Futures Contract

An agreement to buy or sell an asset at a certain time in the future

What Is a Futures Contract?

A futures contract is an agreement to buy or sell a specified quantity of a specified asset (underlying asset) at a certain time (expiry date) in the future for a price agreed upon at the time of entering into the contract.

The underlying asset could be anything, from commodities like gold or oil to financial instruments like currencies or stocks. Traders and investors commonly use futures contracts to hedge against potential price movements in the underlying asset.

For example, September Pepper Futures expires on September 20 at $15,700 at NCDEX India. This means that the underlying asset is pepper, and the specified quantity per contract is 1,000 kg. The expiry date is September 20. The futures price is $15,700 per quintal (100 kg).

This means that a producer of pepper who buys a single pepper futures contract can buy 1,000 kg of pepper on September 20 at $15,700 per quintal.

Futures contracts are typically settled in cash, meaning the underlying asset is not physically exchanged. However, some contracts may require physical delivery of the underlying asset upon expiration.

Key Takeaways

- A futures contract is an agreement to buy or sell an asset at a predetermined date and price. The underlying assets can be commodities, financial instruments, etc.

- Futures contracts allow investors to hedge against potential price movements in the asset. They are typically settled in cash.

- Participants include hedgers trying to reduce risk, speculators betting on price direction, and arbitrageurs profiting from price discrepancies.

- Contract specifications include asset, quantity, grade, delivery date and arrangements, daily price limits, and position limits.

- Futures are traded on exchanges that guarantee performance. Most contracts are closed out before expiration rather than requiring physical delivery.

Participants In The Futures Contracts Market

The participants in the futures contract market are classified as hedgers, speculators, or arbitrageurs, according to the motive with which they enter the contract to reduce risk or to make further profit with less investment.

1. Hedgers

Hedgers are those who want to reduce price risk using futures contracts. Producers of commodities and the users of these commodities use commodity futures contracts so that the price risk of the commodities can be eliminated.

Borrowers and investors use interest rate futures contracts to hedge the risk of uncertain future interest rates. Businesses and individuals exposed to foreign currency risk use currency futures contracts.

Portfolio managers and individual managers use stock futures and stock index futures to hedge stock price movements.

However, hedging can result in losses or gains depending on the difference between the future price of the underlying asset and the locked-in future prices.

2. Speculators

Speculators enter the market by placing bets on the movement of prices in the market and expect to make money from their predictions. Speculators like to take positions in the market without any underlying future cash flow.

Note

The role of speculators is very important in the futures market as they provide stability and liquidity.

3. Arbitrageurs

Arbitrage means making a riskless profit by simultaneously entering into transactions in two or more markets.

An arbitrage aims to even out the price of assets in the markets in which they are traded. If assets are not correctly priced relative to each other, arbitrageurs can make riskless profits by buying underpriced assets and selling overpriced ones.

However, such arbitrage opportunities cannot exist for long because the arbitrageurs' actions will bring asset prices in line in all the markets.

Note

An arbitrage opportunity arises in futures trading as the prices of futures contracts and the prices of the underlying assets are related.

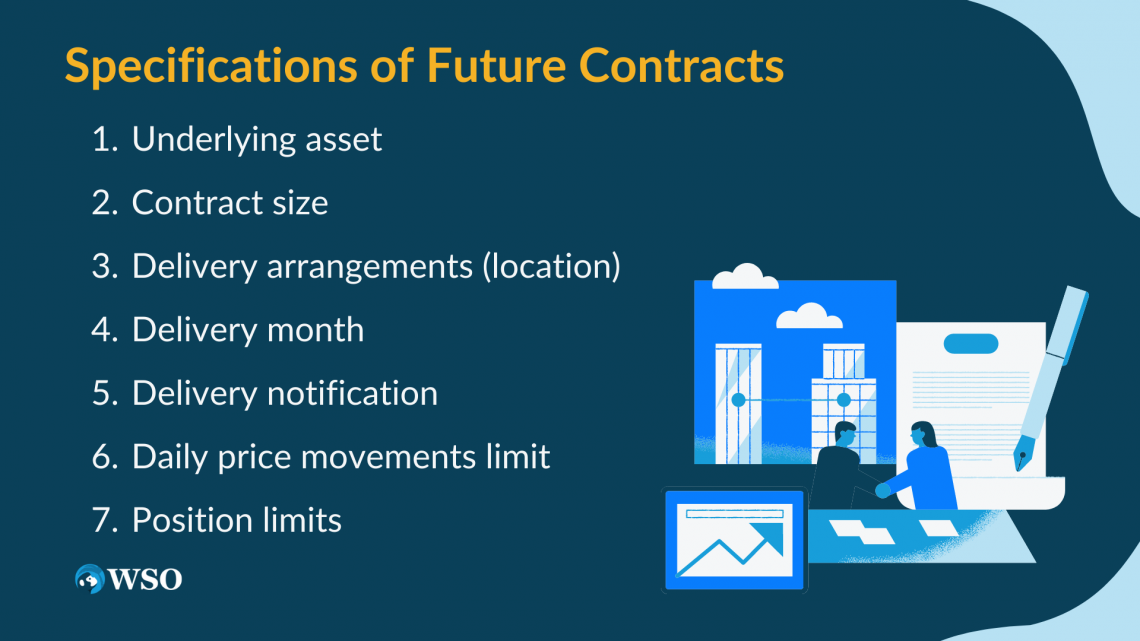

Specifications of futures contracts

Whenever a new futures contract is made, the futures exchanges must specify the assets on which the contract is written, the contract size, the asset quality, and the time and location of delivery.

When the asset is a commodity, there might be quite a variation in the quality of what is available. Therefore, the futures contract must specify the grade or grades of a commodity that can be delivered under the contract.

2. Contract size

The contract size specifies the amount of the asset deliverable under the futures contract. A large contract will deter investors from using futures to hedge or speculate, whereas a small contract will increase the traders' price.

3. Delivery arrangements (location)

The place where the delivery will be made must be specified with alternative delivery locations (the price of the contract adjusted appropriately according to the location chosen). An alternative location is generally preferable to the short-position party.

Note

In the case of financial futures, the delivery is usually made as a book entry.

4. Delivery month

A futures contract is referred to by its delivery month, and the exchange must specify the day of the month on which the delivery can be made.

For example, if the contract is a July cashew contract, the delivery date is the 20th day of the delivery month. If the 20th happens to be a holiday, Saturday, or Sunday, the due date is the immediately preceding trading day of the exchange.

On the expiry date, contracts will not be available for trading after 5 p.m.

5. Delivery notification

The exchange must specify when the party has a long position in the contract and should notify the exchange whether it intends to enforce the contract.

6. Daily price movements limit

When futures are traded, speculative action will likely cause substantial price movements. The exchange specifies daily price movement limits for most contracts to protect traders from wide fluctuations on a single day.

Note

If the prices move down by an amount equal to the daily price limit, the contract is said to be limited down, while it is limited up if the prices move up by an amount equal to the daily price limit.

7. Position limits

The position limit refers to the maximum number of contracts that a trader can hold. The purpose of position limits is to prevent speculators from exercising any influence on the market or to prevent any particular trader from correcting the market.

Closing out the positions & performance of a futures contracts

Closing out a position means that a trader has entered into an offsetting transaction. A person is said to open a position when entering a futures contract.

While opening a position, it could either be a long position, which means that the trader is entering into a contract to buy the underlying assets at expiry, or it could be a short position in which the trader agrees to sell.

If the trader decides not to have the open position at expiry, which calls for taking the delivery if the open position is long, and making the delivery if the open position is short, then the trader can close out their open position before the contract expiry.

It means the opposite position; if the trader had taken a long position while taking the open position, they would close out by taking a short position in the same contract for the same number of contracts and vice versa.

Note

Most hedgers would close the position close to the delivery date so that the actual price at which they trade their asset in the spot market is close to the price at which they entered to trade in the futures market. If the two prices are different, it will lead to arbitrage opportunities.

The major advantage of futures is that it is traded on futures exchanges. All futures exchanges have instituted mechanisms by which the non-performance of the contracts is eliminated. This is accomplished through:

- Creation of a clearinghouse

- Institution of margins

- Marking-to-market of all futures accounts

Clearinghouse

The exchange clearinghouse is a part of the futures exchange and acts as an intermediary in all futures transactions.

For example, assume that John, a cashew producer, has sold five cashew contracts to Oliver, a cashew merchant. Even though the contract is between John and Oliver, the clearinghouse will interpose itself in this contract.

That is, it will be considered that John has sold five cashew contracts to the clearinghouse, and the clearinghouse, in turn, has sold five cashew contracts to Oliver. Thus, the clearinghouse guarantees performance, as it is the counterparty to each future transaction.

The clearinghouse will have several members. When a trader wants to buy or sell futures contracts, the deal will have to be cleared through a member of the clearinghouse, known as the clearing member (CM).

The clearinghouse will keep track of all transactions that take place during the day so that it can calculate the net positions of each of the CMs.

Each CM of the exchange is required to maintain a margin account with the clearinghouse, known as a clearing margin.

Assume that the margin for the cashew contract is 5%, and a contract to buy five cashew futures is cleared through a clearinghouse member at $5,600 per carton. The contract size is 50 cartons.

Value per contract = Futures Price per Carton x Number of Cartons

5,600 x 50 = $250,000

The Total Value of the Five Contracts = Value per Contract x Number of Contracts

= 280,000 x 5 = $1,400,000

Margin amount = Total Value of the Five Contracts x Margin Percentage

= 1,400,000 x 5%= $70,000

A margin amount of $70,000 will have to be provided by the CM to the clearinghouse.

Once the margin amount is provided, it will be entered into the CM's margin account, which the clearing corporation maintains.

Note

This margin account will be updated daily based on the contract's settlement price on that day. This procedure is known as marking-to-market.

Types of orders for futures contracts

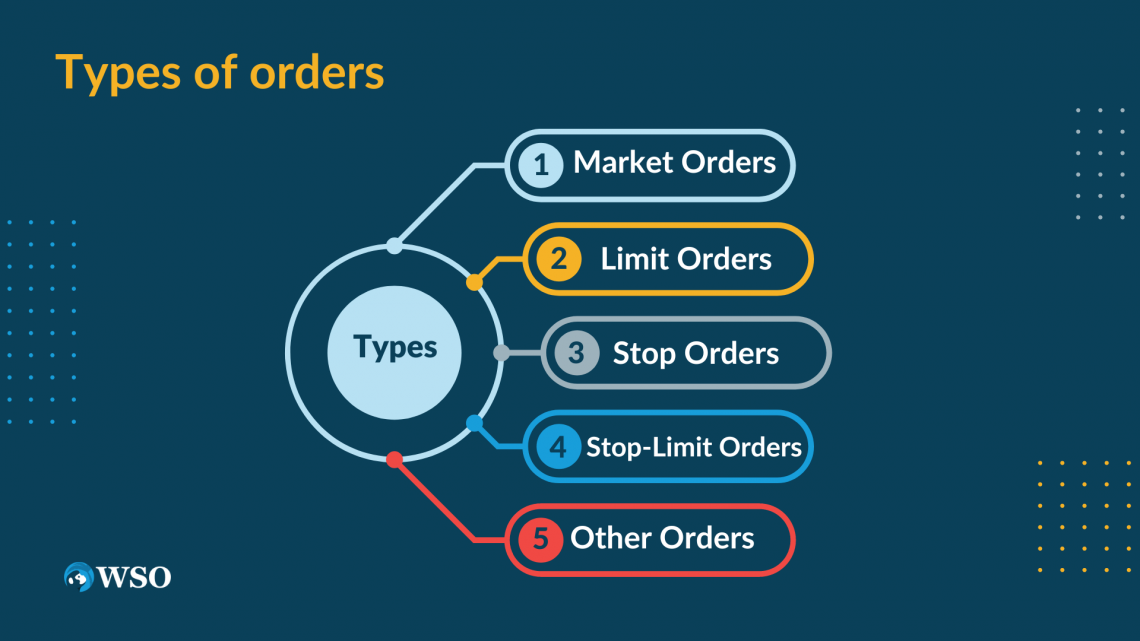

In a stock market, various types of orders can also be placed in the futures market.

These are explained in this section

1. Market Orders

The simplest type of order for an individual to place is a market order. This means that a trade will be carried out at the best-prevailing market price, regardless of what that may be.

2. Limit Orders

A limit order specifies a particular price. The order will be executed either at this price or at a price more favorable to the trader. There is, however, no guarantee that the order will be executed at all, as there is a possibility that the limit price is not reached.

3. Stop Orders

A stop order or a stop-loss specifies a particular price. The order is executed at the best available price once there is a bid at this particular price or a less favorable price.

Suppose a stop order to sell at $3,000 is issued when the market price is $3,200. This will become an order to sell once the price falls to $3,000.

4. Stop-Limit Orders

A stop-limit order combines stop and limit orders. The order will become a limit order as soon as the price reaches a price equal to or less favorable than the stop price. Two prices will be specified in a stop-limit order: the stop and limit prices.

Suppose the market price is $3300 and a stop-limit order with a stop price of $4,000, and a limit price of $4100 is executed. As soon as there is a bid or offer at $4,000, it becomes a limit order at $4,100.

5. Other Orders

A market-if-touched order is executed at the best available price after a trade occurs at a specified price or at a price more favorable than that specified.

A market-if-touched order becomes a market order once the specified price is reached. This is also called a board order.

Note

A time-of-day order specifies a particular time of day at which the order can be executed. An open or good-till-canceled order is in effect until it is executed or until trading in that contract is ended. A fill-or-kill order must be executed immediately or not at all.

Conclusion

Futures contracts are non-negotiable and are traded in futures exchanges. The participants in futures markets include hedgers, speculators, and arbitrageurs.

Hedgers are traders who have a position in some assets and are interested in hedging the price risk on their position. In contrast, pilates has no position in the asset but would like to make money by estimating price changes.

Arbitrageurs try to make profits with no investment and no risk through price imbalances between the price of the asset in the spot market and the price of the asset in the futures market.

A futures contract should specify the underlying asset, the contract size, the maturity of the contract or delivery month, the delivery arrangements, the delivery notification details, how the price will be quoted, the limits on daily price movements, and the position limits.

Most contracts are closed out before maturity. Closing out the position means the trader will place an offsetting order to zero the net position.

FAQs

It is required as a guarantee to avoid defaults by traders and give the counterparty, i.e., the clearinghouse, protection to secure a future position while it is open.

It is the total number of outstanding futures contracts available for delivery at that time and the sum of all long or short positions. Open interest is important in futures trading because it indicates the trading in the contract and the liquidity of the contract.

or Want to Sign up with your social account?