Zero Lower Bound

An economic concept that refers to the point where interest rates can’t fall below 0%.

What Is Zero Lower Bound?

The Zero Lower Bound (ZLB) is an economic concept that refers to the point where interest rates can’t fall below 0%. It's a monetary tool used by central banks to generate economic growth by reducing short-term interest rates to zero, if necessary.

The concept of zero lower bound is relevant in recessionary economies when traditional policies aren't good enough to generate economic activity.

It's important to understand that ZLB exists because financial assets like bonds carry interest, while cash carries a zero nominal interest rate.

If bond returns become negative, investors seek to profit from negative interest rates by borrowing bonds and investing the proceeds in cash, creating a zero lower bound on nominal interest rates.

Besides government intervention, central banks have a crucial role in stimulating the economy. It does so by implementing an expansionary monetary policy.

Key Takeaways

- The Zero Lower Bound (ZLB) refers to the lowest possible level to which central banks can set short-term nominal interest rates.

- When interest rates reach zero or are close to zero, conventional monetary policy tools become ineffective, limiting the central bank's ability to stimulate economic growth and combat deflationary pressures.

- At the ZLB, traditional monetary policy measures such as reducing interest rates to stimulate borrowing and spending become ineffective.

- Central banks may resort to unconventional monetary policies, such as quantitative easing (QE) or forward guidance, to provide additional monetary stimulus and support aggregate demand.

Understanding Zero Lower Bound

Zero Lower Bound (ZLB) is also known by an alternate name as "Zero Nominal Lower Bound (ZNLB). It is most often characterized by interest rates that are close to zero.

This macroeconomic problem is known to cause liquidity traps. Liquidity traps are when interest rates become low and the consumers tend to store cash instead of spending or investing.

This situation, in which people and investors seek to take advantage of hoarding cash and not spending or investing in bonds or other financial instruments that may yield higher benefits, will contribute to liquidity traps.

This reaches the point where the central bank can no longer stimulate the economy during a slowdown or a recession.

In such cases, we can say this central bank policy has failed. This is because the central banks can't stimulate economic growth since they have lowered interest rates, and people are indifferent between holding cash or investing in instruments.

American Economist Paul Krugman defined liquidity traps and the zero lower bound by the following:

“A liquidity trap may be defined as a situation in which conventional monetary policies have become impotent because nominal interest rates are at or near zero rates, creating the zero lower bound.”

He continued,

“injecting the monetary base in the economy has no effect since the monetary base and bonds are viewed by the private sector as perfect substitutes.”

What did he mean by perfect substitutes? Because interest rates are almost zero percent, bonds have an interest near zero. In the meantime, cash also has a zero return. Therefore, one would be indifferent between holding bonds versus holding cash.

If the central banks can’t reduce interest rates any further, monetary policy will be useless for them in trying to save the economy. Hence, they will resort to other non-mainstream policies to reverse the recession and promote growth.

Ways To Boost Money Supply

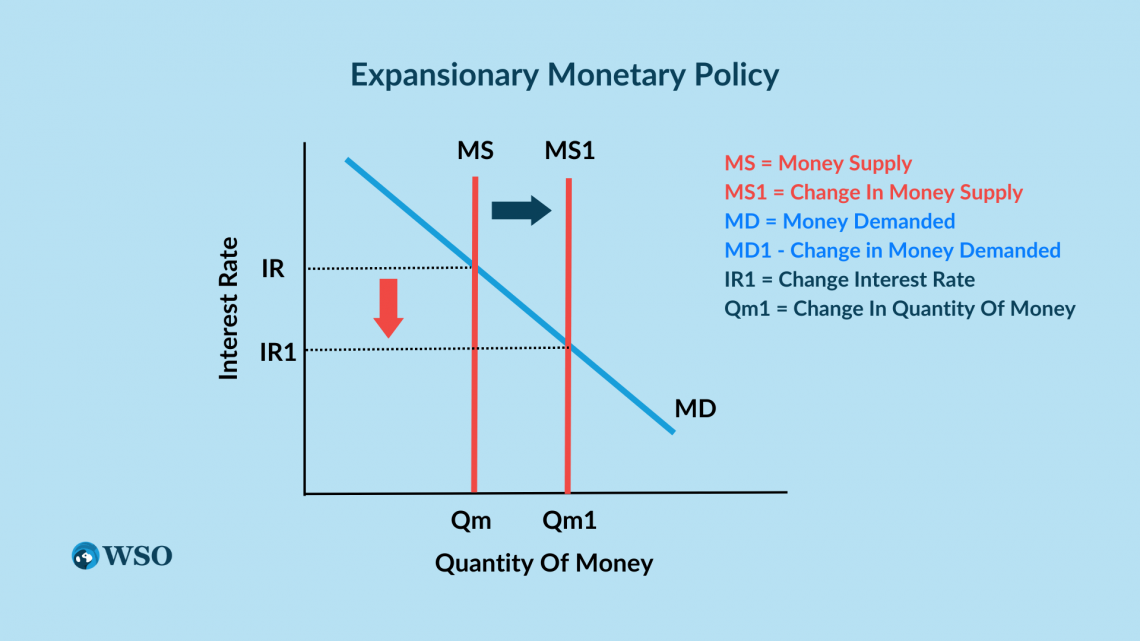

In essence, expansionary monetary policy requires the central bank to increase the money supply in the economy. Multiple methods are available to boost the money supply.

Some of them include:

- Reducing Reserve Ratio: The reserve ratio is the proportion of deposits that banks safeguard in their accounts. Banks should decrease the amount of money they must keep in their vaults. This gives banks more opportunities to create money by lending it to households and firms.

- Central Bank Acquisitions: To increase the money supply, the central bank should conduct open market purchases, in which it buys government bonds and injects money into the economy. To decrease the money supply, it sells government bonds and collects money from the economy.

- After increasing the money supply, the economy is expected to gain more traction. That is because interest would decrease after an increase in the money supply. This will increase investment and consumption, hence boosting the economy.

- Printing More Money: The central bank or the regulatory body of the economy has the right to limit the amount of money that can be printed. An appropriate ratio should be determined for printing money, as excess money printing can cause havoc across the nation in terms of the demand and supply of goods and foreign exchange.

- Reducing Interest Rates: Decreasing the interest rate in an economy could encourage borrowing at lower costs to businesses, making them more profitable and promoting economic activity. Along with these two merits, the mortgage payments can also be made cheaper to be paid.

- Quantitative Easing: Central or Federal Banks can print money since they are the authority in the economy, which increases the bank's vault. They are effortlessly creating money out of nowhere. This created money can be used to buy assets and create cash reserves.

- Expansionary Fiscal Policy: In recessionary economies, the government can announce a decrease in taxes or an increase in spending to encourage economic activities. This combination may create a multiplier effect that leads to consumer spending and investments.

Money Market And Monetary Policy

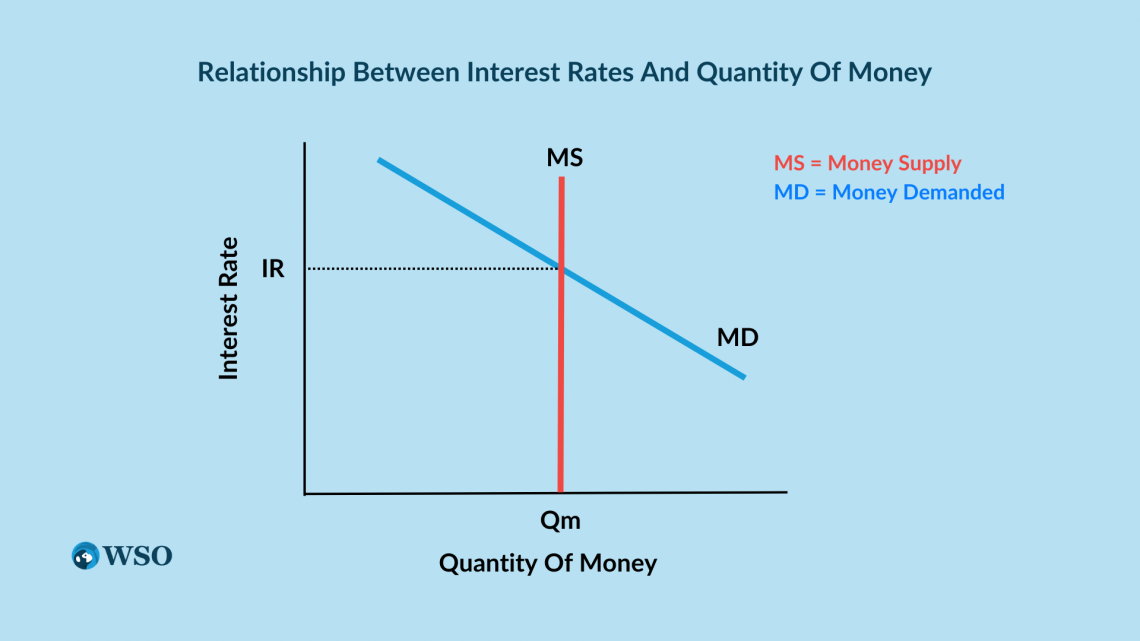

Discussing monetary policy always refers to the money market in the economy. The money market graph is composed of the demand and supply of money.

The demand for money shows the people’s liquidity preference. The supply of money is regarded as exogenously fixed and set by the central bank.

The two main components of the money market:

- Money demand is negatively related to the interest rate: People can either keep their money as cash or buy interest-bearing assets like bonds. The higher the interest rate, the more people would like to hold bonds and less cash, hence the negative relation.

- Vertical money supply: It has been vertical since the central bank decided it. The money demand and money supply together determine the nominal interest rate. Now, we turn to how monetary policy affects the interest rate in the money market. When the Fed increases the money supply, interest rates decrease.

- This decrease in the nominal interest rate stimulates the economy because lower interest rates encourage investment and consumer spending.

Causes of Liquidity Traps

As discussed, central banks can’t decrease interest rates below zero to jumpstart the economy because the rates are already very low. This, combined with individuals' and corporations' reluctance to invest and spend, creates a liquidity trap.

The most common causes of such liquidity traps are:

- No Desire To Purchase Bonds: When interest rates are close to zero, bondholders no longer want to invest their money by buying bonds. They would rather hold all their assets in cash. That is because they expect rates to rise in the future, which will cause bond prices to rise.

- Low Price Levels (Deflation): Very low interest rates, coupled with negative inflation rates, automatically increase the real interest rate. With deflation, stashing cash is more beneficial as it's common to speculate that its value will increase.

- Inelastic Demand For Investment: Generally, firms intend to invest more when interest rates are low. However, companies are unwilling to invest in recessions in a ZLB situation. The low levels of aggregate demand in the economy make investments unattractive for firms though the cost of borrowing is low.

- Saving Rather Than Spending: During economic downturns, firms and households are more cautious, saving a larger portion of their incomes and revenues. This pessimism decreases consumer spending levels and further intensifies the liquidity trap.

- Decreased Borrowing Because Of Recession: Sluggish economies in a recession generally require consumers and companies to pay off their debt. This behavior depresses spending because the agents in the economy are more concerned with paying off their debt.

- Risk Aversion: During recessionary periods and economic uncertainty, individuals and corporations prefer to hold cash instead of investing because they become risk averse depending on the uncertainties surrounding them. The reluctance to invest and preserve the liquidity is to protect the organization from potential economic shocks.

Challenges of the Zero Lower Bound

Zero lower bounds create a number of challenges for implementing economic and monetary policies. For starters, one of the primary challenges faced by an economy and monetary policy is the occurrence of liquidity traps as a result of lowering interest rates too much.

Other challenges include

- Ineffective traditional monetary policies

- Unconventional monetary policies

- Legal, regulatory, and tax changes

- Empirical evidence

Let us discuss the one-by-one:

- Liquidity Traps: The implementation of lower nominal interest rates or negative interest rates will not encourage citizens to invest, rather it kind of promotes hoarding cash since there is little or no sense in investing when the nominal rate of cash and bonds (or, other financial instruments) are the same.

- Ineffective Monetary Policy: Once the central banks lower the interest rate near or at zero (traditional monetary tool), they can't lower it further due to macroeconomic limitations. This adjusting of the short-term interest makes the traditional monetary and fiscal policies less effective, since, it will make people hoard cash.

- Unconventional Monetary Policies: Central banks can resort to unconventional macroeconomic policies such as quantitative easing, forward guidance, and negative interest rates that may help to rejuvenate the economy (since the effectiveness of such policies is debatable).

- Legal, Regulatory, And Tax Challenges: Central banks must implement corrective legal, regulatory, and tax changes to make negative interest rate policies work. This will discourage individuals and businesses from hoarding cash when they transfer to adverse territory.

- Lack Of Empirical Evidence: There is a lack of evidence and data that lowering the interest rates, using a negative interest rate policy (NIRP), or whether the ZLB violates the economic laws can unlock self-levied limitations and contribute to positive response in a negative scape.

In essence, it is important to note that the factors briefly discussed are significant ones that may create economic shocks across the economy and may impact the overall values of financial assets. The impact will, inturn, push to economy toward a collapse.

Overcoming the Zero Lower Bound

An economy can overcome the ZLB by:

Inducing Higher Inflation Rates

The main objective is to increase spending and income in the aggregate economy to pull it out of a recession. At the ZLB, where interest rates are close to zero, the real interest rates on assets such as bonds tend to be high when deflation occurs.

Therefore, if the real interest rate decreases, people will be more willing to invest and spend their money.

The most practical means to achieve this is by inducing higher positive inflation levels. This way, the real interest rate declines, encouraging consumers to spend their saved money on goods and services.

Recall Fisher’s Equation, which establishes a relation between the nominal interest rate, real interest rate, and the rate of inflation.

It states that the real interest rate is approximately equal to the nominal interest rate minus the inflation rate.

r = i - π

Where,

-

r is the real interest rate

-

i is the nominal interest rate

-

π is the rate of inflation

According to this equation, an increase in the inflation rate will reduce the real interest rate, especially at the zero lower bound.

For example, suppose an economy in recession is at the ZLB rate. The recession has caused deflation at a rate of 3%. According to the Fisher Equation, the real interest rate should be:

r = i - π = 0 - (-3) = 3%

As discussed, it is suitable to decrease the real interest rates, in this case, to boost consumer spending and revive the economy. That is achieved by targeting a certain inflation rate. For example, say the government targets an inflation rate of 1%, the real interest rate would be -1%.

For example, if the government wants to reduce the real interest rate further (maybe because the recession is more severe than usual), it targets a higher inflation rate of 3%. This will create a large incentive to borrow and spend.

Another advantage of this strategy is that higher rates of inflation are likely to raise economic expectations, which will boost household and firm expenditures.

However, this approach may also have a downside. Targeting slightly higher inflation rates will increase expected future inflation among the economy's agents.

Sometimes, inflationary expectations become embedded. This psychology produces uncertainty in the economy, which may be the opposite of the desired effect.

Fiscal Policy

As discussed at the beginning of this article, monetary policy is ineffective at the zero lower bound. Increasing the money supply won’t bring an economy out of recession. Of the two main macroeconomic policies, only fiscal policy proves to be effective in reviving the economy.

Fiscal policy includes increasing government spending or decreasing taxes. Increasing government spending directly increases aggregate demand in the economy.

This increase in demand will have a multiplier effect on economic performance, as all the saved money will start getting spent, and the economy will start growing.

Bond yields are generally low at the lower zero bounds because of low-interest rates. This makes it cheaper for the government to buy bonds and borrow money to implement fiscal policy. However, the downside is that it greatly increases public debt.

Negative Interest Rates

One more uncommon and controversial policy that monetary authorities can adopt is charging negative interest rates. This essentially breaks the lower zero bound. As a depositor, you would have to pay money instead of receiving money on your deposits.

Charging negative interest rates has three main purposes:

- Encourage banks to lend out more of their deposits

- Incentivize households and companies to invest and spend their money instead of hoarding it

- Increase aggregate demand in the economy

The Zero Lower Bound and the 2008 Recession

Following the Keynesian economic model, most central banks utilize monetary policy to control interest rates in the economy. However, decreasing interest rates during major recessions may not help stimulate the economy. That is because interest rates are already low and close to zero percent.

The ZLB was a great challenge for the central bank as it limited the ability of central banks to encourage economic growth through traditional policies.

Unorthodox measures and uncommon policies were used to help the economy escape the liquidity trap during the 2008-2009 financial crisis. The use of non-traditional practices and policies led to a challenge for central banks to lower interest rates to encourage investments and spending.

Upon the start of the recession in early 2008, the major central banks of the world, including the European Central Bank, the Bank of England, and the US Federal Reserve - started lowering their interest rates.

However, they eventually reached the ZLB by 2009. For example, the bank rate in England decreased from 5% to 0.5%.

This inability of the central banks to promote investments and savings, coupled with the constraint on bringing down interest rates any further, led to the rise of liquidity traps, leaving monetary policy completely ineffective.

Since they could no longer lower interest rates to save the economy, they were forced to adopt other unconventional policies, the most important of which was quantitative easing.

What Is Quantitative Easing?

Quantitative easing occurs when the government buys bonds to cut interest rates on savings and loans.

Quantitative easing starts with the central bank buying government or corporate bonds. This drives up the price of those bonds, decreasing the yield (essentially the interest rate).

As a result, the decrease in government and corporate bond interest rates will lead to a decrease in the interest rate of household and business loans. Eventually, boosting spending and bringing the economy out of recession.

Another way that quantitative easing stimulates the economy is by affecting the prices of assets like stocks and real estate.

Suppose the central bank buys a hefty amount of bonds from a pension fund. The pension fund puts that cash to work by investing it in assets of higher return like shares.

This action will increase the prices of those shares, making their owners (households and businesses) wealthier and increasing their spending.

Since 2008, the Fed has done over $4.5 trillion of quantitative easing. The Bank of England has done $940 billion of quantitative easing.

Implementing Negative Interest Rates

After the 2008-2009 recession, some countries also tried another alternative: charging negative interest rates. Central banks decrease interest rates to stimulate the economy, and eventually, some of them break out of the ZLB rate to further boost recovery.

When the interest rate is negative, you get the interest for borrowing money from the bank instead of paying interest. This greatly encourages households and businesses to start spending during economic downturns.

Countries that currently have negative interest rates:

-

Switzerland (-0.25%)

-

Denmark (-0.60%)

-

Japan (-0.10%)

Sweden was the first country to implement negative interest rates in 2009, after which the European Central Bank, Bank of Japan, and other major central banks followed suit.

Switzerland, for example, had a unique purpose for its negative interest rates. The Swiss National Banks (SNB) aimed to prevent the country’s currency from being overvalued, so they cut interest rates and even broke the zero lower bound.

Higher interest rates drive the value of that country’s currency. That is because higher interest rates attract capital into that country, increasing the demand for that country’s currency.

Why did Switzerland aim to suppress its currency?

Because when the Swiss Franc goes up in value, that significantly damages the export industry. Swiss goods would be more expensive to other countries, so other countries would stop buying Swiss goods.

SNB keeps interest rates below the zero lower bound partly to protect the export industry. It will continue to do so until it becomes possible to slightly raise interest rates above zero without causing a large appreciation of the currency.

or Want to Sign up with your social account?