Short Selling

A trading strategy where investors bet on a stock's price decline by borrowing shares, selling them, and then repurchasing them later at a lower price

What Is Short Selling?

A trading or investment method known as short selling predicts a stock's price drop or other security. It is considered a sophisticated approach suitable for experienced traders and investors.

Investors or portfolio managers may use short selling as a hedge against the downside risk of a long position in the same security or a comparable one, while traders may use it for speculation.

Speculation involves high-risk trading strategies and is considered more advanced than traditional investing. A more frequent transaction is hedging, which involves taking an opposite position to lessen risk exposure.

When a seller engages in short selling, they open a short position by borrowing shares, typically from a broker-dealer, with the intention of repurchasing them at a profit if the price falls. Because you cannot sell shares that do not exist, shares must be borrowed.

A trader who wants to liquidate a short position purchases the shares again on the open market, hopefully for a lower cost than they borrowed them for, and then returns them to the lender or broker.

Traders must consider any interest charges or commissions the broker imposes when engaging in short selling.

Key Takeaways

- Short selling is a trading strategy where investors bet on a stock's price decline by borrowing shares, selling them, and then repurchasing them later at a lower price.

- Short sellers borrow shares, sell them at the current market price, and aim to buy them back later at a lower price, profiting from the difference. It involves selling high first and buying low later.

- Short selling involves risks like margin calls, timing challenges, short squeeze vulnerability, regulatory uncertainties, and costs like interest on margin and fees for borrowing stock.

- Regulations, like Regulation SHO in the U.S., aim to prevent naked short selling and require disclosure of short positions. Regulations vary globally, with different requirements in the EU, UK, Hong Kong, Japan, and Australia.

- Short selling is criticized for its association with aggressive tactics and market manipulation, but it also contributes to market liquidity and provides valuable market sentiment insights.

How does short selling work?

As mentioned earlier, short selling is borrowing an asset (e.g., company stock) from your broker and selling it. When the price of the security declines in the future, the short seller buys back the borrowed asset at a lower price to return it to the broker, profiting from the difference.

Short selling involves selling borrowed assets with the expectation of buying them back at a lower price, contrasting with the traditional long position where investors buy and hold assets with the expectation of their value increasing.

Another way to look at this concept is that it still follows the rule of thumb in investing by buying low and selling high, with a key difference that short selling reverses the order by selling high and then buying low.

Short selling is a bearish tactic because you are looking to profit from a company’s stock price decline. Although the mechanics of this method differ from selling calls or buying puts, the idea is the same: you think the stock is overpriced.

Shorting is considered a high-risk strategy and should be undertaken by investors with a strong understanding of market mechanisms. To take a short position against a company’s stock, investors would need to have a margin account instead of the standard cash account.

Note

A margin account is necessary for short selling because the broker lends the investor funds to execute the short sale. So you’d need to put up collateral of a certain percentage of the total value of your short position. This is called the initial margin, which is fixed at 50% in the US.

Example of Short Selling

Let’s go over the mechanics of taking a short position or “betting against” a company to show how investors could profit from a decline in its price. For simplicity, let’s assume that no transaction costs, dividends paid, or interest rates are involved.

In addition, suppose that you are an analyst at WSO Inc. analyzing a fake competitor’s stock, Corporate Finance Academy.

The company is trading at around $10 per share. However, as an online education platform, you’ve read some of their articles and realize that most are inaccurate and outdated. Upper management has been complacent and unaware of emerging competitors.

The competition is expected to eat away at Corporate Finance Academy’s market share. Because of this, you believe they are overvalued, and you expect their share price to decline to $5.

You inform your supervisor that you intend to take a short position of 2,000 shares against the company. This is what happens:

- You short 2,000 shares of Corporate Finance Academy, receiving $20,000 (2,000 shares * $10)

- After 6 months, the share price dropped to $4, which was in line with your initial conservative analysis

- You decide to “cover your short position” by buying back the 2,000 shares from the market

- You spend $8,000 (2,000 shares * $4) and subsequently return the 2,000 shares to your broker

- You made a profit of $12,000 ($20,000 - $8,000). Good job!

Essentially, this is the mechanics of shorting a stock. First, you believe a company’s share price will decrease, so you short it to profit from that price movement.

Note

Short selling is one of the mechanisms through which investors can potentially profit from market movements, depending on market conditions and the accuracy of their analysis.

Additional Considerations with Short Selling

Apart from the potential loss due to a bond or stock's increase in price, short selling presents additional hazards that investors should consider.

1. Borrowed Funds Utilization

Short selling involves margin trading, wherein establishing a margin account allows you to borrow funds from the brokerage firm, using your investment as collateral. Similar to going long on margin, losses can escalate quickly as you must maintain a minimum maintenance level of 25%.

Falling below this threshold triggers a margin call, necessitating additional cash infusion or position liquidation.

2. Timing Challenges

Although a company might be overvalued, its stock price may not decline immediately. During this period, you're exposed to interest charges, potential margin calls, and the risk of being compelled to exit your position.

3. Short Squeeze Vulnerability

Highly shorted stocks, characterized by a substantial short float and days-to-cover ratio, are susceptible to short squeezes. This phenomenon occurs when a stock's price starts to rise, prompting short sellers to buy back their short positions.

Note

This buying activity can fuel further price increases, leading to additional short sellers covering their positions, thus intensifying the cycle.

4. Regulatory Uncertainty

Regulators occasionally impose restrictions on short sales within specific sectors or across the broader market to mitigate panic and unwarranted selling pressure. Such interventions can trigger abrupt spikes in stock prices, compelling short sellers to close their positions at significant losses.

5. Contrarian Nature

Historical trends indicate a general upward trajectory for stocks. Over time, most stocks tend to appreciate in value. Even if a company's performance remains relatively stagnant, inflation or overall economic price increases typically contribute to upward stock price movements.

Consequently, shorting entails betting against the prevailing market direction.

Costs of Short Selling

Unlike buying and holding investments, short selling incurs substantial costs beyond standard trading commissions payable to brokers. These costs include:

1. Interest on Margin

Trading stocks on margin entails significant interest expenses. Since short sales require margin accounts, the interest accrued on short trades can accumulate, particularly for prolonged open positions.

2. Fees for Stock Borrowing

Due to factors like high short interest or limited float, shares that are challenging to borrow incur "hard-to-borrow" fees. These fees, often assessed at an annualized rate, vary widely and can range from a fraction of a percent to over 100% of the short trade value.

The exact fee amount may fluctuate daily, making it challenging to predict in advance.

Note

Typically, broker-dealers charge this fee to the client's account either monthly or upon closure of the short trade. Substantial fees can significantly impact the profitability of a short trade or worsen losses.

3. Dividends and Other Obligations

Short sellers are responsible for remitting dividend payments on borrowed stocks to the entity from which they were borrowed. Similarly, for shorted bonds, they must repay the lender the owed coupon or interest.

Additionally, short sellers must cover other payments related to events associated with the shorted stock, such as share splits, spinoffs, and bonus share issuances, which are inherently unpredictable.

Pros Of Short Selling

Here are some benefits of allowing investors to short stocks:

- Price efficiency - investors would be able to push stocks toward their true value and reduce bid-ask spreads

- Market liquidity - there would be an increase in money flow from this activity.

- Hedging tool - Investors who are afraid that their long position may suffer from an impending recession could protect their portfolio by taking a short position.

- Greater returns - investors would be taking on more risk, allowing them to amplify the potential returns on their portfolio. The greater return arises from the fact that you use leverage to generate returns.

In general, short selling may seem like a great idea, but it is a controversial topic.

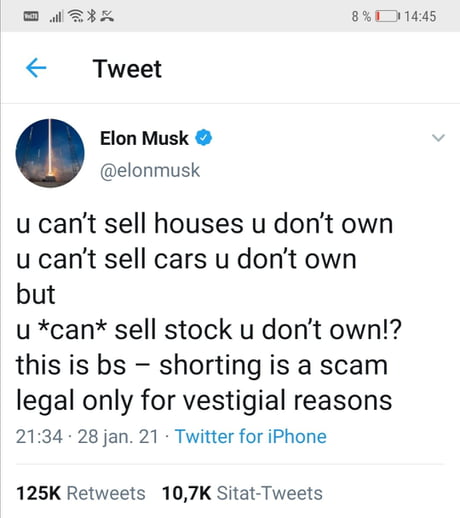

Many people, including Elon Musk, are against short sellers. This is because they consider it predatory, where investors exploit market conditions and profit from the losses of others.

Cons of Short Selling

Aside from the fact that many consider short-selling unethical, some factors can't be ignored when you decide to bet against a company. Here are some disadvantages of short selling:

- Brokerage fees - people who short a company incur additional fees that you wouldn't otherwise experience when simply buying stock.

- Dividend losses - for the period you are shorting a company, you are entitled to pay out any dividends that the company announces. This is because you owe someone the number of shares that you shorted and any money that the company pays out.

- Interest rates - you can think of short selling as taking out a loan (after all, you are trading on margin). Because of that, the amount of money you borrow will be subject to an interest rate until you decide to cover your position.

- Buy in risk - brokers can force you to cover your short before you'd ideally want to. This could result in you losing money even though your strategy was correct.

Short Selling Regulations

In the United States, the U.S. Securities and Exchange Commission (SEC) oversees short selling under the Securities Exchange Act of 1934.

Regulation SHO, introduced in 2005 to modernize previous regulations, is the primary rule governing short selling. It stipulates that short sales can only occur in a tick-up or zero-plus tick market, indicating the security price must be rising at the time of the short sale.

Another crucial aspect of Regulation SHO is the locate requirement. Before executing a short sale, brokers must secure a party willing to lend the shorted shares, or they must reasonably believe that borrowing the shares is feasible.

This precautionary measure aims to prevent naked short selling, where investors sell shares they haven't borrowed.

Note

The SEC also holds the authority to impose temporary bans on short selling for specific stocks under specific circumstances, such as during periods of extreme market volatility.

In October 2023, the SEC introduced new rules to enhance transparency in short selling. These regulations mandate investors to report their short positions to the SEC, and companies lending shares for short selling must report this activity to FINRA.

These updates follow increased scrutiny of short selling, notably after the GameStop (GME) meme stock frenzy in 2021. During this event, retail investors drove up the stock price, resulting in losses for hedge funds that had shorted the company.

With a delay, the SEC intends to publish aggregate stock-specific data, providing a more comprehensive view of market-wide short positions. However, some hedge funds have expressed apprehensions regarding the potential exposure of investors' strategies.

Short Selling Regulations Outside the U.S.

Short selling regulations differ across jurisdictions outside the United States, such as:

| Country | Regulatory Body | Regulations |

|---|---|---|

| European Union | European Securities and Markets Authority (ESMA) | Two-tier model: Positions exceeding 0.2% of issued shares must be disclosed to regulators, and those exceeding 0.5% must be publicly disclosed. |

| United Kingdom | Financial Conduct Authority (FCA) | Regulations generally align with those of the EU. |

| Hong Kong | Securities and Futures Commission (SFC) | Short selling is permitted only for designated securities and must be supported by borrowed shares, with naked short selling prohibited. |

| Japan | Financial Services Agency (FSA) | Short selling is permitted only at a price higher than the latest market price. |

| Australia | Australian Securities and Investments Commission (ASIC) | Reporting mandated for short positions exceeding $100,000 or 0.01% of total shares. |

Short Selling's Reputation

Short selling often faces criticism, and those who engage in it are sometimes portrayed as aggressive individuals aiming to dismantle companies.

However, the truth is that short selling plays a role in maintaining market liquidity, ensuring there are enough buyers and sellers, and preventing overhyped and overly optimistic stocks from surging.

This function becomes evident during asset bubbles that disrupt the market, such as the mortgage-backed security (MBS) market before the 2008 financial crisis, which was notoriously challenging, if not impossible, to short.

Short-selling activity also serves as a valuable source of information regarding market sentiment and demand for a stock. Without this insight, investors may be blindsided by negative fundamental trends or unexpected news.

Unfortunately, short selling has garnered a negative reputation due to the actions of unethical speculators.

These individuals exploit short-selling strategies and derivatives to deflate prices and artificially conduct bear raids on vulnerable stocks. While most forms of market manipulation like this are illegal in the U.S., they still occur periodically.

Researched and authored by Jasper Lim | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?