Equity Market

A platform that allows businesses to raise funds from various sources.

What Is An Equity Market?

An equity market is a platform that allows businesses to raise funds from various sources. As a result, a company issues stocks, which investors or traders buy in the hopes of profiting from future stock sales.

The terms "stock market" and "equity market" are sometimes used interchangeably, as they both serve the same objective of facilitating stock trading.

However, in addition to exchange, the equity markets include over-the-counter trading markets.

As a result, it functions as a marketplace for private equities traded over the counter and public stocks listed on exchanges such as the NYSE, NASDAQ, SSE, BSE, NSE, and many others.

Understanding Equity Market

The stock market is where buyers and sellers of equities come together. Privately held stocks and public stocks, or those listed on a stock exchange, are the two types of assets traded in the equity market. Over-the-counter markets are those in which private stocks are exchanged through dealers.

As previously stated, the hub that links buyers and sellers of stocks is the equity market. An initial public offering (IPO) is used to list equity securities on the market, and they are then traded amongst individuals on the secondary market.

Trading can occur in two ways: openly, through listings on public exchanges, or privately, by dealers initiating deals and issuances rather than through a centralized exchange. OTC marketplaces are characterized by the usage of dealers in the private market.

Among the biggest and most well-known equities markets are:

- London Stock Exchange (LSE) - United Kingdom

- New York Stock Exchange (NYSE) - United States

- Nasdaq (NASDAQ) - United States

- Japan Exchange Group (JPX) - Japan

- China's Shanghai Stock Exchange (SSE)

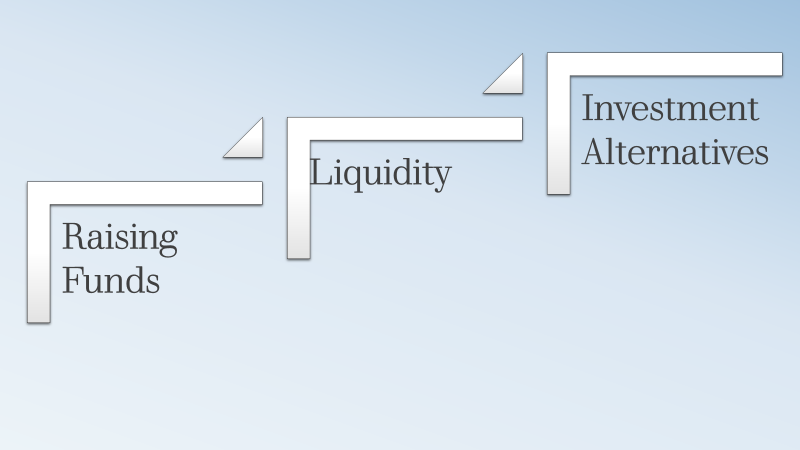

Importance Of equity market

In a market-based economy, equity markets are critical. They offer opportunities to obtain and increase funds, liquidity, and investment size.

These vital functions ensure that our economy continues to thrive and are the hallmark of capitalism.

1. Raising Funds

It makes it easier to raise equity funds. This is critical for entrepreneurs who have a business idea but warrant the necessary finances to get it off the ground.

Banks are debt investors, and they are reluctant to advance loans to these companies without collateral or disproportionately high-interest rates.

As a result, giving up a stake in their company in exchange for backing is a financially sound idea for these entrepreneurs.

These companies may access the largest pools of cash through equity markets because they don't have to go out and find individual investors; rather, investors are brought to them through a network of investment banks and fiscal exchanges.

2. Liquidity

Market liquidity is also provided through it. The ease with which an asset can be converted into cash is referred to as liquidity. For example, checking accounts are the most liquid, but a painting is illiquid as it will typically take longer to sell.

Because equity markets are a centralized center for buyers and sellers, it is simple to identify someone eager to buy or sell your stock, and you can easily convert it into cash.

Because they reflect the immediate underlying supply and demand from millions of buyers and sellers worldwide, these markets are powerful price engines.

Stock prices rise when demand is high and buying activity is high, whereas stock prices fall when demand is low, and selling activity is high.

3. Investment Alternatives

For investors, equity markets offer a wide range of investment alternatives. By selecting different equity securities, investors can tailor their risk profile and gain exposure to various firms and industries.

These are also viable options for debt investing, which is advantageous to investors with larger risk tolerance.

These markets serve as a hub in which shares of companies are issued and traded. The market comes in the form of an exchange – which facilitates the trade between buyers and sellers – or over-the-counter (OTC), in which buyers and sellers find each other.

Equity Formula:

The accounting equation is

Assets – Liabilities = Equity

There are two types of equity:

Equity is recorded in accounting as its book value and is determined using the financial statement and balance sheet equation.

Equity = Assets – Liabilities is the equation used to calculate book value.

Although assets are the total of the company's current and non-current assets.

Fixed assets, cash, inventory, accounts receivable, property plant, intangible assets, and other information are also included in the primary account assets.

On the balance sheet, liabilities are the total of current and non-current obligations. Long-term debt, credit, accounts payable, short-term debt, deferred revenue, fixed financial commitments, and capital leases are some of the other accounts.

Equity is denoted in finance as market value, which might be substantially lower or higher than book value.

The distinction is that an accounting statement looks at the past (past expenditures). Hence the financial statement looks ahead and forecasts what a company's financial situation will be in the future.

The market value of a publicly traded company's stock is calculated as

Market Value = Share Price * Shares Outstanding

A private corporation, on the other hand, hires investment bankers, boutique valuation firms, or accountancy firms to analyze market worth.

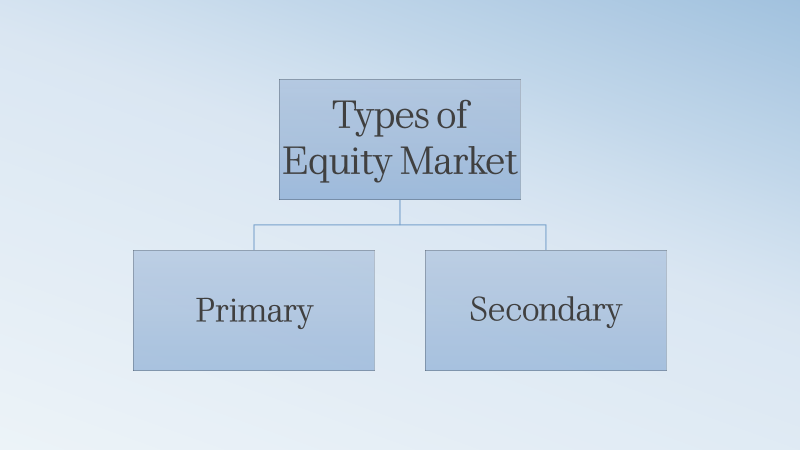

Types of equity market

These are made up of structured trading and investing platforms that are divided into two categories: primary and secondary markets.

The primary market

Each firm that wants to sell its stock to the public must start with an Initial Public Offering (IPO). In this method, the company initially raises funds by selling a portion of its base equity to the public.

The equities offered in the IPO are also listed on the stock exchange for further trading.

The primary market is where a company's initial public offering (IPO) takes place. In other words, this market is solely for launching and investing in initial public offerings (IPOs).

The Secondary Market

Once the shares have been listed on one of the exchanges, they can only be traded in the secondary market. Initial investors can sell their stock in this live equity market to exit their original investments.

These stocks may be comprised of shares and other types of securities such as convertible bonds, corporate bonds, etc.

While investors who missed out on buying shares on the primary market can still invest in the secondary market, it also allows a wider spectrum of traders to invest in these stocks.

Another unique aspect of the secondary market is that trading is typically conducted through middlemen known as stockbrokers.

The Procedures in an Equity Market

It serves more than to facilitate trade. Its operations also include other procedures. Below is an overview of these procedures for trading.

Trading

Trading, as previously said, is a fundamental operation that involves the purchase and sale of securities issued by publicly traded corporations.

Brokering agents provide these services to individual traders for a fee, and the procedure is conducted using a screen-based automated system.

It functions as an open marketplace where buyers and sellers can place orders based on the availability of trade options.

Risk Management market

Another practice linked with stock markets is risk management. Participating in the stock market entails risk. A comprehensive risk management system guarantees that investors' interests are protected while a company's deception is minimized.

The technology keeps the stock market up-to-date with new trading processes and protects against market failures.

Settlement and Clearing Market

By the end of the day, every investment or trade made throughout trading hours has been cleared and settled. A stock exchange does this through a well-defined settlement cycle.

For such settlements on Indian exchanges, the T+2 cycle is used, which indicates that settlements are performed within two days after the deal has been completed for a certain day (day 1).

Individuals can use these markets to meet long-term financial needs by strategically trading and investing. Such gains can help offset rising inflationary pressure and the resulting financial burden caused by increased costs.

It is thus ideal to become familiar with the fundamentals of the stock market, as well as its laws, to generate money in the long run through investment and trading.

What is the Market Value of Equity?

The market value of equity is the entire market value of a company's outstanding stocks. The outstanding stocks are the shares owned by a company's shareholders.

After expenses are paid, a company's assets are awarded equity. Market capitalization is another name for it. As a result, the market value of equity is always changing as the two inputs (existing stock and market value) change.

The market value of equity in a corporation differs from the book value of equity since the book value does not consider the company's future potential development.

Market Value of Equity is calculated by multiplying the current value per share by the total number of outstanding stocks in the organization.

Factors Affecting Market Value of Equity

The factors affecting the market value are

Several Market Contenders- The market becomes more comprehensive and competent if the number of investors, traders, and analysts rises.

Availability of New Information- Any new developments in the firm, such as its expansion or the manufacture of new goods, have an impact on the company's financial condition.

As a result, it affects the price of the company's share, which in turn determines the company's market value. The market value falls, as it does during a recession.

Government Interference- This aspect has a significant impact on the market value of the firms in circumstances where many countries prohibit other countries from trading in their markets.

As a result, the market value of these enterprises in such a limited market cannot expand as much as it might in other free markets.

Examples of Equity:

If PQRS Company had 10 lakh outstanding shares, and the company's current market value is $70 per share. The company's market value of equity will be ($70 per share X 10 lakh outstanding shares = 700 lakhs)

What is 'Growth' in the Equity Market?

Shares exchanged in the equity market belong to growing enterprises. Investors generally invest in 'growth' stocks, which belong to tiny businesses with great development potential.

Growth stocks are those in which investors are willing to make large offers in the live equities market, whether in India or globally. Investors use online equities trading to collect growth stocks and sell them at very low prices later.

What is the difference between Stock and Equity?

There is almost no distinction between stock and equity. These two terms are widely used to refer to the stock.

The terms stock and equity are interchangeable. Online equities trading systems are used for equity share trading.

How can I trade here?

To trade in the equity share market, you'll need the right tools: a Demat and trading account, funds to buy stocks, and a competent broker platform to execute transactions.

You may now trade stocks online from the comfort of your own home, workplace, or even while traveling.

To begin investing, you must first choose the correct stocks. Follow the live equities market to find some promising investment ideas and conduct some studies. This will assist you in fine-tuning your equity market growth and investing plans.

How To Do Online Equity Trading?

Online equities trading in India is now a simple procedure. Every online account holder has a user/customer ID and password. These credentials will enable you to conduct live equity share trading on the stock market.

Always keep in mind that brokers use professional-grade IT security, assuring high-quality, risk-free online equities trading. Here's a step-by-step guide.

Don't forget to register a free Demat account before you start investing.

Learn to access the online broker platform.

To gain access to your account, enter your ID and password. Your personalized page loads and the possibility to trade are now available. Access the online platform only during market/trading hours.

Choose the stock to trade and buy/sell on the stock exchange at your desired price. Your deal is complete after the order is processed. You will receive an SMS notice of the trade order details and confirmation of the ledger balance in the evening.

What Are The Timings Of the Equity Market?

There is no 24-hour stock trading system yet.

The normal trading time is between 9:30 am to 04:30 pm(EST), Monday to Friday. On Saturday and Sunday, trading does not happen unless there are special circumstances.

What Are Equity Trading Holidays?

Apart from weekends and non-business days, trading does not stop. You can check equity trading holidays on the website.

What Are The Things To Know Before You Trade In Equity?

The global share market, whether it is the equity market in India or the Asian equities market, is teeming with traders and investors looking to make a profit. It might be difficult to digest information at times. There are also other sorts of equity markets.

As a result, it is usually a good idea to have certain ground rules in place before trading inequities.

Never go against the current approach of the stock market; the trend is your friend. Do not place contrarian bets completely unless you are very certain. Going against the tide raises the risk factor.

- Buy low, sell high: Try to purchase equities that are selling at historically low prices and low valuations. When you acquire such equities, you can profit when the equity rises again.

- Think long term: Nobody can forecast what the equities market will do next in the near term. As a result, it's critical to have a long-term perspective on the transactions you conduct.

- Intraday trading knowledge: Before you jump on the stock market bandwagon by listening to random advice, it is best to learn how to execute intraday trading for better outcomes with your trades and investments.

- A $100 stock is not expensive, and a $10 stock is not cheap: Some investors approach equity investing the same way they buy clothes or vegetables. They seem to think if a stock is priced at $100, it is more costly than a stock that is $10. Therefore we should use valuations to understand what is cheap and expensive in the market.

or Want to Sign up with your social account?