Financial Distress

It occurs when a business or other organization cannot pay back its creditors and lenders

What Is Financial Distress?

Financial Distress occurs when a business or other organization cannot pay back its creditors and lenders. Companies that fail to meet their financial obligation are often highly leveraged and have a low per unit of profit and high break-even point.

- Stakeholder Support is reduced

- Inefficiency inside the firm increases

- Internal morale declines and decision-making becomes flawed

- The company engages in the selling of its major assets and merges with another firm

- Increased leverage ratios and constant negotiation with banks and creditors for new debts

- Filing for Bankruptcy

We can also say that employees of a distressed firm usually have low morale and higher stress caused by the increased chance of bankruptcy, which could force them out of their jobs.

Moreover, companies under such distress find it challenging to secure new forms of financing due to a decline in their creditworthiness.

Prospective investors who intend to invest in a potential company can usually look at its financial statements to determine its current and future financial health, then identify any signs of such distress. For instance, recurring negative cash flows on a company's cash flow statement may be considered a red flag.

Individuals who experience financial distress may find themselves in a situation whereby their debt exceeds their monthly income. These debts or financial obligations include rent payments, car payments, and utility bills.

People experiencing these situations may ultimately be forced to relinquish their assets, lose their homes, or face eviction.

What are the Signs of Financial Distress?

Very few people seem to discover the signs that a company is in such distress early on. Going back in history, we can recall the collapse of WorldCom and Enron, which surprised most of the world, including their investors.

Henceforth, identifying the signs of distress is of paramount importance for any company, as it will allow them to take the proper actions to solve any underlying issues.

Sign 1: Cash Flow Problems:

If a business is continually spending above its earnings, unless it is deliberate and intends to fund high-potential investments, it will lead to problems. Suppose the cash inflow is not sufficient to pay for all business expenses. In that case, this is a serious indication for any owners to look at their company's cash flow.

Reasons for a company's cash resources being depleted:

- High overhead costs

- Heavy debt loads and high-interest payments

- Poor Budgeting

- An Increasing amount of receivables

Sign 2: Defaulting on bills:

If the frequency at which a business defaults on its bills keeps increasing, it is a strong sign that it is underfunded, for instance, having difficulty collecting its accounts receivables. While defaults to vendors may impact supply and business relationships, defaults on loan repayment can damage credit.

Sign 3: Extended Terms:

Being slow to pay is not as bad as not paying. Still, it can certainly indicate that a business is in such distress. When a firm needs to delay payments to creditors, this can force those suppliers to cut off the supply of vital components/ raw materials.

Likewise, if we cannot effectively collect payments from debtors, it may give rise to future cash flow problems. Either way, sudden changes in these numbers should be investigated to ensure they are signs of something more serious for the company.

Sign 4: Falling Margins:

Long-term survival for a business is more closely tied to profit generation rather than sales volume. Declining margins for a business suggest that costs are rising while income is falling. This is hence a sign of poor financial health.

Other signs to consider include:

- Selling of operational Non-Current Assets to pay maturing debts

- Legal action initiated by undisputed debt holders

- Dramatic loss of confidence in the market reflected in a sudden plunge in share price

- Over-dependence on consumers who have become bankrupt

- Substantial investment in R&D (Research and Development) fails to deliver

- Fraudulent accounting practice by senior management

What are the factors that can lead to Financial Distress?

The factors can be numerous, but let's explain 5 most common factors that can lead to this undesired outcome:

1. Improper Budgeting

Creating budgets based on unrealistic sales, revenue, and expense projections can lead to financial struggles. Incorrect budget assumptions also lead to improper pricing strategies.

2. Poor debt management

Failure to manage your credit use can cause a variety of financial problems. For example, missing credit cards or loan payments can damage the credit score of a business and then decrease its ability to get new credit in the future.

3. Drifting Off Course

Many small to medium-sized businesses don't have a clear growth strategy. Lack of clear strategy, vision, objectives, and revenue are common reasons a company might drift off course. Common behaviors for businesses without a plan consist of trying to do too much and focusing on the wrong things.

4. Poor departmental performance

There is a lot of variation in this one. It could be sales not bringing in the numbers, marketing not delivering a return, finance restricting investment in growth, HR not developing or engaging talent, and technology not providing the proper infrastructure.

5. Decline in demand

External factors such as legal and regulatory change can cause a significant and instant decline in demand for a company's products. For instance, introducing a sugar tax law can curb demand for sugary drinks and hence affect the sales of firms in the beverage industry.

What are the solutions for companies and individuals In Financial Distress?

Below are the key solutions to limit the risks for a company:

- Develop a strategy to deal with major stakeholders (bank, key suppliers, shareholders, and employees). It is a prerequisite to communicating every change or decision taken within the business to all parties involved.

- Develop a marketing strategy to win new customers to diversify the customer segment

- Review the management team- ask the right questions, such as whether you have the right mix of staff with appropriate skills. If not, the existing team should receive the required training and mentoring to make them work-ready and efficient.

- Put in place a strong 13-week rolling cash flow to understand the cash inflow and outflow in the business and what areas to focus on.

| Source of Financial Problem | The Reason Why Difficulties Occur | Solution |

|---|---|---|

| Unemployment | Using credit for daily expenses on lower-income | Come up with a suitable budget and make sure to follow it. If employed, try to get a 2nd job or do more overtime |

| Divorce | It is hard to afford a house solely on one income stream. | Sell the property or even try generating revenue from the property |

| An addiction | Spending above your earnings while trying to satisfy the addiction | Get professional help and counseling to tackle the addiction problem |

Financial Distress And Altman’s Z-score Model

The Altman Z-score determines the company's strength by calculating its financial risk. It highlights the bankruptcy probabilities using various financial indices.

The formula is based on information found on an organization's income statement and balance sheet; as such, it can be readily derived from commonly available information.

The Z score is based on liquidity, profitability, solvency, sales activity, and leverage.

We can also say that given the ease with which the required information can be found, the Z score is a valuable metric for even an outsider who has access to a company's financial statements.

There are three Z-score models, each tailored for different types of businesses.

The first model that came into practice in 1968 was specifically designed for public manufacturing companies with assets over $1 million. This cannot be used for private or non-manufacturing companies with assets less than $1 million.

While the Altman Z score formula was initially designed for predicting the bankruptcy of public manufacturing firms, over the next decade, around 1983, more precisely, Altman adapted his formula to also account for private firms, non-manufacturing firms, as well as firms with net assets below $1 million.

The Z-score formula is written as follows:

Initial Model - Z= 1.2(x1) + 1.4(x2) + 3.3(x3) + 0.6(x4)+ 1.0(x5)

Revised Model ( Public&Private Equity Firms) - Z= 0.717(x1)+ 0.847(x2) + 3.107(x3) + 0.420(x4) + 0.998(x5)

Where,

- x1= Working Capital/ Total Assets

- x2= Retained earning/ Total Assets

- x3= EBIT/ Total Assets

- x4= Market value of equity/ Book value of Total Liabilities

- x5= Sales/ Total Assets

Initial Model

- Z < 1.81 - Distress Firms

- 1.81 < Z < 2.67 - Gray Firms

- Z> 2.67 - Healthy Firms

Revised Model

- Z< 1.23 - Distress Firm

- 1.23< Z < 2.90 - Gray Firms

- Z> 2.90 - Healthy Firms

As we can see from the above formula, a low Z score implies a higher risk a company is heading towards bankruptcy. A score between 1.81 and 2.67 means the business has a moderate probability of filing for bankruptcy, which puts it in the gray area.

Lastly, a score of 2.67 and above implies the company has good financial health and is unlikely to file for bankruptcy. Any company having such a score would be more appealing in the eyes of potential investors as they carry greater financial stability and confidence.

A practical example where the Altman score can be used

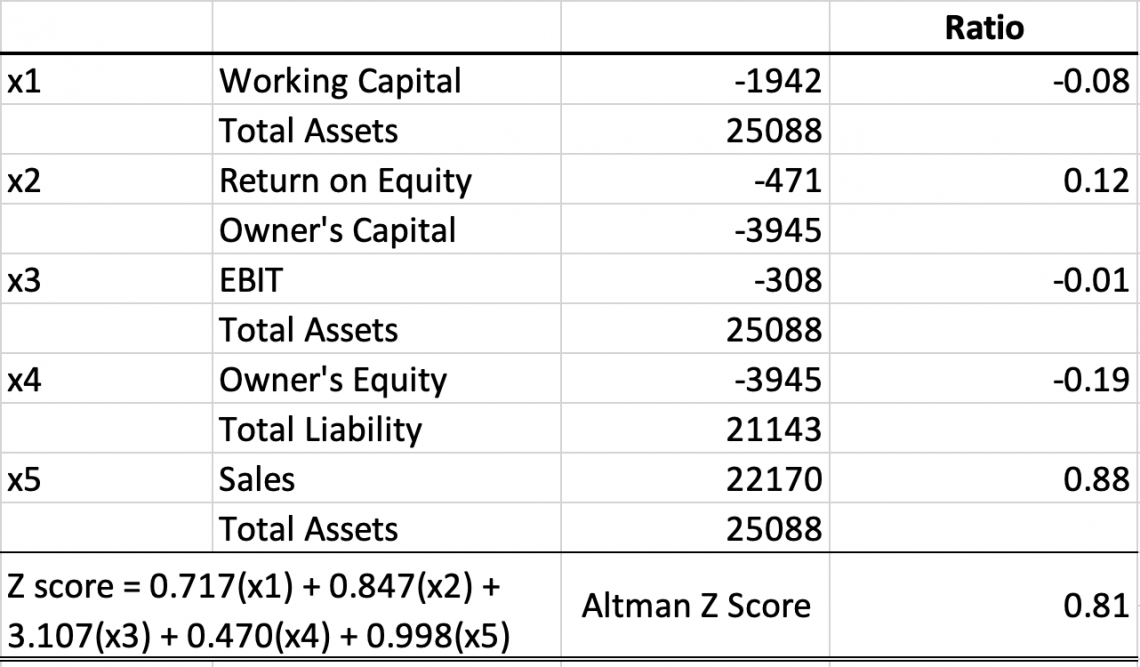

In this scenario, we have taken the case of American Airlines to illustrate how professionals can use the Altman Z Score to accurately predict the likelihood of bankruptcy/ Financial distress for any company.

- Current Asset = 6838

- Current liability = 8780

- Working capital = -1942

As we can see from the table above, the calculated Z score is 0.81, which is way below 1.23. We can therefore conclude with certainty that AMR Corp is facing financial distress.

What are Some Limitations of the Z-Score?

The Z-score is not perfect and needs to be calculated and interpreted with care. The Z-score is still vulnerable to fraudulent accounting practices and is only accurate as to the data that goes into it.

Moreover, the Z-score isn't useful for new companies with little or no earnings. These companies, regardless of their financial health, will score low.

The Z-score also doesn't address the issue of cash flows directly, only hinting at it through the Net Working Capital-to-Asset Ratio.

Lastly, the Altman score is based on historical financial data, which is a significant issue in decision-making since some of the present circumstances can differ from the past.

Financial Distress FAQs

No. Economic distress focuses mainly on the macroeconomic level, whereas Financial pain is primarily related to a microeconomic perspective. The latter is when a company struggles to generate enough profits to meet its financial obligations.

On the other hand, economic distress means conditions affecting a rural community's fiscal and economic viability, including factors such as low per capita income, high unemployment, low wages, and declining purchasing power of individuals in a community.

- Altman Model

- Springate model

- Fulmer model

- Ohlson model

- Zmijewski model

- Asset restructuring

- Financial restructuring

- Liquidation

- Reduce capital and R&D spending

- Raise new funds by selling securities or significant assets

- File for bankruptcy

- Negotiate with lenders

Buyers of distressed assets are usually the competitors of distressed firms. However, they can also include banks, private equity firms, and hedge funds.

First, they may have important information on the distressed firm and have confidence that the firm might emerge from bankruptcy as a viable enterprise. Moreover, they may profit substantially if the distressed firm becomes viable after overcoming financial distress.

Researched and authored by Alvin Dookhony | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?