How to Invest in the S&P 500 Index

A stock index that tracks the largest 500 companies in the US market

How to Invest in the S&P 500 Index

You can’t invest in S&P 500 Index, but you can invest in a mutual fund or Exchange-traded fund (ETF) that tracks the index.

Since the index is based on market capitalization, a company’s influence on the index is determined by the size of its market cap. As a result, large companies such as Apple (AAPL) and Microsoft (MSFT) have a much more significant impact on the index than smaller companies such as Etsy (ETSY).

The index contains 500 of the largest companies (numbers may fluctuate) in the US, determined by market cap and other factors such as sector allocation and liquidity.

The most prominent companies in the index are

| #Rank | Company | Symbol |

|---|---|---|

| 1 | Apple | AAPL |

| 2 | Microsoft | MSFT |

| 3 | Amazon |

AMZN |

| 4 | Alphabet Inc. Class A | GOOGL |

| 5 | Alphabet Inc. Class C | GOOG |

| 6 | Tesla Inc. | TSLA |

| 7 | Berkshire Hathaway Inc. Class B | BRK.B |

| 8 | UnitedHealth Group Incorporated | UNH |

| 9 | Johnson and Johnson | JNJ< |

| 10 | Meta Platforms Inc. Class A | META |

The “information technology” sector holds the largest weight in the index (28%)

The S&P 500 is a trademark of the S&P Dow Jones Indices joint venture, a stock index that tracks the largest 500 companies in the US market.

Launched in 1957, the S&P 500 index was the first based on the market capitalization weighting method. Additionally, the S&P is a float-weighted index. Thus, the market cap of companies in the index is adjusted to the number of publicly traded shares.

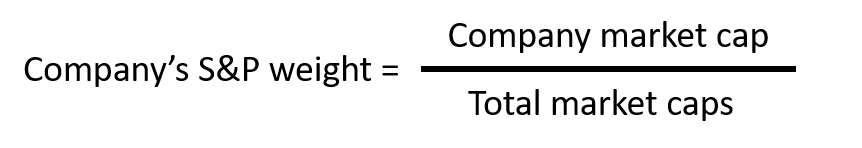

S&P 500 Index—Weighting Formula and Calculations

The index uses market cap weighting, giving companies with higher capitalizations a greater percentage allocation in the index.

To determine the weight of companies in the index. But, first, we have to figure out the market cap of each company and add them together to get the total market caps.

Market cap can be determined by multiplying a company's share price by the number of outstanding shares traded. After that, we divide a company's market cap over the total market cap to determine the weight of a specific company.

Mutual funds

Index funds track the S&P benchmark index and watch their performance closely. In addition, a few index funds enable investors to invest in the S&P index.

The first way would be to invest in mutual funds. A mutual fund is an organization that pools money from different investors and purchases stocks, bonds, and other assets.

Professionals run mutual funds called money managers. They are responsible for allocating the funds' securities and generating capital gains for the investors.

Individuals can get their hands on well-studied diversified portfolios with different bonds, stocks, and other securities. Each participating individual shares part of the profits and losses of the fund.

The fund, in turn, invests in various securities and tracks their performances according to the issuing company's market cap.

The funds are usually part of large investment companies such as

These funds typically have a fund manager responsible for working for the fund's best interest.

Mutual Fund's Pricing

Mutual funds' values depend on their portfolio's performance. Therefore, when investing in mutual funds, you are investing in the fund's performance rather than the securities the funds hold.

Investing in mutual funds is quite different than directly investing in shares. Funds do not grant the investor the voting right provided by the direct investment of shares.

The price of a mutual fund share is known as net asset value (NAV) per share, sometimes referred to as NAVPS. Net asset value is determined by dividing the total value of the securities by the number of outstanding shares.

Therefore, the net asset value (NAV) is the price investors pay for buying mutual funds units. NAVs do not fluctuate during the day as their price is fixed at the end of the trading day.

Since mutual funds hold securities of different companies, investors get their hands on a diversified portfolio.

For instance, assume an individual who owns shares at Amazon, with all his money placed in one company. His investment success relies on the success of the company.

Mutual funds hold a high number of securities ranging from 20 - 60. This variety creates diversification and makes sure one stock does not overinfluence the moment of the entire portfolio.

This hinders the profit compared to investing in a few stocks and drops the portfolio's overall risk and volatility.

These funds track the S&P 500 Index performance and allow investors to diversify their portfolios at a low cost.

Exchange Traded Fund (ETF)

Exchange Traded Funds (ETFs) are mutual funds that track various indices, benchmarks, and other assets.

The only difference between an ETF and a mutual fund is that ETFs can be directly brought on the exchange through any broker, but mutual funds cannot.

Exchange-traded funds are structured to track assets from investment strategies to alternative assets such as commodities and currencies. Additionally, it helps short sellers gain leverage and avoid capital gains taxes in the short term.

Since the first US-listed ETF came to life, exchange-traded funds have come a long way. It was initiated in 1993 and is called SPDR S&P 500 ETF (SPY).

Today, ETFs are found in almost every portfolio, from large institutions to small investors. Investors rely on them as they provide simple investment solutions offering easy, low-cost, and access to a wide variety of assets.

Exchange Traded Fund Pricing

Exchange-traded fund's expense ratio is the cost of managing funds. ETFs allow investors to purchase a group of stocks in a single trade.

Effectively, it makes for less average cost. However, if you buy each stock in the fund individually, their price would be much higher.

Since brokers receive a commission on every trade, purchasing an ETF is a single trade, thus allowing for low-cost investment. Some brokers even offer no commission on low-cost ETFs, making them even cheaper.

ETFs are less expensive because they track an index as a whole. For instance, an ETF tracking the S&P 500 index would contain all 500 stocks, making it passively managed, ultimately reducing the cost of active management, which is more time intensive.

Note

Not all exchange-traded funds passively track indices, and these ETFs would cost higher accordingly.

How to buy index funds

To buy index funds, these are the steps to follow

1. Open an account

Start your investment adventure by opening an account in one of many online platforms such as Fidelity or trading apps like Robinhood. Investment accounts are automatically driven toward retirement, Individual Retirement Account (IRA), or towards tax brokerage accounts to invest in other goals, such as down payment.

Robo-advisors, providing algorithmic financial services, are another alternative. Additionally, mutual funds can be bought directly from firms like Vanguard.

Once you have decided on the platform to use, choose an investment index. The S&P 500 index is probably your choice since you are reading this, but make sure to look at other indices, such as Nasdaq and Dow Jones.

The indices mentioned above are the most popular, but more than 5000 indices make up the US equity market. These indices play a significant role in the US equity market and provide a great insight into the US economy.

3. Choose between mutual funds and Exchange Traded funds

With mutual funds, you can buy shares once a day at the price settled when the market closes at 4 P.M ET However, ETFs can be brought or sold at any time throughout the trading day.

Mutual funds also have a minimum investment value, while ETFs’ minimum value is the price of a single share or part of the share.

For instance, the vanguard 500 index fund requires a minimum of $3000 of investment value, but the Vanguard S&P 500 EFT’s minimum value is the price of a single share.

Index ETFs vs. Index Mutual Funds

Investors looking for a diversified portfolio aim for the world of funds. Exchange-traded and mutual funds are the perfect places for a wide variety of assets from different regions and markets. Thus, investors won’t have to buy individual securities.

So you’re starting your investing career and don’t know what’s better for you. Should I invest in Exchange-traded funds that track indices such as S&P 500 index, or should I invest in mutual funds that do the same at a low cost?

The answer depends on your goals and needs. Let's try to elaborate when you need either.

When to invest in Exchange Traded Funds (ETF)

Exchange-traded funds trade just like stocks but are mainly passive investments that seek to duplicate the performance of a particular index (actively managed funds are also an option).

Passively managed funds allow for lower expense ratios and thus make the investment much more affordable.

Some passive ETFs charge less than 0.05%, while others even charge 0.00%. However, according to Morningstar, actively managed funds’ brokerages may charge an average of 0.62%.

Since ETFs don’t require frequent trading and have the structural ability to minimize capital gains, it is said to be tax efficient.

Throughout history, brokers used to charge commission fees on each trade. But now, some brokers, such as Schwab, trade commission free.

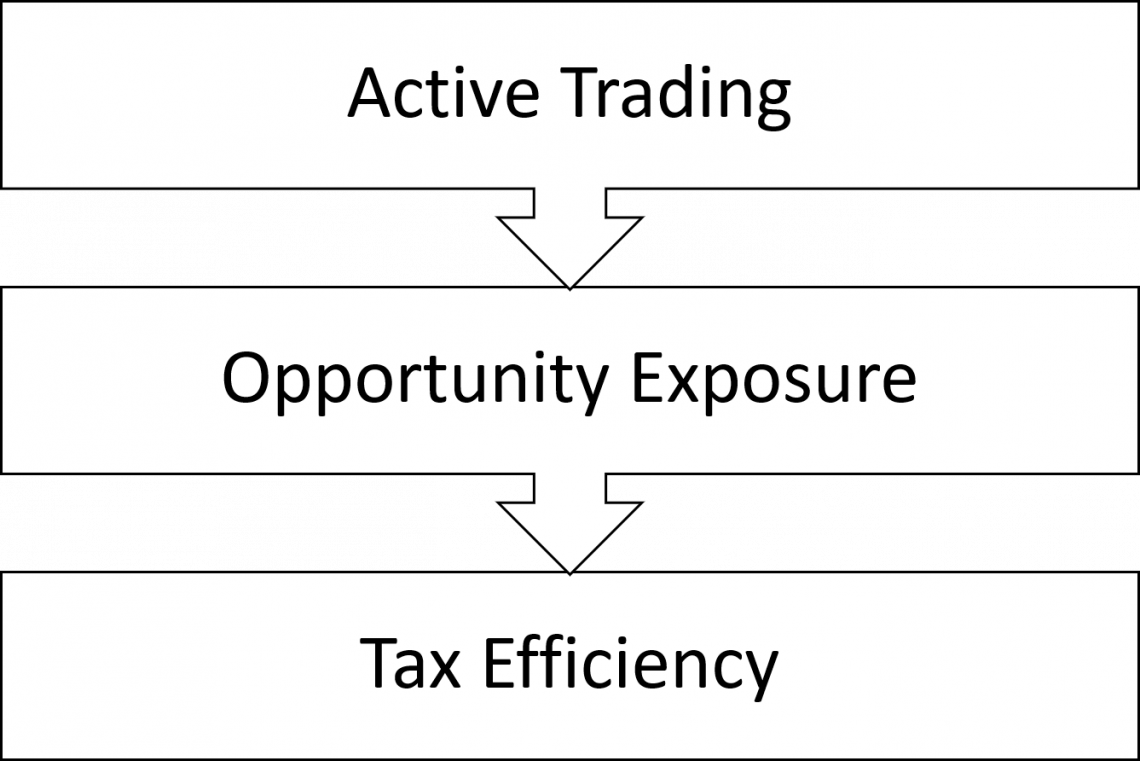

ETF would be your investment option if:

1. You are an active trader. ETFs help in day trades, stop orders, limit orders, and short selling.

2. You are looking to expose an opportunity. ETFs track specific industries and commodities, Thus, they can expose investors to particular market opportunities.

3. You are looking for tax-efficient investments. Unlike actively managed funds, passive ETFs provide tax-efficient investing opportunities.

When to invest in mutual funds

Mutual funds are acquired directly from investment companies and not through investor exchange. Moreover, they do not have a commission fee. However, they do yield expense ratios and other sales fees.

Mutual funds are also passive investments as they track an index. Most of these funds charge an annual expense of 0.1%, making them a low-cost investment option.

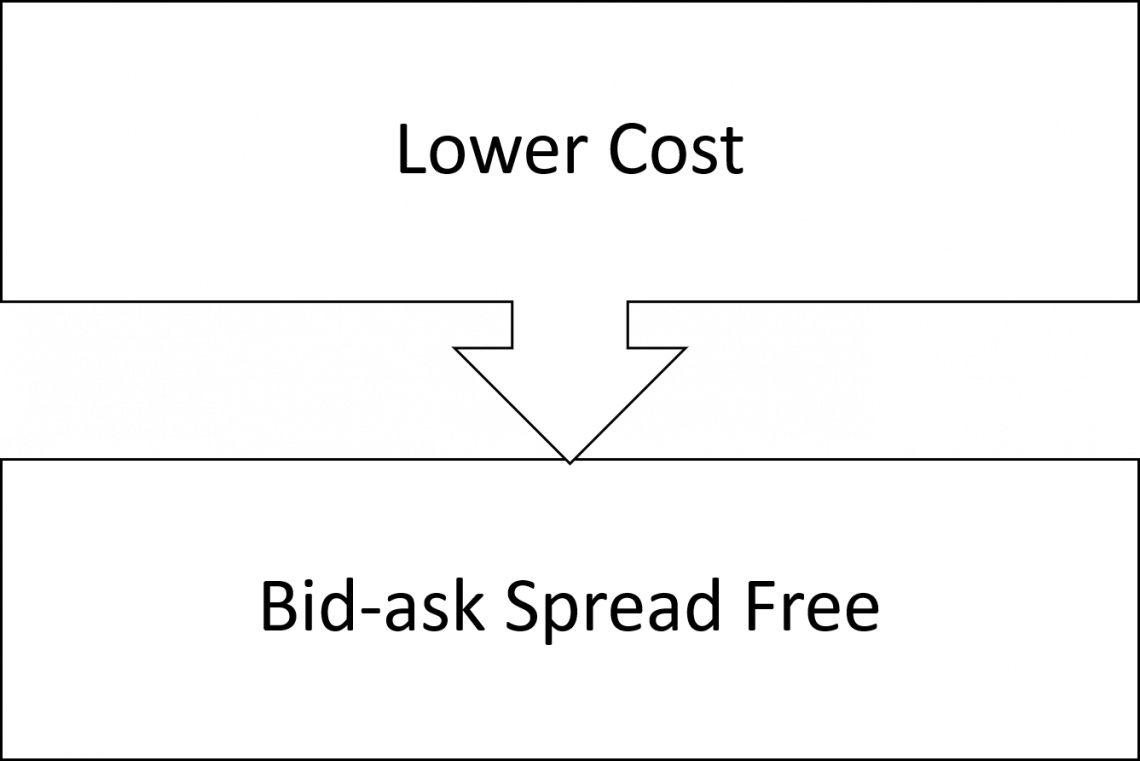

Mutual funds would be your option if:

1. You can get your hands on lower-cost mutual funds than some ETFs. Some index mutual funds may cost less than some comparable ETFs. Thus, assuming ETFs are always cheaper is not valid.

2. Bid-ask spread free. As mentioned earlier, low-volume ETFs may come with a bid-ask spread, making it hard for these funds to trade at a fair price. However, mutual funds are always traded at NAV without a bid-ask spread.

Drawbacks of ETFs and Mutual Funds

ETFs:

1.Large bid-ask spreads. When purchasing or selling ETF shares, the price may be lower than its actual value (Net asset value). This is often effective in ETFs with low trading volume.

2. Temporary fee waivers. Some brokerages offer fee waivers only for a limited time. Then, they would stop the waiver and increase the expense ratio. Make sure to review the waiver’s expiration date in the ETF’s prospectus.

Mutual funds:

1. Index funds can never beat the market. Index mutual funds can never overtake the performance of actively managed funds since they track the performance of an index.

2. Mutual funds are not customizable. When you invest in a mutual fund, the index fund may not include some promising companies in which you would like to invest. Moreover, it may consist of those you think are not worth it.

3. Less crash protection. Even though index funds like S&P 500 are considered an excellent long-term investment, When you hold an index fund, you are the victim of a crashing market. Thus, when the market goes down, so does your index fund.

Actively Managed Funds

Actively managed mutual funds are run by portfolio managers, who expert research analysts assist.

Active managers run your funds according to the way they view the market. Sometimes in a rough market, the manager may decide to play it safe by selling risky assets and buying more conservative ones. These funds are usually more expensive, mainly due to the management compensation.

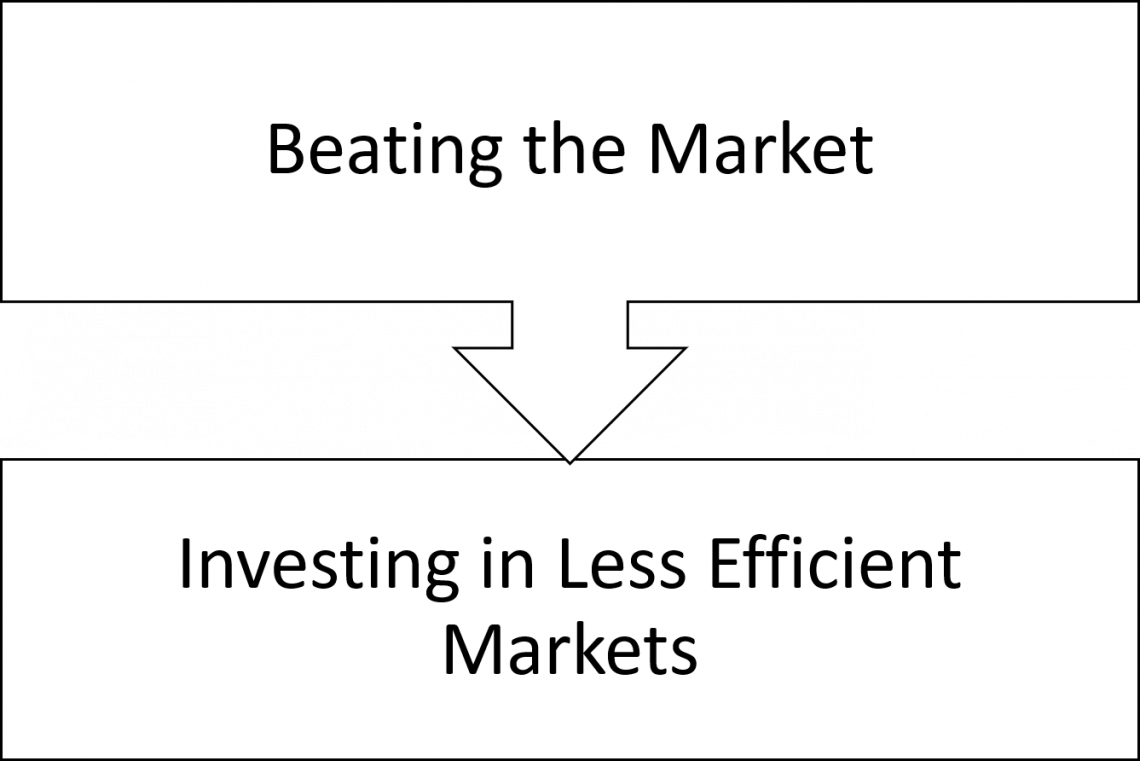

Consider actively managed funds if:

1. You are looking for a fund that can beat the market. Actively managed funds provide the opportunity of beating the market and protection from a potential downfall. This makes these funds the “go-to” option for many investors.

2. You are investing in a less-efficient market. An efficient market is where information is easily spread, and opportunities are quickly eliminated, making active managers useless in such markets. The large-cap US market is an example of an efficient market.

However, in less efficient markets such as emerging stock markets and high-yield bonds, there are many possible opportunities an active manager could help you attain.

Actively managed mutual funds also have some drawbacks.

1. They may be underperforming in the market. You may decide to invest in an actively managed mutual fund to beat the market, but the plot twist is that the market can beat them. Active managers are human beings with mistakes there to be made.

2. Higher fees. Since you are asking a portfolio manager to control and actively manage your fund, you should be ready to pay more fees to compensate for such management.

3. Less tax-efficient. To beat the market, managers will have to make more investments and purchases, providing more capital gains. Effectively, these capital gains are taxed. The more you realize these gains, the more you are taxed.

Key Takeaways

- The S&P 500 index is a stock index that tracks the largest 500 companies in the US equity market.

- You don’t invest in the S&P index but mutual funds and exchange-traded funds (ETF).

- Investors can obtain mutual funds directly from investment companies such as Vanguard and Fidelity investments.

- Funds can be the right choice for beginners looking to enter the world of investments as they allow investors to invest in the performance of the funds, leaving the investor with less stuff to worry about.

- Just like stocks, exchange-traded funds can be attained through direct exchange.

- To buy index funds, open an account via online platforms like Fidelity or apps like Robinhood. Then, choose a stock index (S&P 500, Nasdaq, etc.). Finally, pick between mutual funds or exchange-traded funds.

- Investing in mutual funds, exchange-traded or actively managed mutual funds, depends on your goals and needs.

or Want to Sign up with your social account?