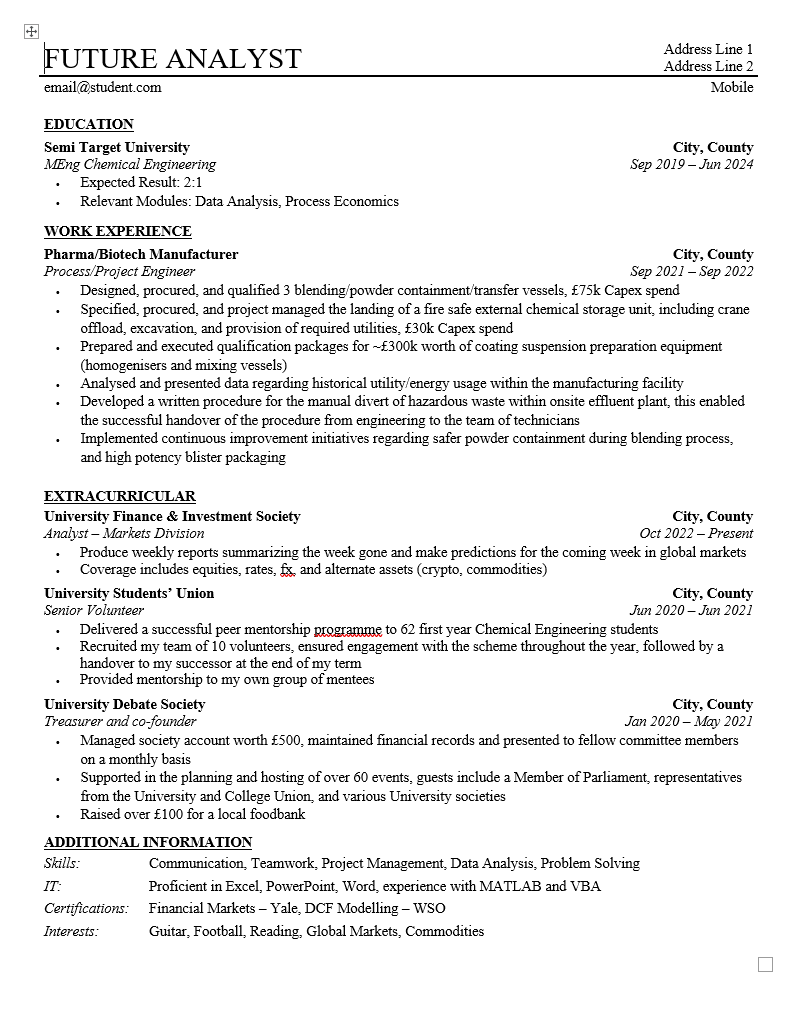

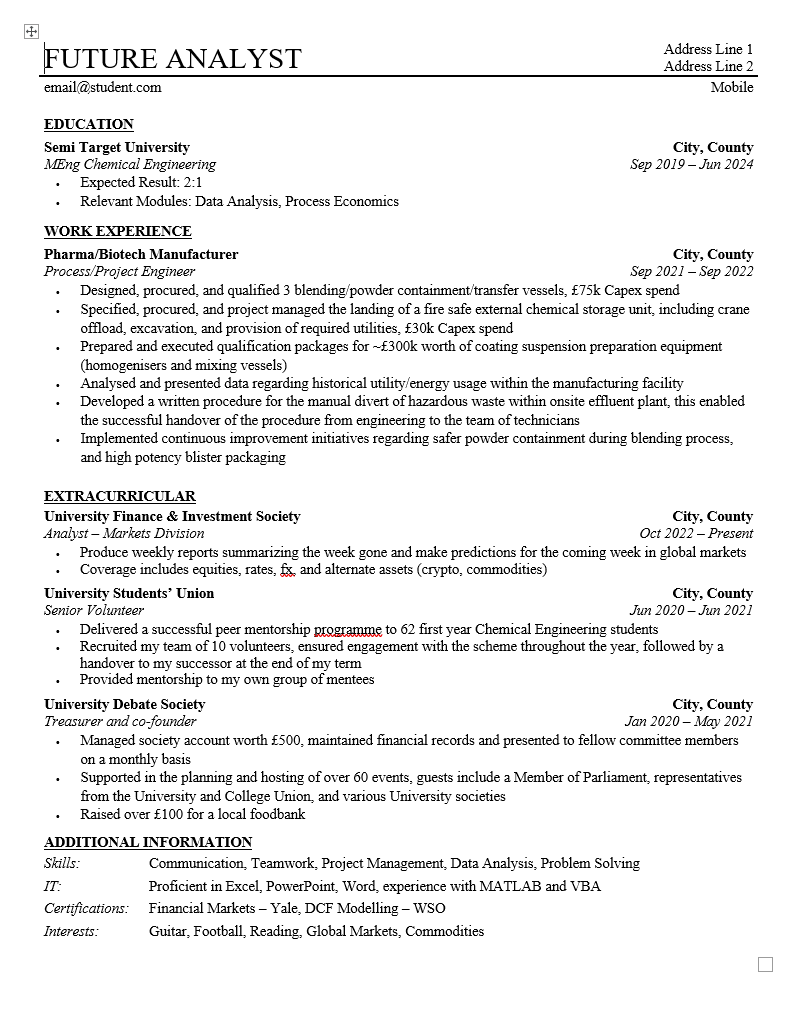

Roast my CV

Title sums it up nicely. Please give me any comments you have on my CV below, going to use it to apply for ER summer positions.

Title sums it up nicely. Please give me any comments you have on my CV below, going to use it to apply for ER summer positions.

Career Resources

Yeah you want to start over, if I saw this I would think that you mistakenly submitted your resume for the job. Keep this for engineering and make a new one for ER. Find out what ER does day to day and tie your relevant experience to that. Make it sound more like you already are in ER.

Thanks for the feedback. Can I ask what you do? Do you have any tips for gearing my experience towards ER? I'm well aware of what ER is, however I can only stretch my work experience to a certain extent.

WM and currently moving to IB. The parallels I drew were:

Developed equity pricing models to calculate investment risk and expected return on investment (Excel modeling)

Created pitchbooks and PIBs for potential clients outlining key portfolio statistics, potential risk/exposure etc. (PowerPoint)

Client interaction stuff like recruiting new clients, building maintaining book of business etc.

Then moved on to equivalent of deals in my space and talked about analysis that I did, action I took, and then result. This is what you should focus on the most zooming into the details of those first bullet points you mentioned as sub bullets.

When ordering your bullets your biggest guns need to be up front.

Your investment society if you keep that as your first in extra needs way more punch to it. That space is a blank check, no one can or will verify the accuracy other than you need to be able to talk at length about whatever you put there.

Shouldn't list your address on your resume, it's not common practice anymore. "Raised over 100 for a local foodbank" not really worth mentioning since the amount is quite low. Thin out the border margins (optional)

Ipsa et maiores voluptatibus dolor. Vero ut aspernatur ad sequi nemo. Harum enim nesciunt quisquam minima dicta. Reprehenderit sed omnis fugit amet fugiat consequatur quibusdam. Ab minus quod ipsam exercitationem vitae ab.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...