Fiscal Policy

Fiscal policy is the government's use of taxation and spending measures to influence economic activity and achieve policy objectives.

In the complex realm of economics, governments worldwide employ various tools to navigate the intricate dance between stability and growth. One such crucial tool is fiscal policy, an indispensable instrument that shapes a nation's economic trajectory.

The policy serves as a guiding force, enabling governments to influence economic activities, manage public finances, and foster sustainable development.

At its center, this policy is a set of acts and strategies undertaken by the government with the intention of adjusting the financial system via the manipulation of public expenditure, taxation, and borrowing.

Governments may promote economic development, manage inflation, address income inequality, and lessen the effects of economic downturns with the help of these potent weapons.

Governments can directly inject capital into the economy by allocating funds to critical sectors such as infrastructure, education, healthcare, and social welfare. This generates employment opportunities and fosters productivity.

Taxation, another vital aspect of fiscal policy, allows governments to raise revenue and redistribute wealth. Governments can fund public services, finance infrastructure projects, and address social disparities by imposing taxes on individuals, businesses, and goods.

Effective fiscal policy-making allows countries to steer their economies toward development and protect the welfare of their populace. A key policy aspect is government spending, which performs an enormous role in stimulating economic activity.

This policy transforms into a powerful weapon for stabilizing the economy during economic downturns or recessions. Governments might enact expansionary policies like raising taxes or increasing expenditures to increase aggregate demand and drive economic activity.

Conversely, during periods of high inflation or overheating, contractionary fiscal policies involving reduced spending or increased taxation can help rein in excessive economic growth and curb inflationary pressures.

A careful balance between immediate objectives and long-term sustainability is necessary for effective policy. When making financial choices, governments must consider public debt, intergenerational equality, and macroeconomic stability.

This policy serves as an important tool in the hands of governments to form economic balance and foster growth. By manipulating public spending, taxation, and borrowing, governments can impact economic activities, deal with social disparities, and navigate numerous economically demanding situations.

- Fiscal policy refers to the government's use of taxation and spending to manage the economic system and attain specific targets.

- It plays a vital role in influencing economic activity by adjusting government spending, taxes, and borrowing levels.

- The policy is important as it could stabilize the economy during periods of recession or inflation.

- One of the foremost goals of the policy is to ensure macroeconomic stability by controlling aggregate demand and supply inside the economic system.

- The policy can be expansionary or contractionary, depending on the financial situation and policy goals.

- Expansionary fiscal policy involves increasing government spending and reducing taxes to stimulate economic growth during a downturn.

- The contractionary fiscal policy seeks to lower inflationary pressures by cutting government expenditure and raising taxes.

- Through progressive taxes and social assistance programs, the policy also aims to achieve economic redistribution and reduce income inequality.

- The policy's instruments include government spending, taxes, and borrowing, all of which are used to impact the entire economy.

Importance Of Fiscal Policy

The policy holds significant importance in shaping the economic landscape of a nation. It allows governments to address economic downturns, stimulate growth, maintain price stability, and promote social welfare.

By adjusting taxation and government spending, fiscal policy can substantially impact the overall economy. The following are some important aspects of the policies, which you can refer to for a better comparison.

1. Economic Stability

By regulating aggregate demand, reining in inflation, and reducing the effects of economic oscillations, this strategy is essential to sustaining economic stability.

2. Employment Generation

Well-crafted fiscal policies may boost employment prospects and lower unemployment rates, such as greater public investment in infrastructure and job development initiatives.

3. Income Redistribution

By introducing progressive tax structures and social welfare programs that redistribute wealth and aid marginalized populations, this strategy enables governments to combat income inequality.

4. Investment Promotion

Strategic fiscal policies, including tax incentives and credits, can attract domestic and foreign investments, promoting economic growth, innovation, and the development of key industries.

5. Infrastructure Development

Governments can use this policy to allocate resources for infrastructure improvement, including transportation networks, communication structures, and public facilities, helping long-term monetary growth and productivity.

The policy permits governments to finance the supply of public goods and services, such as education, healthcare, public safety, and environmental safety, contributing to societal well-being and improvement.

7. Counteracting Economic Downturns

This policy can be used to impose expansionary measures, such as increased government spending or tax cuts, to promote demand and recover economic activity during recessions or financial downturns.

8. Long-term Fiscal Sustainability

The powerful policy considers the long-time period implications of government spending, taxation, and borrowing, aiming to preserve fiscal sustainability, avoid immoderate debt burdens, and guard future generations' financial well-being.

Objectives Of Fiscal Policy

Herein, we will go through the policy's main objective and its future motives for the country's economic growth. As we get accustomed to the meaning of the policy and its importance, it is time for us to delve more into its objectives.

The primary goal of the policy is to influence economic activity and promote stability and growth.

Governments can steer the economy toward achieving specific objectives by implementing fiscal policies effectively. These objectives serve as guiding principles and markers of success in policy formulation and its implementation.

They encompass various dimensions of economic performance, social welfare, and long-term sustainability.

We will delve into the objectives of the policy, exploring the multifaceted goals it aims to achieve. Each objective represents a distinct aspect of economic management and reflects the priorities and values of a nation.

We may acquire insight into the justification for the policy actions and their effects on the economy and society at large by comprehending these goals.

In the following parts, we'll look at the many goals of the policy, such as supporting environmental sustainability, guaranteeing fiscal sustainability, addressing income inequality, and encouraging economic development and stability.

1. Budgetary Discipline

This policy aims to establish and maintain budgetary discipline by ensuring that government expenditures align with available resources. This objective involves managing public finances responsibly, avoiding excessive deficits, and promoting fiscal responsibility.

2. Economic Competitiveness

The policy can also focus on enhancing a country's economic competitiveness.

To promote innovation, draw in enterprises, and maintain a positive business climate, governments may employ strategies including tax incentives, grants for research and development, and investments in human resources.

By fostering a favorable business climate and supporting industries, this policy seeks to generate employment opportunities, enhance labor market conditions, and improve overall economic well-being.

3. Macroeconomic Stabilization

Although economic stability is emphasized, fiscal policy also aims to achieve macroeconomic stabilization. The policy strives to promote social equity, alleviate poverty, and improve living standards for all citizens through targeted social spending and progressive tax systems.

This involves minimizing fluctuations in economic activity, stabilizing prices, and maintaining a balanced business cycle through measures like adjusting government spending, taxation, and borrowing.

4. Sustainable Development

Another objective of fiscal policy is to promote sustainable development. Governments may use fiscal measures to support environmentally friendly practices, invest in renewable energy, and encourage sustainable resource management.

This objective focuses on balancing economic growth with environmental considerations.

5. Regional Development

Fiscal policy can be utilized to address regional disparities and promote balanced development across different regions within a country.

Governments may allocate resources strategically to support infrastructure development, job creation, and public services in less developed regions, fostering regional equity and reducing regional disparities.

Tools Of Fiscal Policy

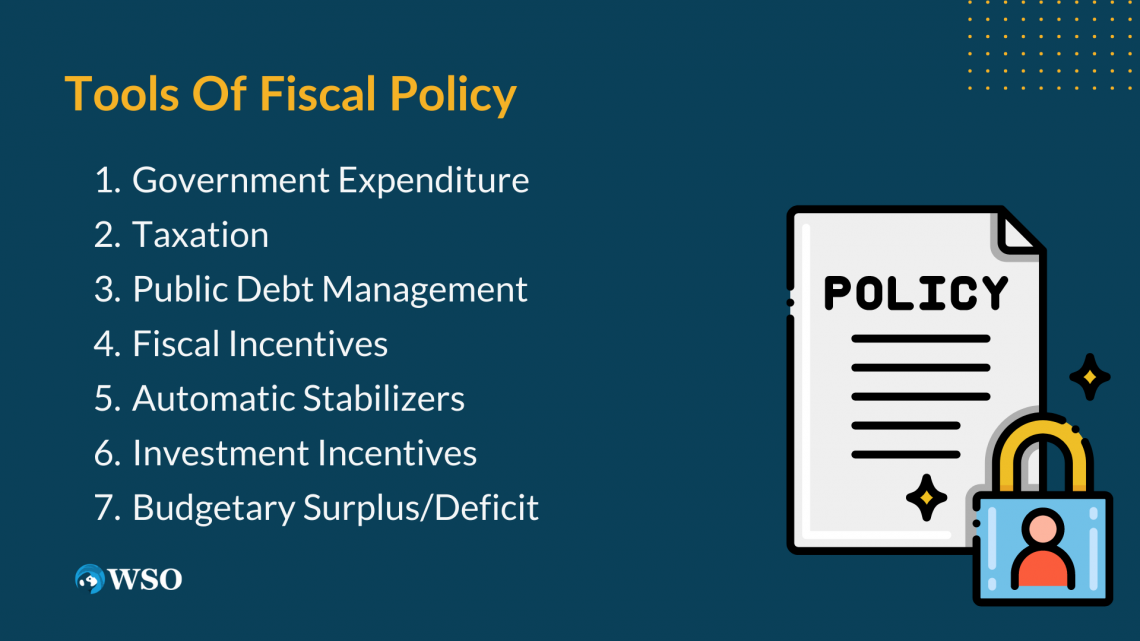

The policy relies on a set of powerful tools that governments employ to shape and influence economic conditions. These tools encompass a range of policy measures related to government spending, taxation, and borrowing.

Using these financial instruments strategically, policymakers can navigate economic challenges, foster growth, and promote stability.

Herein, we will explore the diverse tools of the policy and its significance in economic management. Each tool represents a unique mechanism through which governments can exert influence on the economy and steer it towards desired outcomes.

Understanding those instruments will help us better understand how the policy is implemented and affects various economic sectors.

During the following sections, we will observe the distinctive tools of this policy, starting with government expenditure and taxation to debt control and financial incentives.

The following are the basic instruments of the policy which you can refer to for a better understanding.

1. Government Expenditure

Government expenditure refers to the allocation of funds by government agencies for public goods and services, inclusive of schooling, healthcare, infrastructure, defense, and social welfare programs.

By increasing or decreasing spending levels, fiscal authorities can influence aggregate demand, stimulate economic activity, and address specific societal needs.

Government expenditure is an essential tool that can be applied to support financial growth, enhance public offerings, and promote social welfare.

2. Taxation

As we all know, taxation basically includes taxing individuals, organizations, and other goods and services inside a country. Fiscal policymakers use taxation to generate revenue for the government and regulate economic activity.

Governments can influence consumer behavior, incentivize investment, and address income distribution through changes in tax rates, tax deductions, or tax credits.

Taxation serves as a crucial tool for this policy, allowing policymakers to fund public expenditure, manage fiscal deficits, and shape economic behavior in line with desired objectives.

3. Public Debt Management

Public debt management refers to the management of government borrowing and debt. In an effort to cover financial deficits or put money into long-term projects, governments may additionally borrow money via issuing bonds or other debt instruments.

Effective debt management involves carefully assessing borrowing costs, debt sustainability, and the optimal mix of domestic and foreign borrowing.

By managing public debt responsibly, fiscal policymakers can maintain fiscal stability, control interest payments, and avoid excessive debt burdens that could undermine long-term economic sustainability.

4. Fiscal Incentives

Fiscal incentives are measures designed to influence economic behavior by providing financial benefits or advantages. Governments can offer tax incentives, grants, subsidies, or exemptions to stimulate specific activities or sectors.

Fiscal incentives are crucial in promoting economic growth, attracting investment, and fostering competitiveness in targeted industries.

5. Automatic Stabilizers

Built-in mechanisms known as automatic stabilizers modify fiscal policy in response to economic changes. Examples include income assistance programs, unemployment insurance, and progressive taxation schemes.

Automatic stabilizers have a countercyclical effect during economic downturns by raising government expenditure and lowering tax burdens, boosting demand, and assisting in stabilizing the economy.

Conversely, during periods of economic expansion, these stabilizers adjust to reduce government spending and increase tax revenue, preventing overheating and inflationary pressures. Automatic stabilizers help smooth out economic fluctuations and support economic stability.

6. Investment Incentives

Investment incentives are fiscal measures to encourage private sector investment in specific industries or regions.

Governments offer tax breaks, grants, or subsidies to incentivize organizations to invest in areas such as research and development, infrastructure, or environment-friendly technology. Investment incentives promote monetary growth, job creation, and technological advancement.

By attracting investment, governments can stimulate financial activity, enhance productivity, and make contributions to long-term improvement and competitiveness.

7. Budgetary Surplus/Deficit

The budgetary surplus or deficit refers to the difference between government revenue and expenditure. A budget surplus happens when sales exceed expenditure, while a budget deficit arises when expenditure exceeds revenue.

Fiscal policymakers can use budgetary surpluses to reduce public debt, build reserves, or fund future investments. Contrarily, budget deficits may be used to boost government expenditure and boost economic activity during economic downturns or when more stimulus is needed.

Balancing budgetary surpluses and deficits is a key tool for the policy, allowing governments to manage public finances, promote stability, and support economic growth.

Criticisms of Fiscal Policy

Fiscal policy criticism has become a major issue of discussion and debate among economists, policymakers, and commentators. While this policy is broadly recognized as a valuable tool for economic management, it isn't always without its detractors.

Herein we will delve into the numerous criticisms leveled towards the policy, exploring the challenges and worries surrounding its implementation and effectiveness.

As an instrument of government intervention in the economic system, this policy involves decisions regarding government spending, taxation, and borrowing. The objective is to obtain desired economic outcomes along with growth, balance, and equity.

However, critics argue that this policy might also face limitations and capacity drawbacks that can undermine its efficacy or bring about unintentional effects.

It is vital to engage in a balanced assessment of the policy's strengths and weaknesses to inform ongoing policy discussions and enhance its implementation.

By analyzing the criticisms of this policy, we can gain a nuanced understanding of its complexities as well as its weaknesses.

The criticisms may additionally comment on problems which include the timing and effectiveness of economic measures, the ability for political bias in decision-making, the impact on non-public sector behavior and funding, and concerns about the sustainability of the public budget.

Through careful examination of these criticisms, policymakers and economists can work towards refining the policy frameworks, addressing potential shortcomings, and maximizing their ability as a tool for economic management.

1. Timing and Effectiveness

Critics argue that policy implementation may suffer from timing issues. Delays in enacting fiscal measures or the lag between implementation and impact can limit its effectiveness in addressing economic challenges.

Furthermore, opponents point out the difficulties in precisely forecasting the time and amount of economic swings, which might impede the appropriateness of fiscal policies' responses.

2. Political Considerations

According to critics, these policy decisions are frequently affected by political reasons rather than purely economic factors.

Political biases, electoral cycles, and short-term goals may impact the design and implementation of fiscal measures, potentially compromising their effectiveness and long-term economic stability.

3. Crowding Out and Private Sector Behavior

Critics argue that this expansionary policy, particularly when financed through increased borrowing, may lead to higher interest rates and "crowding out" private sector investment.

This crowding-out effect occurs when increased government borrowing competes with private borrowers for limited funds, potentially reducing private investment and impeding economic growth.

4. Sustainability of Public Finances

One major criticism revolves around the sustainability of the policy, particularly in relation to accumulating public debt.

Critics expressed concerns that excessive public debt burdens resulting from prolonged deficit spending can undermine economic stability, create future fiscal constraints, and limit governments' ability to respond to future crises.

5. Inflationary Pressures

Critics caution that expansionary policies, especially during periods of full employment, can lead to inflationary pressures.

Increased government expenditure and increased aggregate demand may exceed the economy's ability to produce goods and services, thereby driving inflation and diminishing buying power.

6. Unintended Consequences

Critics highlight the potential for unintended consequences arising from this policy's interventions. These may include distortions in resource allocation, the creation of economic imbalances, and unintended shifts in market behavior.

Unforeseen consequences can result from the complexity of fiscal policy and the interconnectedness of various economic sectors.

7. Implementation Challenges

Critics also point out the challenges associated with accurately implementing the policy measures.

These challenges include data limitations, estimation errors, bureaucratic inefficiencies, and difficulties in achieving policy coordination across different levels of government. Such implementation challenges can hinder the desired outcomes of the policy interventions.

Fiscal Policy vs. Monetary Policy

Let's now have a look at the difference between monetary and fiscal policies. In this section, we will have a look at a few key facets of each policy to recognize how they vary from one another and the significance they have for a nation.

Fiscal policy should not be considered in isolation but together with monetary policy. Whilst fiscal policies offer government revenue and expenditure, monetary policy deals with the money supply and interest rates.

Both policies' purpose is to persuade the economic system, but they work through distinctive channels.

Monetary policy, implemented by the central bank, generally uses interest rates and money supply changes to govern inflation, promote economic balance, and influence borrowing charges.

Fiscal policies, on the other hand, is based on government spending, taxation, and borrowing to reap financial goals.

| Aspect | Fiscal Policies | Monetary Policies |

|---|---|---|

|

Definition |

The use of government spending, taxation, and borrowing to influence the economy. | The management of the economic system via a central bank's management over interest fees and the money supply. |

| Authority | It is implemented by the government and legislative bodies. | Carried out with the aid of the central bank, together with the Federal Reserve within the United States. |

|

Objective |

Influencing aggregate demand, stabilizing the economy, addressing social issues, and promoting long-term growth. | Controlling inflation, managing interest rates, promoting price stability, and ensuring financial stability. |

| Tools | Government expenditure, taxation, borrowing, fiscal incentives, and automatic stabilizers. | Open market operations, reserve requirements, discount rates, and interest rate targeting. |

|

Impact on Demand |

This policy directly impacts aggregate demand by changing government spending and taxation, affecting consumer and business behavior. | Monetary policy indirectly influences aggregate demand by affecting interest rates, influencing borrowing costs, and influencing investment and consumption decisions. |

|

Time Horizon |

Fiscal policy decisions typically have longer implementation lags and can take time to take effect on the economy. | Monetary policy actions can have more immediate effects on the economy due to the central bank's ability to adjust interest rates and influence financial markets swiftly. |

|

Policy Flexibility |

The policy implementation may involve complex political processes and may face challenges in adjusting quickly due to legislative constraints. | Monetary policy is generally more flexible as central banks can quickly adjust interest rates and implement policy changes to address changing economic conditions. |

|

Macroeconomic Impact |

The policy may have larger effects on public investment, social welfare programs, and income distribution, influencing many different economic sectors. | Monetary policies primarily focus on the stability of the financial system, inflation control, and interest rate management, with more limited direct impacts on income distribution and social programs. |

|

Coordination |

This policy requires coordination among different government entities and fiscal authorities, which can sometimes pose challenges. | Monetary policy coordination is typically more streamlined within a central bank's decision-making framework and is independent of direct government control. |

|

Limitations |

This policy may face constraints related to budgetary constraints, potential for political bias, and limitations in predicting economic trends accurately. | Monetary policy faces limitations regarding the effectiveness of interest rate adjustments, the impact of financial markets, and potential liquidity traps during economic downturns. |

or Want to Sign up with your social account?