Monetary Policy

An economic strategy that controls the volume and pace of expansion of the money supply in a country.

What Is Monetary Policy?

Monetary policy is an economic strategy that controls the volume and pace of expansion of the money supply in a country. It is a potent instrument for controlling macroeconomic factors like unemployment and inflation.

Policies are carried out when Instruments are used, which include changing the amount of money in the economy, purchasing or selling government property, and changing interest rates. The central bank or a similar regulatory authority makes these rules.

The Federal Reserve Bank of the United States carries out a monetary policy under a twin mandate to maximize employment while containing inflation.

These policies regulate the total quantity of currency in a country and the channels or methods through which it is distributed.

Economic factors like inflation rate, gross domestic product, and sector- and industry-specific growth rates influence the monetary policy strategy. Adjusting interest rates is central banks' common tool to implement this policy.

Commercial banks face increased interest rates, making borrowing more expensive for businesses and individuals. This can lead to reduced borrowing and spending, which can help control inflation or stabilize an overheating economy.

Conversely, banks can pass lower rates to their clients when interest rates decrease, making borrowing more affordable. This promotes economic growth and investment.

The central bank also sets foreign exchange rates, purchases or sells government bonds, and adjusts the minimum amount of cash banks must hold in reserves.

Key Takeaways

- Monetary policy refers to the measures and actions employed by a monetary authority or country's central bank to manage the economy's interest rates, money supply, and credit conditions.

- Interest rate changes and adjustments to bank reserve requirements are examples of monetary policy strategies.

- It is usual to categorize monetary policy as either expansionary or restrictive.

- The United States Federal Reserve frequently employs the discount rate, free market operations, and the need for reserves as its three primary monetary policy tools.

- Granting political independence to central banks is a common practice to ensure their effective implementation of monetary policy.

- Through forward guidance, central banks express their expectations and objectives for monetary policy.

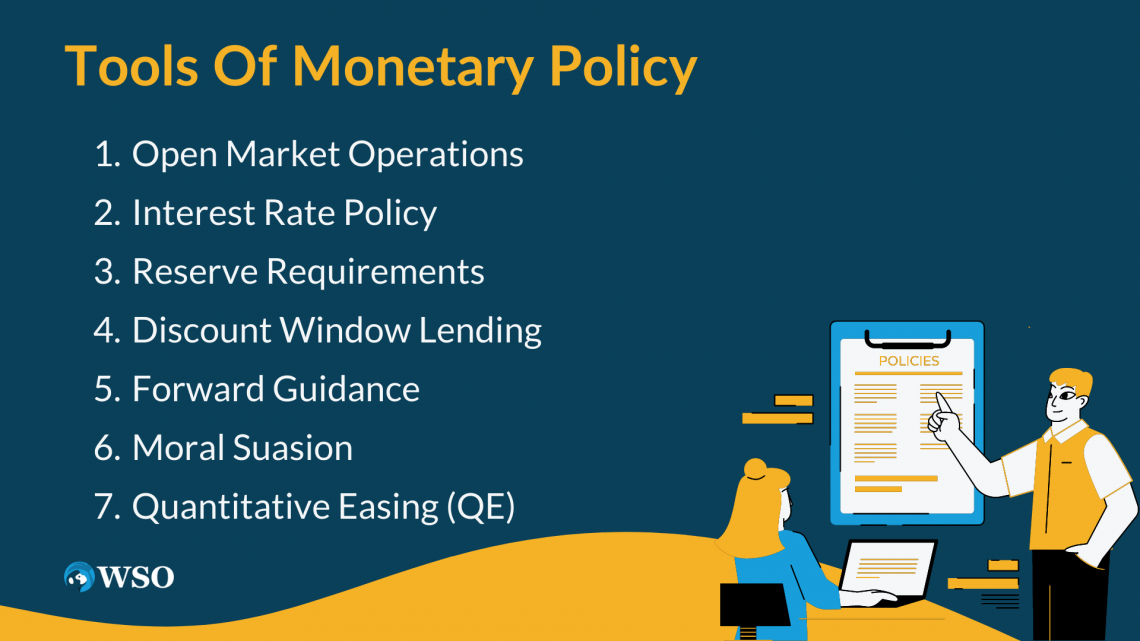

Tools Of Monetary Policy

Central banks employ various tools to actively manage monetary policy and influence the money supply, interest rates, and broader economic conditions.

These tools shape and steer these variables to achieve desired economic outcomes and maintain financial stability.

The major tools used can vary depending on the central bank and the prevailing economic circumstances. Here are some common monetary policy tools:

The central bank buys and sells government securities (bonds) in the open market.

Conversely, when it sells securities, it reduces the money supply. Open market operation are primarily used to control short-term interest rates and manage liquidity in the banking system.

Buying or selling securities is an Open market operations is primarily used to control short-term interest rates and manage liquidity in the banking system.

Note

Selling securities helps manage excess liquidity and prevent potential inflationary pressures.

2. Interest Rate Policy

Central banks set and adjust benchmark interest rates, such as the policy or overnight lending rates. By increasing or decreasing these rates, central banks can influence borrowing costs for banks, businesses, and consumers.

By increasing or decreasing these rates, central banks can directly impact borrowing costs for banks, businesses, and consumers. When RBI increases interest rates, borrowing becomes more expensive, slowing economic activity.

Conversely, lowering interest rates reduces borrowing costs, encouraging borrowing and Promoting economic growth. Central banks use this tool to manage inflation, promote or control economic growth, and stabilize financial markets.

Note

Central banks employ this tool to manage inflation, stimulate economic growth, and maintain Achieving financial stability.

Higher interest rates tend to curb borrowing and spending, thereby controlling inflation, while lower rates encourage borrowing and stimulate economic activity.

3. Reserve Requirements

Central banks mandate that commercial banks hold a certain percentage of their deposits as reserves. By adjusting reserve requirements, central banks can influence the amount of money banks can lend and the liquidity available in the financial system.

Lowering reserve requirements gives banks more funds to lend, promoting economic activity, while increasing requirements restrict lending capacity.

4. Discount Window Lending

The central bank may lend funds directly to commercial banks through its discount window. In addition, banks can borrow from the central bank at a specified interest rate during liquidity shortages or financial distress.

Note

The discount window lending rate is a benchmark for other economic lending rates. It influences the rates at which banks borrow from each other and can indirectly impact other lending rates in the economy, playing a role in shaping overall borrowing costs and credit conditions.

5. Forward Guidance

Central banks use forward guidance to communicate their future monetary policy intentions. By guiding on the expected path of interest rates or other policy measures, central banks aim to influence market expectations and long-term interest rates.

Forward guidance helps shape borrowing costs and economic behavior before policy changes occur.

6. Moral Suasion

Central banks employ moral suasion by directly communicating with banks and other financial institutions.

Central bank officials can influence market participants' behavior and actions through public statements, speeches, or private discussions, encouraging prudent lending practices or policy compliance.

Note

By speaking with banks and other financial institutions directly, central banks employ moral suasion to persuade them.

Central bank personnel promote responsible lending practices, policy compliance, and general behavior that aligns with the central bank's aims through public remarks, speeches, or private conversations, promoting financial stability and efficient monetary policy transmission.

7. Quantitative Easing (QE)

Central banks may implement QE programs in extraordinary circumstances. For example, QE is often used to support economic recovery during severe financial stress or when traditional policy measures have a limited impact.

Central banks use quantitative easing (QE) to stimulate the economy during financial stress. They purchase government securities, like bonds, and Administer a fresh injection. They created money in the economy.

Note

Quantitative easing aims to boost the economy by having central banks create fresh money to buy financial assets.

It is employed in outstanding contexts when conventional policy measures are insufficient to boost liquidity, bring down interest rates, and promote financial stability and economic recovery.

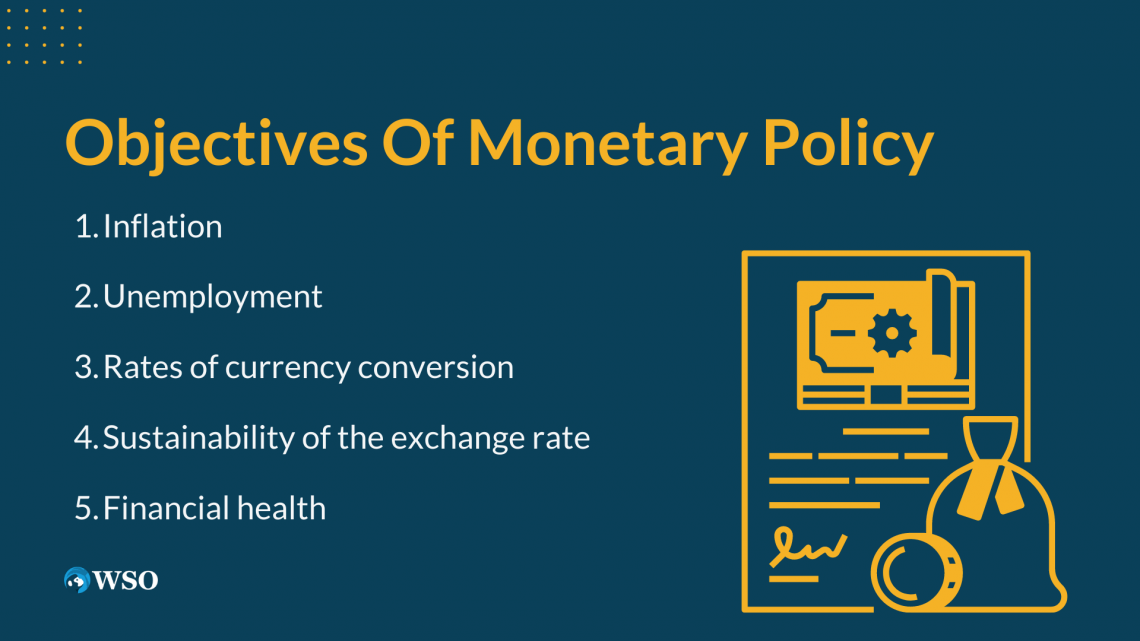

Objectives Of Monetary Policy

Management of inflation or unemployment and preservation of currency exchange rates are the major goals of monetary policy.

Let us take a look at some of the objectives:

1. Inflation

Inflation levels might be the objective of monetary measures. A little inflation is good for the economy. A contractionary policy can combat rising inflation. Managing inflation is one of the primary objectives of monetary policy measures.

Central banks use different tools.to influence the money supply, interest rates, and overall economic conditions, with the goal is to achieve price stability. And they were keeping inflation levels within a desired target range.

To maintain an acceptable level of inflation under control. Price stability promotes economic certainty, preserves the purchasing power of money, and enables long-term sustainable economic growth.

Note

Price stability is a key objective of monetary policy as it promotes economic certainty, protects the buying power of money, and creates the groundwork for sustained long-term economic growth.

With no uncertainty brought on by abrupt or sudden price swings, companies and consumers can make wise economic decisions when prices are steady.

The value of money is preserved throughout time thanks to this stability, ensuring that investments and savings keep their purchasing power. It promotes investment, confidence, and effective resource management, which supports sustained economic growth and prosperity.

Central banks use these policy instruments to handle elements affecting price stability, such as managing inflation and general economic circumstances.

2. Unemployment

The policy can impact the level of unemployment in the economy. For instance, an expansionary monetary policy tends to reduce unemployment since it encourages economic activity and the labor market's growth.

The level of unemployment in the economy is influenced by Monetary policy. For example, it can reduce unemployment by fostering economic activity and promoting growth in the labor market.

Note

Central banks utilize various tools to shape economic conditions and encourage employment opportunities.

3. Rates of currency conversion

The central bank can use monetary policy tools to influence the exchange rates between its currency and other currencies.

For example, the central bank may adjust the money supply through measures like open market operations rather than relying on budgetary power. By managing the money supply, central banks can indirectly impact exchange rates and maintain exchange rate stability.

4. Sustainability of the exchange rate

Central banks may also work to keep their currency's exchange rate steady. A stable rate may help with international trade, draw foreign capital, and give economic certainty to people and companies doing business abroad.

Note

Central banks maintain a stable exchange rate for their currency. A stable exchange rate promotes international trade by providing certainty in the value of currencies for businesses engaged in cross-border transactions.

A stable Exchange Rate helps attract foreign capital by reducing the risks associated with currency fluctuations. Moreover, a stable exchange rate contributes to economic certainty for individuals and companies conducting business abroad, enabling better planning and risk management.

A financial system is said to be stable when it is strong, resilient, and able to absorb shocks and disturbances while still carrying out its essential tasks effectively.

Note

It covers the general health and integrity of the financial system and the stability of financial institutions, markets, and infrastructure.

Expansionary vs. Contractionary Monetary Policy

Central banks' two basic strategies are to control the economy and affect economic activity: contractionary and expansionary monetary policy. Objectives mentioned above are pursued through the implementation of various policy tools.

1. Expansionary Monetary Policy

This policy is employed when the central bank seeks to stimulate economic growth and increase aggregate demand. The key features are:

a. Lowering interest rates

The central bank decreases interest rates to encourage borrowing and investment, making it cheaper for businesses and individuals to access credit. Stimulates consumer spending and business investment, leading to increased economic activity.

For example, individuals may find obtaining mortgages, auto, or personal loans cheaper. Enabling them to make significant purchases or investments they might have postponed at higher interest rates.

Note

The increased consumer borrowing can lead to higher spending on housing, vehicles, or other goods and services, boosting economic activity.

b. Decreasing reserve requirements

The central bank can reduce the reserves that banks are required to hold, freeing up more funds for lending and increasing the money supply in the economy. This decrease in reserve requirements frees up more money for banks to lend to people and companies.

Banks are enticed to enhance their lending operations by having greater liquidity accessible since they must retain lower reserves. The amount of money in the economy increases as banks extend more loans.

When banks offer loans, fresh deposits are made in borrowers' accounts. The money supply is increased due to the newly made deposits, essentially raising the total quantity of money in circulation.

Note

An increase in Money Supply also boosts liquidity and encourages banks to provide more loans to businesses and individuals.

c. Conducting open market operations

The RBI purchases market-traded government securities to add money to the economy. It boosts consumption, expands the money supply, and brings down the cost of borrowing.

2. Contractionary Monetary Policy

This policy is implemented when the central bank aims to slow down an overheating economy, control inflation, or reduce excessive borrowing. The main characteristics are:

a. Raising interest rates

The central bank raises interest rates to deter borrowing and make loans to people and companies more costly.

Note

Higher interest rates cause a decline in company investment and consumer expenditure, which lowers aggregate demand.

b. Increasing reserve requirements

The central bank raises the number of reserves banks must hold, reducing the funds available for lending. It restricts credit availability, decreases the money supply, and helps curb excessive borrowing.

c. Conducting open market operations

The central bank sells government securities, absorbing money from the economy. It reduces the money supply, increases interest rates, and dampens spending.

Monetary Policy And Exchange rates

Interest rates, money circulation, and market expectations influence exchange rates.

These factors can be significantly impacted by monetary policy.

1. The Importance of interest rates

Changes in them may impact exchange rates. When central banks increase interest rates, foreign investors get higher investment returns.

The indigenous currency is in more demand, which causes the exchange rate to grow. When interest rates are cut, the native currency may have less impact, which might result in a depreciation of the exchange rate.

2. Fluctuations in the currency of an economy

Have the potential to impact exchange rates. The central bank employs quantitative easing or other expansionary monetary policies. It puts more money in circulation.

Note

If the bank adopts a contractionary monetary approach to decrease the money supply, it may enhance the currency's value.

3. Price hikes

The control of inflation depends heavily on expectations. A central bank's actions to preserve price stability and manage inflation may impact exchange rates.

A nation's currency may appreciate if it has low inflation or is effective in containing it, which boosts investor confidence.

Conversely, high inflation rates or rising expectations can devalue a nation's currency and cause devaluation.

4. Market Expectations and Confidence

Central bank officials' comments and choices can influence market expectations, affecting exchange rates.

The currency's value increases as the market anticipates a central bank's decision to raise interest rates.

Conversely, currency depreciation and consequent changes in exchange rates may result if market expectations point to a more dovish attitude on interest rates or monetary policy.

Note

Exchange rates and monetary policy have a complex relationship influenced by several regional, global, and national factors.

Other factors that affect exchange rates include trade balances, investor sentiment, geopolitical developments, economic fundamentals, and geopolitical developments. Different countries and economic conditions may have different effects of monetary policy on exchange rates.

Researched and authored by Sethuraman | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?