can be assumed in two ways:

-

New pricing and terms are available. Most USDA loans are assumable in this manner, which not only passes responsibility for the mortgage debt to the buyer but also changes the debt by amortizing it with new rates and terms.

-

The exact pricing and terms apply. Only available in exceptional circumstances, this form of assumption is often reserved for family members swapping property titles.

In these circumstances, the actual mortgage rates and terms are kept, and no assessment of the buyer's creditworthiness or appraisal of the property is necessary.

Assumable mortgage process: How to assume a mortgage

The application process for a house mortgage is similar to any other mortgage. You'll fill out a loan application and supply supporting papers, such as proof of income and employment.

The mortgage underwriter will also request your credit report and credit score to ensure that you fulfill the minimal credit standards.

Finally, you must demonstrate that you can afford the down payment and closing charges using cash from your bank account or another source. Mortgage assumption is not as simple as agreeing to assume the seller's mortgage.

Before signing off on the assumption, the lender must authorize the new buyer. In addition, sellers must make their mortgage payments on time. A buyer and seller assume a risk when they enter an informal assumption without informing the lender.

The following are the steps to take:

-

Confirm that the loan is assumable: Make sure that the loan is indeed assumable. It's also a good idea to check with the present mortgage holder's lender to ensure they'll authorize the assumption and that the borrower has made all their loan payments on time.

-

Prepare for the expenditures: You'll need to make a down payment, although the amount depends on the seller's equity. Once the assumption is granted, you'll have to pay closing expenses, normally lower when you assume a mortgage versus securing a loan the traditional method.

-

Fill out an application: The assumption process varies per lender, but in general, you'll need to complete an application and other forms and submit identification.

-

Close and sign a liability release if the assumption is allowed: If the hypothesis is accepted, you'll need to fill out paperwork just as you would for any other form of house loan. This might contain a liability release indicating that the seller is no longer liable for the mortgage.

How To Qualify For An Assumable Mortgage Loan and Approval and Transfer

Lenders will look at a buyer's credit score and debt-to-income ratio to see if they qualify for an assumable loan. Additional information, such as job history, income statistics, and asset verification, may be required for a down payment.

The buyer had no obligation to qualify for a mortgage before the late 1980s. If the lender feels the buyer is allowed, the parties may proceed with the loan assumption. This form of financing must be approved by the seller's lender or agency.

It is similar to qualifying for any other FHA, VA, or USDA loan to qualify for an assumable loan. You must apply for and get authorized for the mortgage by fulfilling the lender's credit, debt-to-income ratio, down payment, income, and assets standards.

The buyer and seller do not have an ultimate say on whether a mortgage may be transferred. Before either side may sign off on the arrangement, the lender of the original mortgage must authorize the mortgage assumption.

If the lender rejects the transfer, the seller must locate another buyer ready to absorb his mortgage and have good credit. A mortgage that a third party has taken does not free the seller of the obligation to pay the loan.

The seller may be held accountable for any defaults, which may have an impact on their credit rating.

To avoid this, the seller must release their responsibility in writing at the time of assumption, and the lender must confirm the release request, which removes the seller from any loan responsibilities.

| Conventional loan | FHA loan | VA loan | USDA loan | |

|---|---|---|---|---|

| Min DTI | 50% or less | Front-end 31% or less Back-end 43% or less | 41% back- end | Front-end 29% or less Back-end 41% or less |

| Min credit-score | 620 | 580 with 3.5% down 500 with 10% down | 620 | 640 |

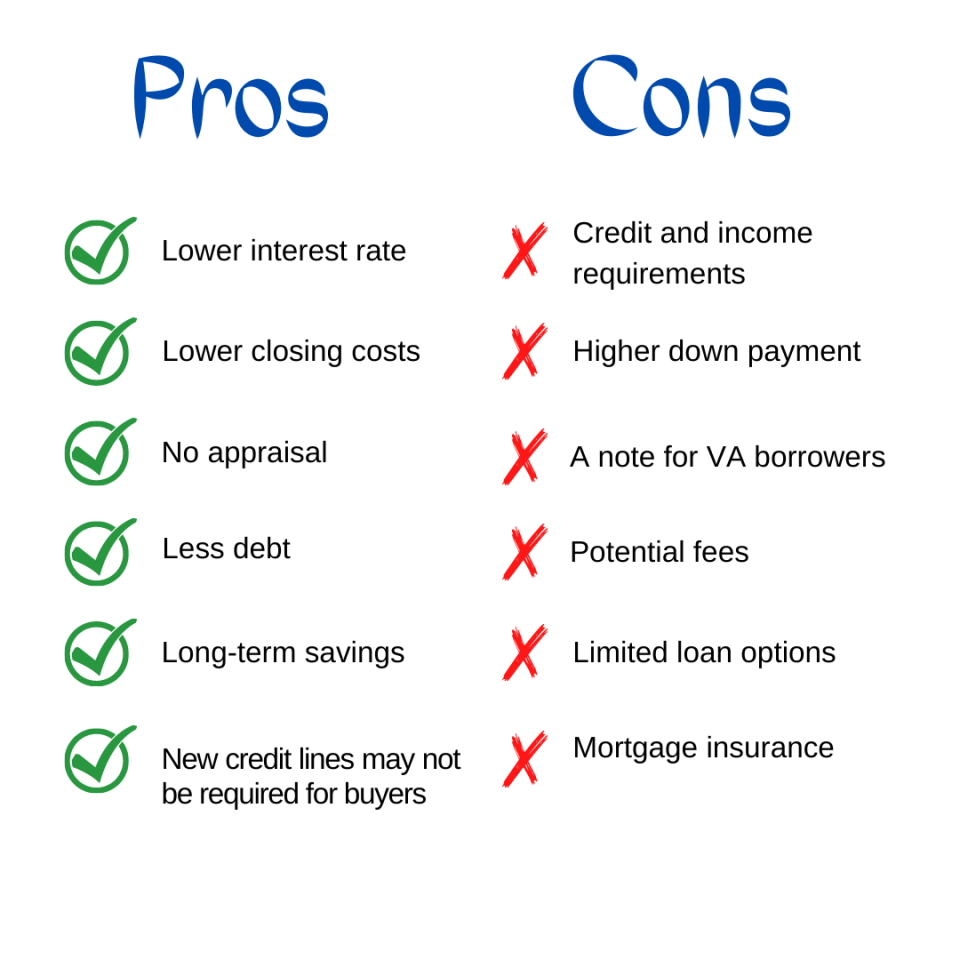

Pros and Cons Of Assumable Mortgage

Pros

-

As a buyer, taking out a mortgage may allow you to lock in a lower interest rate or boost the value of your house. No appraisal is usually required when transferring or selling through assumption, and closing expenses are reduced.

-

Your home may become more appealing to buyers as a seller if you have little equity and a low-interest mortgage. If interest rates rise, an assumable loan may increase the home's value.

-

The main advantage is that you are allowed back into an existing mortgage agreement. When you assume a mortgage, you avoid the appraisal process, which might save you hundreds of dollars.

-

Reduced closing costs, according to lenders, assuming a loan is less expensive than obtaining a new mortgage.

Cons

-

When the house's purchase price exceeds the mortgage debt by a sufficient amount, the buyer must arrange a new mortgage. If the home is worth $250,000 and the projected mortgage debt is $210,000, the buyer has to put down $40,000.

-

These mortgages can include additional risks, particularly when it comes to VA home loans. When you take another person's mortgage, you must make the seller whole.

-

If their property is worth $300,000, but they only owe $200,000 on their mortgage, the buyer must come up with the remaining $100,000 as a down payment.

Some borrowers may be able to finance the difference in other ways; for example, consider using a home equity line of credit.

-

However, payments may become prohibitive in the long run. The disadvantages of taking a mortgage for purchasers include a more significant down payment and the lack of mortgage insurance. If the buyer fails to make payments, your credit may suffer as the seller.

-

Not all mortgage loans can be assumed. Borrowers with excellent credit and large down payments may find it more advantageous to get a new conventional loan rather than taking a government-backed loan.

-

When a buyer accepts a mortgage, they are essentially stepping into the seller's mortgage, which may or may not pay the cost of the home. Rising house values might jeopardize mortgage assumptions.

A seller can avoid this situation by selling to a veteran or service member who is eligible for a VA loan.

A Special Caution For VA Assumable Loans

Anyone without the traditional military service necessary to secure the loan can take a VA loan. However, if a non-eligible military member or a civilian inherits your debt, your VA entitlement will not be restored until the loan is entirely returned.

In this case, you'll need to look into different financing choices to purchase a new property.

Assuming A Mortgage After Divorce Or Death

In the event of a divorce, the spouse who stays in the family home usually is solely responsible for the mortgage. This criterion may not be required if the spouse already has a mortgage.

Still, it's a choice if you want to maintain your family home but don't think you'll be able to qualify right immediately. Obtaining a mortgage does not have to be accomplished through the sale of a house. A family member can take over an existing mortgage from a deceased relative.

Following a divorce or the death of the other spouse, one spouse may assume the loan. The new borrower does not need to qualify for the loan to take it in an inheritance scenario.

In the event of an inheritance, you can continue to make payments under the present loan conditions and have your name placed on the mortgage without qualifying. However, if you wish to refinance, you must have your name on the loan.

This is because you are legally deemed a successor in interest. Mortgage assumption can assist families in transferring mortgaged assets without the lender's consent. For example, a family member can take over an existing mortgage from a deceased relative.

In divorce proceedings, if one individual is given sole property ownership, that person might accept the whole mortgage. Not all mortgage assumptions are the result of house sales.

Can a family member assume a mortgage?

You might be allowed to take over a family member's mortgage. Some lenders make allowances for family members. Even though the contract prohibits them from transferring the mortgage, the lender may agree to add your name to the loan.

In this instance, you and the original owner will both be liable for payments.

Are Assumable Mortgages a Good Idea, and Why Would You Want One?

These mortgages have both advantages and disadvantages, and they may not be suitable for everyone. Examine your budget, your down payment money, and the current market interest rates.

If you're not sure if you can qualify for a low interest rate on your own, this type of mortgage might be a viable option.

Conclusion

Mortgage assumption can be a valuable option for those looking for the possibility of a lower interest rate. Assumable loans are only available on certain government-backed loans. Not all loans are assumable, and buyers must still qualify with the agency and lender.

Assumable Mortgage FAQs

When one party assumes the duty of another, the term "assumable" is used. In the case of this mortgage, the buyer takes over the seller's existing mortgage. When the mortgage is taken, the seller is frequently released from liability.

The buyer cannot take the seller's existing mortgage if it is not assumable. Conventional loans cannot be assumed. Some mortgages have non-assumable clauses that preclude purchasers from taking the seller's mortgage.

The buyer must qualify with the lender before assuming a loan. If the purchase price of the home exceeds the remaining mortgage, the buyer must pay the difference between the sale price and the mortgage.

The buyer may be required to obtain a second mortgage if the gap is significant.

Assumable loans are available in some cases. Each agency has particular standards that both parties must meet to take the loan.

If the loan is assumable, the buyer should check with the seller and the seller's lender. The USDA mandates that the home is in a USDA-approved location.

When the price of buying a house is higher than the interest rates on an existing mortgage, assuming a loan may be a better alternative. If the buyer has significant equity in the house, they may have to pay a big down payment or acquire a second mortgage.

In the same way that you would qualify for any other mortgage. You must apply for and get authorized for the mortgage by fulfilling the lender's credit, debt-to-income ratio, down payment, income, and assets standards.

On a loan assumption, you must pay closing fees, which are normally 2-5 percent of the loan amount. However, some of those may be limited. You're also unlikely to require a new evaluation. So you may pay less at closing than an "average" house buyer — but only slightly less.

With a recent VA or USDA loan, you might not need one because the lender doesn't need a down payment. So it all comes down to your discussions with the owner about what kind of mortgage you're taking on.

Yes, the closing expenses are comparable to standard mortgage closing costs, albeit you may save a few hundred dollars or more by foregoing a house assessment.

With the lender's permission, anyone can take your mortgage. Some borrowers do seek out these private agreements, but they are fraught with danger.

If a borrower dies, lenders may have specific assumption agreements in place for remaining family members – see the relevant section above for more information.

Yes. However, the same cautions apply if you intend to make a "simple assumption."

Non-qualifying assumable mortgages originated before December 14, 1989. These mortgages are nearly extinct because most mortgages have loan terms of 30 years or fewer.

If you have the opportunity to assume a mortgage at a significantly cheaper rate than you can obtain elsewhere, you should surely do the math. However, as with many comparable issues, the answer will rely on your circumstances and requirements.

Mortgage rates are likely to rise, but they're still near historic lows. Great deals can be had without searching for an assumable mortgage or making a big down payment. When you take out a new loan, you have the power to shop around for your lowest rate.

In a buyer's market, sellers may offer lower interest rates as an inducement to prospective buyers. Higher interest rates have slowed house purchases in the past.

If sellers can give buyers a mortgage with a cheaper interest rate, the savings might be enormous while costing sellers nothing.

or Want to Sign up with your social account?