Undergrad Placement Data Differences

Hi guys,

Got a question for those of you who are knowledgeable about data and familiar with the undergrad recruitment/target scene.

I'm making a decision for a university choice right now, and I'm using the two following data sources: Peak Frameworks and College Transitions (for their IB placement by undergrad data). While they both use LinkedIn, they have somewhat different results. Most notably, the CT data seems to favor more "traditionally prestigious" universities, while schools like Brigham and Indiana have better placement than schools like UChic, Duke, and Yale with the PF data. Which is more reflective of the actual finance target scene (I'm guessing CT), and what are the causes of this discrepancy? Is it because of how they treated the data or something?

UChic in particular seems to do a lot better in the CT data table (5th in weighted CT, 11th in weighted PF & 7th in unweighted CT, 15th in unweighted PF). Since this is one of the schools I've been accepted to, which of the perspectives are more representative of reality?

I've attached the "raw placement" tables and "per capita weighted placement" tables for both sources, and their links at the bottom.

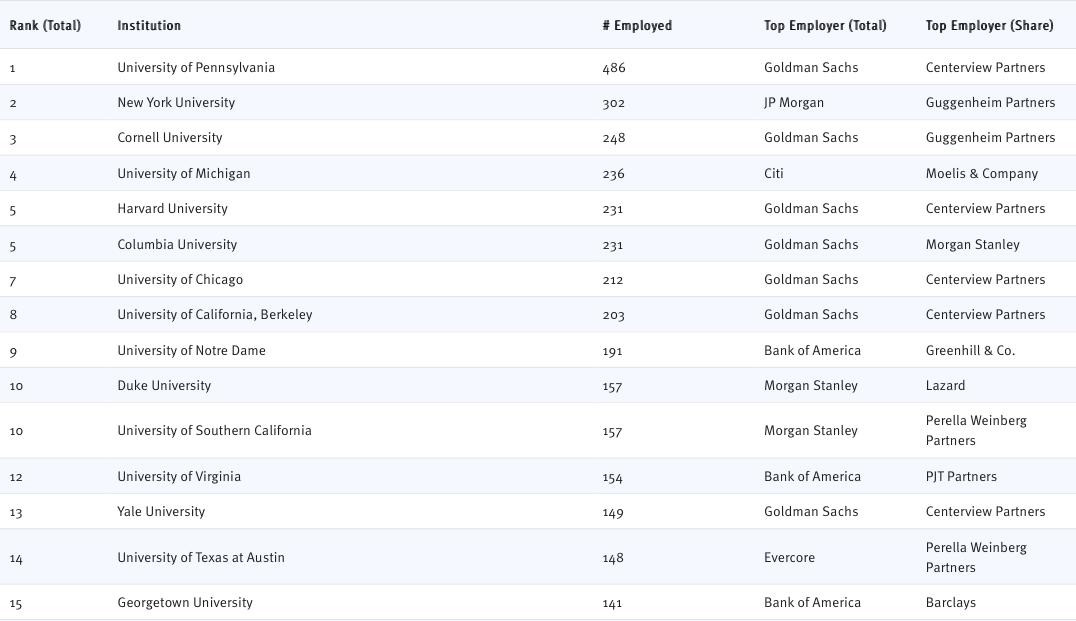

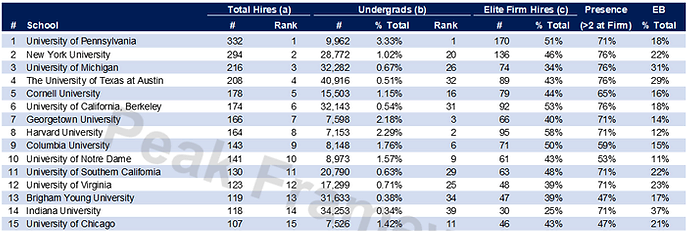

Here are the two "raw placement" tables:

CT:

PF:

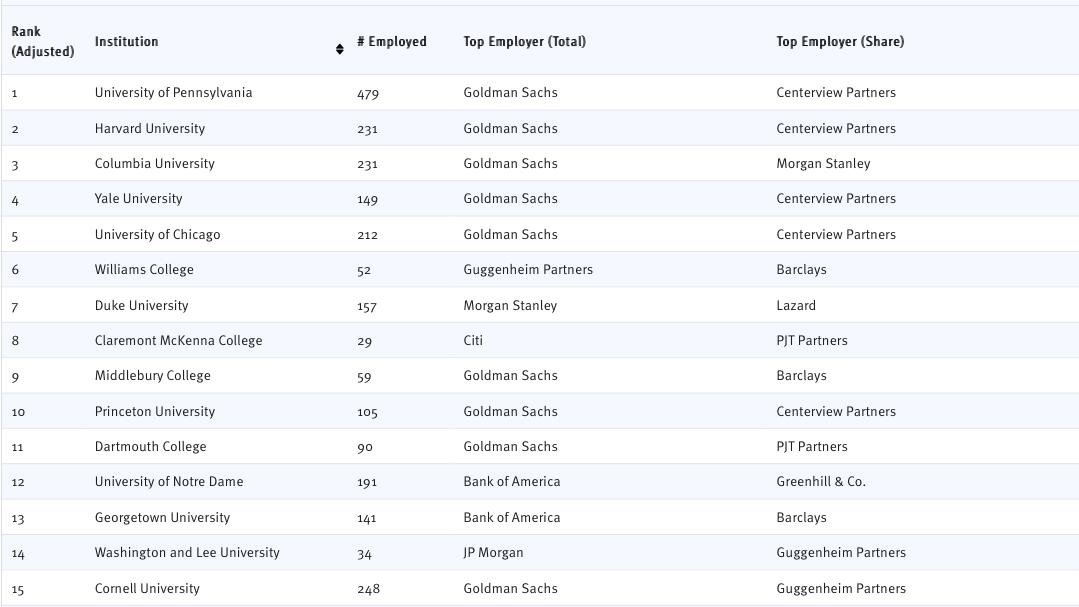

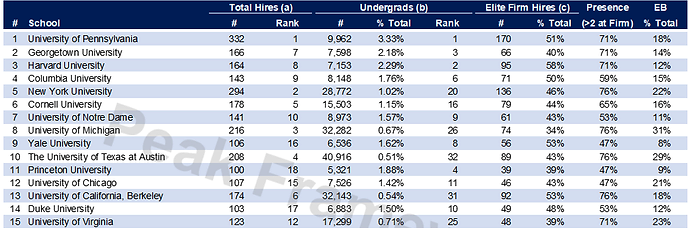

Here are the two "weighted by per capita" tables:

CT:

PF:

Ah, the classic conundrum of data interpretation in the wild world of university rankings and job placements! Here's a little nugget of wisdom for you:

Data Source and Methodology: The differences you're noticing between Peak Frameworks (PF) and College Transitions (CT) could be due to a variety of factors. Both sources may use LinkedIn, but they could have different methodologies for collecting and processing the data. This includes how they define "investment banking placement," the time frame of the data collected, and whether they consider internships or full-time positions only.

Sample Bias: Both sources might have sample biases. For instance, PF and CT could be looking at different subsets of LinkedIn profiles, which can skew the results. If PF includes a broader range of finance roles or a different time frame, that could explain why schools like Brigham and Indiana appear to have better placement compared to UChic, Duke, and Yale.

School Size and Focus: The "per capita weighted placement" is an attempt to normalize the data by the size of the school or program. This can be tricky because it assumes that all students are equally interested in finance careers, which isn't always the case. Some schools may have a higher proportion of students aiming for finance, which could affect their placement rates.

Prestige vs. Performance: Traditionally prestigious universities often have well-established alumni networks in finance, which can help with placement. However, this doesn't necessarily mean that less traditionally prestigious schools don't perform well. Sometimes, these schools have strong dedicated programs that can lead to successful placement in investment banking.

As for which perspective is more representative of reality, it's tough to say without diving into the nitty-gritty of each source's methodology. However, it's important to remember that placement data is just one piece of the puzzle. Consider other factors like the overall fit of the school, the culture, the curriculum, and your personal career goals.

Since UChic is one of your options, and there's a discrepancy in its ranking between CT and PF, you might want to look beyond these rankings. Reach out to current students or alumni, visit the campus, and see if the school's career services can provide you with their own placement data.

Remember, the best school for you is one that aligns with your personal and professional aspirations, not just the one that tops a chart. Now, go swing from those vines of knowledge and make an informed choice!

Sources: Canadian Target Schools Ranked By Detailed Global Placement Data, An old man looking for advice, Undergraduate Representation Among PE Firms (With Data), Corporate Finance Q&A with accountingbyday, BJM85, STorIB, and djfiii, Undergraduate Representation Among PE Firms (With Data)

Don’t base your college decisions purely off of reports on street placements. If you were deciding between Harvard and University of Iowa, and you somehow already know you want to do IB, then obviously pick Harvard. But if they’re similar schools (esp target ones), marginal increases on “placement” don’t matter - just work to be a top candidate wherever you are. Targets are going to be your traditional top colleges - Ivys, Duke, Stanford/MIT, Northwestern, Uchicago, Vandy, Ross, Stern, etc. I wouldn’t argue IU itself is a target school, but their investment banking workshop has incredibly placement, esp for a state school.

I cannot recommend more that you consider other factors in choosing where to go to college. Weather, culture, size, campus, should all be considerations more important what some website says about how many kids going into bulge bracket banks

Similar to above, I know plenty of kids who went to better schools than me but are miserable because everyone is trying to do banking and it’s much more competitive. Not saying that’s true for everyone, but if you can go to a semi-target with a strong banking club that also has a good culture I think you will set yourself up for a good 4 years and still end up in banking. School will also probably be easier so you can spend more time recruiting.

Ea officiis beatae fugiat dolorum earum iure facilis. Neque non laborum amet. Officia omnis perspiciatis temporibus incidunt. Non tempore consequatur impedit tempore ratione.

Eaque et et ex aliquam modi. Ea corporis consequatur ex corrupti illo. Qui earum officia perspiciatis. Ut et necessitatibus quae aut et ratione est. Ullam fuga blanditiis vel voluptas tempora. Non corporis aut nihil qui et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...