Risk

The potential for loss, harm, or negative outcomes associated with an action or decision.

What Is Risk?

Risk refers to the possibility of variability between the expected and actual returns. It means that the actual return may differ from the predicted return; this possibility is known as the risk in finance.

In general, there is risk associated with all investments or securities. However, the level might vary from one security to another.

Sometimes people use the word risk and uncertainty interchangeably, but there is a big difference between the two. In the case of uncertainty, we cannot assign probabilities to the outcome of an expected event, but it is possible in risk.

The volatility associated with security can be measured using statistical concepts like variance and standard deviation. It indicates how much the price or returns deviate from the historical or expected returns' mean.

It is important to mitigate the level of risk after calculating it by investing in a wide variety of securities. The process of identifying, evaluating, and managing risk is called risk management. The recent collapse of Silicon Valley Bank is a perfect example of bad risk management as the bank invested most of the money deposited by tech firms in long-term treasury assets. With the rise in interest rates price of these bonds falls, and the bank has to incur losses.

Note

Generally, U.S. Treasury bonds are referred to as risk-free assets. But some level of exposure is associated with them, which can expand during inflation and higher interest rates.

Key Takeaways

- The possibility that the actual return will differ from the expected return is called risk. It is the possibility of variability between the expected and actual return.

- It is broadly classified into systematic and unsystematic. The former affects the whole market, whereas the latter only affects particular companies and sectors.

- SR is also known as Non-diversifiable because it cannot be reduced through portfolio management or by investing in a large number of securities.

- Diversifiable or non-systematic risk can be reduced or mitigated by investing in many securities or effectively managing the portfolio.

- The various examples of risks are credit, interest rate, liquidity, financial or business, purchasing power, etc.

- Standard deviation or variation is the most popular method for calculating the total volatility associated with a security.

- Beta coefficient is used to calculate the SR of the security. It measures the sensitivity of security to the market.

Systematic and Unsystematic Risk

The risk associated with security arises from various factors. These factors may be external or internal to the business or company. These are called sources or causes of the risk.

Based on these causes or sources, the total risk (TR) associated with security can be classified into systematic and unsystematic. These are described as follows:

1. Systematic Risk (SR)

It is a part of the TR induced by external factors beyond the control of any investor or firm. These factors include economic policies, taxation, inflation, interest rates, political stability, cultural or social change, etc.

It is also known as a non-diversifiable risk since it cannot be diversified by effectively managing a portfolio or investing many assets. As a result, all securities or investments are exposed to this.

For example, an economic slowdown or rising inflation will impact the whole market, making it harder to avoid.

2. Unsystematic Risk (UR)

It is caused by Internal factors like management, efficiency, and governance problems within the company's control. These factors only affect the return of that specific company.

It is also called diversifiable risk because it can be diversified by holding an efficient portfolio of securities.

Note

A change of the CEO of a particular company will affect the price of the share of that particular company only and not the whole market or industry. This is an example of unsystematic risk.

Other types of Risk

Apart from the broad categorization of TR into systematic and unsystematic. It can also be classified into the following types.

1. Credit Risk (CR)

The possibility that a borrower won't be able to make the required payments, resulting in a default, is known as a CR.

When banks provide loans to companies or the general public, a certain level of CR is involved. Thus, the banks charged higher interest based on the borrowers' profiling, exposure, and creditworthiness.

Investors will demand a higher return if a higher default possibility is attached to the bonds. Therefore, treasury bonds have lower interest rates than corporate bonds.

2. Interest Rate Risk (IRR)

It arises due to the change in the market interest rate. It significantly affects fixed-income products like bonds and debentures. This is because bond prices are inversely related to the market interest rates. Therefore, the rise in the interest rate will lead to a fall in the price of bonds.

Consider a 10-year treasury bond of $100 face value issued at an interest rate of 8%. If the market rate climbs to 10%, this bond will become unappealing to investors, and its price will plummet. This is the bond's IRR.

3. Exchange Rate Risk (ERR)

It is associated with fluctuations in the value of foreign currencies. This mostly impacts corporations and businesses that deal in foreign currencies and import or export products or services.

This also affects the government and the sovereign countries, as changes in the exchange rate may increase the country's import bill and may impact the country's foreign reserve.

For example, if the euro depreciates in value against the dollar, European nations' overall cost of imports would increase without changing the quantity of imported goods.

4. Business Risk (BR)

It is also known as an operating risk (OR) since it occurs due to the presence of fixed operating costs in the company’s cost structure. The fixed cost has to be paid by the business irrespective of the number of revenue.

Thus the BR of the company rises directly with operating costs. The higher the operating cost, the higher will be the OR associated with it.

5. Financial Risk (FR)

It arises due to the presence of debt capital in the company's capital structure. The fixed interest cost associated with debt has to be paid irrespective of the amount of EBIT or the company's operating profit.

Thus, it rises directly with the financial leverage or debt of the company. The higher the debt higher the FR associated with it.

6. Purchasing Power or Inflation Risk (PPR or IR)

Inflation erodes the value of money or the purchasing power of the money. So, as inflation goes up, returns should do so as well.

However, with fixed-income assets like bonds, investors receive a fixed interest rate until the bonds' maturity. As a result, bonds are more vulnerable to PPR.

7. Liquidity Risk (LR)

It is the possibility that a business or person won't have enough cash on hand to satisfy their financial commitments (pay their debts) on time.

This arises when the company cannot sell its assets to pay its debt without impacting its market price or selling it at a lower price than its actual worth.

Note

In 2010, the Basel Committee of banking supervision introduced net stable funding and liquidity coverage ratio to ensure sufficient liquidity in the banking sector.

How to Calculate Total Risk (TR)?

The variability in anticipated returns is referred to as risk. Thus, it may be quantified using various statistical approaches like range, variance, standard deviation, etc.

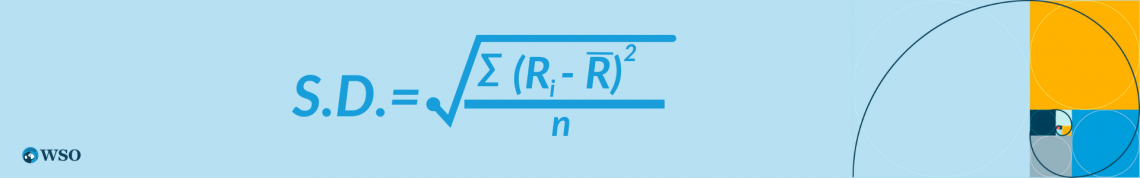

Standard deviation is the most popular method used to calculate the TR of security. It helps find the variability in the returns compared to the average return.

Standard deviation is computed by first deducting the mean or average return from each return, then squaring the difference, adding it all together, and averaging it to determine the variance of the security. Standard deviation is the square root of the variance.

Note

Variance can be used to measure the total risk. But it is expressed in terms of square percentage, which is not useful or the original unit of the data set.

- Ri = Returns

- R̅ = Average or mean return

- n = No. of observations

Example

The last 5 years' return from the security is given, and the investor wants to know the TR of the security based on these returns. The returns were 10%,15%,12%,18%, and 15% for the last five years.

It can be calculated as follows:

| Years | Returns (Ri) | (Ri - R̅)2 |

|---|---|---|

| 1 | 10 | 16 |

| 2 | 14 | 4 |

| 3 | 16 | 4 |

| 4 | 12 | 4 |

| 5 | 18 | 16 |

| ΣRi =70 |

Σ=44 |

R̅ = 70/5 = 14%

= 44/5

= 8.8%

Calculation of Systematic Risk

SR is the portion of TR caused by external events beyond the control of the firm. It affects the whole market and can be assessed by comparing the sensitivity of security returns with market returns.

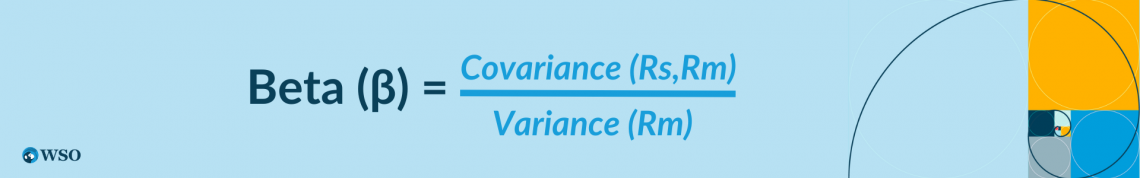

The beta (β) coefficient measures the sensitivity of the security return with the market return. A security's beta is computed by dividing its covariance with the market return by the variance of the market returns.

Where:

-

Rs = Return of the Security

-

Rm = Market Return

The value of the Beta can be interpreted in the following way:

-

If β>1, then the security is more sensitive or volatile than the market portfolio. This means the risk associated with this security is higher. These securities are called aggressive securities.

-

If β=1, then the security moves similarly to the market.

- If β<1, then the security is less risky than the market and is less volatile. This security is called defensive stocks, and they provide a lower return as compared to aggressive stocks.

Note

Beta can be negative. It implies that security returns move opposite to market returns. Usually, gold is said to be a negative beta security.

The example is as follows:

An investor is looking to calculate the beta of company ABC compared to the NASDAQ. Data over the past five years shows that the covariance between the firm ABC and NASDAQ is 5% square. NASDAQ has a variance of returns of 3% square.

Beta can be calculated as follows:

Covariance (Rs, Rm)= 5%

Variance (Rm) = 3%

= 5/3

Beta (β) =1.67

The beta in the above example is equal to 1.67. It means the security is more volatile and riskier than the overall market.

Note

The value of Beta can be computed using the Slope function in Excel. It returns the slope of the linear regression line between the market and security returns.

or Want to Sign up with your social account?