Sustainable Growth Rate

A company's maximum possible growth rate without needing external equity and debt financing

What is the Sustainable Growth Rate?

The sustainable growth rate (SGR) is a company's maximum possible growth rate without needing external equity and debt financing. SGR is the growth rate that is achieved through internal accruals alone. A high sustainable growth rate is a positive factor for a company.

A high SGR states that the company is profitable and efficient enough to fund everything through internal accruals.

Internal accruals are the company’s leftover profits after dividend payments. They are also called the plowback ratio, which shows the company’s retained earnings level.

Formula:

Sustainable Growth Rate = Retention Ratio * Return on Equity

Where

- Retention Ratio = 1 - Dividend Payout Ratio

- Return on Equity = Net Profit/ Equity

ROE is used because retained earnings are accounted for in the equity account.

Dividend payout ratios can be adjusted depending on the company. For example, if a company has payout cycles, the ratio can be normalized and then used to achieve a more consistent growth rate.

The SGR is the rate at which the company is expected to grow in the future. A higher SGR suggests that the company is efficiently using retained earnings to generate a high return on its equity.

The SGR is a very useful tool for investors, creditors, rating agencies, and the company's corporate finance team.

Key Takeaways

- SGR is the maximum growth rate a company can achieve without relying on external financing, calculated using the retention ratio and return on equity.

- SGR helps visualize a company's stage in its lifecycle, with younger companies typically requiring external financing for growth, while mature companies have higher SGRs due to higher profitability.

- SGR influences a company's capital structure. Low SGRs make it difficult to function without external capital. As SGR rises, companies may consider debt financing as an alternative to equity.

- SGR directly affects a company's credit rating, with higher SGRs typically leading to better credit ratings due to improved debt servicing capacity and lower borrowing costs.

Understanding the Sustainable Growth Rate

It is the maximum limit a company can grow without needing any external financing of equity or debt.

The SGR of a company tells a lot about the company. For example:

- Its position in the corporate cycle

- Its financing options

- Payout strategy for the future

It dictates the financial health of the company. Firms with high sustainable growth rates won't need to fill their balance sheets with debt or dilute their equity.

A high-quality, high-growth business usually has a high SGR. The reason for that is the firm can reinvest the capital at a higher rate which further increases the ROE.

Dividend payout is also equally important. If the company is paying a large chunk of its net profits as its dividend it will drive down the overall sustainable growth rate of the company.

For example, if a business generates a 50% return on its equity capital, which is very impressive, but pays out 90% of its profits, then the SGR is 5%.

The above example suggests a couple of outcomes, either the company is paying out more than its capacity, or a 5% growth rate is suitable for the company given its overall growth, maturity, market position, and capital structure.

This can also be used as a relative metric.

A high SGR also tells us that the company is investing heavily in R&D and Capex into projects with high net present values (NPVs).

The sustainable growth rate is used to assess:

- Company’s corporate life-cycle

- Capital structure & dividend payout

- Credit rating

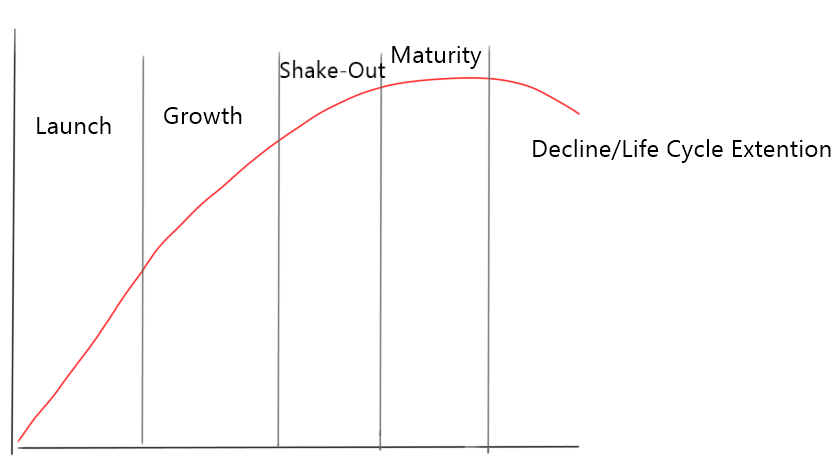

Sustainable Growth Rate (SGR) and Company Lifecycle

It can be used to visualize the stage of the firm in its corporate life cycle.

Younger companies usually have high requirements for external financing, especially if they are in a competitive industry or are aiming at disruptions. They need external financing because they have high operating expenses, which leave the firm with little to no profits to reinvest.

So, these firms need to raise capital for Capex, investments, expansion, and, at times, even to pay operating expenses.

As profits are limited to none, return on equity is either negative or not very high, leaving sustainable growth rates on the lower end. A negative or low SGR means that the company cannot function very long without external capital.

On the other hand, mature companies have higher sustainable growth rates as they produce high levels of net profits and can finance their expansion through internal acquisitions.

High net income means high ROE, which will result in high SGRs. As the SGR starts to grow it can be assumed that the company is also growing through its life cycle.

Sustainable Growth Rate and Capital Structure

It is one of the key metrics that actually dictates the capital structure of the firm. Low sustainable growth rates make it really difficult for a company to function for a long time without the infusion of outside capital.

The external capital can be equity or debt. Equity is more expensive to raise but will not impact the balance sheet; debt is cheaper and has tax benefits but can deteriorate the balance sheet and, if not handled properly, can potentially destroy the firm.

Usually, if the SGR is very low or negative, equity funding is preferred by the management as the operational expenses are so high that adding another line item will disturb the operational spending.

As the SGR starts to rise, the company can look at debt as a funding alternative, as they will have enough EBIT to service that debt. Eventually, the need for external financing will be very limited.

Just because it has a high rate it does not mean that the company will not take any external financing or debt.

The capital structure of the company is a decision of the corporate finance team, the management, and the industry standards and requirements. SGR only serves as a benchmark.

Sustainable Growth Rate and Credit Rating

A company's credit rating is directly impacted by its Sustainable Growth Rate (SGR), which is a crucial metric for assessing the risk and health of its finances.

A greater SGR indicates that the business has good potential for earnings growth and cash flow generation, which improves its capacity to pay down debt.

As a result, credit rating agencies frequently perceive enterprises with higher SGRs more favorably, which results in higher credit ratings.

On the other hand, a lower SGR can cause investors to question the company's capacity to continue operations and efficiently handle debt. If it suggests restricted growth potential, operational inefficiencies, or financial instability, a negative credit rating could result.

Larger borrowing costs are usually associated with worse credit ratings because lenders view them as carrying a larger risk when making loans.

Businesses actively manage their SGR to preserve or raise their credit ratings. To improve their creditworthiness, they can concentrate on methods to increase profitability, optimize capital structure, and promote sustainable growth.

In addition to supporting a higher credit rating, a good SGR inspires confidence in creditors and investors, making it easier to obtain financing on favorable terms.

How to Calculate the Sustainable Growth Rate?

To better understand the SGR, we'll examine a few different businesses that have different levels of debt and operating leverage and are in different stages of their corporate life cycle.

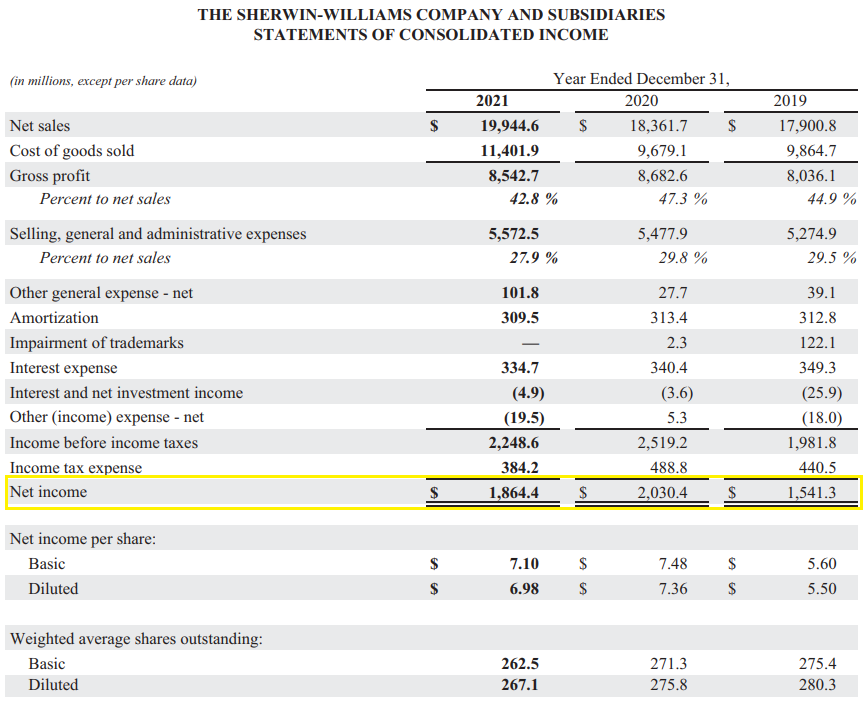

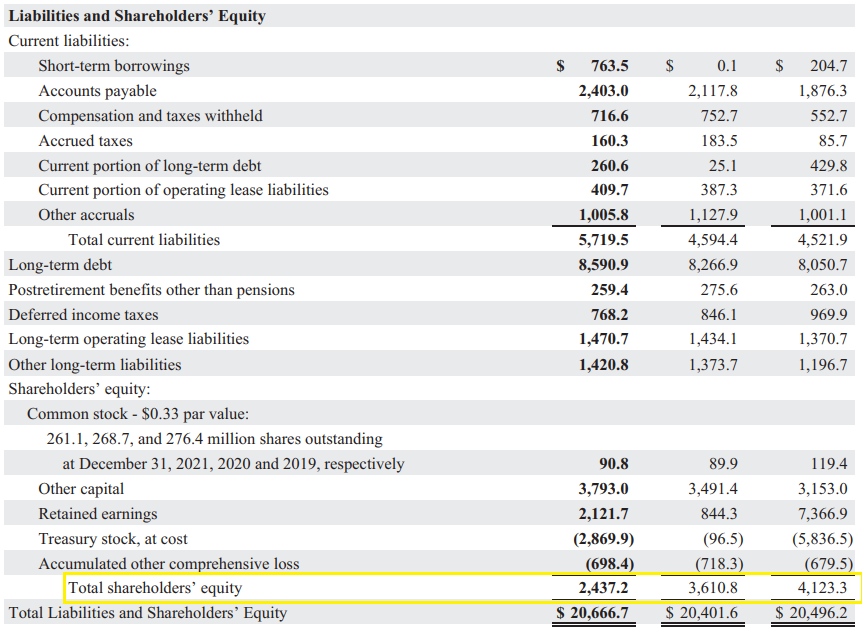

Exhibit 1: The Sherwin-Williams Company (SHW)

Sherwin-Williams is the largest paints and coatings manufacturer in the world. The overall industry has a stable growth rate, and SHW specifically grows through M&A.

Return on Equity = Net Income / Shareholder’s Equity

| (figures in million $) | 2021 | 2020 |

|---|---|---|

| Net Income | 1864 | 2030 |

| Shareholder’s Equity | 2437 | 3610 |

| Return on Equity | 76.48% | 56.23% |

The diluted EPS for 2021 stands at $6.98, and SHW has paid dividends of $2.20 per share.

The payout ratio comes at 31.5%.

The retention ratio comes to 68.5%

SGR = Retention Rate * ROE

SGR = 68.50% * 76.48%

SGR = 52.38%

This means The Sherwin-Williams company can grow at 52% without any need for external financing.

This is possible because Sherwin-Williams is a mature business with competitive advantages that allow it to generate a consistently high ROE.

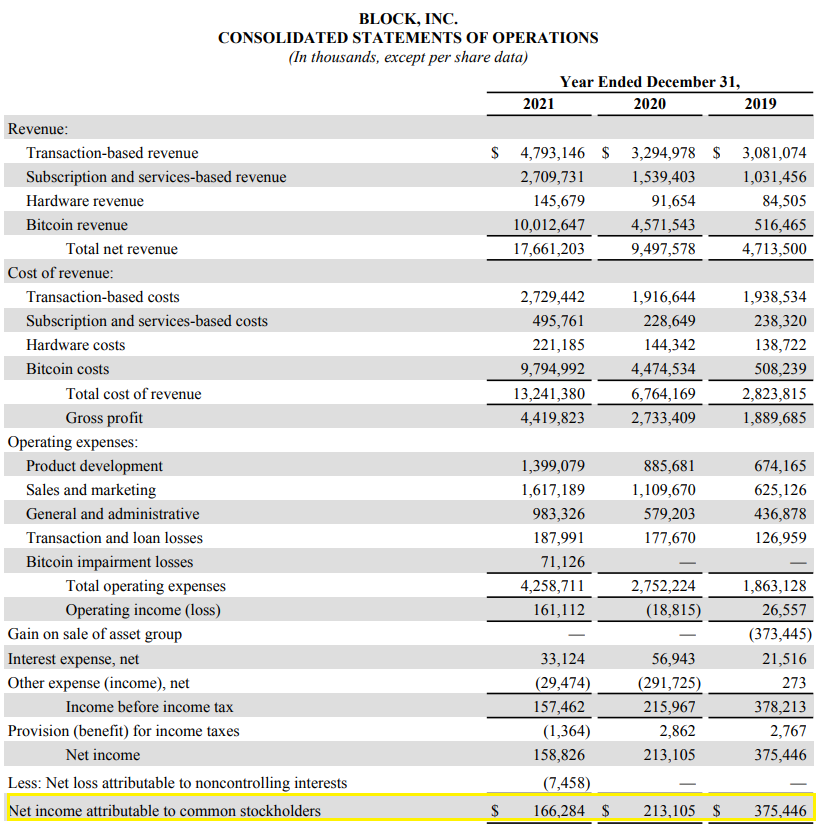

Exhibit 2: Block Inc. (SQ)

Block, previously known as Square, is a financial services company that sells hardware systems and software for payment processing and analysis and a few related businesses.

Return on Equity = Net Income / Shareholder’s Equity

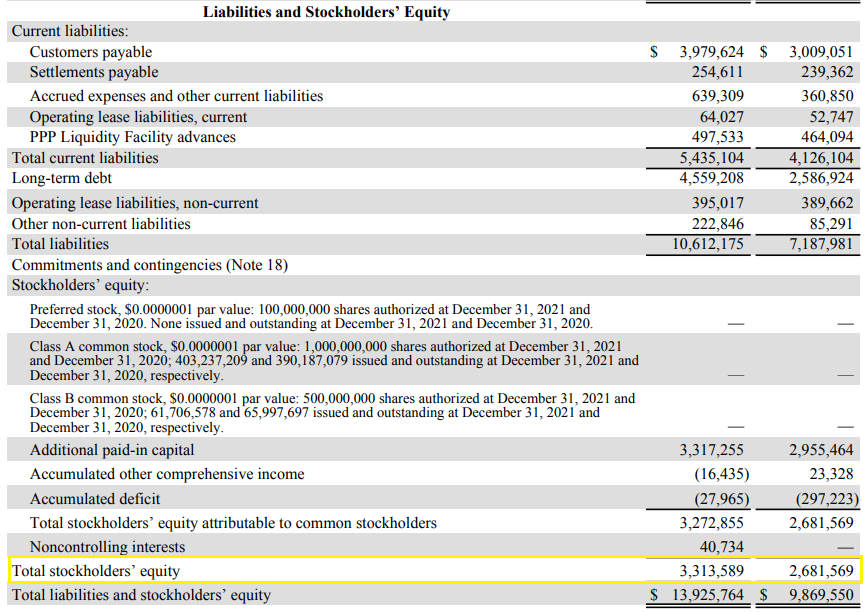

| (figures in thousand $) | 2021 | 2020 |

|---|---|---|

| Net Income | 166284 | 213105 |

| Shareholder’s Equity | 3313589 | 2681569 |

| Return on Equity | 5.00% | 8.00% |

SQ has an ROE of 5% for 2021.

Block Inc. pays no dividends to its shareholders, so the retention rate is 100%.

This means SGR = ROE = 5%.

An SGR of 5% states that SQ can only grow at 5% without any need for external funding. This low growth rate results from high operating expenses and lower returns on the capital being invested into the business.

Sustainable Growth Rate vs. Internal Growth Rate

In financial research, the Sustainable Growth Rate (SGR) and Internal Growth Rate (IGR) are crucial indicators that assess a company's capacity to expand without outside funding. Despite having similar ideas, they assess various facets of a business's potential for growth.

| Aspect | Sustainable Growth Rate (SGR) | Internal Growth Rate (IGR) |

|---|---|---|

| Definition | Maximum rate of growth without external financing, considering profitability, dividend policy, asset utilization, and financial leverage | Maximum rate of growth without external financing, focusing solely on sales revenue and reinvestment rate |

| Formula | SGR = (Net Profit Margin) * (Retention Ratio) * (Asset Turnover) * (Financial Leverage) | IGR = ROA * (1 - Dividend Payout Ratio) |

| Focus | Considers profitability, dividend policy, asset turnover, and financial leverage | Focuses primarily on return on assets and reinvestment rate |

| Components | Includes net profit margin, retention ratio, asset turnover, and financial leverage | Includes return on assets and reinvestment rate |

| Complexity | More complex due to the inclusion of multiple factors | Less complex as it focuses on fewer variables |

| Purpose | Provides a comprehensive view of growth potential, considering both internal and external financing factors | Specifically evaluates growth achievable without external financing |

| Calculation Complexity | More complex due to the involvement of multiple factors. | Simpler as it relies on ROA and dividend payout ratio only. |

Advantages of using a sustainable growth rate

The following are the benefits of applying the Sustainable Growth Rate (SGR) in financial analysis:

- Comprehensive Evaluation: It provides a comprehensive picture of growth potential by taking into account a number of financial indicators.

- Takes into Account Dividend Policy: It takes into consideration how dividend policy affects reinvestment and retained earnings.

- Thinks about Asset Efficiency: It shows operational efficiency in growth by reflecting asset turnover.

- Reflects Financial Leverage: It incorporates the function of leverage in promoting long-term expansion.

- Sustainability over the Long Term: It prioritizes organic growth without outside funding to ensure stability over the long term.

- Beneficial for Strategic Planning: It is a standard by which to measure growth and improve important financial KPIs.

- Investor Confidence: It enhances investor confidence by offering information about internal fund production.

Disadvantages of using a sustainable growth rate

The following are the drawbacks of applying the Sustainable Growth Rate:

- Sensitivity to Assumptions: SGR computations are susceptible to assumptions, which could result in errors.

- Restricted Scope: It ignores external market dynamics in favor of internal considerations.

- Ignores Market Dynamics: It makes the assumption that past growth rates will continue, ignoring changes in the market.

- Ignored Capital Constraints: It considers no potential capital constraints, particularly in times of economic recession.

- Complex Calculation: Interpretation may be hampered by formula complexity.

- Dependent on Historical Data: This relies on historical data, which might not always be an accurate indicator of future results.

- Limited Strategic Insights: They might not provide useful information for making strategic plans.

- Not Suitable for All Industries or Stages of Development: It may not be relevant or appropriate to businesses in specific sectors or phases of development, such as early-stage startups or established firms in highly cyclical industries when growth dynamics diverge markedly from conventional business models.

Factors Contributing to the Decline of Sustainable Growth Rates

The dynamics of the industry, the state of the external economy, and a company's internal operations can all cause the Sustainable Growth Rate (SGR) to decrease over time. The SGR may decline over time for the following reasons:

1. Market Saturation: As a business expands, it may eventually reach saturation in its intended market, which will reduce prospects for growth. The company's sustainable growth rate declines as expansion prospects diminish.

2. Competitive Pressures: A company's capacity to sustain rapid growth rates over an extended period of time may be constrained by heightened industry rivalry. Rivals could imitate such tactics, diminishing the company's potential for expansion and decreasing its market share.

3. Decreasing Margins: A company's profit margins may gradually decrease due to increased expenses, pressure to raise prices or shifts in customer preferences.

Note

Reduced profitability lowers the sustainable growth rate since there are fewer retained earnings available for reinvestment.

4. Declining Efficiency: A company's capacity to grow may be hampered by operational inefficiencies or dwindling returns on capital asset investments. The business might find it difficult to maintain its prior growth rates if efficiency declines.

5. Maturity Stage: As market demand stabilizes and competition heats up, businesses in mature industries sometimes see slower rates of growth. A company's sustainable growth rate gradually decreases as it matures.

6. Macroeconomic Factors: A company's growth prospects may be impacted by external economic factors such as changes in inflation, interest rate movements, or GDP growth.

Note

Recessions or downturns in the economy can result in fewer demand for goods and services, lower consumer spending, and a drop in the sustainable growth rate.

7. Capital Restrictions: As a business expands, financing for new projects may become increasingly necessary. The company's growth rate may be limited if it has trouble obtaining outside funding or is hesitant to take on additional leverage.

8. Regulatory Challenges: New expenses or operational restrictions imposed by regulatory changes or compliance requirements may lower a company's profitability and development potential.

9. Technological disruptions: New technological developments have the potential to upend established business models, forcing organizations to adjust quickly to remain competitive.

Inadequate innovation or ineffective adaptation to technological advancements can obstruct progress and lower the rate of sustainable growth.

Conclusion

The sustainable growth rate (SGR) is a key indicator that affects many facets of a business's financial management and strategic decision-making. It offers insightful information about a company's creditworthiness, capital structure choices, and development possibilities.

Comprehending the SGR facilitates companies' efficient navigation of their growth trajectory, particularly for financing and capital allocation tactics.

Higher SGR companies have more financing choices and are generally seen more favorably by credit rating agencies, which leads to lower borrowing rates and improved access to capital markets.

Lower SGRs, on the other hand, could raise concerns about the sustainability of finances and result in higher borrowing costs or worse credit ratings.

Therefore, businesses must manage SGR properly to maximize their financial performance and solidify their market position.

Sustainable Growth Rate FAQs

The Sustainable Growth Rate (SGR) is essentially the rate at which the company will grow without any need for external funding, be it debt or equity.

The terminal growth rate on the other hand is the assumed perpetual growth rate to forecast the free cash flows till perpetuity in a DCF model.

The use of the terminal growth rate is restricted to a valuation model and should not exceed the long-term average economic growth of the country.

SGR often exceeds the overall GDP growth as an individual company naturally grows faster than the entire economy.

A high SGR means that the company can fuel its high growth entirely through internal accruals, eliminating outside funding together.

This suggests that the business has become self-sufficient and the overall business risk has gone down while the quality of its operations and management has gone up.

A low SGR means that the business will require outside capital to fund and grow its operations. This can show the corporate life cycle of the business.

Younger companies burning through cash have a lower sustainable growth rate while more mature firms having a lot of FCF (Free cash flows) have high SGRs.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?