International Monetary Fund (IMF)

International establishment with the essential cause of facilitating worldwide exchange and promoting worldwide economic cooperation.

What Is the International Monetary Fund (IMF)?

The International Monetary Fund is an international establishment founded in 1944 with the fundamental cause of facilitating worldwide exchange and promoting worldwide economic cooperation.

The International Monetary Fund's headquarters is based in Washington, DC. It comprises 190 member countries, embodying over 97% of the world's Gross Domestic Product (GDP).

The IMF's mission is to warrant global financial steadiness, spur economic progress, and alleviate poverty by furnishing policy counsel, fiscal support, and technical assistance to its member countries.

The primary function of the International Monetary Fund is to provide monetary help to its member nations. When a member country goes through a recession or economic difficulties, they stand with these countries to help them through financial hardship, debt crisis, and foreign money crises.

They dispense loans to member countries to help them establish economic stability and re-establish their financial equilibrium. However, these loans come with specific obligations, such as instituting economic reforms to address the underlying predicaments that led to the crisis.

Like its monetary assistance programs, it also gives its member nations coverage recommendations and technical support on various financial issues, such as economic coverage, economic policy, monetary law, and structural reforms.

The establishment also undertakes research and analysis on global economic patterns and publishes reports on these subjects.

Key Takeaways

- The International Monetary Fund (IMF) is an international organization established in 1944 to facilitate global trade and promote economic cooperation.

- Its mission is to ensure global financial stability, foster economic growth, and alleviate poverty by providing policy advice, financial support, and technical assistance to member countries.

- The IMF's primary function is to provide monetary assistance to member nations facing economic difficulties, including recessions, debt crises, and foreign currency crises.

- The IMF's primary objectives include promoting global monetary cooperation, maintaining financial stability, providing financial assistance, promoting economic growth, and contributing to poverty reduction.

Understanding the International Monetary Fund (IMF)

The International Monetary Fund is governed via its Board of Governors, which incorporates a governor and an alternate governor from every member country. The Board of Governors assembles annually to deliberate its policies and operations.

We must know that the IMF's executive board oversees and manages the organization's routine day-to-day activities. And generally, the executive board consists of 24 directors appointed with the aid of member countries.

Regarding its policies and practices, the IMF has faced criticism and controversy over the years, notably concerning its lending criteria and its strategy for economic reforms in developing and rising nations.

Opponents argue that their policies have often exacerbated economic difficulties in recipient countries, amplifying poverty and social turmoil.

International Monetary Fund backers contend that the organization is essential for promoting global economic development and financial stability. Its policies are created to address the root causes of financial crises.

The organization's dedication is to provide financial steadiness and diminish poverty in a country by helping them via fundamental and technical analysis skills.

Want to understand more about their services and regulations? You can go through the official website of the International Monetary Fund.

Importance of the International Monetary Fund

It provides us with a wide range of economic data and technical analysis. It helps a member nation to evaluate its financial competency and other economic health. It also has importance according to their situation.

We must remember that even though the International Monetary Fund has its employees and executive members who always try to provide the best services to the member nations, they also have their code of conduct.

NOTE

The international monetary Fund gives offerings to all 190 member nations, not just a few. Each member nation is represented in the IMF in proportion to its size in the global economy.

We will go through some basic importance of the IMF to provide an overall view of its significance in services.

- Promotes global economic stability: Works to ensure stable exchange rates, promote balanced economic growth, and help prevent financial crises in member countries.

- Provides financial assistance: Provides monetary aid to member countries suffering economic issues, helping them enforce economic reforms and stabilizing their economies.

- Offers technical assistance: In addition to financial aid, it offers member nations technical help and policy advice on tax policy, monetary policy, and financial regulation.

- Facilitates international trade: It supports the growth of international trade by providing member countries with data and analysis on global economic trends and helping to reduce trade barriers.

- Promotes poverty reduction: It works to reduce poverty by promoting sustainable economic growth and supporting needy countries.

- Enhances global economic governance: It helps to coordinate economic policies among member countries and plays a key role in promoting international cooperation on economic issues.

- Provides a forum for dialogue: It always tries to provide a platform for member countries to discuss and address economic challenges and opportunities, promoting greater understanding and cooperation among nations.

- Monitors global economic trends: It gathers and analyzes financial information from worldwide data, presenting essential insights into global economic developments and adjustments.

- Early warning of financial crises: It can detect developing risks and warn about future financial crises by monitoring and analyzing global economic trends.

- Coordinates international economic policies: Works with other international organizations to coordinate economic policies and promote global economic stability.

- Promotes financial sector stability: Offers member nations technical support and policy guidance to help them develop their financial sectors and decrease the risk of financial crises.

- Supports debt relief to countries: Supports debt relief initiatives for heavily indebted countries, helping to reduce poverty and promote economic growth.

- Building Capacity in Developing Nations: It offers technical help and training to growing countries to promote sustainable financial growth and poverty reduction.

- Facilitates international monetary cooperation: The basic aims are to promote international monetary cooperation and preserve the global monetary system's stability.

Functions of the IMF in the Global Economy

The International Monetary Fund is a major international company that plays a critical role in operating the worldwide financial system.

Its diverse and intricate functions range from fostering international monetary cooperation to furnishing financial assistance to member countries during economic crises.

We will dive into some of the International Monetary Fund's most basic and important functions.

The following are the functions of the International Monetary Fund.

Monetary Support

It provides financial support to member countries in dire situations or financial crises. In addition, it bestows loans to member countries to aid them in stabilizing their economies and restoring their fiscal stability.

These loans are accompanied by specific stipulations, such as implementing economic overhauls designed to address the underlying problems that triggered the crisis. It also dispenses technical support and policy guidance to assist countries in executing these overhauls.

Encouraging Economic Advancement

It also plays a pivotal role in encouraging economic advancement and development by giving member countries policy guidance and technical assistance.

It collaborates with member countries to assist them in designing and executing sound macroeconomic policies that back economic advancement and stability. In addition, it researches and analyzes global economic trends and publishes reports on these subjects.

NOTE

While the International Monetary Fund has encountered criticism and controversy over its policies and practices, its role in promoting international monetary collaboration and economic stability is still indispensable.

Global Economy Monitoring

It oversees the global economy to recognize potential hazards and vulnerabilities that could jeopardize worldwide fiscal stability.

The IMF's supervisory activities encompass regular assessments of the member countries' economic policies and fiscal systems and publishing recurring reports on worldwide economic trends.

Encouraging International Monetary Collaboration

It boosts international monetary collaboration by providing a platform for member countries to discuss and coordinate their economic policies. It also aids member countries in managing their international reserves and exchange rate policies.

Providing Technical Assistance

It assists member countries with huge forms of monetary assistance, financial policy, financial coverage, financial law, and structural reforms. In addition, the IMF's technical support helps member countries to build robust and sustainable economies.

NOTE

The IMF is a pivotal establishment in the global economy, carrying out a spectrum of essential functions in promoting economic stability, advancement, and development.

Its monetary support programs, policy guidance, and technical assistance are designed to help member countries navigate the challenges of the worldwide economy and attain sustainable economic growth.

Objectives of the International Monetary Fund

Now we know the IMF's functions and importance and why executive and member countries establish it. For example, it provides monetary services and help to its member countries. And the management of the IMF has been under more than 24 executive members.

In this topic, we will learn about the IMF's primary objective and purpose. Why does it want to provide financial support and growth to its member countries? What are the IMF's goals over the longer horizon?

So let us start with its main objectives; the following are the most significant objectives you can refer to.

Promoting Global Monetary Cooperation

The International Monetary Fund has a significant objective in promoting international monetary collaboration and sustaining exchange rate stability.

This institution works with its member nations to help them manage their exchange rates and avert currency crises by providing technical assistance on exchange rate policies and coordinating global economic policies.

Maintaining Financial Stability

Moreover, it is responsible for ensuring international monetary stability by offering monetary resources to member nations to deal with the balance of payments issues, which arise when a country's foreign payments exceed its international revenues.

NOTE

IMF provides financial assistance programs to stabilize economies and prevent financial crises from spreading to other nations.

Providing Financial Assistance

Another primary goal is to provide and encourage financial help to its member countries in economic crises. For example, the IMF makes loans to member nations to assist them in dealing with balance-of-payments concerns and implementing economic reforms.

It helps fellow countries, but behind that help, there is a subjective matter: the requirements for the help. Here the requirements are the implementation of economic reforms to address the underlying problems that led to the disaster.

Promoting Economic Growth

The IMF is essential in helping financial growth and development in member countries by presenting policy advice and technical assistance to member countries in developing and enforcing precise macroeconomic rules that promote economic growth and balance.

NOTE

The IMF researches and analyzes global economic trends and publishes reports.

Contributing To Poverty Reduction

When a member country faces poverty or growth issues within its borders, the IMF's mission is to encourage these countries to help them overcome crises and walk on the development path.

The IMF enables poverty reduction by assisting member countries in planning and executing guidelines that may help decrease poverty. These include enhancing access to education, healthcare, and different primary services.

Enhancing The International Monetary System

Lastly, it aims to enhance the international monetary and financial system. It offers member nations technical support on financial regulation, macroeconomic policies, and other issues concerning its operation.

How Does the International Monetary Fund Work?

The IMF works by promoting global economic cooperation and exchange rate stability. In addition, the organization provides member countries with technical assistance, financial support, and policy advice.

To understand how the IMF works, we must understand its financing mechanisms. The IMF helps other member countries with these financing mechanisms. So we can say that its work provides these financing mechanisms to member countries for prosperity.

We must understand these mechanisms to understand how the IMF works in the global economy to maintain sustainability and growth.

The IMF's financing mechanisms are designed to provide financial assistance to member countries facing economic challenges.

The IMF's financing mechanisms include the following:

- Stand-By Arrangements (SBAs): These are short-term financing facilities that provide support to member countries facing temporary balance of payments difficulties. The funds are typically repaid within three years.

- Extended Fund Facilities (EFFs): These medium-term financing facilities support member countries facing protracted balance of payments difficulties. The funds are typically repaid within four to ten years.

- Flexible Credit Line (FCL): This financing facility provides pre-approved, unconditional, and immediately available financial assistance to member countries with strong economic policies and fundamentals. The funds are typically repaid within one to two years.

- Rapid Financing Instrument (RFI): This financing facility provides emergency financial assistance to member countries facing urgent balance of payments needs. The funds are typically repaid within three to five years.

- Catastrophe Containment & Relief Trust (CCRT): This financing facility provides grants to member countries facing natural disasters, public health emergencies, and other catastrophes.

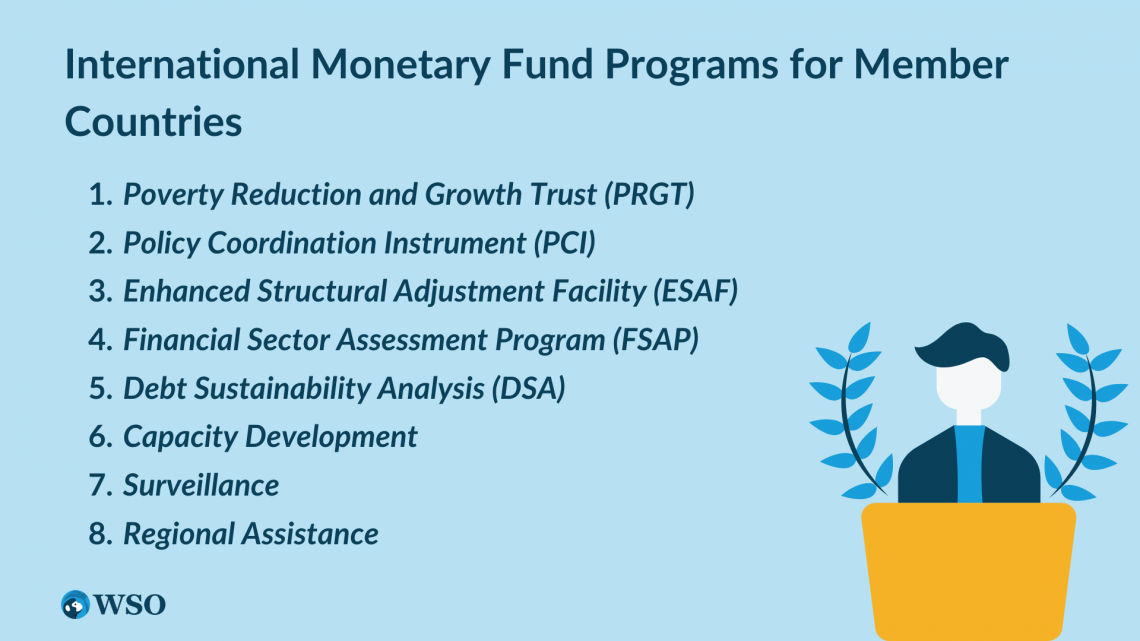

International Monetary Fund Programs for Member Countries

IMF always presents member countries with technical assistance and policy advice to assist them in improving their economic policies and institutions. The organization also financially supports member countries facing economic challenges through its financing mechanisms.

The programs for member countries normally contain policy modifications and structural reforms aimed at promoting macroeconomic stability, decreasing inflation, enhancing economic sustainability, and improving the resilience of the financial area.

Their programs promote economic growth and sustainable development while addressing social and environmental problems.

Here are some popular programs organized by the IMF for its member countries:

- Poverty Reduction and Growth Trust (PRGT): The IMF offers a notable program called the Poverty Reduction and Growth Trust (PRGT). The PRGT provides concessional financing to low-income member countries that pursue economic policies to reduce poverty and promote growth.

- The PRGT also provides these countries with technical assistance and policy advice to help them achieve their development goals.

- Policy Coordination Instrument (PCI): The IMF offers another program called the Policy Coordination Instrument (PCI). This instrument is designed to help member countries with sound economic policies and frameworks achieve their policy objectives through policy dialogue with the IMF.

- Enhanced Structural Adjustment Facility (ESAF): This program offers low-income nations concessional loans to help them execute economic reforms to decrease poverty and support economic growth.

- Financial Sector Assessment Program (FSAP): This program helps member countries identify and address weaknesses in their financial sectors, including banking systems, securities markets, and insurance.

- Debt Sustainability Analysis (DSA): This program evaluates member countries' debt sustainability, including analyzing their potential to repay their debts and the dangers associated with their debt levels.

- Capacity Development: This program gives technical help and training to member countries to assist them in building the skills and institutions needed to design and enforce effective economic guidelines.

- Surveillance: This program involves the IMF monitoring and analyzing global economic developments and providing policy advice to member countries to help them address economic challenges.

- Regional Assistance: The IMF also provides regional assistance to member countries through its regional offices. This includes providing policy advice, technical assistance, and financial assistance to address regional economic challenges.

International Monetary Fund (IMF) FAQs

The IMF has a unique role in the global economy. They provide various types of programs and operations worldwide to foster global financial stability and prosper in the future.

The Poverty Reduction and Development Trust is an IMF program offering low-income member countries concessional finance for economic measures to decrease poverty and stimulate development.

The IMF provides financial support to member countries through its various financing facilities, including Stand-By Arrangements, Extended Fund Facilities, Flexible Credit Lines, and Rapid Financing Instruments.

The IMF has faced criticism over its policy prescriptions for member countries, which can involve socially and politically tough measures, and its governance structure, which gives more voting power to developed countries than to developing countries.

They have numerous programs that help the countries sustain their economic growth and development. As well as it helps countries facing social and environmental challenges with a different view of growth.

Non-member nations can get IMF financial assistance under the organization's lending into arrears policy, which permits the IMF to offer money to governments that are in arrears to formal creditors, including the IMF. Non-member nations, on the other hand, are not permitted for the IMF's other funding instruments.

or Want to Sign up with your social account?