Data on Hedge Funds, PE, and VC Performance versus Benchmarks?

Does anyone here have data on the how hedge funds, private equity funds and venture capital funds perform versus benchmarks? I know it is a generalization but I am sure the risks for investors are higher in these products but I wonder if the returns justify the risk.

PrivatePyle Here's an investment topic but no one is interested. Whatever1984 Are you familiar with performance of non traditional investments versus benchmarks?

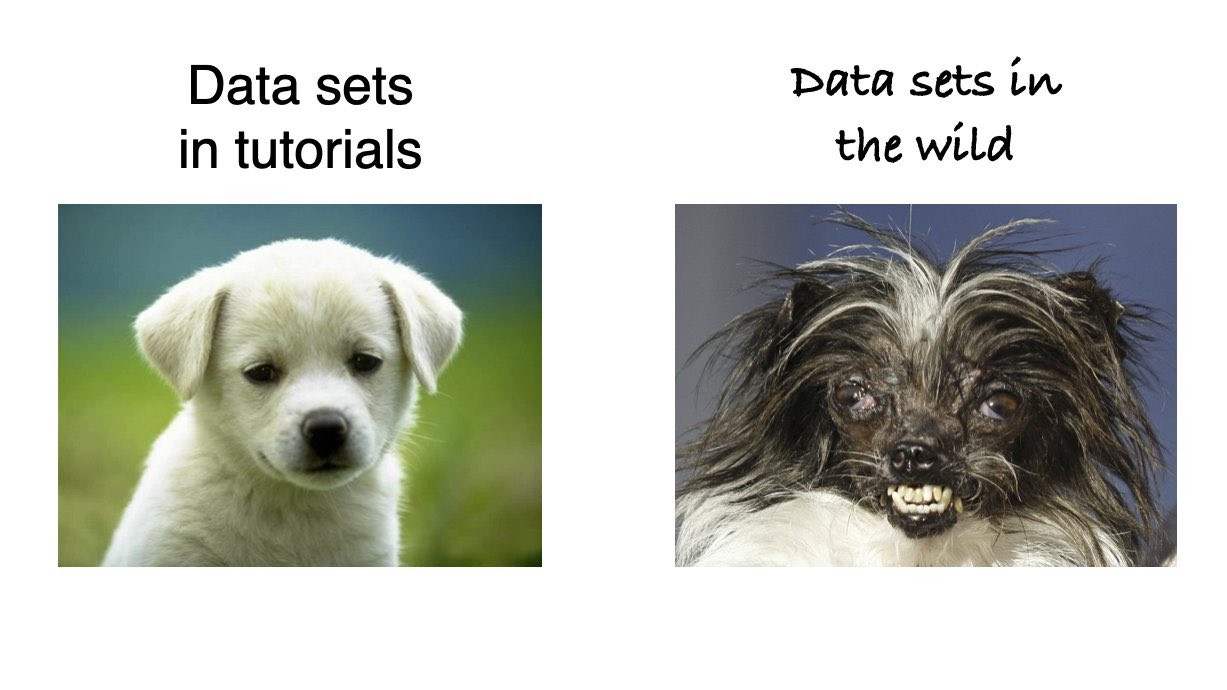

Where do you want me to begin? Who defines the benchmark? You should. If you let me, the fund manager, do it and if I'm underperforming, I can just go benchmark shopping for a new friendlier benchmark that I'm beating. It really is the wild west out there.

A couple semantics items here: Private Equity is the umbrella term. Venture Capital (VC) Leveraged Buy Out funds (LBO) and arguably Hedge Funds all fall under it, as well as some smaller strategy groups.

The good news is that there is actually an index that tracks how LBO funds in the US are doing, the PrEQin Buyout index. The data I have is dated and third-hand, but I'm told that from 2001-2015 it basically tripled the S&P 500's return. The problem with it is that because no type of PE is available to the public, return disclosure isn't required, and am I more likely to disclose to the PrEQin people how I did if I did well or poorly?

The other issue is that measurement is even a pain in LBOs and VCs. Are we measuring based on committed or invested capital? The investor may say "I want to put $100 into your fund" but would probably be told "OK, but I only need $5 now. I'm going to come back for the other $95 when I find a company to buy/startup to invest in though. You'd better have it when I ask." Do you count the return on the $5, or the full $100? The requests for cash may even come in small amounts over time.

Hedge Funds are a different animal, as they will normally take all the capital up front. They *should* be hedging their exposure and trying to deliver pure alpha, but you see other types as well, like 190/90 long funds, short funds, etc. It is really tough to lump them all together as one unit. You still have the voluntary reporting issue though.

The tl;dr version of what I'm trying to say though is that ANY data that you get for any of these should be taken with several tablespoons worth of salt.

Thanks for the reply. The benchmark should reflect a strategy that would be similar to that of a group of private equity or hedge funds.

That is good news that there is an index for comparison but I guess that LBO funds are only one type of private equity.

I realize that the data can be suspect here. I am thinking about this because sometimes you hear that hedge funds or private equity investments have great returns but no one seems to have any data to back it up. Sure, a few funds could have great returns, but that does not mean that most of them do. It is so much easier to to an analysis in the mutual fund world where all of the data is published.

Sorry man, but if you're looking for something similar to a Morningstar Category Average for a style then as far as I am aware, you're up shit creek without a paddle.

I did a bit of research on this a while back. The managers normally provide estimates of their value every quarter or so. Those are obviously not unbiased. We were looking to get the HFT industry to arb them for us. If you decide what the value is, and you only need to report quarterly then "look low volatility" claims are worthless, as are all risk-adjusted metrics.

If I were to pick benchmarks for VC it'd be the 600 or the R2k. Those are likely the most similar. (Personally I'd go R2k, since it goes more down-cap and includes unprofitable companies) For classic market neutral hedge funds? I'd probably go with treasuries, but beware style creep. They have a strong incentive to tilt to goose returns.

EDIT: I've been looking for a good place to use this for a while:

Haha. There is danger in the wild

For VC there are a few sources, most consistent/notable are Cambridge Associates and data providers such as pitchbook. While by no means perfect, they give you a rough reference (by vintage/broad strategy e.g early stage etc.). PB also include LBO and PrEQin was also mentioned above.

hedge fund and VC investors typically lose their investor's money. PE funds generally destroy common benchmarks, but there's a lockup period that's typically longer so there's liquidity risk too.

Essentially, don't put your money in a hedge fund unless it's rentech unless you like losing money

Yeah, I have heard some bad things about hedge funds results, which is kind of the reason I am interested in the data. You mostly hear about the hedge funds funds that perform extremely well.

Quos sed fuga odit harum. Accusantium aliquid voluptatibus minus nobis quis. Maiores nostrum ipsa facilis enim incidunt unde debitis. Consectetur at omnis voluptas rem inventore.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...