DCF Modeling Questions

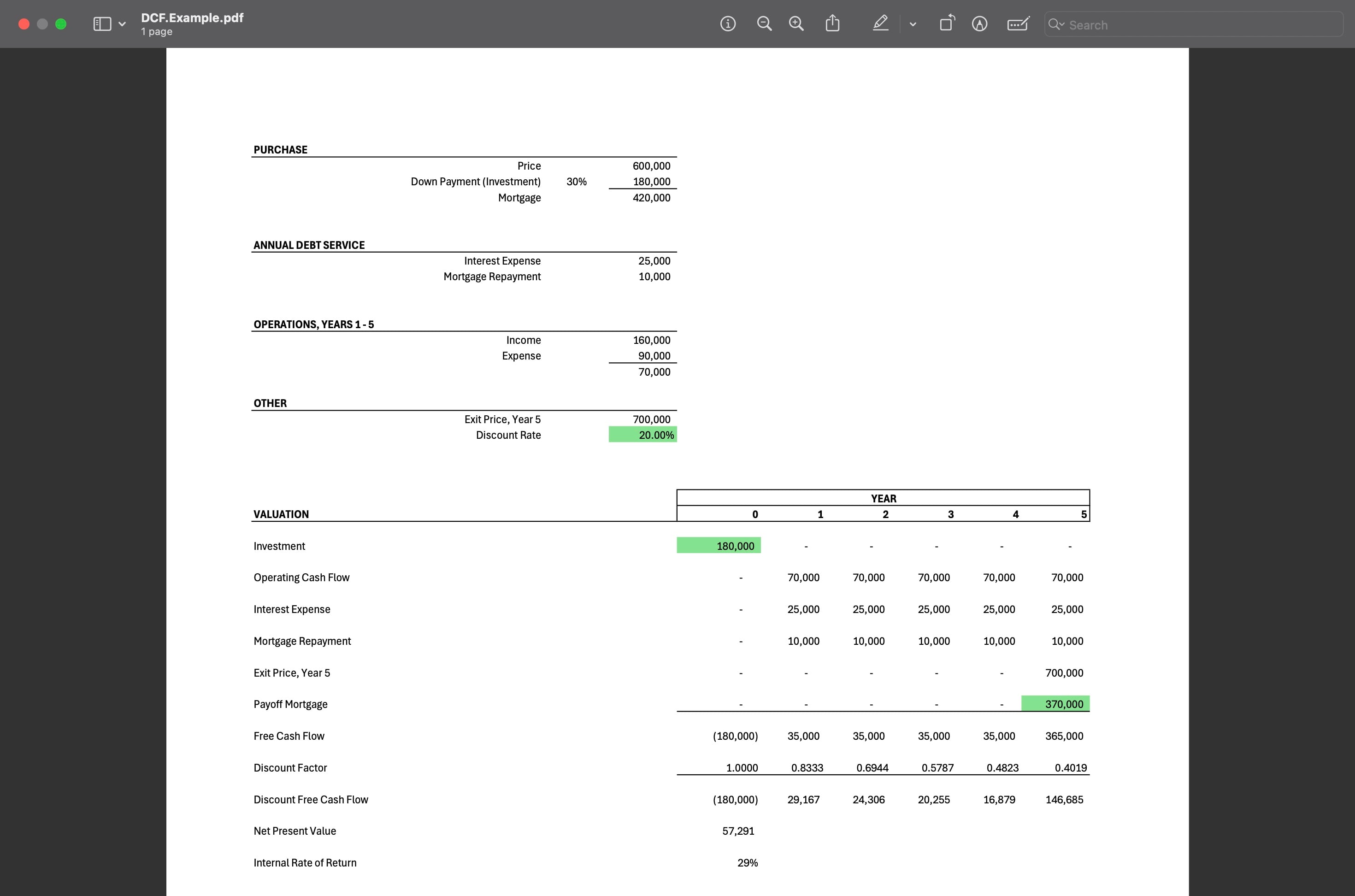

I am looking at purchasing a real estate investment property. I have created a detailed DCF model to analyze the investment and have stumbled across a couple of questions that I hope you guys can help me answer. I have numbered my questions below and also attached a very simplifed version of a DCF valuation to illustrate my questions. The relevant cells are highlighted in green. Thanks in advance!

-

Should the time 0 investment only include the cash investment (down payment) or the full purchase price (down payment AND mortgage amount)? It seems to me that it should only be the cash investment.

-

In the year that the investment property is sold, should the cash flows include not only the cash inflow from the sale of the property but also a cash outflow equal to the mortgage balance on the Balance Sheet at the time? Seems to me it should include both.

-

In calculating the Net Present Value of the investment, what is the appropriate methodology to use in arriving at a discount rate? I am familiar with CAPM and WACC but I don't know which, if either, is appropriate to use.

Based on the most helpful WSO content, let's tackle your questions one by one:

Time 0 Investment Consideration: In a DCF model for real estate investment, the initial investment at time 0 typically includes the total amount of cash outlay required to acquire the property. This means considering both the down payment and the mortgage amount. However, from a cash flow perspective, the actual cash investment from the investor's pocket is the down payment. The mortgage represents leverage used to finance the purchase but is not an immediate cash outlay by the investor. Therefore, for the purpose of calculating initial cash flows in your DCF model, you should include only the cash investment (down payment). This approach aligns with focusing on the investor's out-of-pocket expenses and the direct cash flows affecting their investment decision.

Accounting for Sale and Mortgage Balance: When the investment property is sold, the cash flows for that year should indeed reflect the cash inflow from the sale of the property. Additionally, you should account for the repayment of the remaining mortgage balance as a cash outflow. This ensures that your model accurately reflects the net cash proceeds from the sale, which is the sale price minus any outstanding mortgage balance. This approach provides a clearer picture of the actual cash benefit to the investor from selling the property.

Determining the Discount Rate: The appropriate methodology for arriving at a discount rate in a DCF model for real estate investment can vary based on the specifics of the investment and the investor's required rate of return. While CAPM (Capital Asset Pricing Model) and WACC (Weighted Average Cost of Capital) are common methods for estimating the cost of capital in corporate finance, real estate investments often use a more tailored approach. For real estate, the discount rate is typically determined based on the investor's required rate of return, considering the risk profile of the investment. This rate is often informed by market fundamentals and comparable investment opportunities. For example, large homebuilders valuing land in certain markets might use a discount rate of at least 25%, reflecting the specific risk/reward profile of those projects. Therefore, while CAPM and WACC can provide insights, the discount rate for real estate DCF analysis is more subjective and should be aligned with the investor's expectations and market conditions.

Remember, the key to a successful DCF model is accurately reflecting the cash flows and risks associated with the investment, and these answers are aimed at guiding you through that process based on insights from the WSO community.

Sources: Relationship among Cap Rate, IRR, Discount rate and NPV, Biotech finance part 2: valuation methodologies and modeling considerations, Trying to understand the concept of IRR

Based on the highest ranked content on WSO, let's tackle your questions one by one:

Time 0 Investment Consideration: In a DCF model, especially when analyzing real estate investments, the initial investment at time 0 should indeed reflect the actual cash outlay required to acquire the property. This typically includes the down payment and any other upfront costs (such as closing costs) that are paid out of pocket. The mortgage amount is not included in the initial cash outlay in the DCF model because it represents financing, not an investment cost. The mortgage impacts the investment through the interest and principal payments that affect future cash flows.

Accounting for Mortgage in Sale Year: When you sell the investment property, the cash flows for that year should include the net proceeds from the sale, which is the sale price minus any selling costs and the outstanding mortgage balance. The reason you subtract the mortgage balance is that it represents a liability that must be settled upon the sale of the property. Therefore, your cash inflow from the sale is the gross sale proceeds less the remaining mortgage balance and any other sale-related expenses.

Determining the Discount Rate: The choice between CAPM (Capital Asset Pricing Model) and WACC (Weighted Average Cost of Capital) for determining the discount rate depends on the nature of the investment and the investor's capital structure. For a standalone real estate investment property, CAPM could be more appropriate as it provides a way to calculate the expected return on the investment considering the risk-free rate, the market risk premium, and the beta (risk level relative to the market) of the investment. WACC is typically used for investments made by firms with a mix of debt and equity in their capital structure, as it accounts for the cost of both. However, for an individual investor analyzing a real estate investment, using a discount rate derived from CAPM or a rate that reflects the investor's required rate of return given the risk of the project might be more straightforward and relevant.

Remember, the choice of discount rate is crucial as it significantly impacts the valuation of the investment. It should reflect the risk profile of the investment and the opportunity cost of capital.

Sources: Relationship among Cap Rate, IRR, Discount rate and NPV, Architect, teaching myself RE finance. DCF, DR, MIRR vs NPV?, Biotech finance part 2: valuation methodologies and modeling considerations, Trying to understand the concept of IRR

1. DCF valuations calculate the present value of the cash flows associated with the property over the holding period. Year 0 is not typically included in the analysis because you are valuing the cash flows today which assumes the cash outlay has already occurred. I believe the formula you are looking for is: NPV = (Cost of financing, cash flow year 1:cash flow year 5) + cash flow Year 0. The outlay would be the purchase price in order to determine if the investment makes sense.

2. In this case, you would capture year 5 income and the reversion value based on year 6's NOI, less the costs to sell (usually 3%).

3. Typically, you'd see the discount rate be anywhere between 6 and 20%, depending on the investor, property type, location, etc. In other words, find out what is typical for investors in your particular market OR what your internal requirements are.

Also - why are the income and expense projections flat in this scenario? And, is the exit price set by this assignment's parameters or how did you arrive at the $700k exit?

Also to note discount rate is treasuries (risk free rate) + a risk premium so in today's environment 6% is likely too low.

Oh, more than likely that's correct. Although there are definitely circumstances where you could use a discount rate below the Tbill+premium, the typical market oriented formula you outlined will usually be reasonable.

What are some cases you'd use a discount rate lower than a Tbill? Have never thought that would be the case bc tbill is considered the safest investment and real estate even NNN is riskier.

I think he meant less than the T-Bill with a default premium, not just less than a T-Bill straight up

1. In order to calculate NPV or IRR you must include the initial investment, otherwise you are simply calculating the PV of future cash flows.

3. This is just a very simplified example used to illustrate my questions. This is not the actual DCF model I am using.

Quo tenetur velit et pariatur sunt iste sit. Aut quisquam quidem ipsa et.

Hic consequuntur perspiciatis asperiores accusamus tempore tempore. Nihil mollitia est praesentium qui quae temporibus voluptate. Soluta non optio placeat voluptas sequi ut nemo. Totam sed a est possimus quia. Molestiae amet rem et. Deleniti magni dicta non dignissimos nobis.

Perferendis doloremque optio aliquam magnam a assumenda. Optio maiores quia tempora eveniet quisquam.

Enim quidem nulla aut adipisci. Id expedita assumenda suscipit non. Magni at neque atque eius.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...