Stop Order

Is a stipulation set by investors to buy or sell a security when the price reaches a predetermined target

What Is A Stop Order?

One of the three primary order types you will come across in the market is a stop order. The other two are market and limit orders.

Stop Order is a stipulation set by investors to buy or sell a security when the price reaches a predetermined target. Once it reaches the target level, the order is activated and executed. This type of order can limit potential losses that may incur during a trade. Not to mention, it also guarantees the best execution price available.

Every stop order is always carried out in the direction of the market's movement. For example, the stop order is programmed to sell at a predetermined price below the current market price if the market is trending lower.

As an alternative, if the price is rising, the stop order will be to buy the security at a predetermined price that is greater than the going rate of the market.

An investor can use a stop order as a contingent order to enter or exit the market. The activation or triggering of a stop order occurs when a traded security, such as a specific stock, hits a market price that is stated in the order.

Learning to use stop orders is a must to be a successful trader. Before entering any position to buy or sell securities, a stop order can be beneficial to reduce the risk of losing a considerable amount of money from an open position.

However, it does not always secure execution and may trigger beyond the price chosen depending on the order type.

How To Use Stop Order

Traders can use many orders to reduce risk exposure and limit the likelihood of a loss. For example, the investor will place a stop order at a specific price. When the price is reached, the order activates and executes. Remember that a stop order will never be conducted before it is activated.

Unlike a limit order, the stop order is conditional, meaning it needs to reach a specific price called the stop to become active. Otherwise, it won't activate.

The investor chooses what type of order to place when buying a stock. Then, if the order gets filled, they can sell the stocks using a market order, limit order, stop-market order, or stop-limit order to limit potential losses. For instance, a market order guarantees activation at the best price available at the selling moment. On the other hand, a limit order will guarantee a price but not the execution.

The stop market order will activate and execute at the best price available. In contrast, the stop-limit order will start and run at the investor's chosen price.

Time in Force orders:

- Day Order Definition: A day order is a request from the investor to the broker to buy or sell a stock at a specific price that has a time limit until the end of a trading session.

- Good till date (GTD) definition: Good till date is a request from an investor to the broker that allows them to set a specific date on which the order will expire.

- Good till canceled (GTC) definition: Good till canceled is a request from the investor to the broker to keep the order active until it is either filled or canceled. Note that the Brokerage cancels the order after a considerable time has passed.

- Market on open (MOO) definition: A market on open is a request from the investor to the broker to execute a trade at the market's opening. The execution price will reflect the moment price at the beginning of the trading session.

- Fill or Kill (FOK) Definition: Fill or kill is a request by the investor to the broker to fill the order immediately and completely, otherwise canceled.

Market Vs. Limit Order

Market Order:

The primary purpose of a market order is to execute the trade as soon as possible and guarantee to buy or sell a stock at the current best available price. Also, note that it always ensures execution but will never promise a specific price.

A market order is sometimes used by traders when they panic sell, which means when the market dumps, retail traders immediately sell their held stocks.

Usually, you can place a market order at any time. However, it is preferable to place it during the open hours, considering that stock prices will change between each trading session. Also, note that the price of a stock can vary significantly between trading hours due to many different national or international influences.

In the above example, the stock price seems to be moving fast; we can see that the stock price is changing significantly from minute to minute. To illustrate, if an investor owns one share of stock and has decided to sell it at 12:03, a price of $4.

The share won't necessarily sell at $4 because of the volatility. Therefore, what could happen is that the stock will sell anywhere in the range of $4 and $2.

Limit Order:

A limit order is applied to set a price at which an investor wants to buy or sell a security. Therefore, it will guarantee a stipulated price but won't ensure execution. Usually, this type of order is employed when the investor wants to sell a stock above the current price or buy the stock below the current price.

Consider the above example, a trader bought a share of stock on Monday for $25 and placed a limit sell order at $20 to limit losses no further than $5. The investor was bullish on this trade, yet on Friday, the stock dropped below $20. The limit order has been triggered and executed at $20.

Types Of Stop Order

The types are:

1. Stop Market Order/ Stop Loss:

A stop market order reaches a stop price and then becomes a market order. First, the order activates at the stop level and then executes at the best price available. Sometimes, the order can start and run above the stop price since it is a market order.

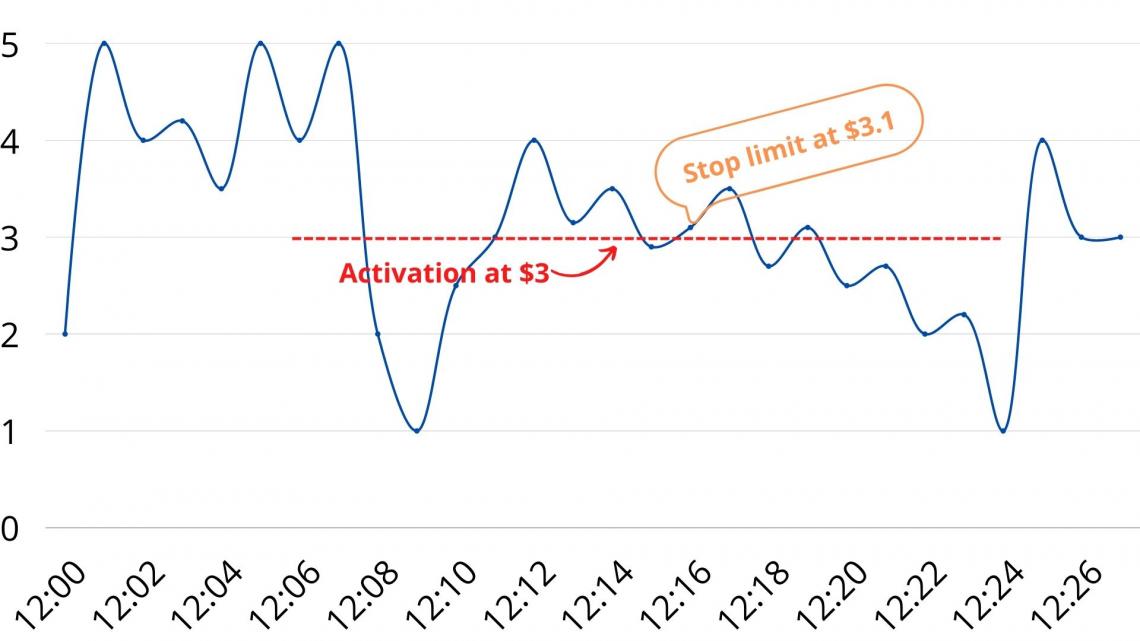

In the above example, an investor placed a sell-stop order at $3; when the price hit the target, the order activated and became a market order. Regarding the execution, it will execute anywhere on the indicated orange line depending on the price movement.

Note that at $3, the order activated, and the stock price plunged, explaining why the market order will execute below $3. However, if the stop market order touches the price of $3 and reverses to continue the bull run, the order will activate and execute above the price of $3.

2. Stop Limit Order:

A stop-limit order combines both the stop order and the stop limit. The order reaches a stop price, then becomes a limit order. For instance, the order activates at the stop level and then executes at the designated limit.

The investor can specify the price to be executed with the stop-limit order. However, the stop and limit order can have different set prices. Therefore, execution is not assured when the stop order activates, especially if the price moves away from the limit.

In the above example, an investor placed a stop-limit order, a stop order at $3, and a limit order at $3.1. When the price touched the red line, the stop order was activated. Apart from this, the stock price increased again, passing through the $3.1 stop limit, thus executing the order.

Researched and authored by Elie Zakhour | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?