Stock Option

A contract between two parties where the buyer has the right to buy or sell

What is a Stock Option?

A stock option is a contract between two parties where the buyer has the right to buy or sell underlying stocks at a predetermined price within a specified time frame but is not obligated to do so.

To better understand option contracts, let us look at an analogy. Let us say you wanted to buy a house worth 200 thousand in hopes of selling it in the future for a profit, but you are not sure if buying the house would be profitable for you.

So instead of buying the house, you convince the owner to sign a contract where you could buy the house at any time during the specified period at 200 thousand regardless of the market price. In return, the owner of the house would get 10% of the value of the asset.

During the period, if the price of the house went to 300 thousand, you could buy it for 200 thousand and sell it at a profit of 80 thousand as you spent 200 thousand on buying the house and 20 thousand to get into the contract.

Whereas if the price of the house went to 100 thousand, you would only lose 20 thousand, which was the dollar amount you paid to get into the contract as you are not obligated to buy the house.

Options contracts are extremely similar to the above analogy where you would not be obligated to buy the asset, but you could choose to regardless of the market value.

Key Takeaways

- Stock options grant the right, not obligation, to buy/sell assets at a fixed price within a set timeframe, with call options for bullish positions and put options for bearish ones.

- Options come in American (exercise anytime) and European (only at expiration) styles, each with distinct trading and exercise rules.

- Key parameters include expiration date (end of contract), strike price (fixed price for trade), premium (cost of option), and contract size (usually 100 shares).

- Options offer risk management tools, potential for high returns, and strategies for income generation, but demand active monitoring and entail higher risk compared to stocks.

Stock Option Types

Let us take a look at different Stock Option types below:

1. Call Option

A Call option is where the option buyer has the right to buy a specified amount of the underlying asset at a predetermined price during a specified time frame. The buyer of the call profits if the price of the option goes up. This is a bullish position.

2. Put Option

A Put option is where the option buyer has the right to sell a specified amount of the underlying asset at a predetermined price during a specified time frame. The buyer of the put profits if the price of the option goes down. This is a bearish position.

| Holder (Buyer) | Writer (Seller) | |

|---|---|---|

| Call | Right to buy | Obligation to sell |

| Put | Right to sell | Obligation to buy |

Stock Option Styles

There are two styles of options contracts:

1. American options

These options can be exercised at any time between the purchase of the contract and the expiration date of the contract.

2. European options

These contracts are less common. They can only be exercised on the expiration date and not before it. European options trading ends one day early, on the Thursday preceding the third Friday of the expiry month, at the close of business.

For European-style options, determining the settlement price is more difficult. In reality, the settlement price isn't announced until many hours after the market has opened.

Stock Option Parameters

Some of the main parameters are listed below:

1. Expiration

Options contracts allow traders to choose when their option contract would expire. This is known as the expiration date.

The expiration date plays an integral role in determining the price of an option which we will get into later. After the option contract has passed its expiration date, the contract would expire and be rendered void.

Most options that expire each month usually expire on the third Friday of the month. Therefore, this third Friday is the last trading day for all expiring equity options.

This day is called Expiration Friday. If the third Friday of the month is an exchange holiday, the last trading day is the Thursday immediately preceding this exchange holiday.

2. Strike price

The strike price is a fixed price where an option can be bought or sold when the contract is exercised. If a trader wants to take a bullish position on Apple, they could buy a call option for a specific expiration and a particular strike price.

3. Premium

The premium is the current price of an option contract. The premium is given to the writer of the option or the person who creates the contract.

4. Contract Size

The contract size represents the number of underlying shares a trader would want to purchase. Typically, an option contract consists of 100 shares of the underlying stock.

For example: if a trader is looking to buy 700 shares of AT&T at $18.20, they could buy seven call options of AT&T with a strike price of $18.20.

If the strike price rises over $18.20 before the expiration, the trader would have the option to exercise the option and buy the 700 shares at $18.20 or let it expire.

However, if the strike price goes below $18.20, the contract would expire worthlessly, and the trader would be at a loss of the amount they paid as a premium.

Stocks vs. Option Contracts

To understand the main difference between the two, we'll take certain basis points. Let us take a look at the difference below:

1. When can options be a better choice than stocks?

-

If you want to keep risk to a minimum, options may be better. Options may help you earn a stock-like return while investing less money, so they're a good method to keep your risk under control.

-

If you're an experienced investor, options can be a valuable technique. When using a particular options strategy, experienced investors know how to reduce their risk and comprehend the hazards they're taking.

-

Some options methods might help you get a better deal on stocks. Writing puts, for example, allows you to receive a premium in exchange for the chance to buy a stock at a lower price.

-

Options provide you the opportunity to grow your money at a significantly faster rate. Options allow you to earn a significantly bigger return but also expose you to the danger of losing everything if you're incorrect.

-

Options may enable you to earn money. As a strategy to generate revenue, some shareholders sell call options against their stock positions or write put options against their stock positions. Such tactics can be appealing and low-risk approaches to using options.

2. When can stocks be a better choice than options?

-

You have at least some, ideally a lot, of market investment experience. Stocks need research and effort, but options necessitate much more. For beginners and even intermediate investors, ETFs or mutual funds that invest in equities are a preferable option.

-

You want to make a long-term investment. Stocks can go up a lot in the long run, but you also have to ride out downturns, and because options are short-term, they might expire before the stock price changes in your favor.

-

You don't want to keep a close eye on the market. While stocks do necessitate some monitoring, it is significantly less than the amount required by options, which expire on a predetermined schedule.

-

The stock is quite volatile. It's simple for options to expire worthless if you believe in a company for the long run, yet it's erratic. Stocks provide a long-term investment, but you'll have to ride out the ups and downs, something you won't be able to do with options.

| Criteria | Options | Stocks |

|---|---|---|

| Risk Management | Can help minimize risk with controlled investment | Long-term investments with inherent market risk |

| Experience | More suitable for experienced investors | Beginner-friendly, but research still required |

| Investment Size | Lesser investment for similar returns | Typically require larger investments for comparable returns |

| Return Potential | Potential for higher returns but with higher risk | Generally stable returns with long-term growth potential |

| Income Generation | Strategies for generating income through options | Dividends or long-term growth as sources of income |

| Time Horizon | Short-term, expires within a specific period | Long-term investments with the potential for volatility |

| Market Monitoring | Requires active monitoring due to expiration dates | Less intensive monitoring compared to options |

| Volatility | Exposed to market volatility; can lead to significant gains or losses | Opportunity to ride out market volatility over time |

Long Term Equity Anticipation Securities (LEAPS®)

LEAPS® are long-term options with an expiration date of up to two years and eight months, as opposed to shorter-term options having an expiration date of less than a year.

LEAPS® allows a buyer the option to purchase shares of a stock at a specified price on or before a specific date. Equity LEAPS® are American-style options.

As a result, they can be exercised and settled in shares before they expire. The Saturday after the third Friday of the expiry month, which is usually in January, is when LEAPS® expires.

If you buy LEAPS® calls or puts, your risk is limited to the amount you paid for the position. There is no limit to the danger you face as an exposed seller of LEAPS® calls.

There are a lot of risks involved with selling LEAPS® puts. The level of risk varies based on the technique used. It is critical for an investor to thoroughly comprehend the risks associated with any approach.

Investors can also acquire access to the long-term options market without having to employ a mix of shorter-term option contracts using LEAPS®.

Short-term options have a one-year maximum expiry date. Without LEAPS®, investors who wanted a two-year option would have to buy a one-year option, wait for it to expire, and then buy another one-year option.

Exercising a stock option

If the option buyer exercises his right, the option seller, also known as the option writer, is responsible for carrying out the conditions of the option contract.

If the option is a call, the option writer is compelled to sell the underlying securities to the option buyer at the strike price. If the option is a put, the option writer is compelled to buy the underlying securities from the option buyer at the strike price.

The option writer is not bound to meet the conditions of the option contract unless and until the option buyer exercises the contract. The buyer has the choice to exercise it, but he is not required to do so.

Although only roughly 7% of option contracts are regularly exercised, this does not mean that investors can expect to get allocated on just 7% of their short holdings. Some, all, or none of an investor's short holdings may be allocated.

Upon receiving news of the assignment, an investor allocated to a short option position must comply with the provisions of the written option contract. In the event of a short equity call, the option seller is required to deliver shares at the strike price in exchange for cash.

Because each contract represents 100 shares, an investor who does not already possess them must purchase and deliver them in exchange for cash in the amount of the strike price multiplied by 100.

When selling a short equity put, the option seller is obligated to buy the shares at the strike price.

Stock Option Trading Strategies

There are a variety of option trading strategies that can be used. The most common strategies are the Long Call, Long Put, Short Call, and Short Put.

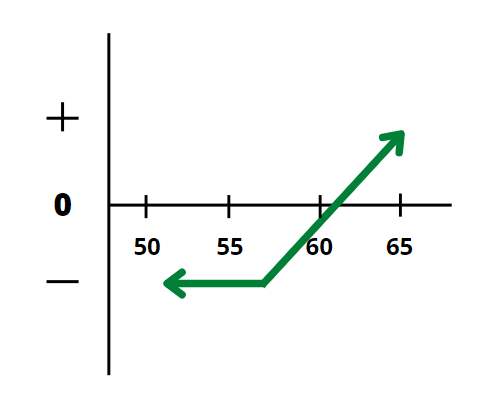

1. Long Call

The long call option strategy is the most basic options trading strategy, in which an options trader buys call options in the hopes that the underlying security's price would rise significantly beyond the strike price before the option expiration date.

Max Profit = Unlimited

Profit = Price - Strike Price - Premium Paid

Break-Even Point = Strike Price + Premium Paid

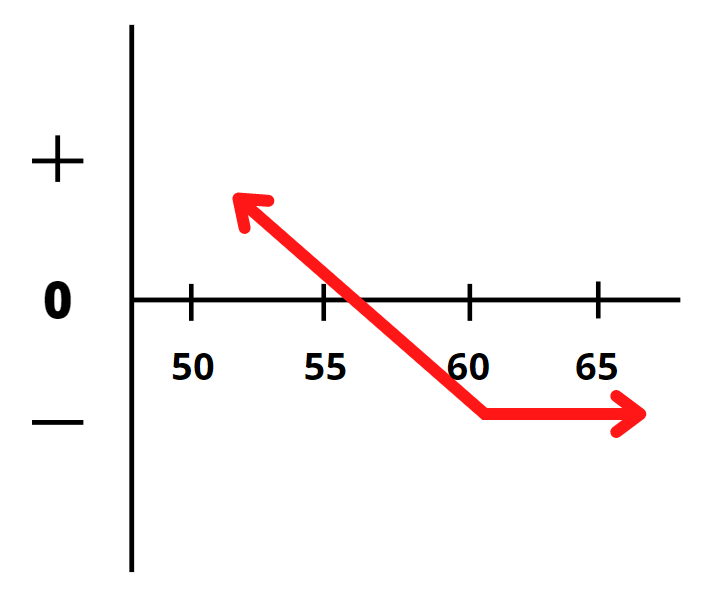

2. Long Put

The long put option strategy is a common options trading strategy in which an investor purchases put options with the expectation that the underlying security's price will fall considerably below the strike price before the expiration date.

Max Profit = Unlimited

Profit = Strike Price - Premium Paid

Maximum Loss = Premium Paid + Commissions Paid

Break-Even Point = Strike Price - Premium Paid

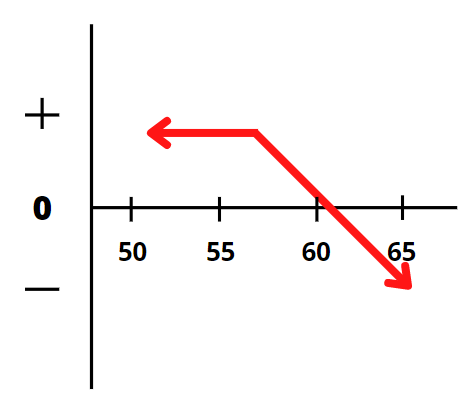

3. Short Call (Naked Call)

Writing call options without owning the underlying stock is known as the naked call strategy or the Short Call. It is an alternative to shorting the stock when one is bearish to highly bearish on the underlying stock.

Maximum Profit = Premium Received - Commissions Paid

Max Loss = Unlimited

Loss = Price - Strike Price - Premium Received + Commissions Paid

Break-Even Point = Strike Price + Premium Received

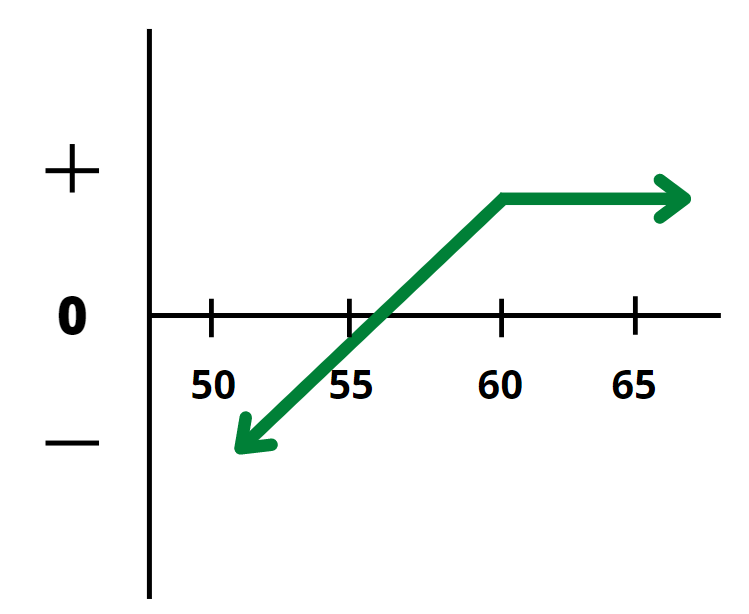

4. Short Put

Writing put options without owning the underlying stock is known as the naked put strategy or the short put. This strategy is used when one is bullish on an underlying stock.

Max Profit = Premium Received - Commissions Paid

Max Loss = Unlimited

Loss = Strike Price - Price of Underlying - Premium Received + Commissions Paid

Break-Even Point = Strike Price - Premium Received

Composition of an option contract

All option contracts (derivatives) have a premium composition that may be divided into two categories: intrinsic and extrinsic value.

Any options contract's value is the total of its intrinsic and extrinsic value:

Option Price = Intrinsic Value + Extrinsic Value

1. Intrinsic Value

The value that an option possesses in and of itself if it is executed right away is known as the intrinsic value. Intrinsic value is an option's "inward" value, discounting time and future volatility.

2. Extrinsic Value

An option's value that is greater than its intrinsic value is known as extrinsic value. Extrinsic value is defined as anything "leftover" from intrinsic value.

This is the "premium" associated with the possibility for an option to become more valuable before it expires. "Time value" is another term for extrinsic value.

3. Call Option

-

In-the-money = strike price less than the stock price

-

At-the-money = strike price same as stock price

-

Out-of-the-money = strike price greater than the stock price

4. Put Option

-

In-the-money = strike price greater than the stock price

-

At-the-money = strike price same as stock price

-

Out-of-the-money = strike price less than the stock price

5. Time Value (Extrinsic Value)

The longer an option is left until it expires, the larger its premium will be. This is because the longer the life of an option, the more likely the underlying share price will move the option into the money.

Even if all other factors influencing an option's pricing stay constant, the time value element of the premium will decline (or decay) with time.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?