Investing in Manipulation

I read a very interesting article from one of my favorite bloggers, Nir Eyal, the other day. In The Morality of Manipulation Nir explores products, and the type of manipulation used to sell them.

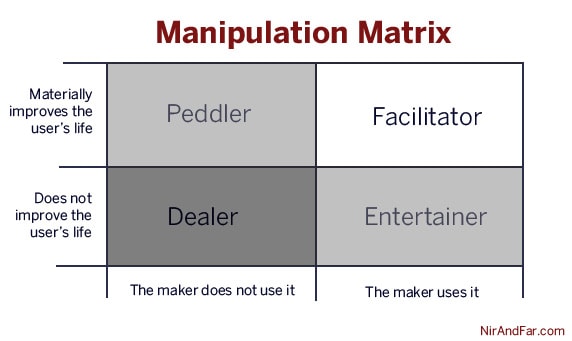

He uses a manipulation matrix, which is categorized by the yes/no answers to two questions.

1) Will I use the product myself?

2) Will the product help users materially improve their lives?

The article focuses on the morality behind each type of manipulator. I'm not going to focus on that, but rather on how you can use these classifications to make money.

The Dealer:

Creating a product that the designer does not believe improves the user’s life and which the maker would not use is exploitation.

Products in this category need one thing to be successful. They need to be addicting. (Nir classifies casinos in this category, I would say that is true for slots only type casinos. Las Vegas casinos are much more the entertainer than the dealer.)

To make money in this category, create or invest in a product that no one has seen before. (Or lobby your state's electorate to grant you a slots only casino monopoly.)

Funny example: The Cowpocalypse

The Peddler:

Too often, designers of manipulative technology have a strong motivation to improve the lives of their users, but when pressed, they admit they would not actually use their own creations.

Don't invest time or money here. Peddler's have no emotional attachment to their products.

The peddler’s project tends to end up a time-wasting failure because fundamentally, no one finds it useful or fun. If it were, the peddler would be using it instead of hawking it.

Would you invest in an up and coming ciggarette company that is managed by a doctor who hates tobbacco (but loves money)?

The Entertainer:

If a creator of a potentially addictive technology makes something that they would use but can’t in good conscience claim improves the lives of their users, they’re making entertainment.

The not so secret to sucess here, invest in the best (and keep it addicting). No one wants to see "the second greatest show on earth." The great thing about entertainers, is that customers keep coming back for more. As long as your product keeps improving in quality, and competitors don't think of something better, you can expect returns for years to come.

Call of Duty is my favorite example. COD3 (the first released for PS3 and Xbox360) sold some 3 million copies worldwide (for ~$180 Million in sales @ $60). Just five years and 3 editions later, COD:MW3 sold more than $1 Billion in the first three weeks of release. The COD team built on something that was already sucessful and turned it into what is arguably the most sucessful video game of all time.

Alternatively, you can create something like World of Warcraft, and extract a stable stream of revenue year after year. (WoW generates ~$1 Billion annually, hows that for an LBO prospect?)

The Facilitator:

Arguably, the only moral route to money.

To take liberties with Mahatma Gandhi, facilitators “build the change they want to see in the world.”

Facilitators make easy investments. They have a product which people need (even if they don't know it) and the creators believe in the product. Nir uses Facbook and Twitter as examples, but you can pick almost any company from the Fortune 500 and place them in this list. These are the companies that will deliver long-term value.

What does all this mean for you?

- Ignore the peddlers.

- Be the first dealer.

- Bet big on the top entertainer.

- Invest broadly in facilitators.

"Would you invest in an up and coming cigarette company that is managed by a doctor who hates tobacco (but loves money)?"

Yes, provided he loves money more than he hates tobacco.

Laboriosam qui molestiae occaecati nam delectus. Distinctio quasi recusandae quo sint in fuga nesciunt. Id aut quia eligendi ut. Recusandae similique error rerum. Omnis qui doloremque vero quaerat eligendi fuga deleniti.

Sint eos nisi quas velit. Tempore vel ratione voluptates fugit. Assumenda in et voluptas nobis rerum necessitatibus.

Deserunt qui culpa laborum illum voluptatem incidunt dolor eum. Officia nulla maiores autem atque. Dolorem nulla quis et illo cupiditate accusamus sapiente.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...