Utility Theory

The concept of maximizing well-being and satisfaction from personal preferences for consuming goods & services.

What Is Utility Theory?

Moral philosophers were the founders of the theory of utilitarianism that focused on the school of thought maximizing well-being and satisfaction.

In economics, this concept was derived from this, but it focuses on personal preferences for the consumption of goods & services.

The theory is based on individuals' preferences according to which they rank their choices.

Each individual has intrinsic preferences; its function can be used to quantify and measure the conceptual ideas behind satisfaction and intentions.

Characteristics

- It depends on the intensity of the wants.

- It is individualistic and relative to time & place.

- It is not permanently attached to necessity or usefulness.

- It is a different concept than pleasure and is interrelated to satisfaction.

- The measurement is subjective rather than objective.

- It has no ethical or moral obligation and doesn't depend on the social acceptability of the good.

- It is psychological and depends on the consumer's mindset and personal assessment of the goods & services.

Types

- Form: Changing the arrangement or shape of the material, i.e., from raw material to a finished product.

- Place: Transport or transfer of goods involving marketplace, factories, retail - merchants, etc.

- Time: Storage or preservation of goods to release later in the market or at the time of scarcity by hoarding to get higher prices.

- Service: Personal services supplied by professionals.

Utility Theory Function

The theory of utilitarianism involved philosophy, physics, psychology, & economics back in the 18th & 19th centuries. The origins of its measurement changed when it was freed from physics.

- Ordinal: It can be ranked in ordinal form as a function of goods as Ø(X1, X2, X3, …) and is also represented by indifference curve analysis.

- Cardinal: In cardinal form, it can be represented as U = √ P x C, where the utils of satisfaction from pizza & cake are defined as a function and characterized by marginal utility analysis.

Factors Affecting The Function

The factors are:

1. Uncertainty

When a consumer makes a decision, their satisfaction value depends on the level of uncertainty they are willing to take for a particular outcome.

There are three levels of uncertainty listed below:

A. Risk-averse: The consumer is apprehensive, avoids taking any risk regardless of the outcome, and opts for a lower payoff if the risk is low.

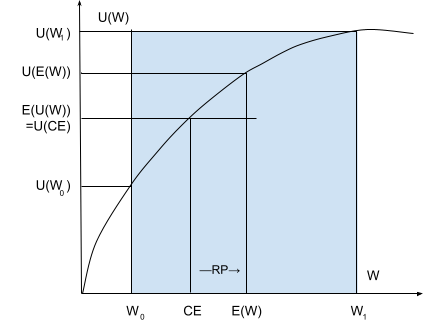

Illustration 1: Risk-averse

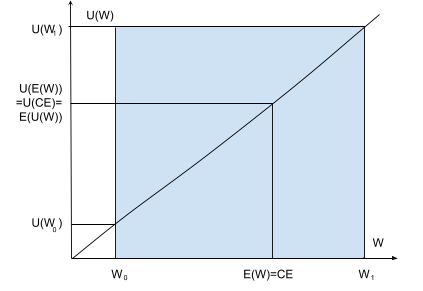

B. Risk neutral: The consumer is indifferent towards any level of risk to get a favorable outcome.

Illustration 2: Risk-neutral

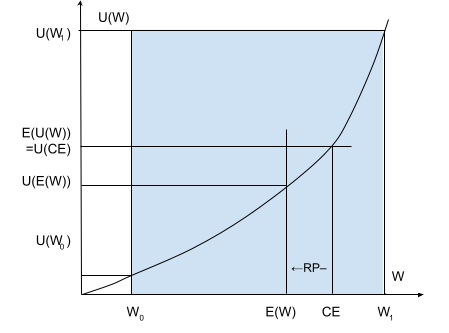

C. Risk loving: The consumer seeks risk and would take any risk regardless of the outcome and opt for a higher payoff even if the risk is high.

Illustration 3: Risk-loving

Where,

- Utility → U

- Certainty equivalent → CE

- The expected U of the uncertain payment W → E(U(W))

- The expected value of the uncertain payment W → E(W)

- U of the certainty equivalent → U(CE)

- U of the expected value of the uncertain payment → U(E(W))

- U of the minimal payment → U(W0)

- U of the maximal payment → U(W1)

- Minimal payment → W0

- Maximal payment → W1

- Risk premium → RP

2. Irrational decisions

The causes of irrational decisions can be as follows:

- Imperfect information.

- Over or under consumption.

- Lack of information between employees, i.e., the employer doesn't have complete information on the skills.

- Issue of 2nd hand car where the buyer has a lack of information.

- While taking risks, the individual takes more risks when the liability isn't personal.

Key Takeaways

- There are four forms of it, namely: form, place, time, and service

- The function measures the preferences of goods & services in cardinal and ordinal form

- There are three levels of uncertainty that affect the choice of consumers: risk-averse, risk-loving, & risk-neutral

- Irrational decisions are caused due to the lack of information and asymmetric information

- Preferences display the value of choice for goods & services

- Preferences differ as per the type of goods: normal, inferior, necessity, luxury, substitute, complementary

- MU is the additional benefit from the consumption of each additional unit; it can be positive, negative, or zero

- TU is the sum of total satisfaction derived from the consumption

- AU is the TU divided by the quantity consumed, and it decreases gradually

- DMU is the law that states MU decreases eventually with the consumption of each additional unit

- EMU is the law of maximum satisfaction/substitution wherein the consumer weighs the most urgent demand

Preferences Under Utility Theory

They are evaluations concerned with the value of the consumer's choice. They are based on relative utility leading to an optimal choice. For example, a person's taste determines preference instead of price, income, or availability.

Assumptions On Preferences

- Consumer rationality of choice to maximize their satisfaction.

- Monotonicity of preference on non-satiation, i.e., more is better.

- Completeness of preference as in there is no indifference between choices.

- Transitive preference is where the preference of bundle carryforwards to another bundle.

- Convexity of preference where the consumer selects averages to extremes.

Consumer Preferences Are Based On The Type Of Good

- Normal goods: Demand for normal goods ∝ positively correlated with the consumer's income.

- Inferior goods: Demand for inferior goods ∝ negatively correlated with the consumer's income.

- Necessity goods: Their demand doesn't change regardless of changes in the earnings level of the consumer.

- Luxury goods: These are expensive and desirable goods; their demand increases with a significant increase in income.

- Substitute goods: If two goods can be used for the same purpose and are similar, then demand for the substitute can reduce the consumption of the other.

- Complementary goods: It is used with another good to utilize the product as a whole and has a joint demand. If the demand goes up, so would the demand for the complementary good and vice versa.

NOTE

These goods can be represented on the indifference curve, which represents the points on graphs connecting different quantities of two goods between which consumers are indifferent. It helps in indicating the value of the goods to the consumer.

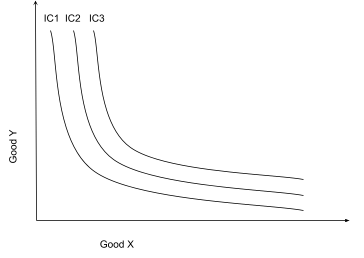

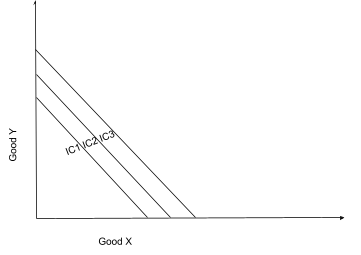

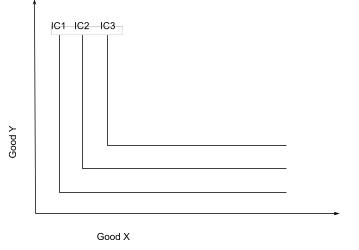

Following are some examples of indifference curves for the normal, substitute, and complementary goods:

Illustration 4: Indifference curve of normal goods & services (Convex Preferences & the opposite is Concave Preference)

Illustration 5: Indifference curve of perfect substitutes (straight line indifference)

Illustration 6: Indifference curve of perfect complements

Utility Theory: Basic terms and concepts

Marginal Utility (MU)

Marginal additional private benefit when each additional unit is consumed. It is calculated with the following formula:

MU = Total Utility Difference/ Quantity of Goods Difference

Three kinds of MU are:

- Positive: When there is additional satisfaction to TU [refer to Table 1 & Illustration 8 → quantity 1 to 3 consumption pattern]

- Zero: No additional satisfaction from consumption of the good [refer to Table 1 & Illustration 8 → quantity five consumption pattern]

- Negative: Dissatisfaction caused due to excessive consumption [refer to Table 1 & Illustration 8 → quantity six consumption pattern]

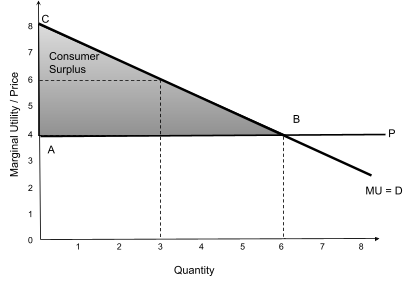

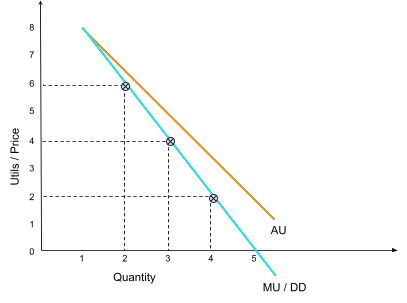

The following illustrates the MU curve, where the area ABC represents the consumer surplus, i.e., MU is greater than the price the consumer is willing to pay, i.e., the consumer is willing to pay the price of 6 for three quantities vs. price = 4 for six quantities.

Illustration 7: Consumer surplus and MU curve

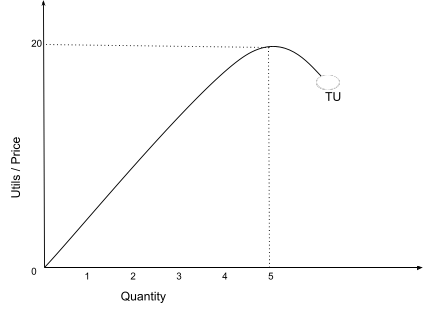

Total Utility (TU)

t is the aggregate of the total satisfaction derived from the consumption of the good & service; TU is maximized where MU = 0 [refer to Table 1 & Illustration 8 → quantity five consumption pattern]

- Every unit of goods/service has its own MU, and TU is the sum of MU.

- A consumer aims to get the maximum TU amount with the least possible cost.

- With more units of good/service consumed, the additional satisfaction, i.e., the marginal satisfaction, falls.

- The first unit consumed gives the highest MU, and it keeps declining with the consumption of every additional unit, and so on.

TU is expressed as follows:

TU = (Un1 + Un2 + … Unn)

Where,

- Un1 + Un2 + … Unn are the MU derived from 1st, 2nd, … nth units, respectively.

Example: Consumption of 4 chocolates gives satisfaction from the first unit 16, from the second unit 12, from the third unit 8, and the fourth unit 4. The TU would be the sum of all units, i.e., 40.

Average Utility (AU)

It is the satisfaction that the consumer obtains by consuming each unit, and AU gradually reduces with the consumption of an additional unit [refer to Table 1 & Illustration 8 → quantity 1 to 6 consumption pattern]

AU is calculated by dividing the TU by the quantity consumed:

AU = TU/ Q

Example: If the TU of 4 chocolates is 40, as given in the example above, then the AU of 4 chocolates will be ten if the TU of 4 chocolates is 36, i.e., 40 ÷ 4 = 10.

The concept of TU, MU, and AU is further explained in the following table and illustration.

Measurement

Table 1 [Explanation of the above basic terms & concepts]

| Qty | TU | MU | AU |

|---|---|---|---|

| 0 | 0 | - | - |

| 1 | 8 | 8 | 8 |

| 2 | 14 | 6 | 7 |

| 3 | 18 | 4 | 6 |

| 4 | 20 | 2 | 5 |

| 5 | 20 | 2 | 5 |

| 6 | 18 | -2 | 3 |

Illustration 8: [Explanation in the above basic terms & concepts]

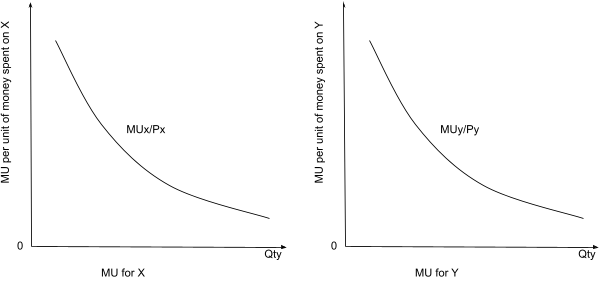

The Law Of Diminishing Marginal Utility (DMU)

This law states that the MU with each additional unit declines as consumption increases. It is directly related to diminishing prices.

As the satisfaction of a product decreases with an increase in its consumption, consumers aren't willing to pay more price for the additional units. It directly impacts the pricing because the price for a product must correspond to the consumer's MU and willingness to consume

As the quantity consumed increases, the MU derived from each unit decreases [refer to Table 1 & Illustration 8 → quantity 4 to 6 consumption pattern]

Uses

- It is used in public finance for the basis of calculating progressive taxes - the ability to pay

- Income redistribution as a concept of public finance, as stated above, is also used to study the utility of money to a person as a form of taxes later used as taxes for welfare- redistribution of income.

- The law of DMU is used as a basis to derive the demand curve to understand why it is a downward-sloping curve.

- It is helpful to determine the price of a commodity as the MU decreases as the number of its consumption increases.

- Water-Diamond Paradox: The Law of DMU explains the difference between value-in-use and value-in-exchange; for example, water is essential but not costly and has value in use, whereas diamond is costly and has a value for exchange.

- The DMU law determines the optimum expenditure utilization on a particular commodity.

- It serves as a basis for economic laws and concepts such as the law of demand, consumer surplus, substitution law, and demand elasticity.

Examples Of DMU

Table 2 [MUx & MUy shows DMU for goods X & Y from different units consumed]

| Number of Units Consumed | MUx | MUy |

|---|---|---|

| 1 | 40 | 55 |

| 2 | 36 | 50 |

| 3 | 32 | 30 |

| 4 | 28 | 20 |

| 5 | 24 | 15 |

| 6 | 20 | 5 |

Below is the weighted MU:

Table 3 [5 units of X and three units of Y have equal MU so that the consumer would purchase this combination of X & Y]

| Number of Units Consumed | MUx/Px | MUy/Py |

|---|---|---|

| 1 | 10 | 11 |

| 2 | 9 | 10 |

| 3 | 8 | 6 |

| 4 | 7 | 4 |

| 5 | 6 | 3 |

| 6 | 5 | 1 |

Illustration 9: DMU for X & Y [refer to Tables 2 & 3]

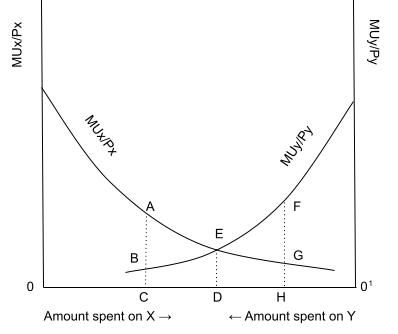

The Law Of Equi-Marginal Utility (EMU)

It is an extension of the law of DMU. It is also known as the law of maximum satisfaction/law of substitution and implies that human wants are unlimited, but the means to satisfy these wants are limited.

A consumer weighs the most urgent want to be satisfied within their reach per the quantity and pricing allowed. Every rational consumer tries to make the best use of their resources and derive maximum satisfaction.

Every unit of money spent by a consumer on a product must give them maximum satisfaction, i.e., some units of a product are substituted for greater satisfaction as substitute goods increase the satisfaction over the goods that were replaced.

It applies to satisfaction from a single commodity where MU equals price. It is a more practical approach to DMU.

Uses

- The law of EMU is used in the consumption field to derive maximum satisfaction from different products from the limited income of a consumer.

- Producers use the law of EMU to get maximum profit from investments by determining the cost and quantity of the products.

- It is used as the primary basis for exchange - goods for money wherein every exchange, the satisfaction is considered until it is equal.

- Distributing the cost for factors of production (land, labor, capital & organization) as per their marginal productivity, i.e., the producer would use more of the factor where their marginal productivity is more.

- It is utilized in public finance for taxation, redistribution of income, and welfare.

- Just like the law of DMU, EMU is used as a basis for economic laws.

Illustration 10: EMU of X & Y [refer to Table 2 & 3]

Utility Theory FAQs

In economics, it is the extent of satisfaction achieved by an individual from an economic act of utilizing a good or service.

The concept is significant in economics as it explains the characteristics of supply, demand, and pricing.

The four types are form, time, place, and possession.

The theory was proposed by Bernoulli back in 1738 to settle the problem using expected value.

It is psychological, it is not equivalent to usefulness, it is not the same as pleasure, it is personal & relative, it is the function of the intensity of human want, it cannot be measured objectively, and it has no ethical or moral significance.

Researched and Authored by Akanksha

Reviewed and Edited by Aditya Murarka | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?