Celler-Kefauver Act

This act expanded upon the Clayton Act by addressing and preventing anti-competitive practices in the marketplace.

What Is the Celler-Kefauver Act?

The U.S. Congress passed the Celler-Kefauver Act in 1950. The Act reformed and strengthened antitrust legislation found within the Clayton Antitrust Act of 1914. In addition, it specifically broadened the applicability of anti-merger provisions in the Clayton Antitrust Act.

It is also referred to as the Anti-Merger Act. For example, the Celler–Kefauver Act allowed the government to prevent vertical and conglomerate mergers that could limit competition.

BARE ACT of Celler-Kefauver Act: "An Act to amend an Act entitled "An Act to supplement existing laws against unlawful restraints and monopolies, and for other purposes," approved October 15, 1914 (38 Stat. 730), as amended".

It was passed to eliminate a loophole regarding acquisitions involving firms that were not direct competitors and asset acquisitions.

While the Clayton Antitrust Act prohibited mergers through stock purchases that resulted in reduced competition, businessmen were able to find ways around them simply by buying up a competitor's assets.

The Celler–Kefauver Act prohibited this practice if competition would be reduced due to the asset acquisition. This Act remains one of the strongest antitrust laws in the United States.

Key Takeaways

- The Celler-Kefauver Act, enacted in 1950, strengthened U.S. antitrust laws by closing loopholes and preventing vertical and conglomerate mergers that could harm competition.

- The Celler-Kefauver Act empowered the government to intervene in mergers that would diminish competition, with a focus on asset acquisitions that might restrict fair market access for competitors.

- The act empowered the government to intervene in vertical and conglomerate mergers if they would diminish competition. It closed the loophole that allowed companies to avoid antitrust action by acquiring assets rather than stock.

History of the Celler-Kefauver Act

The original antitrust legislation in the U.S., the Sherman Antitrust Act of 1890, was utilized frequently during the administrations of T. Roosevelt and William H. Taft.

The legislation prohibited any move by private firms that would prevent the regulatory action of the U.S. market system. Instead, it encouraged a market system with many competitors in each industry, ensuring market competition.

Empowered by the Act, the attorney general of the United States was authorized to bring lawsuits against companies suspected of creating monopolies in the marketplace.

This Act accounted for the historic antitrust cases against Standard Oil and American Tobacco, resulting in the fragmentation of these massive companies into smaller companies.

The Sherman Act was met with controversy and was plagued with vague language, causing difficulty while enforcing it. The Act proved ineffective because of loopholes derived from language difficulties.

For example, the Act only outlaws "monopolizing" explicitly on paper but doesn't ban the existence of a "monopoly," resulting in legal battles over the interpretation of these terms.

In 1914, Congress attempted to rectify the problematic Sherman Act by amending it with the Clayton Antitrust Act.

The Clayton Antitrust Act, composed by U.S. Rep. Henry De Lamar Clayton, clarified the interpretation difficulties by amending language and adding specific examples of illegal actions by companies.

Locally targeted price-cutting, a type of price discrimination, was outlawed by the Act, along with horizontal mergers and acquisitions and exclusive dealership agreements.

Soon after the Clayton Antitrust Act was enacted, Congress established the Federal Trade Commission (FTC).

As it was authorized to enforce federal legislation, the Federal Trade Commission utilized antitrust laws to continue to curb and regulate monopolistic firms. Unfortunately, the Clayton Act didn't solve all of the difficulties around antitrust legislation.

Nevertheless, it was necessary for price-discrimination practices to be defined further by the Robinson-Patman Act of 1936 and to prevent illegal M&A from being expanded by the Celler-Kefauver Act of 1950.

Impact of the Celler-Kefauver Act

The Celler-Kefauver legislation significantly strengthened powers granted by the Clayton Act to prevent mergers that could result in reduced competition.

The Celler-Kefauver Act prevented vertical and conglomerate mergers by forbidding companies from buying assets from competitors when it would result in reduced competition.

The Clayton Antitrust Act, on the other hand, only tried to prevent horizontal mergers, i.e., the union of two companies with similar output products, ignoring vertical and conglomerate mergers entirely.

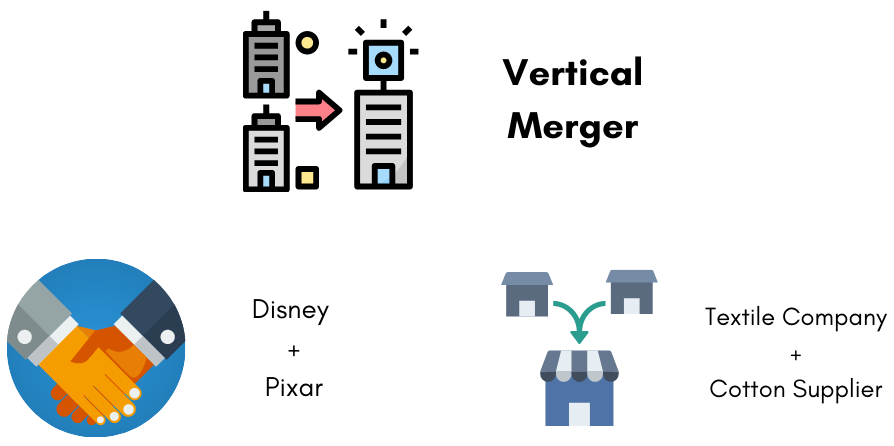

Vertical mergers occur when a vendor company merges with a customer company. Government officials generally attack these mergers because they are thought to create entry barriers, barring fair access to other companies with similar products to potential consumers.

Conglomerate mergers occur when a company uses its money, success, and resources from one market to create a monopoly over another. These were also challenged.

This Act remains one of the strongest antitrust laws in the United States.

What Does The Celler-Kefauver Act Do?

The Act discusses mergers in which companies buy suppliers (including competitors' suppliers) to guarantee production because it can unduly cut off supply to competitors, something considered an anti-competitive practice.

The law intended to regulate mergers that would create a monopoly or significantly reduce competition.

The Clayton Antitrust Act already addressed horizontal mergers, but the Celler-Kefauver Law added conglomerate and vertical mergers to the list of possible antitrust violations.

Note

Vertical and conglomerate mergers are not illegal under the Celler-Kefauver Act unless these mergers lead to significantly reduced competition.

Like any other antitrust law, classifying actions that reduce competition is challenging.

The benefits of a vertical merger include streamlining production and stabilizing supply. Therefore, this merger is not prohibited as long as other suppliers in the market allow other companies to access raw materials.

The old antitrust legislation established controls over certain mergers and acquisitions but only in the case of purchasing shares in circulation. Thus, antitrust rules could be primarily circumvented by buying only the target company's assets.

The Celler-Kefauver Act prevents this interim measure, thus reinforcing the antitrust rules in the United States.

Special Considerations

History has shown that the Celler-Kefauver Act has not thwarted not all conglomerate and vertical mergers.

To prevent such transactions from going ahead, it must be proven that combining two companies would significantly reduce competition. Yet, even if this is obvious, a handful of vertical and conglomerate mergers still manage to get away scot-free.

Publicly traded companies on the US stock market must inform the Federal Trade Commission (FTC) and the Department of Justice (DoJ) if they plan to execute a merger that falls under one of these two categories (conglomerate or vertical).

These government agencies have the power to decide whether to stop a deal from happening. Sometimes, the Department of Justice and Federal Trade Commission can be overruled by the courthouses.

The Judge(s) might disagree that a merger violates the Celler-Kefauver Act and permit it to go through—as was the case in 1974 with General Dynamics Corp.'s (GD) acquisition of United Electric.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?