Buying on Margin

Refers to borrowing money by an investor from the bank or broker to purchase a more significant amount of securities than they could solely buy with cash

What Is Buying on Margin?

Buying on margin is when an investor is borrowing money from the bank or broker to purchase a more significant amount of securities than they could solely buy with cash. Margin trading is used to amplify returns, enabling one to bet with more substantial amounts of money.

Margin trading can bring considerable returns to those who outperform the markets. However, to be successful, investors must bring in returns more significant than the cost of the loan, as the investor must pay back the borrower's interest on the borrowed funds.

If the investment does poorly, the downside is much worse than trading with cash. This is why it is usually best to restrict margin trading to professionals.

Experienced traders within large institutions, hedge funds, and mutual funds are more likely to trade on margin as they are better at managing risk.

However, even professionals use margin trading to leverage their money to gain the most significant profits possible. There have been times in history when the top traders have become greedy within the markets and overleveraged themselves, resulting in financial crises.

The number of funds in the brokerage account and the position size will determine the investor's buying power. In addition, each broker will set initial margins and maintenance margins which inform the investor of how much they are allowed to borrow.

How does buying on margin work?

To fully grasp how margin trading works, let's set up an example to go through the process. For simplicity, interest rate payments on the borrowed funds will be left out.

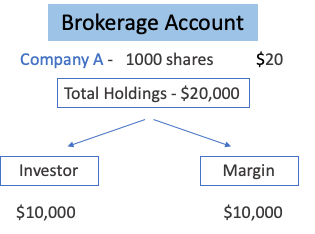

Imagine an investor who is buying 1000 shares of Company A for $20 per share. Of this $20,000 investment, $10,000 is contributed in cash, and the investor will borrow the rest through margin.

Therefore, the investor is borrowing $10,000 to purchase the shares and, in return, will pay the theoretical interest until the principal loan is returned.

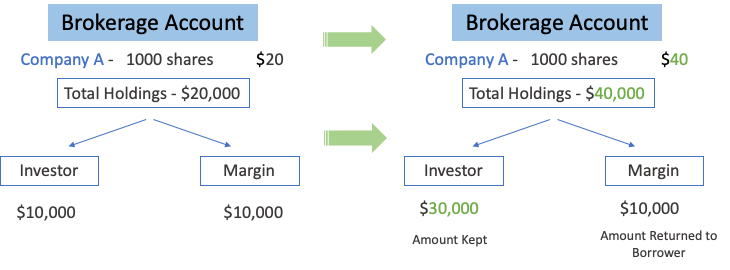

If the investor is correct on their investment, and the share price increases from $20 to $40, they may sell the securities for $40,000. Then, after giving back $10,000 to the broker, the investor makes a $20,000 gain, bringing their new balance to $30,000.

In a real scenario, the total gain would be slightly less due to interest payments but a considerable increase.

In the end, the investor has tripled their investment through margin trading. Their funds have now tripled; if only the original cash amount had been used, they would have only doubled their portfolio ($10,000 to $20,000).

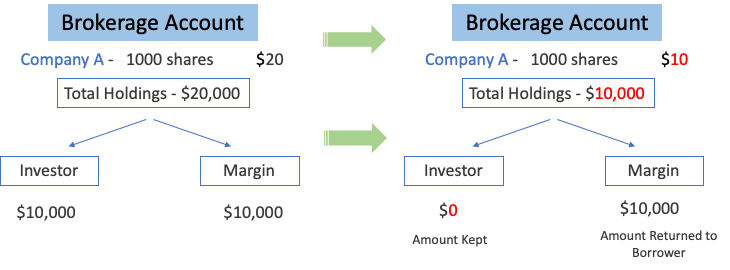

On the flip side, let's discuss what happens if the investment doesn't increase over the term but falls by 50%. In this case, the investor will sell at a $10,000 loss (half of the $20,000 investment), leaving $10,000 left, which is owed back to the broker.

As a result, the investor has lost 100% of their investment.

In reality, the investor would have lost over 100% of interest payments on the margin loan.

If the investor chose not to trade on margin and instead used their cash, their losses would have been significantly less, losing 50% of the original $10,000, leaving $5,000. It is scenarios like this that prove how risky margin trading can be.

Initial and Maintenance Margin

Before being approved to trade on margin, the trading account must meet specific requirements. Then, the broker will set an initial margin and maintenance margin, deciding the amount of borrowing the investor is allowed.

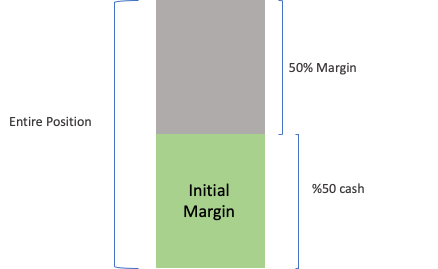

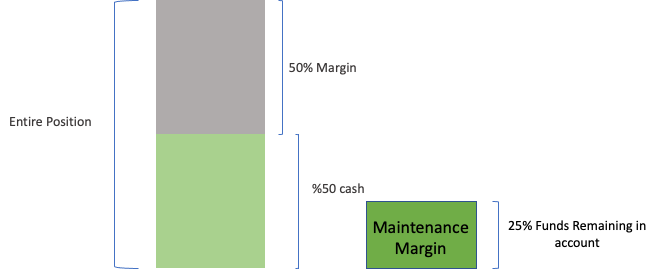

Initial Margin: The initial margin is a percentage of the securities purchased that need to be covered by cash or collateral. The minimum initial margin set by the Federal Reserve is 50%. However, firms may set theirs higher according to their risk maintenance.

If we kept the 50% initial margin figure, then, for an initial cash amount of $10,000, one could borrow another $10,000 of margin. This would raise their purchasing power to $20,000, giving the investor two-to-one leverage.

Maintenance Margin: Maintenance margin is the minimum amount of funds an investor must hold in their account after the trade is made. Currently, the minimum set by the Financial Industry Regulatory Authority (FINRA) is 25%. However, brokerages may raise it to 40% to decrease the risk of investor defaults.

For instance, if an investor had $10,000 in a brokerage account with a set maintenance margin of 25%. If the account's value dropped below $2,500, the investor might receive a margin call.

To continue, the investor must bring the account back up to the maintenance margin by adding cash or selling positions. If the investor chooses not to comply, the broker may sell off investments from the account to regain the maintenance margin or close the place with the margin.

Advantages and Disadvantages of Buying on Margin

As mentioned, margin trading can lead to high gains and heavy losses. A few contributing factors to the advantages and disadvantages of trading margin exist.

Some of the disadvantages are:

1. Losses can amount to more than the original investment

In the example above, we explained the scenario of an investor buying 1000 shares of Company A at $20 a share. The trade equates to a total of $20,000, half of which, so $10,000, was the investor's money, and the other $10,000 was borrowed through margin.

If the investment were to go down 50%, the investor would lose half of the $20,000, leaving $10,000. The investor still owes the broker their $10,000 back. Thus, the investor loses it all.

In this instance, the investment falls below 50%, leaving less than the borrowed amount. The investor must make up the funds to pay back the broker. Imagine the investment fell 60%, which would be a $12,000 loss, leaving $8,000 in funds in the account.

The investor needs $10,000 to pay back their loan, for which they are $2000 short. In this case, the investor must make up another $2000 to become even with the broker. Therefore, from the $10,000 invested and the extra $2000, the total losses equal $12,000 for a 120% loss.

2. The occurrence of a margin call

Above, we explained the importance of the maintenance margin and how the investor must keep a certain percentage of funds in their account after the purchase.

A margin call occurs when those funds fall below that percentage. Using the example above again, the investor loses 60% of their position, leaving $8000 of funds from their $20,000 job.

If the maintenance margin were 50%, $10,000 would need to be kept at all times. Therefore, going down to $8,000 would trigger a margin call if the investor cannot make up the funds in cash.

If the investor fails to add funds or sell their positions, the broker is free to sell the investor's positions from the account on their behalf.

The benefits that can be gained are as follows:

1. Ability to leverage money to bring more significant returns

The most appealing benefit to margin trading is the ability to trade beyond your means. Using a margin account gains easy access to up to double the funds you have in your budget.

For the most part, professional traders can gain a fortune by leveraging their funds during bull markets. However, beginners also have simple access to borrowing funds if they desire to handle the risk.

2. Easy access to liquidity

Margin accounts offer access to liquidity quicker than ever before. Typically, the investor must wait around three days before withdrawing the funds when selling a stock position.

Trading with a margin eliminates the waiting time, allowing the investor to trade using borrowed funds from the margin throughout that waiting period. Of course, interest payments on those funds will have to be accounted for; however, they are minimal for a short period.

Who Should Buy on Margin?

As stated earlier, margin trading is sectioned chiefly off to professionals. Therefore, it is hazardous for beginners to indulge in borrowing money with little experience and risk management.

They are holding positions while margin trading requires constant attention and a high level of risk tolerance from the trader.

The stock market is already volatile enough that even investors using cash can't handle the constant swings. Moreover, leveraging investments on margin makes investing for individuals increasingly more stressful.

There are certain areas in the market, however, where margin trading is commonly used, such as the commodity futures market.

Derivative contracts, like option contracts, can also be traded using margin, a relatively new development. However, it requires that the option has an expiration date greater than nine months away.

The bottom line is that using borrowed funds can boost returns. However, it's important to remember that leverage will also exponentially increase negative returns.

Suppose the investor borrows more than they can afford, thus being overleveraged. In that case, the risk of losing other holdings in their portfolio is bound to happen if a margin call occurs.

For most, the negatives outweigh the positives, as trading on margin is too risky for an average investor. Therefore, it is best to leave margin trading to professionals.

Buying on Margin FAQs

Buying on margin involves borrowing funds, giving the trader more purchasing power. As a result, the investor may receive higher gains on investments than they would have using their funds. However, with higher rewards also comes greater risk.

Margin trading is risky if the investor is inexperienced with the markets and managing risk. For example, if an investor begins to borrow more than they can afford to lose, they are exposing themself to a margin call if the investments do poorly.

If a margin call occurs and the investor has no funds to pay back their borrowings, the broker is allowed to sell other holdings until there is no outstanding debt.

Borrowing is not free. Margin traders may make monthly interest payments on the amount borrowed, updated daily. If a position is held for an extended period, the interest will accrue against the investor.

Therefore, it's best to use margin when trading in the short term. Also, traders should stay out of trading on margin while markets show bearish sentiment, as losing borrowed funds will put the investor further into debt.

or Want to Sign up with your social account?