Trade Order

A preset instruction to either buy or sell a security. It is automatically executed when the price of the stock or bond triggers the preset desired price.

What are Trade Orders?

A trade order is an instruction to either buy or sell a security. It is executed when a stock or bond is involved in a transaction. Each type of trade order has a specific function that can benefit the trader or investor, but some charges may have a fee.

The buyer and seller of a transaction must specify the type of order that they are placing. The most common types of charges and restrictions are:

- Market order

- Limit order

- Stop order

- All or none (AON)

- Immediate or cancel (IOC)

- Fill or Kill (FOK)

- Good ‘til canceled (GTC)

These are some of the most common orders associated with the stock, bond, commodity, financial derivative, and cryptocurrency markets.

Understanding the different types of orders is imperative for investing on your own without the assistance of an advisor. This article lets you determine what kinds of orders complement your investing profile and experience.

For example, depending on your time horizon, the order type you pursue could change. A long-term investor would likely be more interested in a simple market order because it is the more effortless, cost-effective method, as the current market price is not as paramount.

Understanding the different trade orders can:

- Save you time

- Reduce your risk

- Save you money

Types of stock trade orders

There are two types of trade orders that are most commonly used among average investors: market and limit orders. These can both be used to purchase or sell a security.

Individuals who are committed to long-term investing are more likely to use market orders because they are the most cost-effective and typically secure the immediate execution of the order.

If you desire the immediate execution of an asset, a market order is the most immediate transaction.

Traders and individuals seeking to capitalize on short-term volatility are more likely to use limit orders, stop orders, and other order types that are often accompanied by fees.

Choosing an order type should coincide with your investing goals and time horizon. Make sure that the brokerage you invest with provides the trade orders you would like to use.

Here is a brief video about the most commonly used order types by TD Ameritrade.

Trade Order: Market order

This is the most commonly used order among investors because it is the cheapest option. This order buys or sells the stock at the current market price. In other words, the market sets the price rather than the individual.

A market order does not necessarily have to be placed while the market is open (9:30 AM to 4:00 PM EST on non-holiday weekdays). However, if the order is placed when markets are closed, the trade will be executed at the price when the market opens the following day.

This price could be significantly different from when the market closed.

Some events that could occur and affect the stock’s price while the market is closed are:

- Release of an earnings report

- Company news

- Economy news

- Unexpected events that affect the specific sector/industry or market as a whole

For the most part, a market order ensures that your transaction will be executed at the market price, but this price is not guaranteed. This order is guaranteed to be completed as soon as possible.

Market orders are commonly used when:

- You believe the stock is at a satisfactory price to buy or sell

- You are confident you want to execute the trade

- You want the exchange to be completed immediately

The shares are purchased at or near the posted ask price with this order. On the other hand, the stock is sold at or near the published bid price. Both the bid and ask prices hover around the current stock price but fluctuate significantly depending on volatility.

For example, a large-cap company with a stock price of $150 could see millions of shares involved in transactions per day.

In the seconds between the time an order is placed and when the order is executed, the stock price could decrease to $149.50 or increase to $150.50. When the price moves in an unfavorable direction following the placement of a market order, it is called “slippage.”

Market orders are practical for most individual investors.

Trade Order: Limit Order

Limit orders are the second most commonly used order type. These are sometimes referred to as pending orders. These orders allow the investor to buy or sell a stock at a defined price in the future. The order will not be filled if the price does not reach the pre-defined level.

There are two types of limit orders:

- A buy limit is an order to purchase a security at or below a defined price.

- For example, if you wanted to buy a stock at $85, you could place a limit order to buy at this price. As a result, shares would not be purchased until it reached $85.

- A sell limit establishes that the security will not be sold below a defined price.

- For instance, if you set the sell limit price to $90, the stock would only be sold when it reaches $90.

Limit orders can be accompanied by a fee depending on the brokerage. It’s essential to determine whether placing a limit order to execute a trade at a specified price provides more value than the cost incurred by the order.

Additionally, limit orders are not guaranteed to be executed because these orders are fulfilled on a first-come, first-serve basis. There is a set amount of limited orders for a price that can be managed at once.

Trade Order: Stop order

Stop orders are designed to limit the potential losses on a position. This order sells a stock when it reaches a specific price.

Stop orders are just market or limit orders with an activation price (“stop price”). When this activation price is reached, the specified order is executed. For a buy order, the stop price has to be above the current market price.

For a sell order, the stop price has to be below the current price. In essence, the purpose of stop orders is to minimize losses, which is why they are commonly referred to as “stop-loss” orders.

For example, imagine an investor has a target sell price of $40, and it is currently at $30. The individual could place a stop order at $20. The position would be executed when the price hits $20, but it would not necessarily be sold for exactly $20.

The price the position sells depends on the supply and demand of the stock. As a result, if the stock rapidly declined, the stock could be sold at $18 or even lower. More specific examples of stop orders are mentioned below.

Three types of stop orders:

1. Stop Market Order

A stop market order is designed to immediately buy or sell a security once it reaches the stop price. Similar to a market order, it is intended to execute the order at the best available price, but this is not guaranteed.

For example, if you own a stock valued at $14, you could place a stop market order to sell at $13.50. If the price decreases to at least $13.50, the stop order becomes a market order to sell and will sell the stock at the best available price.

2. Stop-Limit Order

A stop-limit order specifies a price to activate the limit order. The stop price and limit cost of an order can be different. Once the stop price is reached, the stop-limit order becomes a limit order, but the execution is not guaranteed.

For example, say a stock is currently at $20, but you think it’ll skyrocket if it hits $22. You can place a stop-limit buy order with a stop price of $22 and a limit price of $25. The stop-limit sell order would automatically become a limit order once the price rises to $22.

Once the stop price is met, the trade will be filled as long as the order can be executed under the limit price of $25. The order will not be filled if the stock price surpasses $25.

3. Trailing Stop Order

A trailing stop order sets the stop price concerning the market price. The stop price can be measured by dollar amounts or a percentage change in relation to the market price.

For example, if you own a stock valued at $30, and the price rises to $33 in just a few days, you could set a trailing stop order to sell at $2 below the market price.

If the stock price were to fall by $2 to $31, the order would become a market order, and the stock would be sold at the best available price. This stop price fluctuates. For instance, if the stock rose to $37, the stop price would now be $35.

Other Stock Order Types

1. All-Or-None order (AON)

A more important stock order type for trading penny stocks. This order ensures you receive the entire quantity of shares specified or none at all.

For example, if your order demands the purchase of 3,000 shares, but there are only 2,500 shares available at your preferred price, then the order will not be executed. Without the all-or-none restriction, the order would be filled for 2,500 shares.

2. Immediate Or Cancel (IOC) Order

This type of order intends to be executed immediately, with any unfilled portion canceling.

This can be designated as a limit or market order and only requires a partial fill, unlike the all-or-none restriction. This is commonly used to take advantage of a volatile market and capitalize on lower prices to buy as many shares as possible.

3. Fill Or Kill (FOK)

This type requires the order to be filled in its entirety and immediately. This combines the AON order with the IOC restriction. If one of these conditions is not met, the order is canceled.

4. Good ‘Til Canceled (GTC)

Here, the restriction can be placed on orders. The order remains active until it is filled or the investor withdraws it. The maximum time a brokerage will typically allow you to keep a GTC order active is 90 days.

Trade Order FAQs

The order type you should use entirely depends on your investing profile. Short-term traders may use different orders than long-term investors.

For long-term investing, it is most common to use market orders because they are the most cost-effective and guarantee the security’s purchase.

Your order type depends on if you have a specific profit target in mind, if you have a maximum price you are willing to sell a stock for, etc.

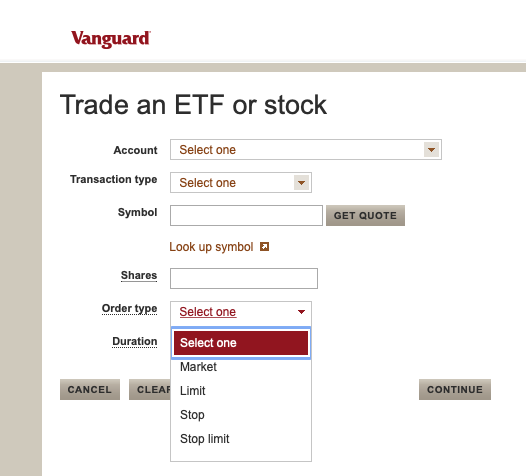

An order can be placed on your brokerage website. Here is an example from Vanguard:

Depending on the order type and time of day, the order may not be immediately executed.

Stock exchanges do not have a role in creating and controlling trade orders. This responsibility lies with the brokerages. This is why some brokerages offer more options for trading than others.

Brokerages supply these various order types to provide more options for their clients.

or Want to Sign up with your social account?