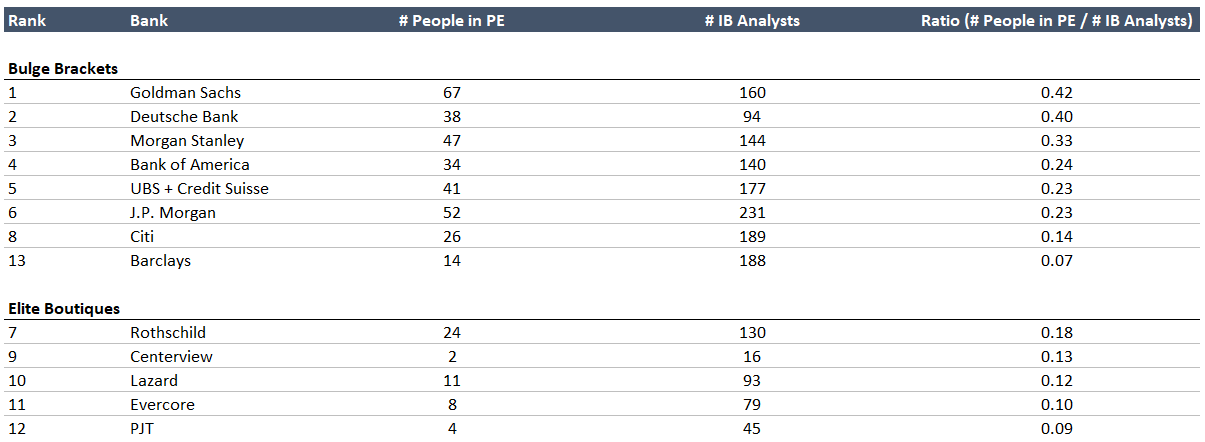

London - Banks ranked by PE exits

Using LinkedIn, I ranked banks in London by PE exits. Overall, the results are in line with what you might expect. I was a bit surprised to see the weakness of Citi / JPM and extremely surprised to see how strong Deutsche Bank is (most likely something spooky with that figure). See description of method below.

Very curious to hear your thoughts on this ranking.

Method:

I started with screening LinkedIn for current PE Associates at the funds listed below (mostly MF / UMM):

Advent, Blackstone, Apax, Silver Lake, EQT, Permira, Apollo, CVC, Warburg Pincus, Nordic Capital, L Catterton, Vista Equity Partners, Bain Capital, KKR, Astorg, Cinven, Partners Group, Hg, PSG, CD&R, TPG, PAI, Waterland, Carlyle

After that, I sorted on previous company (GS / MS / JPM etc.) to figure out how many exits there were from each bank into the above-mentioned PE firms.

Subsequently, I screened for the number of IB analysts at each bank because just looking at the number of exits doesn't tell you very much if you don't know how large the pool of analysts is.

Potential flaws:

The biggest potential flaw is that when looking at the previous company, anyone who has ever been at that company is included, regardless of position. So for example, if someone did a spring week at Deutsche Bank, then did a 2-year analyst program at GS, they would also be included in the Deutsche Bank exit figure.

There is also a potential issue with titles as they may differ across firms. For example, some PE firms might use titles such as "Investment Professional" rather than "Associate". There is also a possibility that the title Associate includes other roles at certain PE firms (e.g. IR Associate). Lastly, I know that people sometimes title themselves "Investment Banking Analyst" despite being in LevFin or ECM.

del

del

Interesting analysis. I would think you’re not doing justice to Roth by bucketting it with the Elite Boutiques. Roth is only elite in France (Global Advisory only), otherwise it’s just a mid-market shop, esp. in the UK. Roth has good placing in the MM PE shops (think your MML, ECI, Exponent…), not so much in the funds you are listing.

Yeah I agree that they mostly do MM deals as their avg. transaction size is about $600m. However, the volume of transactions they churn out makes them pretty strong and they ranked #5 in EMEA league tables last year.

Congrats on roths rejection

Its a good start, but as you noted the issue with LinkedIn is that it includes those who had spring weeks etc. It also doesn't account for candidates personal preference, as looking at the chart above you would think exists from JPM/Lazard/PJT are pretty bad compared to DB/UBS & co when in reality its not the case (self selection etc)

Another issue with linkedin is that it doesnt show those who went to a good fund, then left for an upcoming fund or went elsewhere. For example, if someone went from JPM to KKR, then left KKR to be a founding partner at a new PE firm or just exited finance, linkedin wont pick up on this as it would be counted as a previous firm too

What this really shows is how random recruiting is in Europe, and how there is less of an emphasis on your bank and more so about other qualities you have (whether its languages, diversity, technical and soft skills).

If you go to any of the above banks, you will get a chance to recruit at mostly every PE firm out there as long as you aren't in a weird group or do RE. Yes some funds have preferences, but in the end no one really cares as its all banking (every one who gets in the recruiting process is at a level playing field regardless of bank). most if not all of the very "prestigious funds" have hired people from lesser bb's/boutiques

if you really wanted to "benchmark" with the above in mind, you would need to just compile all the exits from a single bank and put it out there for people to see. If someone from said bank is at fund X, you can assume that fund X is completely fine with recruiting from there. You can also look at firms and estimate where you will get looks (ie if from Bank X an alum is at BX, you can assume KKR & co will also look at you). Total no of analysts vs exits below would also tell you how keen people are on exiting vs just staying to be a career banker etc

List as of Q2 2023:

will add as people tell me if I'm missing something - if someone did it for other banks just send it and will update. Also some of the names here the specific banks have sent multiple people to there but you get the idea

PJT: Ares SS and PC, Apollo buyout, Sona, Oaktree global opps, Mudrick, Centerbridge, Angelo Gordon, SVP, Searchlight, BCC SS, Blantyre, Tresidor, CQS, Algebris, EQT, KKR Credit, Triton Debt, KKR buyout, KSL, Partners Group, Stellex, PSG, Norvestor, ASP, Blackrock, GIC, Arena, Ashgrove, Riverock, Roundshield, Softbank, Talis, Helios, Glendower, NB, Lakemore, Cross ocean

CVP: Aea Investors, All Seas Capital, Bell Rock, Burda Principal Investments, CapVest, Citadel, CVC, Entrepreneur First, G Square HC PE, General Atlantic, Kinnevik, Millennium, Silver Lake, SVPGlobal, TA Associates

PWP: Alberta (AIMCo), Alteri Investors, Apax, Apollo, Balyasny, Blackrock, Brookfield, Builders Union, Cambridge Innovation Capital, Carlyle (CIEP), Carlyle PE, Centerbridge, Cinven, Citadel, Coller Capital Corsair, CPP (European Credit), CVC, Fortress, G Square HC PE, GIC ,Global Holdings Management, HarbourVest (Direct Investments), KKR (Infra), KKR (PC, SI), Pamplona Capital, Permira, Providence, PSP, RTP Global, Saudi Public Investment Fund, Sixth Street, TA Associates, Tiger Infrastructure Partner, Triton, Warburg Pincus

All good points. I think that in general people at EBs are often more interested in being career bankers. Across the BBs, I think one factor to consider is bias / culture / hours. If you look at BBs like GS and MS, you will have brutal hours, a rough culture and many people just go there for the prestige so they can exit ASAP. Meanwhile, at BBs like DB / Barclays / UBS, hours and culture is often a bit better and people don't just go there chasing prestige to the same extent. As such, people from GS / MS are much more likely to wanna go into PE to begin with and exit ASAP due to hours / culture.

You're implying that there are a material amount of people at DB/Barclays/UBS that decline a GS/MS offer due to hours and culture. I think that's unlikely, especially at the junior level.

Think evercore had a recent exit breakdown in a thread I saw recently, let me try find it

Would add on to that BAM L/S, and the European chairman moving to Co-Head Warburg Pincus' Europe practice.

PJTs credit / distressed exits are extremely impressive. I'm also quite surprised with PWP - had always thought they had lacklustre exits from WSO but some great names above.

Did some digging into the Deutsche Bank exits and turns out pretty much all of them are people who did an internship at DB but then started FT at another bank. In reality, only a few of them were from FT at DB to corporate PE positions.

barclays lmao

Was surprised to see them doing so poorly. Expected them to be more in line with UBS + CS / Deutsche.

Would think that the reason EB exits are lower is because more people choose to stay in banking there as pay is higher and there's also proportionally less PE seats in Europe than US. I would assume your expected career comp is better staying at PJT vs going to some random MM PE fund

The potential flaws is major, and 100% skewed the results, so this really isn't relevant imo.

Feel free to contribute, sir.

Banana for effort

What strikes me is the amount of analysts at UBS and Barclays for so little deal flow. I mean compare it with MS and GS that’s insane.

Literally just read the comments above regrding the issues with the linkedin method. DB/UBS aren't even remotely close to GS/MS/JP in exits and I can say that by just looking at my MF.

I am not referring to exits but # of current analysts at UBS and Barclays

I'd say that in LDN, BBs have slight advantage over EBs in PE recruiting. Regardless, I don't think being in an EB will limit you in any way. As in the US, it mostly depends on your performance during PE recruiting.

Also, I don't get the notion that EBs are that much worse in PE recruiting. See the below exits I found for some EBs over the last couple of years:

EVR: Advent, CVC, Partners Group, Carlye, Oaktree, Permira, Silverlake, EQT, Ares, Mubadala

PJT: Centerbridge, Searchlight, GIC, PSG, KKR, Apollo, Helios, Partners Group, Ashgrove, Angelo Gordon

PWP: Permira, CVC, KKR, Warburg Pincus, TA Associates, Sixth Street, PIF, Cinven, Citadel, CPP

GHL: Carlyle, Advent, GIC, Hg, Balyasny, DWS Group, HIG Capital, Platinum, iCON Infrastructure

I'd say that the smaller London EBs (Moelis, Greenhill, or Centerview) have less of an established buy-side pipeline, mainly because of (1) a very small analyst class (3-5/year), and (2) preference to stay in as associates due to the stable/comfortable culture of the firm (might be less applicable to Moelis).

Overall, you tend to see more A2A in London, as you can still break in into buy-side after your associate years.

EVR has APAX, TPG and Apollo, too.

What's EVR's analyst intake size?

Iure autem odio modi. Aliquid saepe est error consequatur ea similique. Nihil laudantium impedit id pariatur voluptatem praesentium.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

In reiciendis dolor voluptatem hic eum quaerat culpa. Aut est maxime non explicabo eos. Incidunt repudiandae debitis incidunt. Culpa laudantium eaque deserunt non vero. Dolore non fuga accusantium dolorem aspernatur. Neque qui laudantium dolorem sequi maiores cum. Nostrum facere neque reiciendis necessitatibus aut quis sunt quo.

Voluptatem quaerat et vero eum laboriosam officia eveniet totam. Aliquid tempore dolorem ipsum sit et necessitatibus. Ut quod eveniet consequatur voluptatem reiciendis placeat. Unde animi autem suscipit quam alias.

Autem voluptatem illum dolorem magni modi ex ut. Delectus est non harum consequatur architecto. Non quod ducimus officiis ea.