Industry Analysis

A tool to assess the competitiveness of the industry

What is Industry Analysis?

Are you an equity research analyst who analyzes companies? Or are you a business person? Probably you are in a top managerial position within the firm. Anyway, you need to know one thing: how to analyze the industry.

Industry analysis is a tool to assess the competitiveness of the industry. However, it is just an analysis of the market in a particular sector.

It helps you get a sense of:

- The competition is in the industry

- The demand for and the supply of the products

- The impact of external factors (economic and political events, technological changes, etc.)

Industry analysis helps both analysts and entrepreneurs understand the company's position in the industry. It is a straightforward way to identify opportunities and potential threats to the company. Also, this analysis clarifies the trends in the industry.

The best and surest way to survive for the company is to know its industry, itself, and its competitors.

Therefore, the company must exploit all the advantages that differentiate itself from its competitors—only in that way can it address the customers' ever-changing demand.

As of May 2022, you might see that the only constant we have is changes. This is because the recent events have directly affected all businesses around the world. And the only possible way both to strive and stay alive is to adapt to the current environment.

The more you understand the industry, the better your business/investments will be in that industry. That's an unwritten law of business and investing.

Overall, there are three elements that you have to consider when conducting industry analysis:

- The underlying forces at work

- The overall attractiveness

- The critical factors that determine success within the industry

Below we will discuss:

- How to conduct the industry analysis

- What are the different types of it

- The importance of the industry analysis

Key Takeaways

- Industry analysis assesses competitiveness and positions within the industry.

- It identifies opportunities, threats, and trends for informed decision-making.

- Steps include industry identification, overview, forecasting, regulations, unique positioning, limitations and risks, and networking.

- Common methods are Porter's Five Forces, PEST Analysis, and SWOT Analysis.

- Industry analysis guides decision-making, strategy development, and investment recommendations.

How to do an industry analysis

There are seven steps to analyzing an industry:

1. Identify your industry and provide a brief overview

Explore the industry on a local, provincial/state, national/federal, regional/continental, and global level. Make sure you know the relevant industry codes. Provide historical data and statistics of the industry and growth potential for the company, considering economic factors.

2. Summarize the nature of the industry

Consider specific patterns, trends, and changes in the economy. Then, make an income projection and document all the innovations and emerging technologies in the segment. Also, don't forget to discuss the marketing strategies to address them.

Note

Operational and management trends will be the key factors in constructing the marketing strategy.

3. Provide a forecast for your industry

You have to construct the industry's projections in 5, 10, and 20 years. As in all kinds of reports, you have to cite all the resources you've used. The larger the industry size, the more resources you have to use. Also, you should state at which stage the industry is:

- Emerging

- Growing

- Maturing

- Declining

4. Identify government regulations that affect the industry

Laws, rules, and regulations are inevitable factors in the report. State all the recent changes in laws and the needed licenses or certifications for the business to operate in its target market. Also, add all the applicable fees and costs.

5. Explain your unique position within the industry

Once you've completed one of the three industry analysis methods (described in the next section), list all the direct and indirect competitors and industry leaders. Then understand the differences between your firm and other firms and find their unique advantages.

6. List potential limitations and risks

You must include all the possible threats to the firm in the context of 5, 10, and even 20 years. The threats come from external factors such as regulations, technological changes, customer behavior, and competitors' strategies.

7. Talk to people!

Last but not least is talking to people. Most people underestimate how it is essential to network and gather information from people who work in the industry. Attend trade shows, industry conferences, cold calls, or cold emails to people, and join industry associations.

Types of industry analysis

To pick the proper method of industry analysis, we have to answer these questions:

- What are the main features of the industry in which the company operates?

- What are the competitive forces and their strengths in the industry?

- What are the changes and their drivers in the industry? How do they affect the company?

- How intense is the rivalry? Who are the strong and weak competitors?

- What are the next moves of your competitors?

- What is the crucial factor for success in the future?

- How attractive is the industry in the long-term perspective?

There are three most common ways to analyze the industry:

- Competitive Forces Model or Porter's Five Forces

- Broad Factors Analysis (PEST Analysis)

- SWOT Analysis

These methods fully answer all the mentioned questions. Other methods include ratio analysis, Thompson and Strickland's-7 forces model, and the "Structure-Conduct-Performance."

We will focus only on the widely used top three methods for our purpose.

We discuss each of them in the following sections. So, let's now discuss the first method: Porter's Five Forces.

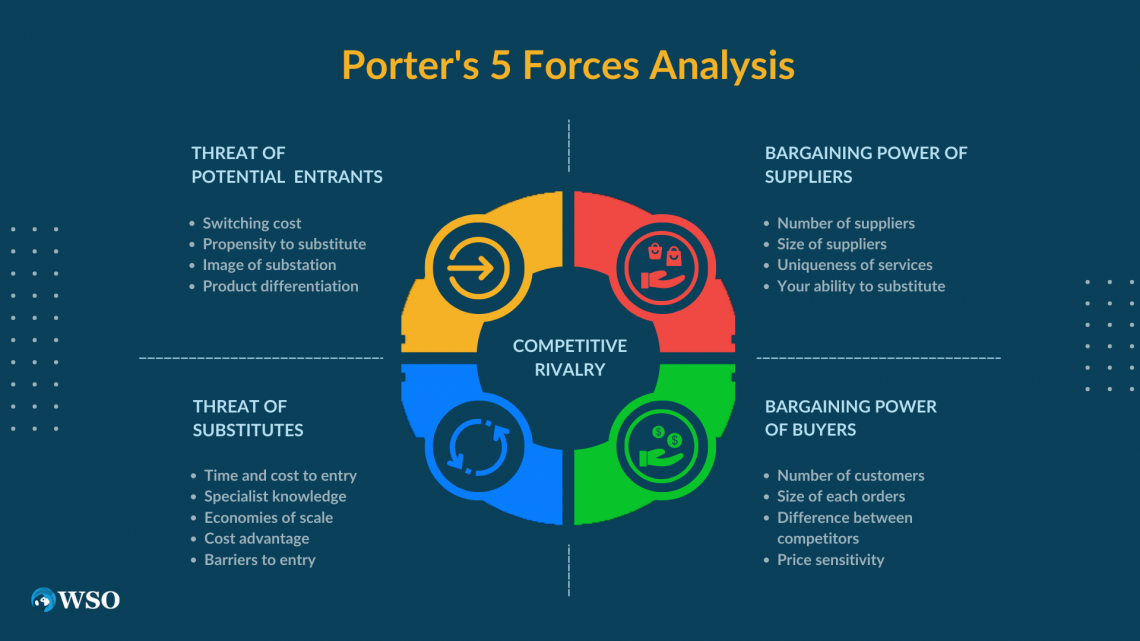

#1 Competitive Forces Model (Porter's 5 Forces)

Michael Porter introduced his Five Forces in 1980 in his book called "Competitive Strategy: Techniques for Analyzing Industries and Competitors." According to Michael Porter, these five forces describe any industry completely.

These five forces and additional "power of complementary goods/services" are:

1. Intensity of industry rivalry

The industry's competitiveness depends on how many competitors exist at the current moment. Also, we should consider the market share of those competitors. The industry tends to be competitive if the product is less differentiated.

For example, the biotechnology industry has less competition. Compare it with the restaurant business. In every corner of any city, you will find many restaurants.

Also, the high exit costs motivate current players to fight for the existing market. Examples of high exit costs might be high fixed assets, labor unions, government restrictions, and many others.

2. Threat of potential entrants

The threat of potential entrants is how easily new players can enter the market. If it is easy to start a business in the industry, the risk of new competitors will be unavoidable. Vice-versa, if it's hard to enter the market, then the sector has a minimal threat of new entrants.

The existing competitors in the industry can use their competitive advantage to prevent new entrants from entering the field.

Note

This force is also called "barriers to entry." The barriers can be in the form of regulations, licensing, or technological advancements.

For example, Microsoft, Apple, and Google dominate the mobile and desktop operating systems market due to technological advancements and network effects. Contrast this with the blogging and dropshipping business, where you don't need expertise or capital expenditure.

3. Bargaining power of suppliers

Suppliers also play an essential role in any industry. If there is a small number of suppliers, then the bargaining power of suppliers is high. However, if there are many suppliers, companies have more control over suppliers.

For example, software companies heavily rely on operating system providers such as Apple, Microsoft, and Google. So, the bargaining power of suppliers is high. But, in the car manufacturing industry, many small manufacturing shops provide specific parts.

Due to the access to numerous suppliers, this power is low for the car manufacturing industry.

4. Bargaining power of buyers

If the industry has many customers, then the bargaining power of buyers is low. The opposite is true for markets with few consumers.

For example, contrast the two different investment management companies: one is a mutual fund, and the other is a wealth management company. The prior one works with the masses and manages vast capital—the former works with ultra-high-net-worth individuals (UHNWIs).

The mutual fund has more power over multiple clients, while the wealth management company is dependent on a few UHNWIs.

5. Threat of substitute goods/services

The businesses are not only competing in the same industry. They also compete with companies in complementary industries. This is true for all industries. The more substitutes the product has, the lower prices can charge an average player.

Substitutes can take two forms:

- Product with the same function/quality, but at the lower price

- Product of better quality at the same price (more utility compared with other products)

One of the excellent examples is the auto industry. The car has such substitutes as public transportation, ride-sharing services (Uber, Lyft), bicycles, and scooters. All of these substitutes are doing the same job but in different ways.

Note

The threat of substitutes is higher when substitute products are available at a lower price.

6. Existence of Complements

This is a new concept that many business practitioners suggested. The existence of complements affects the demand side of the industry. The higher the demand for complementary goods, the higher the demand for the goods offered by the industry.

For example, if the demand for cars increases, the demand for oil products (gas/petrol) will rise. So complementary goods and services exist in all industries.

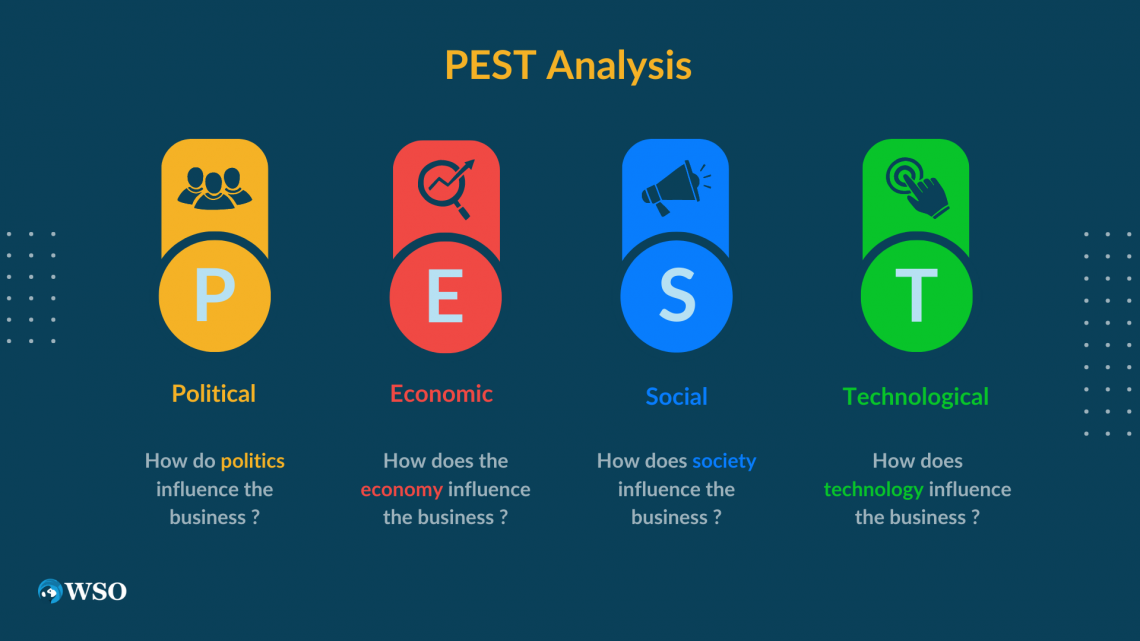

#2 Broad Factors Analysis (PEST Analysis)

The comprehensive factor analysis considers all the external factors that might affect business operations. The external components include:

1. Political

This factor is all about the laws and regulations on tariffs, trade policies, taxes, environmental regulations, and political stability. The greatest example of political factors that affect businesses could be the trade war between U.S. and China.

2. Economic

This factor considers inflation, exchange rates (FX), interest rates, GDP growth rates, the stock market, and many other economic factors. The interest rates are affected by the monetary policy of the central bank.

3. Social

As the name suggests, the social factor focuses on people. Therefore, such characteristics of people as age, population, and gender might drastically change the demand for the company's products.

Consumer behavior is another crucial factor to consider. It is affected by the population's health, fashion, and social changes. For example, if the population prefers environmentally friendly products (like Tesla cars), you should adjust to serve your customers.

Or the most recent trend among IT products' clients is the preference for cybersecurity and privacy above all. If you want to serve your target market in your industry, always check what your customers want.

4. Technological

Technological advancement is one of the most important factors to consider in scaling the business. Technological development directly affects how the company must operate to be successful.

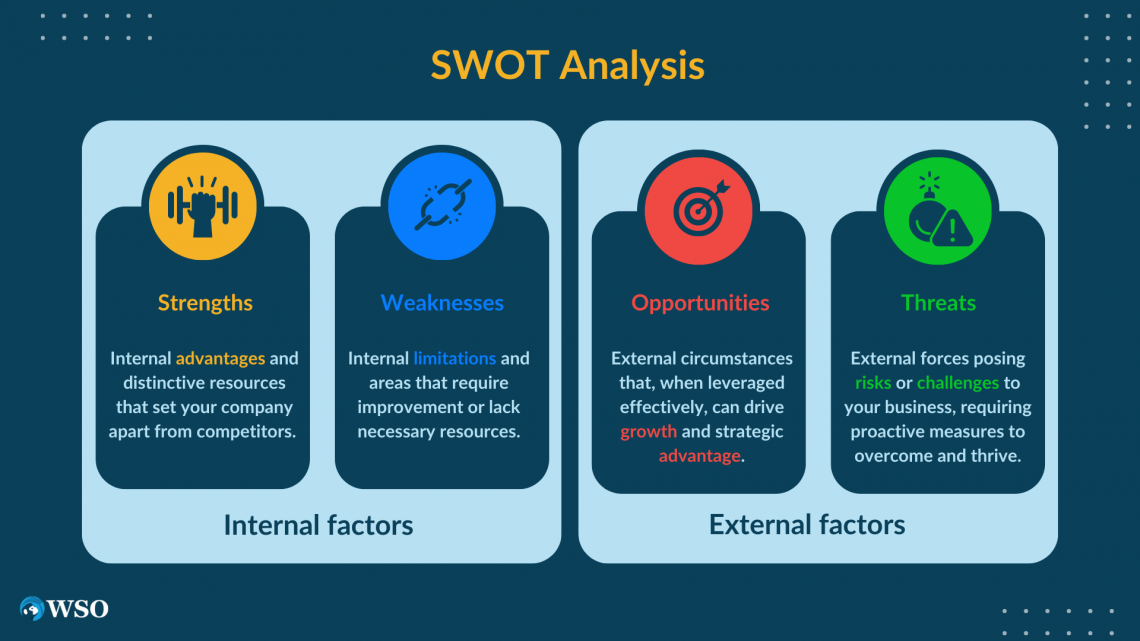

#3 SWOT Analysis

SWOT analysis is most common in academia/research and business. SWOT consists of two different types of forces:

1. Internal

Internal factors are concerned with the things that are in control of the firm: production, cost, efficiency, customer services, and so on. Internal factors cover the following two sides:

-

Strengths

The company's strengths include a competitive advantage against other industry players.

-

Weaknesses

The weaknesses include the firm's characteristics, making it weaker than other competitors. For example, poorly skilled labor or unjust labor compensation might disadvantage the company.

2. External

External factors are concerned with the future condition of the company. The typical external factors are concerned with politics, the general economy, market conditions, customer tastes, and other outside factors not controlled by the company. External factors include the following:

-

Opportunities

Favorable external conditions might boost the company's profitability. For example, the government might put tariffs and quotas on imports. That might favorably affect domestic businesses at the cost of foreign companies.

-

Threats

The elements of the external environment could endanger the integrity and profitability of the business. Therefore, companies must assess the likelihood and severity of external conditions. If the threat is both likely and severe, the best strategy is to avoid that risk.

Importance of Industry Analysis

As you saw, all types of analysis cover a broad range of factors. These factors give you a clear understanding of the industry. So, industry analysis indicates the entry and exit costs of the industry.

The analysis helps to determine the development stage of the company and industry. The growth stage shows the company if there is room for development.

Industry knowledge directly correlates with the success of an entrepreneur. A successful founder has expertise in how:

- The industry operates

- How the power is distributed among stakeholders

- How the industry is affected by external factors

The industry analysis is also applicable to investment bankers and equity research analysts who focus on a single industry.

Suppose you work in the technology industry group of an Investment Bank. Before making any recommendations, you must analyze the tech industry.

You give a piece of crucial advice if you know the position of the target and the acquirer compared with their competitors.

Want to break into investment banking, check our Investment Banking Interview course.

If you want to learn about careers in different financial industries, check out our Industry Comparisons course.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?