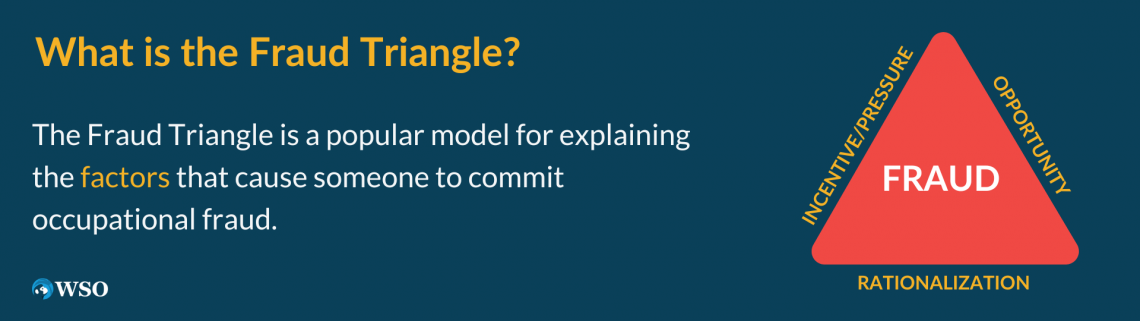

Fraud Triangle

The Fraud Triangle is a popular model for explaining the factors that cause someone to commit occupational fraud

The fraud triangle is a popular model for explaining the factors that cause someone to commit occupational fraud. According to this model, people commit fraud due to one or a combination of three forces. These motivations are opportunity, incentive/pressure, and rationalization.

The fraud triangle was first proposed by Donald R. Cressey, a famous criminologist, in his book Other People’s Money: A Study in the Social Psychology of Embezzlement. In it, he sums up his hypothesis as follows:

Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-sharable, are aware this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their own conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds or property.

According to Cressey, these three circumstances must line up to create an ideal climate for fraud.

Pressure refers to the stress or urgency that leads someone to take an action they may not usually take.

Opportunity refers to the resources available for committing the crime, which causes temptation to commit the crime.

Rationalization helps someone justify why what they are doing is okay.

What is Fraud?

Fraud is defined as an intentional perversion of truth to achieve some type of gain. A fraudster is someone who commits fraud. It is not uncommon for both individuals and organizations to commit fraud.

While large-scale fraud is relatively rare, it does occur more often than one might think. The 10-80-10 rule can serve as a reasonable assumption of how many people may commit fraud.

This rule proposes that 10% of people will never commit fraud, 80% of people may commit fraud under the right circumstances, and 10% of people are actively looking for ways to commit fraud.

There are many different ways in which fraud occurs. Fraud can be something as simple as a cashier stealing money from the register. Even cheating on a test in school would be considered fraudulent.

Common types of financial fraud include corporate fraud, credit card fraud, and consumer fraud.

One well-known type of financial fraud is called a Ponzi scheme. This is when an individual or organization takes money from investors with the promise of return along with profits. This person then borrows money from other investors to pay back the first investor. This is known as “robbing Peter to pay Paul.”

Bernie Madoff orchestrated one of the most famous Ponzi schemes in the world, worth about $64.8 billion. Most point to his extensive network and cunning ability to lie that allowed him to grow a scheme this large without getting caught earlier.

The Fraud Triangle - Opportunities

Opportunity is the weakness in internal control that someone could exploit to commit fraud.

For example, suppose a person in charge of inventory for a company is ordering products for the company. In that case, they may be tempted to order more than they need and then sell these products on the black market, especially if this product is not available for retail, such as pharmaceuticals or certain chemicals.

Opportunities come from a range of circumstances. Improving internal controls is the best way to prevent opportunities for committing fraud.

A few measures for improving internal control to reduce the opportunity for fraud are as follows:

- A company should keep accurate and timely records. If records are unorganized and not diligently kept, it makes it much easier for a fraudster to falsify records without ever being caught.

- A company can also institute several policies that prevent fraud. Supervision is vital to make sure that employees feel as though they do not have the opportunity to commit fraud. Another way to do this is by involving multiple departments or people in the completion of a single goal. If numerous unbiased people must cooperate in different stages of a task, it makes it much more difficult for fraud to occur.

The Fraud Triangle - Incentive/Pressure

Pressure, sometimes substituted for incentive in the fraud triangle, refers to the stress or urgency that leads someone to take an action they may not normally take. People may feel pressure to act for any number of reasons.

Some may feel compelled if they are having personal problems. This may include large debts or a gambling problem that they feel they are unable to get out of unless they are able to bend the rules.

In some cases, those who commit fraud may not be in debt or trouble of any kind, but simply wish to make more money and are willing to cheat to get ahead.

For most ordinary individuals, however, large amounts of stress can be the reason they do something that might be antithetical to their normal code of ethics.

Others commit fraud because of career pressures. Often people are worried about missing deadlines or benchmarks and will create lies to make their performance appear better. This type of fraud is especially prevalent even in the most senior positions.

Elizabeth Holmes, the founder of Theranos, a biotechnology company, was convicted of fraud in 2021. She had claimed to create a revolutionary new blood-testing technology, but it was soon revealed that this invention was essentially non-existent.

The Fraud Triangle - Rationalization

Rationalization is the third factor in the fraud triangle and refers to why people commit fraud.

When someone decides to commit fraud, they may use rationalization as a way to justify their actions. For example, they may come up with reasons why they should do it or why it won't be an issue.

People have an uncanny ability to rationalize their actions to themselves. Even the most heinous criminals do not believe they have done anything wrong. With this in mind, it should come as no surprise that those who commit fraud can rationalize their actions.

This rationalization often comes in the form of desperation. Many people do not believe they have any other options and that their actions are justified because of their difficult position. Others may tell themselves that everyone is doing it, and it is okay for them to commit fraud. This is why it’s essential to ensure that fraud is caught quickly and punished in order to deter others from following in their steps.

Some of the most common ways that people are able to rationalize their actions are found below:

- The organization deserves it

- My boss deserves it

- I deserve it

- It's not that bad

- It's for a good cause

- I was just following orders

- Nobody will notice

- Others do it

- I have no choice

Rationalization is an important part of the fraud triangle, as it is this element at play that helps ordinary people set aside their morals and commit acts that are ethically corrupt.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?