Equity Derivatives

Financial products/instruments based on the rise or fall in the value of the underlying assets, such as equity stocks or shares traded on the secondary market

What Is an Equity Derivative?

Equity derivatives are financial products/instruments based on the rise or fall in the value of the underlying assets, such as equity stocks or shares traded on the secondary market.

Equity derivatives are contracts between a buyer and a seller to purchase or sell the underlying asset at a particular price in the future. They can have the right or the responsibility to exchange the asset when the contract expires.

To trade an equity derivative, an investor must have a thorough understanding of the product and business, as derivatives allow investors to speculate and earn significant gains or losses.

Investing in stock derivatives carries risks including:

- Interest rate risk

- Currency risk

- Commodity price risk

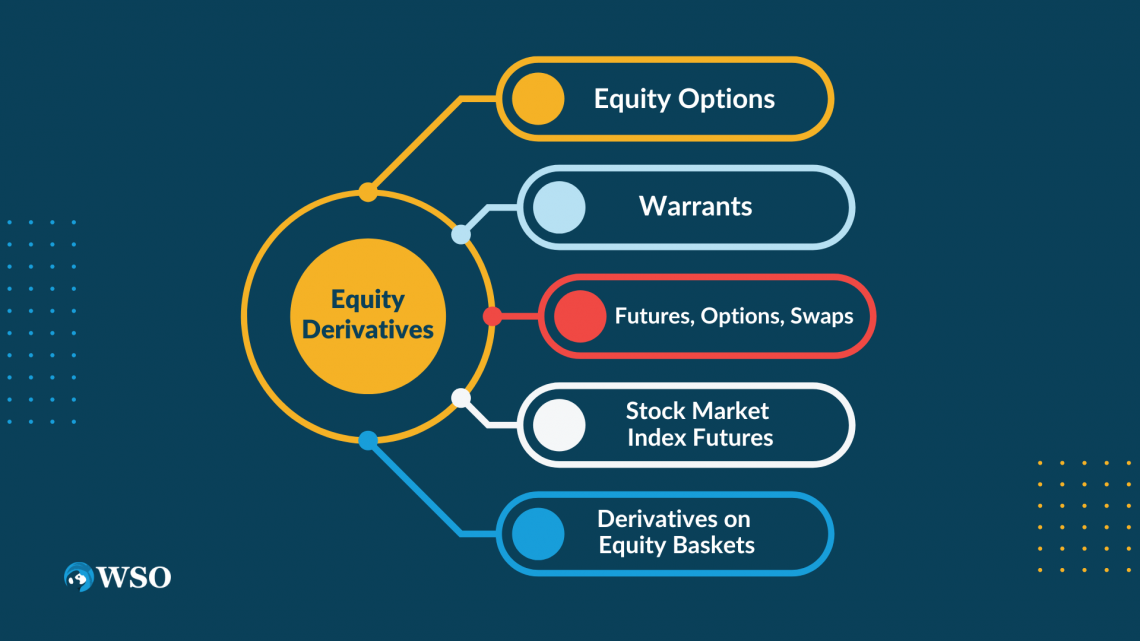

1. Equity Options

The most prevalent sort of equity derivative is equity options. They provide you the option, but not the responsibility, to purchase (call) or sell (put) a specified amount of stock at a defined price over a set time (1 contract = 100 shares of stock).

2. Warrants

A warrant is a financial asset that permits the holder to purchase shares in the firm that issued it at a predetermined price much lower than the stock price at the time of issue.

As a sweetener, warrants are often linked to bonds or preferred shares, allowing the issuer to pay reduced interest rates or dividends. In addition, they can be used to boost the bond's yield and make it more appealing to potential purchasers.

3. Futures, Options, Swaps, and Stocks

Futures, options, and swaps can be used to obtain exposure to the equity markets. These can be performed on individual stocks, a customized basket of equities, or a stock index. The price of the underlying stock or stocks determines the value of these equity derivatives.

4. Futures on the Stock Market Index

Futures contracts intended to imitate the performance of an underlying stock market index are known as stock market index futures.

They can be used to hedge against an existing equity position or to speculate on the index's future fluctuations.

Futures indexes include well-known indices like:

- S&P 500

- FTSE 100

- DAX

- CAC 40

- Other G12 nation indices.

OTC product indices are comparable to prescription drugs, although they have more flexibility.

5. Derivatives on Equity Baskets

Equity basket derivatives are futures, options, or swaps using a non-index basket of stocks as the underlying.

They are comparable to equities index derivatives, but because the basket definition is not defined as an equity index, they are always traded OTC (over the counter, i.e., between established institutional investors).

Key Takeaways

- Equity derivatives are financial products whose value is derived from the underlying asset's price changes.

- Traders use equity derivatives to speculate and manage risk in their stock portfolios.

- There are two types of equity derivatives: equity options and equity index futures.

- Equity derivatives include equity swaps, warrants, and single-stock futures.

Correlation trading using equity derivatives

The different equity derivatives that can be used for correlation trading are:

1. Futures on a Single Stock

Exchange-traded futures contracts based on a single underlying asset rather than a stock index are known as single-stock futures.

Their performance is comparable to the underlying equities, albeit they are frequently traded with more leverage because they are futures contracts.

Another distinction is that long-term holders of single-stock futures do not often receive dividends, while short-term holders do not pay dividends.

Single-stock futures can be cash-settled or physically paid by transferring the underlying stocks at expiry; however, only physical settlement is utilized in the United States to minimize market speculation.

2. Swaps of Equity Indexes

An equity index swap is a contract between two parties to exchange two sets of cash flows on predefined dates for a specified time.

For example, the cash flows will be an equity index value. Swaps may be considered a reasonably simple approach to obtaining exposure to a particular asset class. They can also be relatively inexpensive.

3. Swap of Equity

An equity swap is a two-party exchange of future cash flows that allows each party to diversify their income for a specific time while keeping their original assets.

The two sets of ostensibly equal cash flows are swapped according to the swap's parameters, which may or may not entail an equity-based cash flow (such as from a stock asset) being traded for a fixed-income cash flow (such as a benchmark rate).

Equity swaps allow major institutions to hedge specific assets or holdings in their portfolios and provide diversification and tax benefits.

Understanding Equity derivatives

Equity derivatives can operate as a kind of insurance. The investor obtains a possible payment by paying the cost of the derivative contract, also known as a premium in the options market.

When buying a stock, an investor might buy a put option to protect against a drop in the value of the shares. On the other hand, an investor who has shorted shares might purchase a call option to protect against a rise in the share price.

On the other hand, an investor who has shorted shares might purchase a call option to protect against a rise in the share price.

Equity derivatives can also be utilized as a means of speculating.

For example, a trader might buy equity options to profit on the underlying asset's price swings instead of purchasing the actual stock. A strategy like this has two advantages.

To begin, traders can save money by purchasing options (which are less expensive) rather than the underlying stock. Second, traders can reduce risk by buying and selling put-and-call options on the price of a stock.

Futures on Equity Indexes

A futures contract, like an option, derives its value from an underlying security, or in the case of index futures contracts, a collection of securities that make up an index.

For example, the following indexes offer futures contracts priced depending on the index's value:

On the other hand, the indexes' values are generated from the sum of the underlying stocks in the index. As a result, index futures get their value from stocks, thus the moniker "equity index futures." Futures contracts are liquid and adaptable financial instruments.

They may be used for various purposes, including intraday trading and risk hedging for big diversified portfolios.

Futures and options are also derivatives, although they have different functions. The buyer of options has the option to purchase or sell the underlying at the strike price but not the responsibility to do so.

The terms of a futures contract bind both the buyer and the seller. As a result, unlike when buying an option, the risk in the future is not capped.

Taking Advantage of Equity Options

Single equity security is used to create equity options. Equity options allow investors and traders to take a long or short position in a stock without actually buying or selling it.

It is helpful since taking a position with options provides additional leverage. In addition, the amount of cash required is substantially lower than establishing an identical outright long or short position on margin.

As a result, investors/traders can earn more from a price change in the underlying stock.

For example, buying 100 shares of a $10 stock costs $1,000. However, buying a call option with a $10 strike price may only cost $0.50 or $50 since one option controls 100 shares ($0.50 x 100 shares).

If the shares increase to $11, the option is worth at least $1, and the options trader doubles their money. As a result, the stock trader makes $100 (the position is now worth $1,100), which is a 10% gain on the $1,000 they paid. Comparatively, the options trader makes a better percentage return.

If the underlying stock moves in the wrong direction and the options expire out of the money, the trader loses the price they paid for the option.

Trading option spreads are another popular equity options strategy. Traders combine long and short options positions with multiple strike prices and expiry dates to profit from option premiums with the least risk.

How Do Equity Derivatives Get Traded?

Why Should You Invest in Equity Derivatives?

The ownership of an investment is one of the risks linked with it. Equity derivatives allow investors to purchase the underlying investment's performance rather than the firm itself.

As a result, the danger of losing money is lower than if you owned the product.

Long-term investment items are advantageous. But on the other hand, equity derivatives are the greatest alternatives for investors looking for more substantial short-term returns.

An investor with a long-term investment portfolio can add equity derivatives to create a well-balanced portfolio that pays both short- and long-term returns.

Investing in stock derivatives is challenging and necessitates a thorough understanding of the industry. In addition, it implies that the investor will need to receive training to understand derivatives trading.

As a result, the investor will be able to work more effectively with a financial adviser since they will better understand how their money is managed and invested.

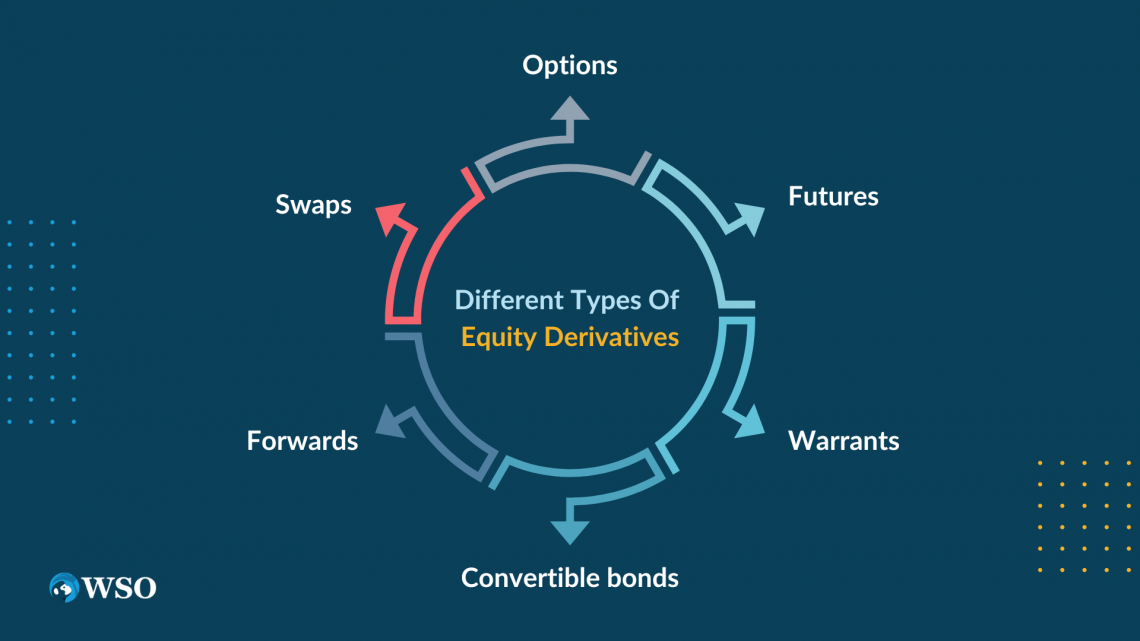

Different types of equity derivatives

Different equity derivates and their working:

1. Options

The holder of an option has the right, but not the responsibility, to purchase (call option) or sell (put option) a specific stock at a predetermined price.

The contract specifies the provided price, known as the special price, as well as the contract's expiration date and terms and conditions. An options contract is suitable for investors who wish to protect or hedge against potential price rises or declines.

2. Warrants

Warrants offer the holder the right, but not the responsibility, to purchase (call warrants) or sell (put warrants) the underlying investment in the future, similar to options.

As an inducement to acquire the issue, the corporation provides warrants to holders of its bonds or preferred shares.

3. Futures

The secondary market is where futures contracts are exchanged. In a futures contract, the buyer promises to acquire an asset at a specific price and date.

In contrast to options, the futures contract buyer has to purchase the asset. The buyer must buy the asset on the designated date and for the stipulated price as stated in the contract.

4. Forwards

A forward contract, like a futures contract, specifies the date and price at which the buyer should acquire the underlying asset from the seller in the future.

The difference is that a forward contract takes place on a private market, with conditions specific to the deal's participants.

Convertible bonds give the holder the option of converting the bonds into business shares.

Convertible bonds have a conversion rate and price linked with them, in addition to the bond's attributes (coupon and maturity date).

Because of the conversion feature, such bonds pay a lower rate of interest than regular bonds.

6. Swaps

Swaps are derivatives in which two parties exchange the returns of two separate equity equities.

Apart from equity returns, the exchange rate can be influenced by floating and fixed interest rates, various nations' currencies, etc.

risks associated with trading equity derivatives

The risks involved with derivatives are:

1. Risk of rising interest rates

If an investor expects interest rates to climb in the future and enters into a derivative contract to pay a fixed rate, he or she runs the risk of interest rates falling.

They may be stuck into paying more money rather than getting a loan at a cheaper rate in the future if they pay a fixed rate of interest.

Currency volatility is a significant risk. Importers and exporters use derivative contracts to protect themselves against currency rate fluctuations.

The danger here is that the currency will plummet or move opposite to what the investor is anticipating.

2. The risk associated with commodity prices

If investors predict the underlying asset's price to fall in the future, commodity derivatives are exchanged. Oil futures are the most prevalent commodity derivative traded on the market.

The risk here is that the commodity's price will rise because the investor must now sell the commodity at the set price, which is lower than the current price, which has increased.

Researched and authored by Akhilesh Jagtap | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?