Swap

A derivative contract between two parties that involves exchanging pre-agreed cash flows between two financial instruments

What Is a Swap?

A swap is a derivative contract between two parties that involves exchanging pre-agreed cash flows between two financial instruments. The underlying instrument can be anything.

They are over-the-counter (OTC) contracts primarily between businesses or financial institutions that are customized to both parties' needs and do not trade on exchanges.

The cash flows are usually determined using a nominal value, i.e., the notional principal amount, such as a loan or bond. Generally, the principal amount does not change hands.

Introduced in the late 1980s by IBM and the World Bank, this financial derivative is a relatively new type. However, their extensive applications make them one of the most frequently traded financial contracts.

One may use this contract to minimize the uncertainty of specific operations and hedge risk.

A single cash flow comprises one "leg" of the swap. Generally, One cash flow is fixed, while the other cash flows are variable and based on a benchmark floating currency exchange rate, interest rate, or index price.

Retail investors usually do not engage in these contracts because of the high risk of counterparty default.

Companies and financial institutions are usually counterparties in the contract. The institutions, i.e., swap banks, facilitate the transactions by matching counterparties.

Key Takeaways

- Swaps are derivative contracts exchanging cash flows between financial instruments and are customized contracts between businesses or financial institutions.

- Types of swaps include interest rate, currency/cross-currency, commodity, and credit default swaps, each serving different purposes.

- Swaps are used for risk hedging and accessing new markets, reducing exposure to fluctuations and enabling market expansion.

- Major Swap Participants (MSPs) facilitate swap transactions and assume risks as dealers or brokers.

- Exiting a swap contract can be done through buying out the counterparty, selling the contract, entering an offsetting swap, or using a swaption.

History of swaps

They were first introduced in 1981 to the public when IBM and the World Bank agreed.

Today, they are one of the world's most heavily traded financial contracts. According to the Bank for International Settlements (BIS), the total amount of interest rates and currency swaps outstanding was more than $348 trillion in 2010.

Most of them are traded "tailor-made" over-the-counter (OTC) for the parties involved.

The Dodd-Frank Act in 2010 envisions a multilateral platform for quoting, the swaps execution facility (SEF).

The act mandates that these agreements must be reported and cleared through clearing houses or exchanges, which led to the formation of a central facility for data reporting and recordkeeping, i.e., swap data repositories (SDRs).

Data vendors, such as Bloomberg, and big exchanges, such as the Chicago Board Options Exchange and the Chicago Mercantile Exchange, registered to become SDRs.

They started listing variations on their platforms, like swap futures and swaptions. Other exchanges followed, such as Frankfurt-based Eurex AG and the Intercontinental Exchange.

Size of swap Market

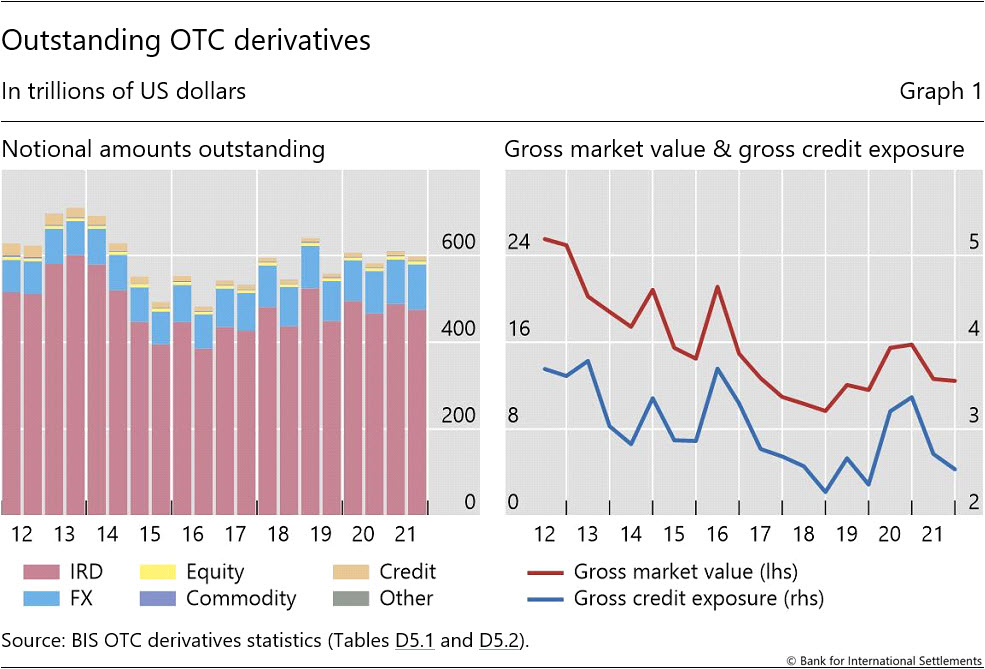

The Bank for International Settlements, or BIS, is an international financial institution that publishes statistics on the notional amounts outstanding in the OTC derivatives market.

The notional amount of OTC derivatives declined in the second half of 2021 to $600 trillion. As a result, the gross credit exposure and gross market value also fell during this period.

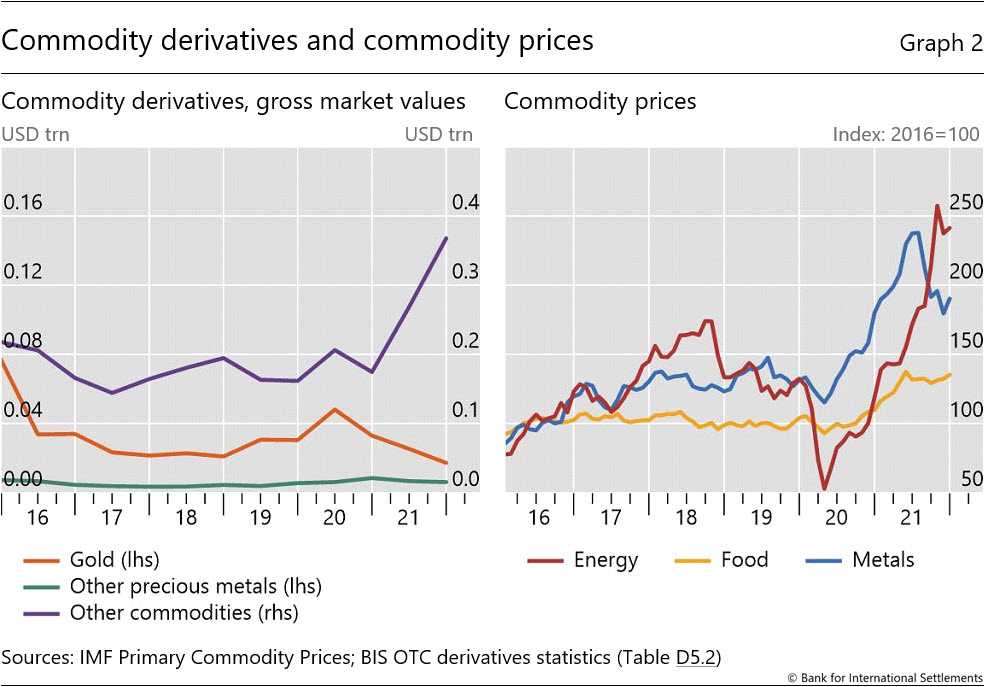

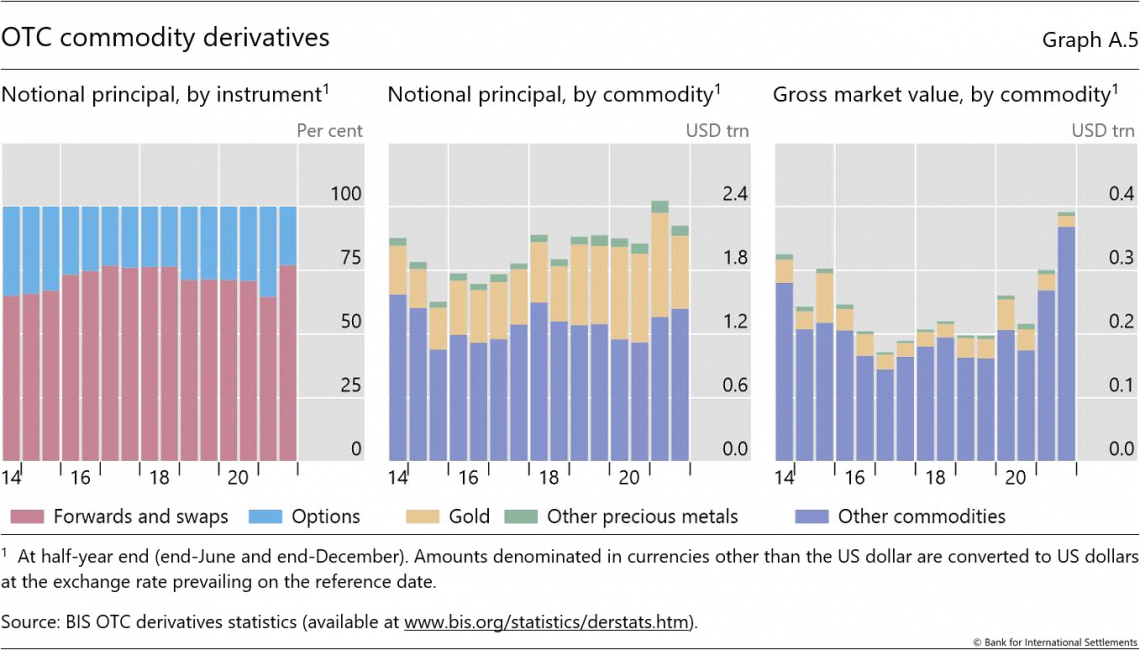

Amid the rising commodity prices during the second half of 2021, the gross market value of commodity derivatives rose by 30%.

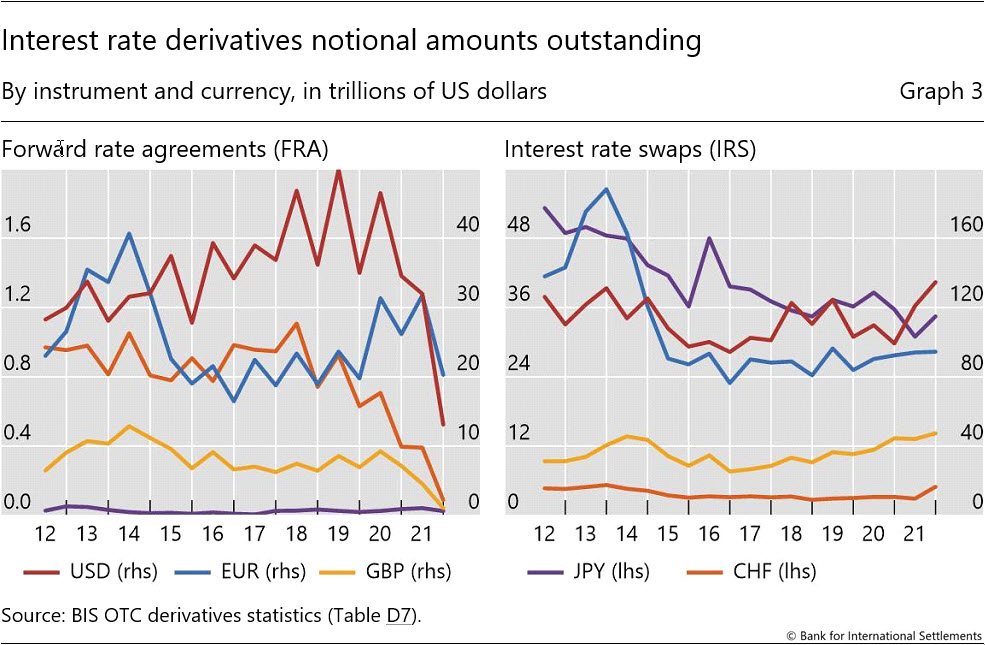

The notional amount of forwarding rate agreements contracted as investors prepared for LIBOR benchmarks to be phased out at the end of the year.

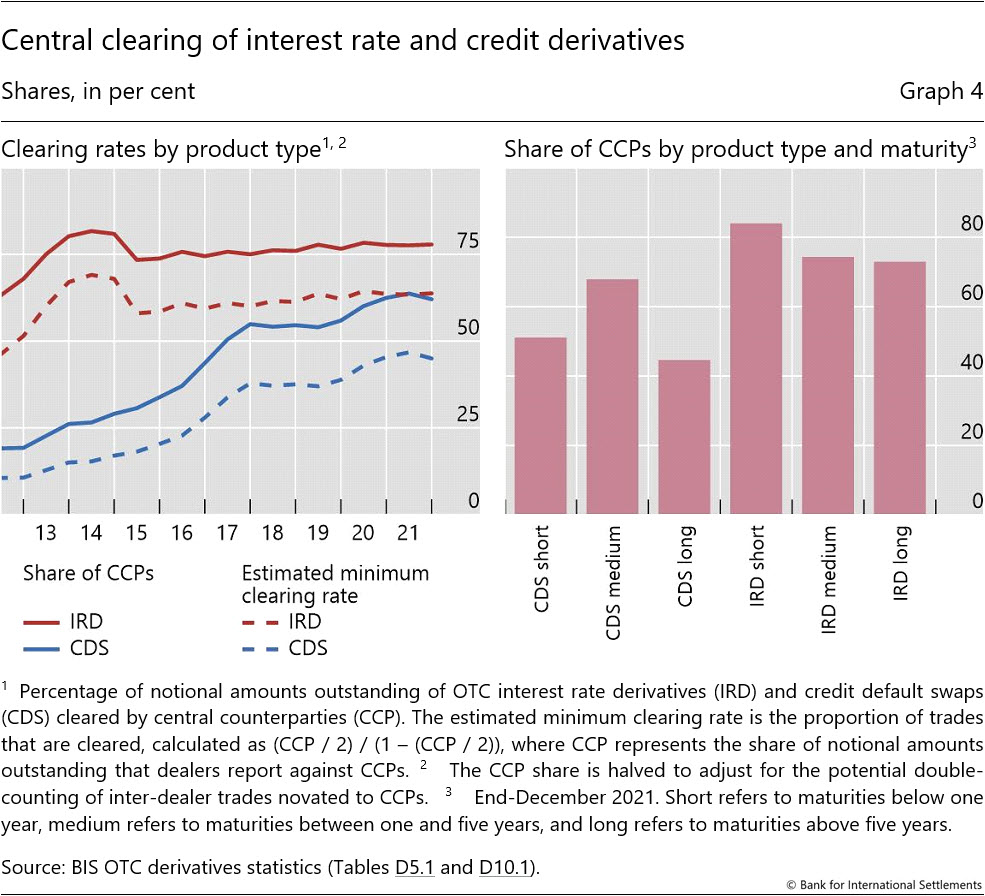

Central clearing rates remained stable for CDS and interest rate derivatives (IRDs), 78% and 62% of notional amounts, respectively.

OTC derivatives statistics in end-December 2021:

1. Outstanding positions of OTC derivatives declined:

2. The gross market value of commodity derivatives surged sharply:

3. Significant decline in forwarding rate agreements following the LIBOR transition:

3. Central clearing rates remained stable:

Types of swaps

Modern financial markets employ various derivatives suitable for different purposes. The most popular types include:

1. Interest rate

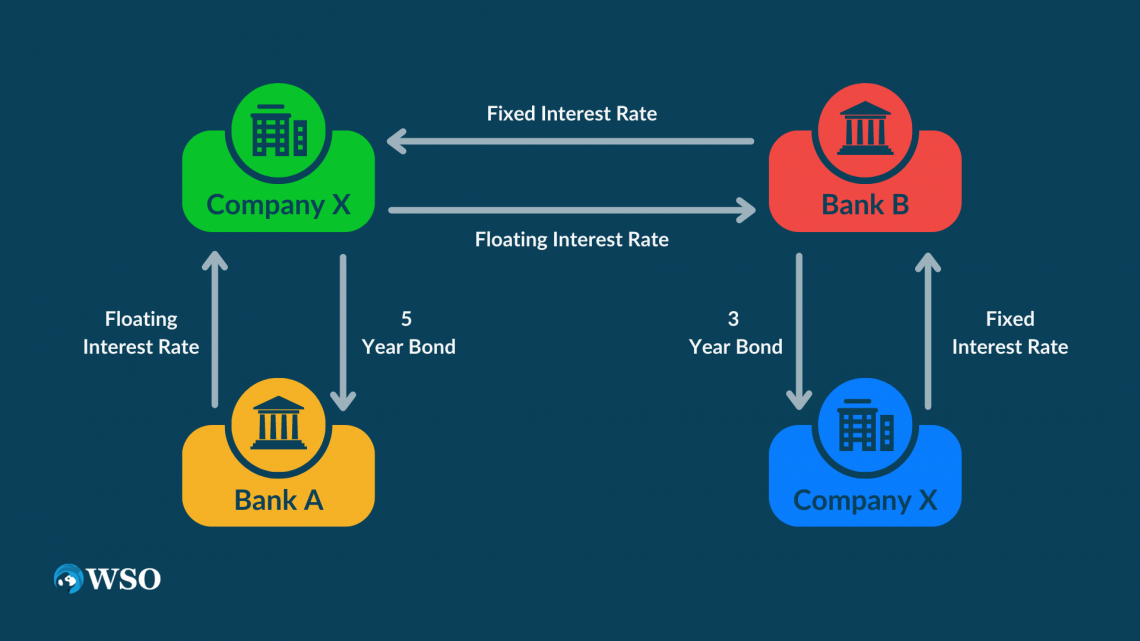

These allow counterparties to agree to exchange a single stream of future interest payments for another based on a predetermined notional principal amount.

They involve the exchange of a fixed interest rate for a floating interest rate.

Generally, they include the exchange of a fixed interest rate for a floating rate.

Like other types, interest rate swaps are not traded on public exchanges – only over-the-counter (OTC).

2. Currency/cross-currency

- These contracts between two parties involve the exchange of interest payments and principal amounts that are sometimes denominated in different currencies.

- Although these contracts generally imply the exchange of principal amounts, some may require only the transfer of interest payments.

3. Commodity

These contracts allow two parties to exchange cash flows dependent on the underlying asset's price. Here, the underlying asset is a commodity.

In many commodity-based industries, such as livestock and oil, these are important as they hedge against the underlying product's market price swings. In addition, they allow commodity producers and end users to lock in a price for the underlying commodity.

4. Credit default

A credit default swap (CDS) protects the buyer against default and other risks. A CDS buyer makes periodic payments to the seller until the credit maturity date. CDSs came into existence in 1994 when Blythe Masters from JP Morgan invented them.

Through the contract, the seller commits that if the debt issuer defaults, the seller will pay the buyer all premiums and interest that would have been paid up to the maturity date (or at least the insured amount).

A buyer can take risk control measures with the help of a CDS by transferring the risk to an insurance company in return for periodic payments. Similar to an insurance policy, a CDS allows purchasers to buy protection against an unlikely event that may affect their investment.

Applications of swaps

This financial derivative is an essential part of modern finance and can be used in the following ways:

1. Risk hedging

The primary function is hedging risks created by fluctuations in the markets. Risk hedging is a strategy for reducing exposure to risk in an investment.

An investor can hedge the risk of an investment by taking an offsetting position in another investment. The value of the offsetting investment should be inversely correlated.

For example, using currency swaps to hedge against currency exchange rate fluctuations. For the producer, a derivative contract reduces risk by ensuring a specified sum, even if the commodity prices fall.

2. Access to new markets

It can act as a tool for big businesses and market players to venture into markets they previously could not access. This is because hedging allows for risk reduction, which can be utilized to approach new financial markets.

For example, a UK company may enter into a derivative contract with an American company.

For the UK company, the incentive is accessing the more attractive pound-to-dollar exchange rate. For the US-based firm, it's the fact that they can borrow pounds at a lower rate.

They also have various applications depending on the counterparties involved in the contract.

Major swap Participant (MSP)

A swap bank, or Major Swap Participant (MSP), is a term used to describe a financial institution that facilitates the derivative contract between counterparties. The bank can be an investment bank, an international commercial bank, an independent operator, or a merchant bank.

They maintain a substantial position in any major category.

As a market maker, the bank is willing to accept the deal from either side. In this capacity, the bank assumes a position in the financial derivative and, therefore, assumes some risks. They then, later on, sell it or match it with a counterparty.

In 2011, the Securities and Exchange Commission finalized the proposals requiring dealers and participants to register with the SEC as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

The bank either serves as a dealer or broker. As a broker, the bank matches counterparties. The broker does not assume any risk of the financial derivative. The broker receives a commission for this service.

A dealer's job is riskier, and the bank would receive a portion of the cash flows passed through to compensate it for bearing this risk. Today, most banks serve as dealers or market makers.

Swap Market Efficiency

There are two primary reasons for a counterparty to use them.

- Hedging long-run exchange rate exposure

- Obtaining debt financing in the swapped currency at a reduced interest rate is brought about through comparative advantages each counterparty has in its national capital market.

Name recognition is critical in raising funds in the international bond market. Statistically, firms using these derivatives have higher levels of long-term foreign-denominated debt than firms with no currency derivatives.

The primary users of these financial derivatives are global firms with long-term foreign-currency financing needs. From a foreign investor's perspective, the valuation of foreign currency debt excludes the exposure effect that a domestic investor would see.

Financing foreign currency debt using currency swaps and domestic currency is superior to financing directly with foreign-currency debt.

The two primary reasons why swapping interest rates is better is because it matches the maturities of assets and liabilities and obtains cost savings via the quality spread differential (QSD).

Evidence suggests that the QSD between A-rated commercial and AAA-rated commercial paper (floating) is slightly less than the spread between an A-rated obligation of the same tenor and an AAA-rated five-year obligation (fixed).

The findings suggest that firms are more likely to pay fixed with lower (or floating with higher) credit ratings, and fixed-rate payers have shorter debt maturity than floating-rate payers.

In particular, an A-rated firm would be more likely to borrow using commercial paper and enter into a short-term fixed-for-floating derivative contract as a payer at a QSD over the AAA rate.

Who Uses Swaps?

The motivation for using this financial derivative contract falls into a comparative advantage and commercial needs.

The movie The Big Short is based on a real-life event where a hedge fund manager from California called Michael Burry predicted the financial crisis in 2008. Thus, he bought large credit default swaps, making about $700 million.

Some firms' ordinary business operations can lead to specific currency exposures or interest rates that only they can alleviate.

For example, consider a commercial bank, which pays a floating interest rate on deposits (e.g., liabilities) and earns a fixed interest rate on borrowings like a loan (e.g., assets).

This mismatch between assets and liabilities causes tremendous difficulties.

Instead, The bank could use a fixed-pay (pay a fixed rate and receive a floating rate) to get floating-rate assets by converting its fixed-rate assets, which would match well with its floating-rate liabilities.

Some firms have a comparative advantage in acquiring certain types of financing.

This comparative advantage, however, may not be for the desired type of financing. Here, the company may acquire financing for which it has a comparative advantage and then converts it to the desired type of financing.

For example, consider a well-known U.K. firm that wants to expand its operations into North America, where it is lesser known.

It will likely receive more favorable financing terms in the U.K. By using a currency derivative contract. As a result, the firm ends up with the fund's dollars it needs for its expansion.

How to Exit a Swap Contract?

Sometimes one of the parties must exist before the agreed-upon termination date. It is similar to an investor selling exchange-traded futures or options contracts before expiration. There are four ways to exit the agreement:

1. Buy out the counterparty

These derivatives have a calculable market value like a future or options contract. So, a party may terminate a contract by paying the counterparty this market value.

However, as this is not an automatic feature, either the party who wants out must secure the counterparty's consent, or it should be specified in the contract in advance.

2. Sell it to someone else

One party may sell the contract to a third party because they have calculable value. This requires the permission of the counterparty.

3. Enter an offsetting swap

The contract can be terminated indirectly by entering into a similar agreement that offsets the original contract.

4. Use a swaption

An option on a swap is called a swaption. It grants a party the right, but not the obligation, to enter into an underlying derivative contract. A party can use it to enter into an offsetting swap at the time; thus, This will reduce some of the market risks associated with strategy 3.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?