Market Share

Percentage of total revenue or sales in a market that a company or organization earns in a given period

Market share is the percentage of total revenue or sales in a market that a company or organization earns in a given period. In particular, the share of a company's business in the market is its total sales relative to the total sales of the industry in which it operates.

It also allows a company to evaluate not only the overall growth or decline of the market but also the trends in consumer choice among competitors.

This metric is calculated by taking a company's total sales over a given period and the total sales of the industry in which the company operates over that period. This metric and changes in sales help a company evaluate both primary and selective demand in its market.

To illustrate this in the real world, let's assume that a given company sells 10,000 units yearly. If the total number of goods sold by all companies within a particular market is 100,000 units a year, then a given company will have 10 percent shares in that market.

Companies with higher market shares usually have higher sales and a solid barrier to entry for other competitors. However, companies with a percentage below a certain level may need to be more viable in the market. These share trends are considered early indicators of future opportunities.

It also provides companies with important information about the following:

- Shares of the company's competitors

- Consumer perceptions and preferences for the company's business, brand, and products

- Consumer behavior and changing economic trends

- Company's price competitiveness

- Strengths and weaknesses of the company's business locations

- Future growth and opportunities

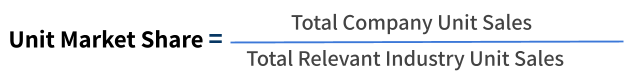

formula

Calculating the shares of a company's business in the market is reasonably straightforward. Two popular methods are used to calculate percentages in units of sales or sales revenue.

- Unit Share: units sold by a company as a percentage of total sales in a particular market

- Sales Revenue Share: total sales revenue of the company relative to the total sales of the industry

1. Unit Share

The unit share has value when the company is primarily interested in the number of units sold. Unit share is used and is more focused on when a company wants to measure the total volume or number of units of its product among retailers.

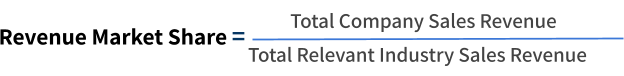

2. Sales Revenue Share:

Sales revenue shares, also known as dollar shares, are essential when a company wants to calculate percentages for a category containing many price points. Revenue share measures the dollar amount of sales for the industry and a particular company.

The information needed to calculate a company's share in the market is the company's total sales for a given period and the total sales of the relevant industry market. A given period can be a fiscal quarter, a year, or several years.

Once the required information is determined, market share is calculated by dividing the company's total sales by the industry's total sales.

Examples

Some of the examples are:

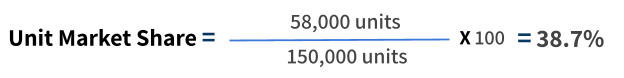

1. Unit Share Calculation With Example

Suppose a company wants to know the unit share of the market for the smartphones it will sell.

Let's assume that Apple sells 58,000 smartphones in a market with a total unit sale of 150,000. Then Apple's unit share in the market would be as follows:

2. Sales Revenue Share Calculation With Example

Suppose a company wants to know the sales revenue share of the market for the smartphones it will sell.

Let's assume that Apple sells $1,200,000 iPhone smartphones in a market with a total sale of $2,500,000. Then Apple's sales revenue share in the market would be as follows:

These market share calculations demonstrate that a company has a 39% share in units and a 48% share in sales revenue in the smartphone market. By calculating its shares in the market, Apple can find what percentage of the market belongs to its operating business.

Moreover, Apple can determine which line of smartphones in the market is the most targeted by consumers and which region of the world favors Apple products over its competitor.

Why Is it Important?

It is the most important metric as it shows a company's competitiveness compared to its competitors in the market. When a company's share of the market is higher, it has an opportunity to increase its profitability and growth.

A company with the largest share leads the market in a particular industry where it becomes the market leader. The market leader also has the highest profitability margin. That is why the market leader can control the market, influencing consumer loyalty to its brand.

Having the highest market share allows a company to use its leading position to increase economic efficiency in the market. The market leader can drive down unit costs through economies of scale and set price trends with a first-mover advantage.

A larger share in the market indicates that a company has achieved economies of scale where it will have more significant cost savings and higher production levels. It allows a company to be more competitive and overtake its competitors.

Larger companies with high shares have achieved economies of scale in the:

- Procurement

- Marketing

- Manufacturing

- Other cost components

For example, a company with a 60% share in a given market is twice as large as a company with a 30% share in the same market. A company uses more efficient working methods to reduce production costs.

It is also essential in the financial stock market as it affects stock prices in a highly competitive market. The size of a company and its market share greatly influence investors when making an investment decision.

Fluctuations in the market are essential for a company's stock performance. When a company's stock market performs well, it means that a company will raise more capital at a higher price.

Share of the market and return on investment (ROI) are closely related. The larger the company's claim, the higher the investment turnover and return on sales (ROS). The ROI rises about the level of net income from sales and the investment required to maintain a given sales volume.

How Does it Impact A Company?

Changes in the share of the market have a significant impact on the company's profitability. If a stake in the demand increases, the company will have a higher profit margin, better quality, and, most importantly, higher brand loyalty.

It is also an important metric to evaluate a company's performance relative to its competitors. A higher share allows a company to gain a cost advantage, operate at a larger scale, and increase profitability compared to competitors.

Some of the important impacts of a company's shares on its business performance include:

- Higher profitability

- Economies of scale

- Brand loyalty

- Better reputation

- Industry dominance

- Higher bargaining power

1. Increase in profitability

The market share increase is associated with the company's profitability. A higher share helps a company increase its total sales, giving it a competitive advantage to increase its profitability and growth.

2. Economies of scale

Increasing its share in the market allows the company to reduce the cost of producing a single unit of production due to economies of scale and increase the efficiency of production processes.

3. Increase in brand loyalty

Increasing its shares helps a company expand its customer base as potential new consumers follow the lead of brand-loyal consumers. A company with a high market share can use its dominant market position to influence consumer loyalty to its brand, product, and price.

4. Better Reputation

Increasing a company's share can strengthen and highlight its reputation relative to its competitors.

Thus, having a good market reputation helps a company increase its overall sales and expand its customer base.

5. Industry dominance

Increasing its shares can enable a company to become a market leader and increase its dominance in the industry in which it operates. A company with the largest share dominates the market in a particular sector.

6. Increase in bargaining power

A company with a higher share can use its dominant position in the industry to bargain good negotiations with suppliers and set price trends with a first-mover advantage.

How Can Companies Increase Market Share?

It's a sign of a company's competitiveness, allowing it to achieve a grander scale in the industry in which it operates. A company not only becomes more competitive but also improves its profitability by increasing its share.

A company can expand its share of the market through the following:

- Frequent launch of new products

- New innovative technology

- Boosting customer loyalty

- Improving marketing and advertising

- Having a skilled workforce

- Acquiring other companies

1. Frequent launch of new products

The launching of new innovative products to the market increases the company’s share in the market. New products create value propositions that meet unmet consumer needs. Most of the profits from new developments increase the shares of a company.

For example, Apple is best known for introducing innovative new products, improving its features yearly, and ensuring a seamless experience across multiple devices. Apple hosts an average of three to four events annually to announce new or updated products.

By releasing new or updated products yearly, Apple increases its sales by keeping its consumers informed about the latest innovation trends. That is why Apple is one of the market leaders in the smartphone industry. In the US, Apple owns 57.65% shares of the market.

2. New innovative technology

Innovation and breakthroughs are great methods a company can use to increase its share. When a company introduces new technology to the market that competitors do not yet have access to, it is a very effective way to convince consumers to switch to its product.

Many of these consumers who have switched to a company because of innovations can become loyal consumers, increasing a company's share and potentially reducing the percentage of the competitor they left.

For example, Tesla releases undeniably innovative products that exceed consumer expectations. Unlike other automobile companies, Tesla used a unique approach to establish itself in the market by creating an attractive car that started the demand for electric vehicles.

3. Boosting customer loyalty

Consumer loyalty to the brand and its product is crucial for the company's success in the market. By strengthening customer relationships, a company can protect its existing market share and increase it by expanding its new customer base.

Maintaining strong customer relationships is a crucial tactic for increasing a company's share in the market. The most loyal consumers pass on a positive experience to others when they are satisfied with a service or product received from a company.

For example, Tesla's strategy to strengthen consumer relationships is unique compared to its competitors. The company sells its vehicles directly to its customers and does not include third parties. It gives Tesla complete control over the relationship to offer consistent quality service.

4. Improving marketing and advertising

Advertising is an effective way to stimulate business growth. It is an expensive but practical way to increase a company's share. Advertising helps a company reach the right audience with compelling messages that turn potential customers into loyal customers.

Many marketers know that even though advertising is very high, these high costs increase market share. Not only in business for customers but also in business for business markets, the sales team's efforts are critical.

5. Having a skilled workforce

Most successful companies with the largest share of the market employ the most talented, highly skilled, and dedicated people. The presence of highly qualified employees in the workplace gives a company much more productive results.

A skilled workforce results in greater profits due to reduced employee turnover and training costs. In addition, it allows a company to allocate more resources to focus on its core competencies and increase workplace productivity.

Google is a great example of a company with a highly skilled workforce. The company builds and puts a lot of effort into office space to make it a very attractive workplace. Google is known as the best place to work because it has one of the most productive workplaces.

6. Acquiring other companies

One of the most effective ways to increase a company’s share is to acquire a competitor company. By acquiring its competitor, a company will be able to take over the acquired company's current customer base and reduce the number of companies competing in the market.

The acquisition of competing companies is a successful method of establishing dominance in the industry in which a company operates. This will allow a company to accelerate growth, increase revenue and grow its share without significant effort.

For example, The Walt Disney Company acquired Pixar in 2006 for $7.4 billion and Marvel Entertainment in 2009 for $4 billion. By merging Pixar and Marvel, Disney increased its share, lowered production costs, and became more competitive.

- Market share is the percentage of total sales in a market that a company earns in a given period.

- It is calculated by dividing a company's sales for a given period by the industry's total sales for the same period.

- Understanding and analyzing the market share is vital to a company looking to increase its profitability.

- Changes in shares have a significant impact on the company's stock performance.

Researched and authored by Mumina Abdurakhmonova | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?