Petty Cash

A small amount of money that is kept on hand and can be utilized for handling small-dollar purchases

What Is Petty Cash?

Petty Cash is a small amount of money that is kept on hand and can be utilized for handling small-dollar purchases. For example, purchases that are not over $500 during the day-to-day operations of a business. Although the funds are small, they need proper management to prevent the company's money from going to waste.

In large corporations, each department may have its petty cash fund for small expenses to be accounted for all the time.

It is often wiser to have a petty cash policy in the business. This is essential because it ensures that employees know the procedures and that everyone can be held accountable for their actions in the future.

A petty cash receipt is usually used to fill out the information about each transaction during business operations and maintain internal controls.

Petty Cash Uses

These funds can be used for the following transactions:

-

Reimbursing employees for small expenses

-

Office Supplies

-

Packing for work trips

-

Coffee and snacks during meetings

-

Postage stamps

Employees/Employers cannot use it for the following:

-

Personal reasons

-

Prizes and Awards

-

Travel Expenses

-

Cashing Checks

-

Loans

Every time coins and bills from the fund are used, all transactions are to be recorded on financial statements. The funds will be listed in the balance sheet’s current assets section. It is usually near the top of the balance sheet because it is highly liquid.

Recording Petty Cash

When a company does not have a formal cash fund, paying out of pocket for small expenses can hurt the business in the long run. Therefore, knowing how the money is spent in a business is essential. Additionally, the number of tax-deductible expenses the company incurs grows.

Typically, each department appoints a custodian responsible for the small-dollar funds. The duties of a custodian include:

-

Accountable for managing and documenting accurate records of the funds.

-

Maintain records of cash used daily in the office (with or without notice)

-

Ensure that the funds are kept in a secure and safe location

To set up office spending money, the following steps must be followed:

-

First, create a little cash account in the chart of accounts. A Chart Of Account (COA) is a financial and organizational tool that lists every account in a company.

-

Deposit funds into the account. The custodian can deposit funds by writing a check.

-

Set up a petty cash log. The custodian should track all the little cash funds on the business's accounting records.

-

The small cash fund should be replenished by the custodian periodically. This is crucial because it avoids mistakes and misunderstandings in a business.

Journal entries are recorded when a custodian needs cash and receives new funds. However, if a purchase has been made with a small change, it is unnecessary to make any journal entries. The journal entry for more money is a debit to the little cash fund and cash credit.

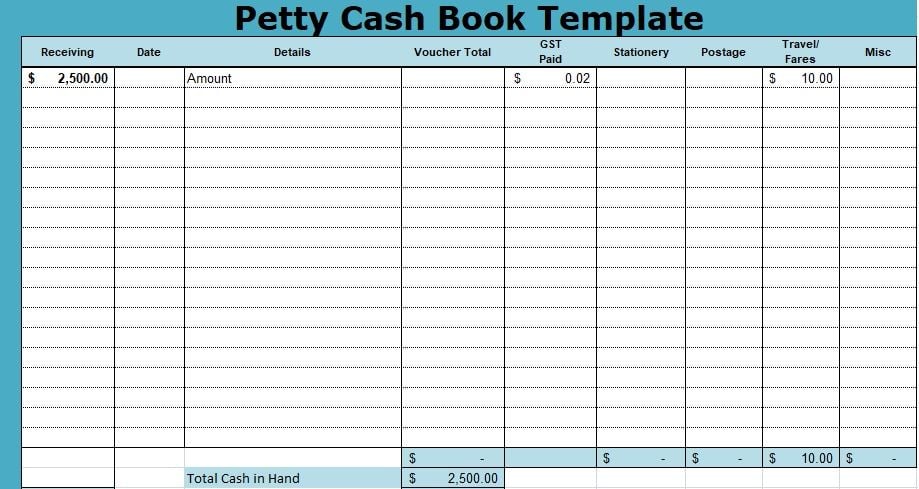

Below is a sample of a Small Cash Book Template. This template is accessible to employees and is easy to follow. Employees must accurately fill it when necessary.

How To Manage Petty Cash

Although non-cash transactions are becoming increasingly popular and more of a norm, bank notes are needed to cover small expenses around the office. Even though the funds spent on business expenses are small, managing the funds is still far-reaching.

Managing little cash funds ensures that company money is not misused and all transactions are correctly documented. In addition, this system protects businesses from cases of fraud and theft.

-

Track all the small cash expenses through the bookkeeping system to ensure that tax-deductible expenses are recorded.

-

Set a limit on purchases that a business can make from little funds. For example, a limit can be anywhere from $25.

-

Propose and introduce a small cash policy. The custodian should write all the necessary details in the policy.

-

Record disbursement. Reimbursements should be entered into a log of small cash transactions.

-

The custodian should require receipts to enhance internal control.

-

Monitor the use to ensure that the funds were used for eligible things.

-

Reconcile little cash. The little cash should be reconciled daily to make sure that the balance of the fund is correct. When the total of all receipts is calculated, it should match the disbursed funds.

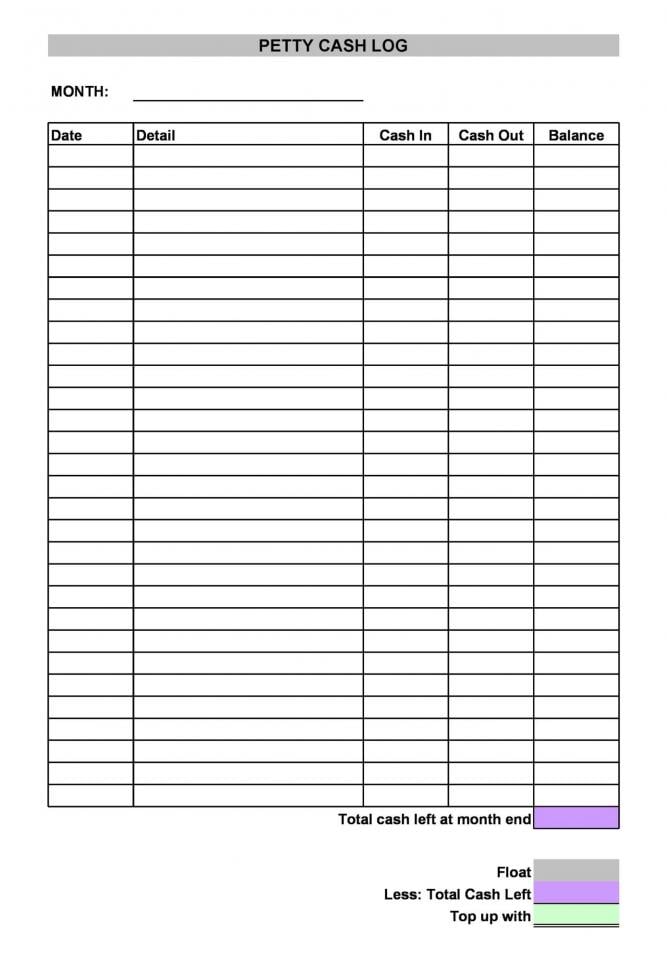

Here is a sample of a small cash log by templatelab.com

Petty Cash Vs. Cash on Hand

These terms are usually confused with each other since they intersect. However, these two terms are different and serve different purposes.

For example, little cash is generally stored in a safe box and does not require the use of a credit card or a cheque, whereas money on hand is a mix of all assets.

Petty Cash refers to the company's funds on hand for small conveniences. Employees spend this money on expenses around the office. It is technically cash on hand because all little cash is a form of cash on hand, but not all cash on hand is little cash.

Cash on Hand is the sum of all the money (in cash) available in a business. This means any accessible cash the business or liquid funds have.

The term liquid funds is used when talking about Cash on Hand because, in the financial world, it is a company's liquid assets. Sometimes, it does not mean literal "Cash on Hand." The cash does not have to be in physical form like petty cash.

Cash on Hand is money received from customers or reimbursed to customers. This can be amounts of money that have not been deposited in the bank or small bills and coins. It includes all accounts, assets, and other forms of payments.

Advantages and Disadvantages of Petty Cash

Small money amounts remain one of the most convenient and quickest ways to make purchases worldwide. However, some debit and credit card machines charge an extra $0.50 when paying with a card. Using cash can help you avoid additional charges.

It works well with small expenses like tipping drivers for employees who work overtime or food delivered during team-building meetings in the office.

Cash is also appropriate for taking a client out to lunch to discuss a contract or to have a discussion. However, in cases of power cuts, using credit cards regularly may backfire.

Some companies do not give employees access to company credit cards, and some prefer not to wait to be reimbursed for the pocket money they used for office expenses. Therefore, pocket money in businesses is an easy alternative.

However, it is hard to keep track of large companies' small outgoing amounts of cash, which may lead to overspending and theft.

Most restaurants and retail stores have a strict "no cash policy." Pocket money has become outdated and unrealistic for making more significant expenses. Many alternatives include credit cards, debit cards, PayPal, and apple pay. Money is useless because these payments can be traceable.

Pros are:

-

Convenient and easy for small purchases

-

A simple alternative to credit/debit cards

-

Less oversight and accessible

Cons are:

-

Outdated and Inefficient

-

Susceptible to Abuse (theft/fraud)

-

Requires much work: monitoring and record-keeping

Is A Petty Cash A Current Asset?

An asset is any resource controlled or owned by a business or an economic entity. A popular type of asset is a current asset. A current asset refers to any asset that can be sold or exhausted through the operations of a business.

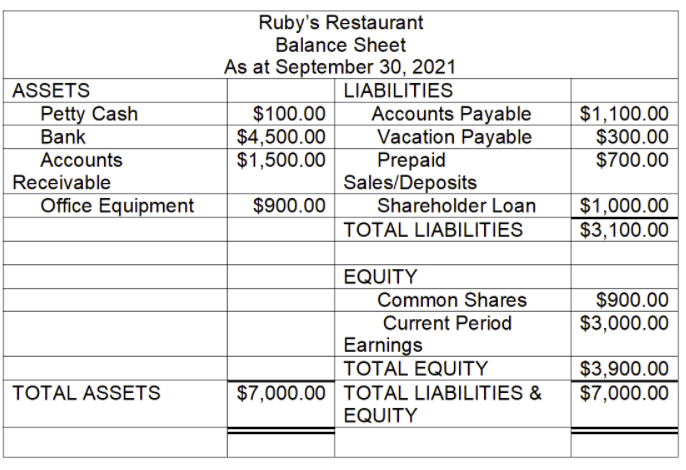

For example, it is a current asset in a company because it provides an economic benefit within an industry. In addition, little cash appears within the existing assets of a balance sheet.

A balance sheet is a financial statement that summarizes a company's assets and liabilities. This sheet is crucial because it tracks a company's finances and gives investors insight into a company.

Here is a petty cash entry on a balance sheet from Ruby's business.

Petty Cash and Taxes

Since cash funds are used strictly for business purposes, a business can be able to deduct them from taxes at the end of the year. When a business documents all its cash expenses, this increases deductions and lowers the company’s tax bill. That is why it is essential to:

-

Keep receipts and petty cash vouchers for all minor cash purchases.

-

Document all minor cash purchases.

-

Periodically make sure that all money has been accounted for accurately.

-

Keep cash in a locked, secure drawer where only the custodian can access the key.

-

Balance the small-dollar account.

or Want to Sign up with your social account?