Architect, teaching myself RE finance. DCF, DR, MIRR vs NPV?

Hello everyone,

I am an architect and I have been working to teach myself the basics of real estate finance. Long term, I am looking to make my way over to the development side of things after I finish rounding out my experience at a general contractor. After surveying the internet/WSO forums, it seems the finance and proforma modeling component is the area that I need to focus on the most if I want to make that move.

Since I do not have a background in development or finance I have picked up "Geltner and Miller's Commerical Real Estate: Analysis and Investments" to teach myself the basics. I have been building example proformas in excel to test my understanding of the content. However, I do not have a class/peer group that has development experience which I can check this understanding against.

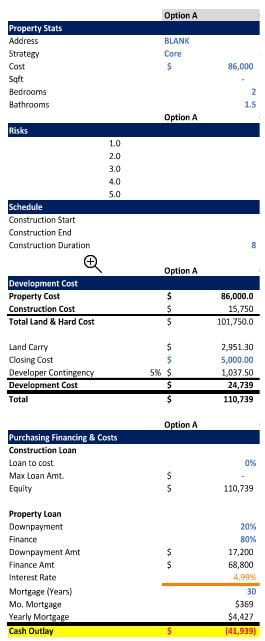

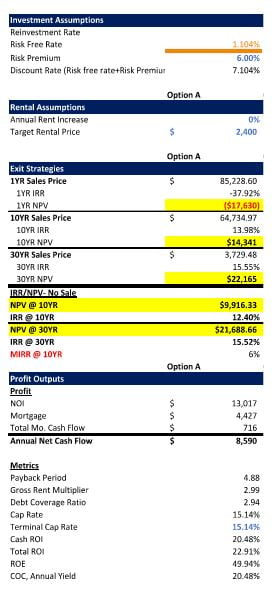

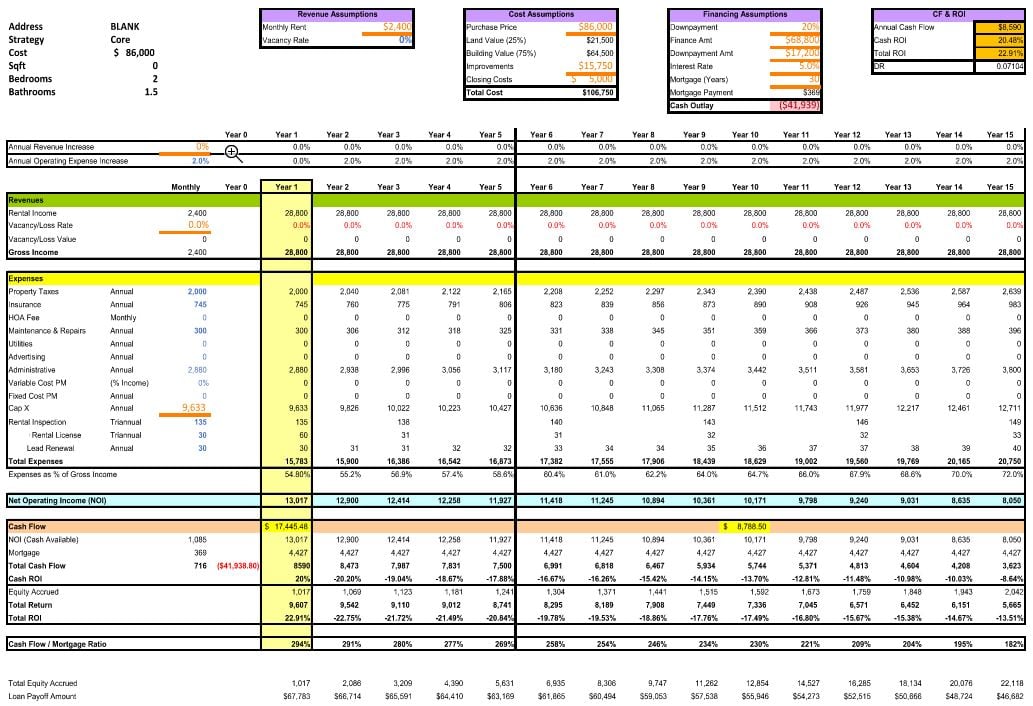

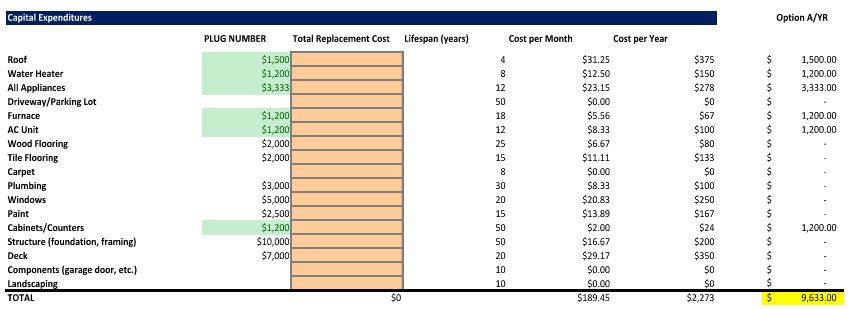

I am interested in getting some feedback on the attached proforma that I have assembled to see if I am missing anything major. To keep it simple -for me- the proforma is for a hypothetical rowhouse in a mid tier city. I recognize that most on this forum are not involved in such small scale projects...so bear with me as I work to understand the scalable concepts captured in a proforma and how they are connected to each other.

The area I have struggled with the most while forming an understanding of DCF modeling is the appropriate risk premium to use as well as the terminal cap rate. I understand that the discount rate (risk free rate+risk premium) is correlated to the perceived risk of the deal AND the opportunity cost of passing up another investment. In this case, I have used a risk premium of 6.0% to mirror a return generated from an SP500 index fund (the alternative investment). I imagine I would then increase that risk premium if I believed that the RE deal would require more effort or risk than simply indexing the capital. I have read about WACC and how that is built up but in this case lets assume the investor is not raising outside debt or equity. Is this an appropriate way to think about how a discount rate is formed?

Regarding the terminal cap rate, is it best to set the exit cap rate equal to the entry cap rate in order to "approximate" the sale price of the asset at a future date given that bldgs age and become less able to grow their rents? My understanding is that the terminal cap rate informs the "projected" sale price of the asset upon termination. Is this correct?

My other question is related to the topic of the modified internal rate of return and the NPV. In day to day practice, do real estate finance firms hold one metric higher than the other when evaluating if a potential deal makes sense?

Thanks in advance!