Dodd-Frank Act

An intricate and complicated piece of financial regulation

What is The Dodd-Frank Act?

Dodd-Frank refers to an intricate and complicated piece of financial regulation born out of the Great Recession of 2008. It is a United States federal law.

The bill's full name is the Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly known as Dodd-Frank. Simply put, it is a bill that regulates the financial sector.

It developed as a response to the Great Recession of 2008, intending to avoid another significant financial institution collapse. The law was first proposed by the Obama administration in June 2009, after a series of revisions from senator Chris Dodd and U.S. Representative Barney Frank.

It was enacted in July 2010. It is one of the most significant pieces of legislation passed under Barack Obama's presidency.

Key Takeaways

- Dodd-Frank act is a United States federal law that refers to an intricate and complicated piece of financial regulation born out of the Great Recession of 2008.

- The Obama administration first proposed the law in June 2009, after revisions from senator Chris Dodd and U.S. Representative Barney Frank, the legislation's sponsors.

- It was enacted in July 2010.

- It protects customers and the economy against hazardous actions by banks and insurance corporations.

- The act's key provisions entail financial stability, reliable credit rating, consumer protection, default swap, the Lincoln amendment, and the most famous Volcker rule.

- Dodd-Frank has made significant progress, but like any comprehensive reform package, there are lessons to be learned from its execution and corrections and tweaks that could enhance its results.

Dodd-Frank Act Background

People were furious in 2009. The world attempted to emerge from the most significant global recession since World War 2.

Banks were closing, and millions of people lost their jobs. The 2008 financial crisis caused unemployment to soar, reaching a peak of 10% in October 2009. As a result, the U.S. economy collapsed, and many Americans missed mortgage and vehicle loan payments.

The banks are to blame for all the suffering, but more crucially, their risky activity set off the subprime mortgage and global financial crises. With Lehman Brothers' bankruptcy, the subprime mortgage crisis peaked on September 15, 2008.

The Federal Reserve called several banks to discuss financing for the financial services company's reorganization after the firm was informed of an impending rating downgrading because of its significant holdings in subprime mortgages.

After these negotiations fell, Lehman filed a Chapter 11 petition—involving more than the U.S. $600 billion in assets—which is still the most extensive bankruptcy filing in American history. The Dodd-Frank Wall Street Reform and Consumer Protection Act enters the picture here.

A plan for a "sweeping overhaul of the United States financial regulatory system, a transformation on a scale not seen since the reforms that followed the Great Depression," was unveiled by President Obama in June 2009.

President Obama declared that 90% of the changes he suggested were included in the final bill as it emerged from the conference.

Components of the Dodd-Frank Act

The Act's over 2300 pages are filled with many provisions that were supposed to be implemented over several years. The following are some of the critical conditions of the Act-

1. Financial Stability

Some banks are so large and interconnected that their failure would be disastrous for the entire economic system. As a result, such banks require special government assistance.

Some banks are so large and interconnected that their failure would be disastrous for the entire economic system. As a result, such banks require special government assistance.

To cater to this situation, a new council of influential people, including the Securities and Exchange Commission (SEC), Financial Stability Oversight Council (FSOC), Federal Reserve System (Fed), and Treasury Secretary, was established under the act.

Its objective is to prevent banks, hedge funds, and businesses from growing to be "too big to fail." It achieves this by requiring companies to maintain more cash via the orderly liquidation fund.

A large, sophisticated financial corporation on the verge of failure can be liquidated promptly and effectively using the Act's Orderly Liquidation provision, Title II).

Each year, banks must pass a stress test to evaluate whether they could fail in the event of a catastrophe. They even have the authority to dissolve corporations that pose a severe risk to the financial system.

2. Reliable credit rating

The riskiness of lending to an individual, business, or even a government is determined by organizations like Standard & Poor and Moody's.

Therefore, a low rating should alert investors that these debtors would not be able to repay their loans. However, after the financial crisis, we discovered that a lot of dangerous debt was granted higher ratings.

The SEC Office of Credit Ratings was established under the Act to ensure reliability and correct ratings. Since these ratings are now being watched, faulty ratings could result in them losing their standing.

3. Regulations on emergency loans

Due to the controversy surrounding the Fed's emergency loans during the financial crisis, dodd frank gave the government authority to examine these loans. The treasury must now approve all emergency loans, and the government now has the power to audit the Fed once more in the future.

4. Consumer Protection

Numerous variables contributed to the financial crisis of 2008. Still, one of them was the widespread habit of borrowers taking out loans with small down payments and low teaser rates that would significantly increase in a year or two.

These borrowers frequently couldn't afford more significant payments, so they counted on the chance of refinancing the loan when the initial low rate increased, giving the broker another profit.

They owed more money than the house was worth when real estate prices dropped, frequently resulting in default.

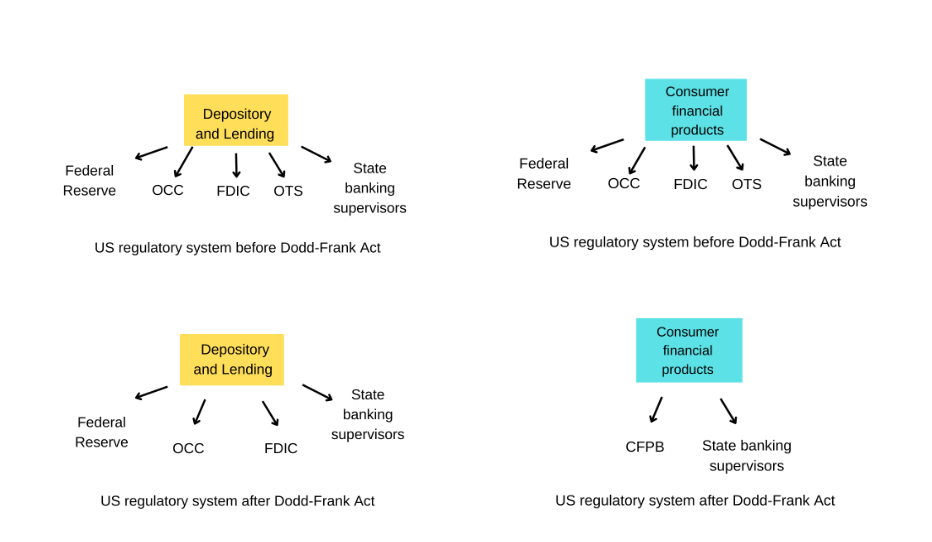

The Consumer Financial Protection Bureau (CFPB), established under Dodd-Frank, was tasked with preventing predatory mortgage lending and making it simpler for consumers to comprehend a mortgage's terms before agreeing to them.

It prohibits mortgage brokers from receiving more excellent commissions for completing loans with higher fees or interest rates. It also mandates that mortgage originators refrain from directing prospective borrowers toward the loan that will net them the highest payment.

The CFPB offers consumers access to accurate information about mortgages and credit scores, regulatory restrictions, and a 24-hour, toll-free consumer hotline to report problems with financial services.

5. Lincoln Amendment

The swaps push-out regulation, also known as the Lincoln Amendment, is another policy that aims to keep securities and commercial banking activities apart.

By prohibiting insured depository institutions with access to Federal Reserve liquidity facilities from engaging in specific derivatives trading activities. Senator Blanche Lincoln added that the provision aims to prevent taxpayers from financing trading activity, particularly products.

6. Hedge funds

The law requires that hedge funds must first register with the SEC.

Hedge funds were because they were exempt from securities laws' disclosure and oversight requirements and related regulations.

Hedge fund advisers must now register and be accessible for recurring inspections under the Dodd-Frank Act.

7. Volcker rule

Banks are prohibited from engaging in speculative trading operations by the Volcker Rule. It is named after former Federal Reserve Chairman Paul Volcker.

It prohibits banks from engaging in proprietary trading, which means that a bank's agents or units cannot buy or sell securities, derivatives, commodity futures, or options in the accounts of the banks.

You anticipate that your money will be kept secure when you deposit it in a bank. However, before the Act, banks were free to trade with your funds for their benefit. An example is the 2012 JPMorgan Chase trading loss, where they lost around $6 billion in risky trading in 20012.

They must stop operating in this industry unless they act as an agent, broker, or custodian for their customers. According to the guideline, banks may only engage in trading when it is essential to their operations, such as when exchanging currencies.

The rule also prohibited banks from funding or supporting hedge funds and private equity businesses. There are numerous derivatives, some of which maintain economic stability and others that have the exact opposite effect.

The credit default swap is one of them that is more debatable. Exchanges were unregulated before Dodd-Frank.

Furthermore, the sellers of the credit default swaps lacked the resources to make payments in the event of the worst-case scenario. These insurance-like products are now subject to greater regulation.

Impact of the Dodd-Frank Act

Numerous consumer and financial markets now have stronger regulations because of the Act.

Many people think it was a necessary response to the 2008 crisis, helping to prevent another market meltdown. On the contrary, some claim that some of its requirements are overly stringent.

It has made significant progress, but like any comprehensive reform package, there are lessons to be learned from its execution and corrections and tweaks that could enhance its results.

Some of the impacts are:

-

We have improved transparency and pricing in the derivatives and market.

-

Only regulated exchanges or swap execution facilities will be used for trading, increasing competition and promoting better pricing to the marketplace, resulting in lower costs for businesses and clients.

-

Increase transparency in hedge fund trades, as hedge funds must register with the Securities and Exchange Commission (SEC) and publish information about their businesses and portfolios. As a result, the SEC can calculate overall market risk.

-

The CFPB consolidates oversight roles, reduces potentially dangerous gaps in the regulatory framework, and has enhanced consumer protections.

-

They have increased stability without seriously impairing productivity or economic expansion. These measures include the SPOE (single point of entry) resolution strategy, the CFPB (Consumer Financial Protection Bureau), and more significant capital requirements.

-

Consumers are better protected now.

Criticism of the Dodd-Frank Act

The criticisms are:

-

According to a paper by Martin Neil Baily, Aaron Klein, and Justin Schardin- The law requires the FDIC (Federal Deposit Insurance Corporation) to seek and secure a joint resolution from Congress.

-

This resolution is made before giving temporary liquidity guarantees on specific types of debt and requiring the Federal Reserve to make emergency loans accessible to an entire category of institutions rather than just one company.

-

During stressful times, it is likely that these proposals will harm financial stability while having no positive impact on economic growth.

-

The Volcker Rule produces costly trade-offs, which forbids commercial banks from engaging in proprietary trading. The Lincoln Amendment prohibits organizations that engage in swaps from receiving federal funding.

-

The Volcker Rule has drawn criticism for being difficult for regulators to execute and enforce because it is complicated, confusing, and expensive, which makes it challenging for banks to comply with its requirements.

-

Others contend that the Volcker Rule can accomplish the purposes of the Lincoln Amendment, rendering it unnecessary and eliminating its financial and regulatory constraints.

-

Influence the cost and availability of credit and the lending and borrowing of securities.

Small banks that do not fit into standardized financial modeling will find it difficult to obtain credit, forcing community banks to merge, consolidate, or go out of business due to the Act created for large banks that are "too-big-to-fail."

As a result of the new regulations, small banks have been forced to discontinue some operations, such as mortgages and car loans.

-

In the areas of regulatory consolidation and FSOC authority, more work needs to be put out.

-

The Volcker Rule requirements for banks need to be explained to make implementation more straightforward and effective.

-

The Current restrictions on the Federal Reserve and FDIC's crisis in this authority should be lifted.

Dodd-Frank and Covid-19

The ongoing pandemic of Covid-19 came as a reality check for the act, which is put for testing.

In an interview with Forbes, Dodd said, "We would have collapsed economically (without it). I don't know anyone who disagrees. We would be in such a deep hole I am not sure we could get out of it."

On the contrary, by Section 1502 of the law, manufacturers must disclose whether any of their products contain "conflict minerals" mined in the Democratic Republic of the Congo and nine other neighboring African nations.

Companies registered on U.S. stock exchanges must audit their supply chains and disclose whether their goods contain even minute amounts of the four designated minerals—gold, tantalum, tin, and tungsten.

According to a report by Wall Street Journal, In 2014, businesses tried to track down conflict minerals in their supply chains, investing around $709 million and more than six million person-hours in the process.

And 90 percent of those businesses still couldn't vouch for the conflict-free status of their goods.

Tantalum energy-storage capacitors are frequently used in ventilators. X-ray devices rely on tungsten components to maintain stability in electron emission at high temperatures. More of the minerals will be utilized in producing Inogen's oxygen concentrators.

The composition and manufacture of the needles, syringes, and vials required to carry and administer billions of doses of vaccinations frequently involve the usage of the minerals banned by the Act.

It posed a huge barrier to producing medical equipment essential to fight against Covid-19.

Dodd-Frank under the Trump administration

It was called a "disaster" by President Donald Trump in 2017, and he pledged to "do a big number" to modify it in the future. The Trump administration has now made several moves to undercut the law.

A bill that significantly amended the Dodd-Frank Act in 2018, called the financial choice act, which exempted several small and regional banks from its harshest rules, was signed. Weakening regulations meant to prevent the collapse of large banks.

It significantly decreased the number of banks required to undertake annual stress tests to prove they could withstand a catastrophic downturn.

The Federal Deposit Insurance Corporation (FDIC) relaxed the Volcker Rule's restrictions in 2020. Bank capital requirements were reduced under the amended regulation, and banks were allowed to invest in venture capital funds.

The Act also grants the President of the United States the authority to appoint new directors to the Federal Housing Finance Agency (FHFA), which regulates the mortgage industry, and the Consumer Financial Protection Bureau (CFPB).

or Want to Sign up with your social account?