Finance Salary Guide

A comprehensive breakdown of the payouts associated with the different industries in finance

Finance is the study and management of money. Money is just about everywhere, and as such, so is finance. It is an essential discipline that helps keep world economies going. It is a massive field of work with roles spread across both the public and private sectors.

Many different roles in the world of finance can be pursued, from the back office to the front office or something in between.

These jobs are very competitive and highly sought after, thereby attracting many smart and highly qualified candidates.

Part of the reason so many people are heavily attracted to roles in finance is the high payouts that come with it.

Careers in finance can be very lucrative and cover many different fields. That being said, salaries vary heavily between different roles and specific firms.

In addition, there are many other factors to consider when looking for jobs in finance rather than just the salary.

Below is a guide of many different industries in finance and the payouts that come with them, along with brief descriptions of the jobs.

It should be noted that even though the below figures are a reasonable expectation of what one can achieve in the following industries, it is not a guarantee.

They represent a median range, and there are certainly opportunities given a variety of factors that allow one to earn both less or more than what is listed below.

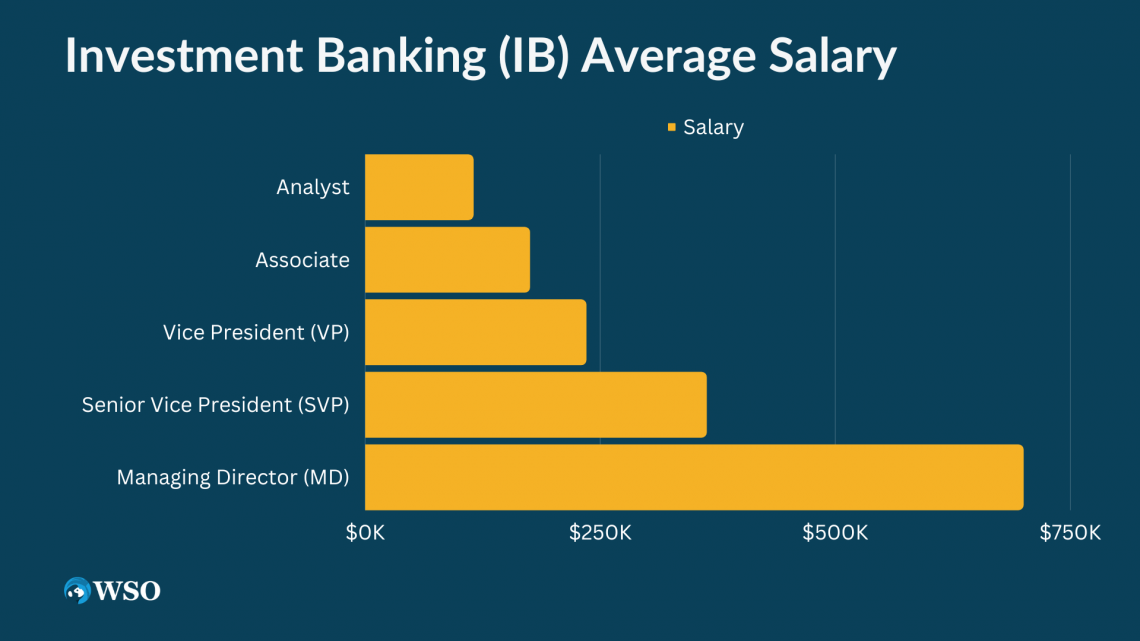

Investment Banking (IB)

The roles in the investment banking division are considered one of the best paid in finance.

The flip side of such a huge salary early on in a person’s career is that those working in IBD have to work long hours to earn it.

| Position | Salary |

|---|---|

|

$90k - $140k |

|

|

$130k - $220k |

|

|

$180k - $290k |

|

|

$250k - $475k |

|

|

$400k - $1M+ |

Analysts are known to work 80-100 hours a week, usually towards the latter end, particularly during busy times of the year.

In addition, you usually don’t find investment banking analysts with big weekend plans, as they are expected to essentially be on call 24/7.

On the bright side, the workload decreases over time, and at the same time, both salary and bonuses increase substantially.

SVPs and MDs can typically earn bonuses that are 100% of their salary or greater, although this also heavily depends on performance.

Despite the allure of higher wages and bonuses and less work down the road, many analysts view their years in investment banking as a means to an end and lateral to other industries after “doing their time,” which is usually about 2 to 3 years.

The investment banking industry is also notoriously difficult to break into. These analysts are typically some of the best of the best talent out there and they really know their stuff.

To get into investment banking out of college, one needs to have a solid academic and extracurricular record and must have worked at some top internships or have other high-quality work experience to have a chance.

Notable Companies Starting Salaries

Morgan Stanley Starting Salary:

- First-year Analyst - $100k

- Second-year Analyst - $105k

Goldman Sachs Starting Salary:

- First-year Analyst - $110k

- Second-year Analyst - $125k

- First-year Associate - $150k

JP Morgan Starting Salary:

- First-year Analyst - $110k

- Second-year Analyst - $125k

- Third-year Analyst - $135k

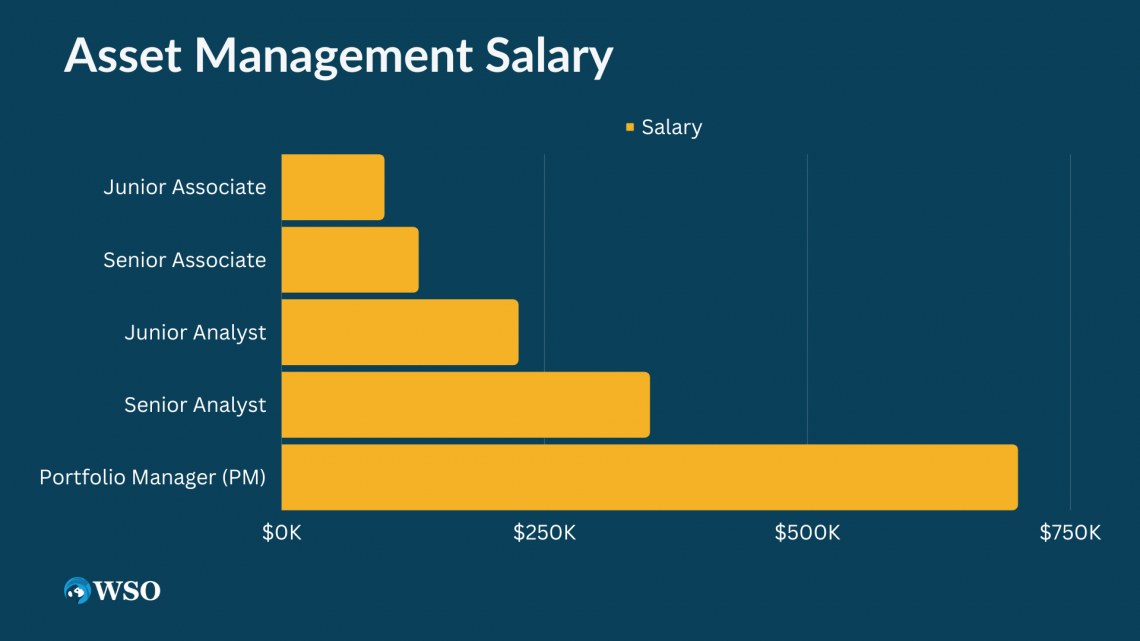

Asset Management (AM)

The career path in asset management tends to be much more variable than in IBD.

IBD has a very clear career path, and most in that field can reasonably expect to know the ladder, how much they will make, and when they will be promoted.

| Position | Salary |

|---|---|

|

Junior Associate |

$85k - $110k |

|

Senior Associate |

$110k - $150k |

|

Junior Analyst |

$150k - $300k |

|

Senior Analyst |

$300k - $400k |

|

Portfolio Manager (PM) |

$400k - $1M+ |

On the other hand, asset management is a lot less clear, with no fixed tenor to move up the ladder. Not only is the tenor to promotions defined, but so are the pathways to becoming a portfolio manager.

In many cases, asset managers make bonuses that are based on the total assets they manage rather than on performance. Hence, managing large portfolios can be extremely lucrative and can bring in huge bonuses.

Asset management is a great career, and although it usually pays less than IBD at the start, it can still be very lucrative and often comes with a better work-life balance.

Junior professionals can expect to work 60 hours a week (higher than that during busy periods like earnings call seasons), but that decreases over time.

Senior professionals can expect to work between 50-60 hours per week.

Like IB, AM is also a competitive field to break into. While it may not be as difficult as investment banking (it isn’t uncommon for people to lateral into this industry from other fields), it still requires a high level of financial knowledge and experience.

Those looking to get into this field should have a strong academic record along with a commanding knowledge of finance and accounting.

Relevant experience goes a long way to landing a role in this industry. Also, it is usually helpful to pursue degrees and certifications beyond a bachelor's degree.

Asset managers will often spend several years as an associate and move to an analyst position after pursuing an MBA.

Others pursue other careers and only lateral into asset management after pursuing an MBA.

Portfolio managers usually have certifications such as the Chartered Financial Analyst (CFA), the Chartered Alternative Investment Analyst (CAIA) accreditation.

Career progression after portfolio manager is usually becoming the CIO, or setting up your own shop.

However, these are incredibly rare, and portfolio manager tends to be the highest that most people can get.

Sales and Trading (S&T)

S&T is another branch of investment banking. In its heyday, it had the same allure as IBD. More recently, this industry (and careers in it) has shrunk, but that doesn’t mean that it isn’t a lucrative industry.

| Position | Salary |

|---|---|

|

Analyst |

$85k - $110k |

|

Associate |

$105k - $180k |

|

Vice President (VP) |

$180k - $400k |

|

Managing Director (MD) |

$400k - $600k+ |

Roles in this industry have the potential for high bonuses. A large part of S&T sells products or ideas, so bonuses and salaries are extremely variable and can be highly based on performance.

S&T is fast-paced and high intensity, but it does have fewer hours than investment banking, with most professionals in S&T working around 50-60 hours per week.

Sales and trading is a competitive industry to get into. Those looking to get into this field should have a strong academic record, better than average communication skills, and finance and accounting. Internships and other related work experience also go a long way to landing a role in this industry.

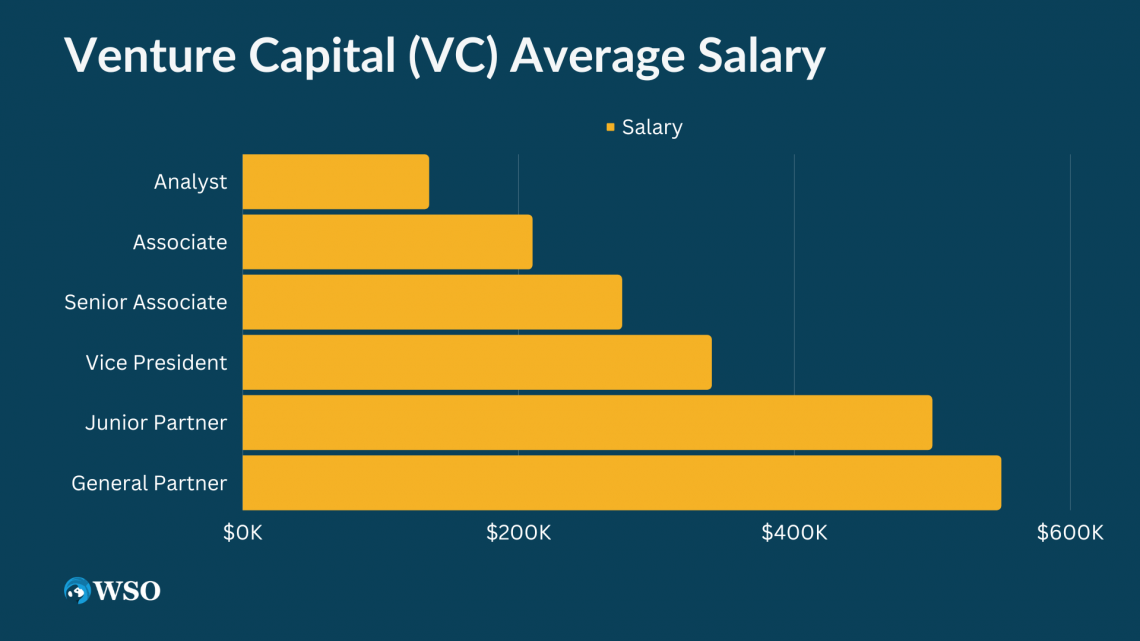

Venture Capital (VC)

Venture capital (VC) is a type of private equity (PE). It involves investing in very new companies that are just starting up and usually have not yet turned any profit. This can be very lucrative for the VC firms in cases where the startup turns out to be successful, as they are able to secure a large stake for less by getting in on the ground floor.

| Position | Salary |

|---|---|

|

Analyst |

$60k - $210k |

|

Associate |

$70k - $350k |

|

Senior Associate |

$150k - $400k |

|

Vice President |

$200k - $480k |

|

Junior Partner |

$400k - $600k |

|

General Partner |

$500k+ |

The flip side to this is that the vast majority of investments are not very successful. It is also focused on long-term investments, meaning that big payoffs may not come until long into the future.

This means that salaries are often not very high, and even when payoffs do occur, it is mostly awarded to the general partner.

That being said, the salaries are still pretty good, and work-life is much more “life-like,” as in much of it includes going to dinners and tech events and talking to entrepreneurs.

It is challenging to get into VC as there are no straightforward paths. In most cases, people enter VC later in their career as it is a challenging career to break into or be successful early in a person’s career.

In many cases, successful entrepreneurs become VCs after exiting their successful startups.

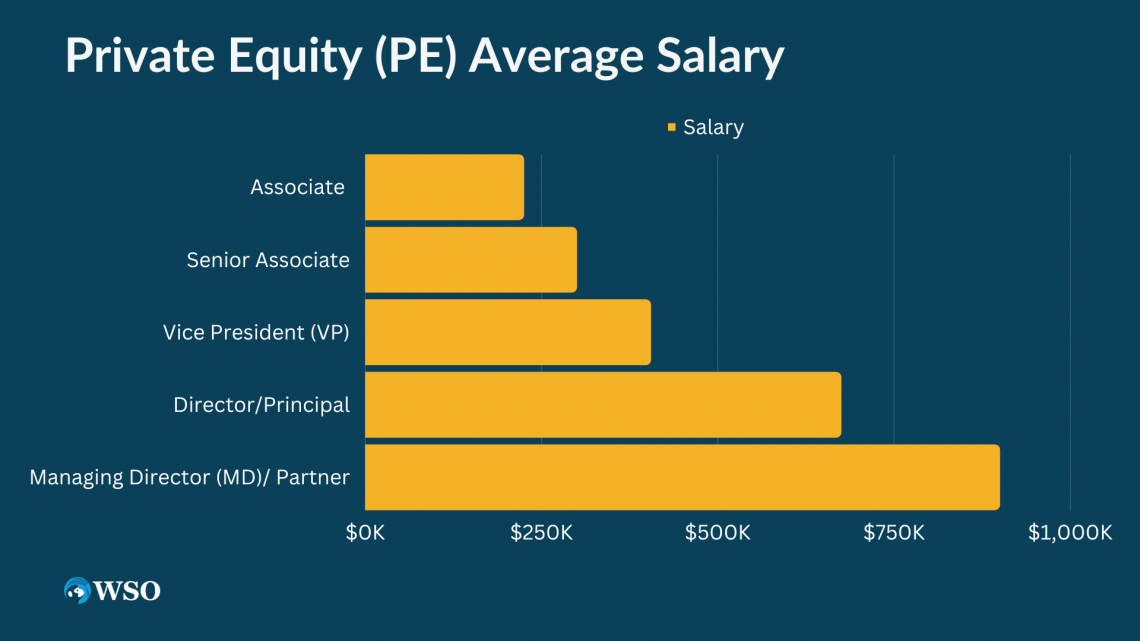

Private Equity (PE)

| Position | Salary |

|---|---|

|

Associate |

$150k - $300k |

|

Senior Associate |

$200k - $400k |

|

Vice President (VP) |

$260k - $550k |

|

Director/Principal |

$550k - $800k |

|

Managing Director (MD)/ Partner |

$800k - $1M+ |

Typically traditional PE guys make a lot more than their VC counterparts on account of the nature of the business.

PE usually has a higher proportion of successful deals, and although investments can take 3-5 years to pay off, they usually have a much shorter time frame than that of VC.

PE firms are compensated based on performance and size, with more weight towards the former.

Many private equity firms have 2 and 20 income structures, as they collect 2% on assets under management and 20% of the profit made from investments.

In most cases, the share of the carry is reserved for those in more senior ranks such as VP, with the largest share of the pie going to the MD.

As opposed to VC, PE work is typically much more numbers-oriented, and there are fewer fun dinners and entrepreneur chats.

Although the hours aren't as bad as IBD, working in PE can be fast-paced and full of long hours. A typical workweek in PE is usually around 50-60 hours.

PE is difficult to get into. Usually, PE firms recruit investment bank analysts that are looking to lateral into other industries.

In most cases, PE firms prefer that candidates get their MBA before becoming a senior associate and may even ask associates to leave and pursue their MBA before continuing again.

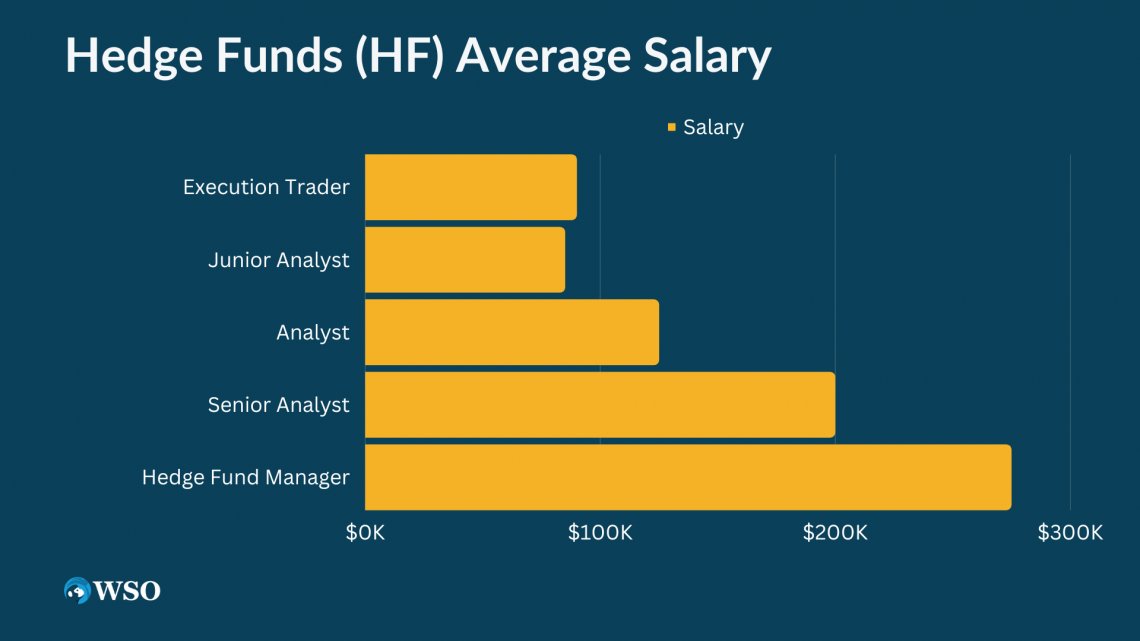

Hedge Funds (HF)

| Position | Salary |

|---|---|

|

Execution Trader |

$80k - $100k |

|

Junior Analyst |

$70k - $100k |

|

Analyst |

$100k - $150k |

|

Senior Analyst |

$150k - $250k |

|

Hedge Fund Manager |

$200k - $350k |

Hedge funds can be very lucrative businesses, especially for managers.

They usually operate with a 2 and 20 income system, meaning that they collect 2% on the assets under management and 20% of the earnings that they make from investments.

As such, the salaries of those in hedge funds can vary heavily depending on the size and success of the firm.

This is, of course, true in most areas of finance but perhaps carries extra weight in hedge funds.

Hedge funds typically recruit from investment banks, poaching analysts after they’ve had their fair share of 80 hour weeks.

Oftentimes, those in hedge funds have strong academic credentials, including a bachelor’s degree, internships, and other professional experience. They have also obtained their MBA or have a CFA charter in many cases.

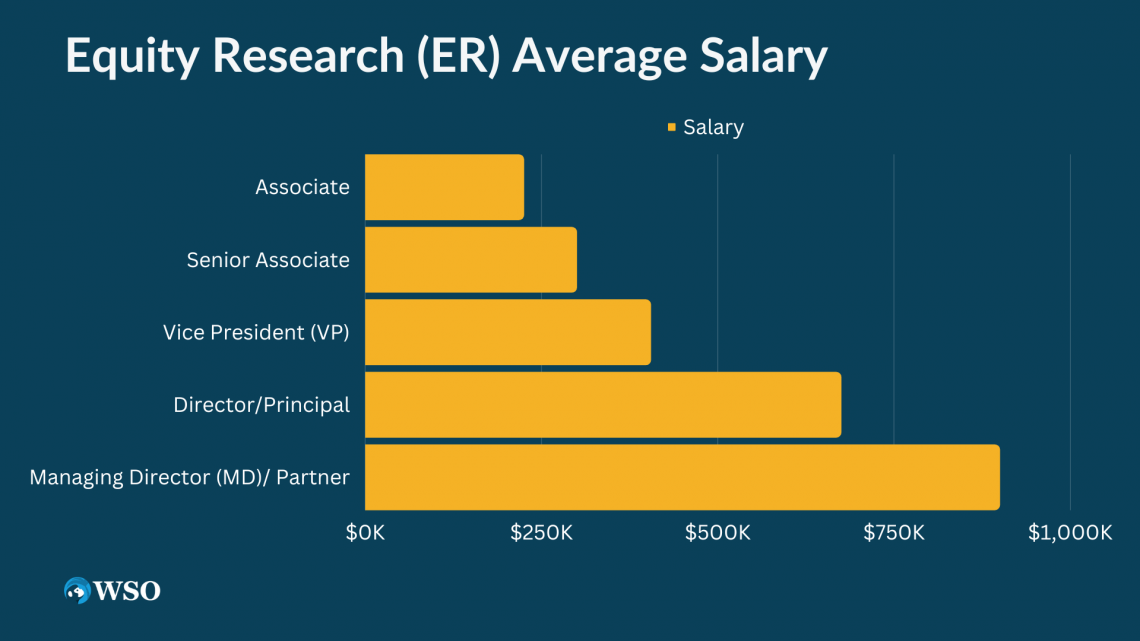

Equity Research (ER)

| Position | Median Salary |

|---|---|

|

Associate |

$150k - $300k |

|

Senior Associate |

$200k - $400k |

|

Vice President (VP) |

$260k - $550k |

|

Director/Principal |

$550k - $800k |

|

Managing Director (MD)/ Partner |

$800k - $1M+ |

Equity research is one of the most sought after jobs in finance behind investment banking and private equity. It offers high salaries and good bonuses (which are very dependent on performance).

The flip side is that equity research typically has fairly long hours, although slightly less than IBD associates may be expected to work between 60-80 hours per week.

However, hours decrease in more senior positions. It is also harder to climb the corporate ladder, and promotions can be slower in equity research than in other fields.

In addition, the work is far from the action, as most work involves scrutinizing large amounts of data for companies and giving recommendations.

Equity research has a lot of exit opportunities, and people in this industry often lateral into others such as asset management or hedge funds.

ER is very competitive and difficult to get into. Candidates for this industry should have a strong academic background with a bachelor’s degree, internships, and in many cases an MBA.

It is fairly rare for candidates to get into equity research as a new graduate, as roles are limited to those who have several years of relevant experience.

Other Jobs in Finance

Finance is a vast field, and many industries and jobs fall under the term’s umbrella. Above is a list of the salaries and brief descriptions of many of the most popular and highly sought-after roles within finance.

While they showcase the roles that embody much of the prestige of finance and are often what people think of, there are many other roles within finance.

Below is a list of some of the other jobs one can find within finance and their data on their salaries.

| Position | Median Salary | Lowest 10% | Highest 10% |

|---|---|---|---|

|

Accountant |

$74k |

$45k |

$129k |

|

Actuary |

$111k |

$66k |

$196k |

|

Bank Teller |

$33k |

$25k |

$41k |

|

Bookkeeper |

$42k |

$27k |

$64k |

|

Budget Head |

$81k |

$54k |

$117k |

|

Business Valuation Specialist |

$69k |

$53k |

$64k |

|

Commercial Insurance Broker |

$75k |

$40k |

$119k |

|

Commercial Real Estate Broker |

$60k |

$24k |

$108k |

|

Comptroller |

$71k |

$49k |

$114k |

|

Credit Analyst |

$75k |

$44k |

$147k |

|

Energy Risk Professional |

$89k |

$20k |

$157k |

|

Enrolled Agent |

$52k |

$33k |

$80k |

|

Financial Advisor |

$89k |

$44k |

$208k |

|

Financial Planner |

$65k |

$42k |

$102k |

|

Insurance Agent |

$52k |

$29k |

$128k |

|

Investor Relations Manager |

$87k |

$54k |

$130k |

|

Management Consultant |

$90k |

$63k |

$147k |

|

Mortgage Broker |

$58k |

$36k |

$124k |

|

Mortgage Originator |

$64k |

$34k |

$134k |

|

Notary |

$42k |

$40k |

$64k |

|

Realtor |

$60k |

$25k |

$174k |

Researched and authored by Ethan Sweeney | LinkedIn

Additional Resources

Thanks for reading our salary guide! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?