Macroeconomics

How overall economies, markets, businesses, consumer spending, and governments interact

What is Macroeconomics?

Macroeconomics studies how overall economies, markets, businesses, consumer spending, and governments interact.

It helps us collect and analyze data such as:

- Unemployment rates

- Inflation

- GDP

- Economic stimulants

- Overall performance

This economics portion deals with large economies' structure, performance, interactions, and behaviors, whereas microeconomics deals will helping smaller economies within counties, cities, or states.

The elements that analysts focus on most are long-term economic growth and short-term business cycles. Both of these factors are extremely important to the success of every nation. If they do not have a strong economy, they do not have a strong country.

Economists and investors can track macro data by following charts, models, and forecasts. Of course, no one can tell where the markets and economies will go, but past data can help analysts calculate and predict future expectations.

Macroeconomics is all based on past information that is collected and interpreted. The history of economic data is extremely important for economists to look at and interpret, as history can repeat itself. The effects of a healthy economy and business cycles are large.

Data reports are produced by government bodies such as the economic development administration to help economists with forecasts and predictions. In addition, reports can help other agencies like central banks create monetary policies based on new data.

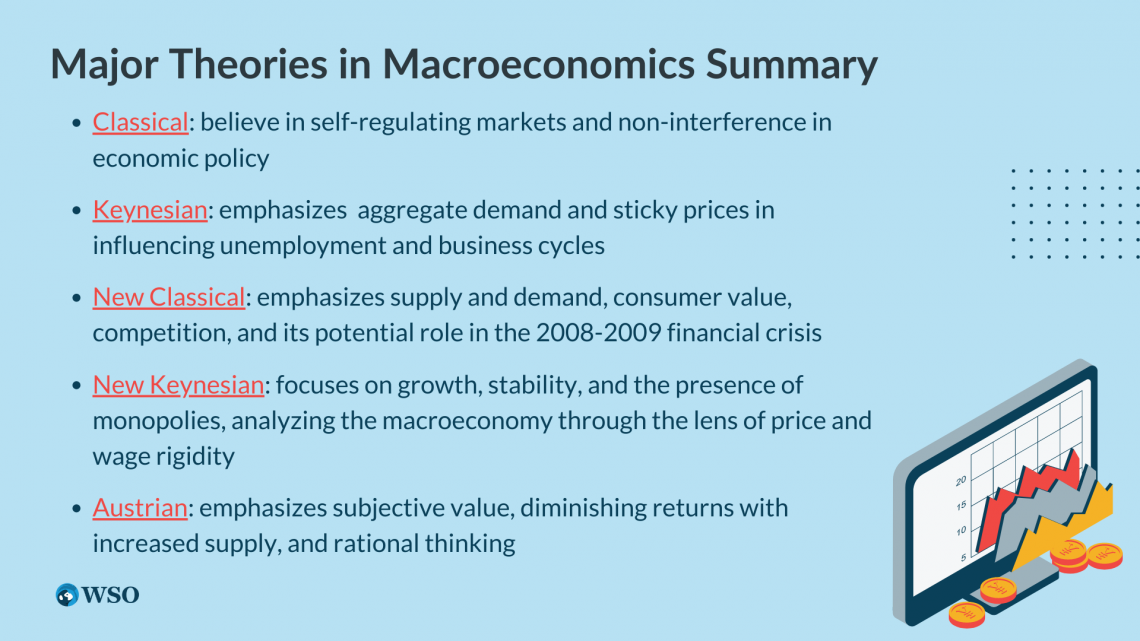

Countries will use different macro ideas or theorems of best fit. There are many different macroeconomic ideas, such as:

- Keynesian

- Classical

- Monetarist

- Neoclassical

- Neo-Keynesian

- Austrian

The economies and markets behave differently in each theorem.

Countries also have different types of economies that they tend to use, and different economies or markets affect everyday life substantially.

For example, consumers have much control over the goods they buy in a mixed economy, whereas those in a command economy have little control.

Key Takeaways

- Macroeconomics studies the interaction of economies, markets, and governments.

- Key indicators like GDP, unemployment, and inflation gauge economic health.

- Different macroeconomic theories offer diverse perspectives on economic behavior.

- Analyzing historical data and business cycles helps predict future trends.

- The goals of macroeconomics include stability, poverty reduction, and improved living standards.

Overview of Macroeconomics: History and Importance

The study of global economics began with the studies of business or economic cycles and monetary theory. Most economists or theorists believed that monetary factors such as inflation or unemployment affected the economy's output. However, John Keynes changed that theory.

John Keynes developed a theory that contradicted classical theory. Instead, he produced an idea describing the entire economy in terms of aggregates or a composite value that measures the result of economic activity. This changed the entirety of economics during its time.

His theory placed many economic factors into one idea. For example, fewer people will invest money when the economy is contracting in the business cycle. Classical theorists believe that all markets cleared, meaning there was no surplus of goods.

Keynes's theory suggests other factors affect the supply and demand of economies, and there are shortages and surpluses. However, he believed demand was the key driver in supply; for example, demand or lack thereof for computers will change how much companies will supply.

Next, monetarists believe the increase or decrease in inflation/deflation is due to the amount of money in circulation. Monetarists thought the Keynesian theory left out the thought of inflation or deflation and its drivers and disregarded the role money supply played in inflation.

New classical economists began to believe supply and demand were the key drivers of production, pricing, and consumption. Keynesian and classical economists are different because Keynesians focus on short-term issues, and neoclassical economics focus on the long-term.

In general, the classical economics theory focused more on microeconomics before the Keynesian theory and new classical theory were developed, and both of these theories focus on the macro. As a result, economists learned that you could use microeconomics to help determine the macro.

Factors influencing Macroeconomics: Key Determinants

Several tools and indicators are used to evaluate a company's performance. Since the macro is focused on the big picture of a nation's economy, we must evaluate data such as GDP, unemployment, and inflation.

These data points are important to the health of an economy. They can tell economists and investors where the economy is and where it could be headed. For example, inflation rates can help determine where fiscal policy is needed and how employment may react.

Countries that have strong economies are normally strong and powerful. This is because countries want their economies to grow, and they put a lot of effort into trying to reach things such as:

- Raising the standard of living

- Keeping inflation low

- Educating the workforce

- Reducing poverty

National governments and other entities that control monetary policies must focus on macro factors and indicators. These factors help them form and move towards creating policy to meet the goals and standards above. The Federal Reserve is one of these entities.

Growing an economy can be challenging because it is not always straightforward; sometimes, you have to move down or sideways to improve. All economies move through business cycles. Business cycles, also called economic cycles, are patterns the economy moves through.

Business cycles are used to judge where an economy is and where it may be headed. Therefore, GDP is considered one of the most important indicators to follow as it measures the output of an economy. When economies are pushing for more output, they are usually expanding.

On the other hand, economies that are not expanding will have lower GDP over time; this is when markets are contracting. Conversely, many indicators of a strong market are when employment levels rise, inflation is low, and high demand is fulfilled by high supply.

In simplest terms, many people focus on microeconomic trends and forget to look at the big picture. However, looking from a farther-back perspective will allow them to find longer-lasting trends affecting a nation much more over time.

For example, if a country is showing signs of forming a trough in the business cycle, then this could be a signal to investors and business owners that the markets may turn to the upside soon. On the other hand, if GDP rises, then the odds are that living standards are too high and poverty is decreasing.

Application and significance of Macroeconomics

Macroeconomics is used to study the behavior of an economy at large. First, government entities will create models, figures, and reports that show how the economy is performing at the large-scale level. Then, economists will use the data that has been provided to make further predictions.

Economists use this data to make predictions and forecasts about the future of a nation's economy. In addition, many investors rely on this information. Therefore, many factors are used to create an economic report and can also be used to predict the following reports.

Some of the main tools and data points that are used to measure the health of an economy are:

- Gross Domestic Product (GDP)

- Consumer Price Index (CPI)

- Producer Price Index (PPI)

- Unemployment levels

All of these contribute largely to economic health.

For example, if inflation is too high, the Federal Reserve may implement monetary policy to raise interest rates. However, if this carries on for too long, it could push the economy into a recession leading to unemployment and a decline in GDP.

The main focus is to measure how a nation's economy is performing. This way, institutions and regulatory entities can take action if necessary. The goals of large-perspective economics are:

- Providing a stable economy

- Reducing poverty

- Increasing the standard of living

A stable economy is a very important aspect of a strong country. When a country's economy is stable and strong, other countries will want to trade with them. This is great for all countries involved because both can perform imports and exports.

An important part of the gross domestic product measurement is the country's number of exports compared to its imports. When economies have more exports than imports, they have a trade surplus, and a trade deficit is when imports are higher than exports.

It is desirable for nations to have trade surpluses to export (sell) more goods to other countries than they are importing (buying). However, a country should export goods if they have an absolute advantage, and comparative advantage is optimal.

Absolute advantage is when a country can produce more goods than another country when given the same amount of resources. Comparative advantage is when a country can produce a given product with better quality at a lower price than another country.

That said, a country should import goods where they do not have an absolute advantage, and they should consider importing goods they do not have a comparative advantage on. This will allow companies to make more and spend less.

major theories in Macroeconomics

There are several different ideas on which macroeconomics is founded; in the early history of economics, the macro was not given much attention. Then, however, a few came up with theories combining microeconomics to form macro ideas.

Many early schools believed there were no market surpluses or deficits; they believed all markets cleared. However, John Keynes contradicted that theory with the main thought that demand drives supply, and markets do not always clear.

1. Classical

Classical economists believe that markets will always be clear because the price will change due to the increases and decreases in supply and demand. Therefore, they also believe that no one should interfere with the policy of any kind.

These economists believe that the economy is self-regulating; thus, it can reach its natural level of real GDP. Real GDP is the natural output level when the country's resources are maximized. Classical theorists believe in Say's Law.

Say's Law is the belief that an economy producing a natural real GDP produces the needed income to consume the output. This way, the demand complements the supply.

2. Keynesian

The Keynesian theory was created on the works of John Keynes and published in 1936. Keynes's theory was based on aggregates. It was focused on the equilibrium at which the aggregate supply and demand intersected.

Keynes created a model called the income-expenditure model. He believed this model proved the level of real GDP did not correlate with the national GDP. Keynes's theory, Say's Law, states that the economy will self-regulate itself.

His theory denied Say's Law; Keynesians believe in sticky prices and wages, which prevent supply and demand from fixing natural surpluses and deficits. Instead, his theory focused on aggregate demand and how it affected unemployment and business cycles.

3. New Classical

New classical economics, sometimes called Neo-classical economics, believes that supply and demand is the main factor behind how goods and services are produced, priced, and consumed. This theory became known around 1900.

Early classical economists believe production is the most important factor when considering the price of a product. However, the neoclassical economist believes the consumer primarily determines the value of a product.

As a result of this belief, many products and services may have much higher valuations than the cost of the product. In addition, the consumer's value for a product or service also affects its demand. Lastly, these economists believe competition is best for economies.

They believe this because competition drives better use of resources throughout the economy. Some believe this theory could have caused the 2008-9 financial crisis because investors believed the housing market had no ceiling.

4. New Keynesian

New Keynesian theory, also known as Neo-Keynesian theory, like the traditional theory, believes an economy is not automated and does clear out its supply. However, they believe in growth and stability, not only full employment.

The neo-Keynesian theory developed after World War II. They also believe that there isn't pure competition in markets because there is a chance for monopolies to exist. After all, some companies can control prices based on demand.

During the 1960s, New Keynesians started analyzing the macro from the perspective of important microeconomics. These factors are price rigidity and wage rigidity. However, their views differ on how prices and wages move.

This theorem of economics became the large-scale view of economics taught in schools and colleges from the 1990s till the Great Recession of 2008.

5. Austrian

Some consider Carl Menger to be the founder of Austrian economics. Menger and his followers believed that the consumer valued how much a product or service was worth. Thus, different people had different values.

They also believed a more supply of a product or service would make it less valuable. Finally, Austrian economics believed laws and issues could be solved without mathematical data but rather with rational thoughts.

Summary

Macroeconomics is important for every nation and the global economy. It is based on historical data; then compiled to produce reports. Some indicators of large economic trends are gross domestic product, inflation, and unemployment.

History will repeat itself in the economic world. Therefore, we can take monetary action and create policies if we can look at specific trends and key data points showing where markets may be heading. Creating monetary policy can either encourage the trend or fight to change it.

Many important economic cycles, such as the Great Depression and Recession, have helped economists learn from their mistakes and prevent them from happening again. If they can learn from the past, they can better help the future economy and goals of macroeconomics.

This part of economics largely affects people's lives. Much of economics is based on how the economy is improving or how much it isn't. Looking at the current business cycle can help a nation understand where they are and how much growth is occurring.

Economies can pursue growth through many different techniques or theorems of macroeconomics. Some of the theories are:

- Classical

- Keynesian

- Monetarist

- Neoclassical

- Neo-Keynesian

These ideas have similar and different factors of how an economy works.

In general, it is about analyzing the bigger picture of economies on national and international levels. The goal of studying this part is to increase the standard of living, decrease poverty, and help economies generate growth and stability.

or Want to Sign up with your social account?