Cash Flow from Investing Activities

Refers to the cash inflow and outflow from purchasing assets, sale proceeds of assets or disposal of shares, or redemption of investments

What Is Cash Flow From Investing Activities?

Cash flow from investing activities refers to the cash inflow and outflow from investing and purchasing assets like property, plant, and equipment (PP&E) and from sale proceeds of assets or disposal of shares or redemption of investments like a collection from loans advanced or debt issued.

The Cash flow statement (CFS) is one of three primary financial statements and summarizes cash flows and cash equivalents (CCEs) coming in and out of the company.

CFS measures the inflows and outflows of cash, ultimately giving us an idea of the efficiency of the company's operations.

Investment Activity Cash Flow is a component of the statement of cash flows that reports the amount received or spent on various investment-related activities over time.

A cash flow statement is a statement that shows a transaction in a particular period. It is one of the three primary financial statements alongside the balance sheet and the income statement.

It outlines sources of cash (incoming cash) and cash applications (where it is employed) during a financial year. It studies the reasons for changes in the cash balance between the balance sheets of two financial periods.

A statement of cash flow includes activities that impact cash. It acts as a bridge between the income statement and the balance sheet.

Key Takeaways

- Cash flow from investment activities is part of the cash flow statement showing the income generated or used concerning the investment of the organization's operations.

- Investment activities include purchasing and selling tangible assets, securities investments, or the sale of securities or fixed assets.

- Negative cash flows from investment activities may not be a bad sign if managers invest in the company long-term.

Overview Of Cash Flow from Investing Activities

Before analyzing the different types of positive and negative cash flows from investment activities, it is essential to review when a company's investment activity includes its financial statements.

There are three primary financial statements:

- Balance sheet

- Income statement

- Cash flow statement.

| Income Statement | Income Statement | Cash Flow Statement |

|---|---|---|

| Provides an overview of the company's assets, liabilities, and owner equity from a specific date. | Provides a summary of the company's income and expenses over some time. | Closes the income gap between the income statement and the balance sheet by indicating how much money is being generated or spent. |

Investment activities include any resources and costs from a company's investment. These may consist of the purchase or sale of goods, loans made to merchants or received from customers, and payments related to acquisitions are included in this section.

Cash flow from investment contains the number of changes a company has experienced over time, reporting any investment or losses, any new investments, or the sale of fixed assets.

Items that can be included in an investment activity line items include the following:

- Procurement of fixed assets

- Fixed real estate sales

- Purchase of investment assets, such as stocks and bonds

- Sales of investment tools, such as stocks and bonds

- Borrowing

- Debt collection

- Insurance benefits associated with fixed assets

When a company reports consolidated financial statements, the assets of the preceding line will include the investment activities of all sub-companies included in the combined results.

In short, changes in equipment, assets, or investments are related to investment income. Changes in investment financing are often regarded as cash outflows because cash is used to buy new tools, buildings, or short-term assets as collateral.

Interpretation of Cash flow from investment activities

Cash flow from investment activities provides an account of the amount spent on non-current or long-term assets, which will bring value in the future. Investment work is an integral part of growth and income.

Change in location, plant, and equipment (PP&E), the main line on the balance sheet, is considered an investment activity. Therefore, investment activities are one of the critical components of the cash flow transactions that businesses report on the cash flow statement.

Investment activities in accounting refer to buying and selling long-term assets and other business investments throughout reporting time.

The reported investment activity of the business provides details of the total investment returns and losses incurred over time.

Investment activities are integral to the company's cash flow statement, which reports revenue and expenditure over time.

When investors and analysts want to know how much a company spends on PPE, they can look at the sources and expenditures in the investment section of the cash flow statement.

Note

The increase in the importance of cash flows is primarily due to the increasing use of the discounted cash flow method (DCF) to evaluate companies and assets

Activities included during cash outflows from investment activities are:

- Capital expenditures

- Borrowing funds

- The sale of investment securities.

In line with this, the cost of property, plant, and equipment falls into this category as it is a long-term investment.

Disclosure of cash inflows and outflows from investing activities

Disclosure is vital because money inflow and outflow represent the expenditure level designed for services that generate income and cash in the future.

Examples of cash flow from investment activities are:

- Cash payments for the acquisition of fixed assets (including intangible assets). These payments include those related to financial research, development costs, and fixed assets.

- Cash receipts for the disposal of fixed assets (including intangible assets).

- Cash payments for the acquisition of shares, permits, or debt instruments for other businesses and interests in joint ventures (other than those payments for devices considered equal to cash and those reserved for sale or trade).

- Cash receipts from issuing shares, authorizations, or debt instruments of other businesses and interests in joint ventures (otherwise, receipts from those instruments are considered equal to cash and those reserved for sale or trade).

- Payments and loans made to third parties (other than that development and loans made by the financial business);

- Cash receipts arising from prepaid payments and loans made to its third parties (excluding advanced funds and financial loans business).

- Cash payments for future contracts, transfer contracts, option contracts, and contracts that change unless contracts are held for commercial or commercial purposes or payments are classified as funding activities and

- Receipts for cash from future contracts, forward contracts, options contracts, and contracts that change unless contracts are held for commercial purposes or receipts are classified as financial activities.

- If the CFI category is positive, that could mean that the company is releasing its assets, which increases its cash balance (i.e., sales revenue).

- In contrast, the company will likely invest heavily in its fixed asset base to generate revenue growth in the coming years if it is negative.

Given the nature of the category - i.e., primarily spending - the impact of residual income is often negative, as Capital expenditure and related expenditures fluctuate significantly and surpass any one-time, non-recurring division.

If a company constantly steals assets, another potential threat could be that executives may face unprecedented challenges (i.e., they cannot benefit from synergies). But negative revenues from the investment phase are not a sign of concern, as managers are investing in the company's long-term growth.

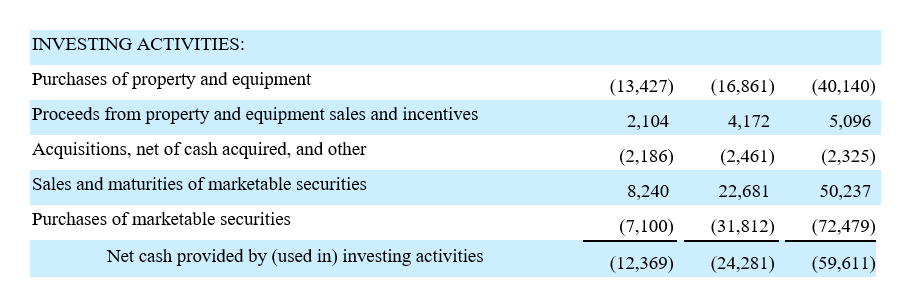

Example of cash flow from investing activities from the books of Amazon.com, Inc.

Let us now interpret the above CFI and see how it relates to the company's situation. The following are some critical points from Amazon's CFI:

- Amazon continues to invest in real estate purchases. Amazon's PPE expense for the years was $13,427bn, $16,861bn, and $40,140bn in 2018, 2019, and 2020 respectively.

- You must remember that the costs under this head can indicate where the company is headed.

- The quality of Capex can be determined by reading the discussion and management analysis. This will give you a good understanding of where the company plans to be in the next few years.

- Another vital point about Amazon's financial outflow is that they have acquired smaller companies yearly. In 2019 alone, Amazon bought $2,461 million worth of companies.

- Amazon has been generating revenue from the sale of its securities. Amazon sold $50,237 million in securities for sale by 2020.

Overall, Amazon has had a negative flow of revenue from investment activities despite investing in goods and equipment.

Importance of cash flow from investing activities

The cash inflows and outflows from investments made during an accounting year are shown in the second three parts of the cash flow statement.

Investing activities include cash flows from the sale of fixed assets, purchase of a fixed asset, sale and purchase of investment of business in shares or properties, etc. Investors used to look into the income statement and balance sheet for clues about the company's situation.

However, over the years, investors have begun to look at each of these statements alongside cash flow statements. This helps grab the whole picture and helps in making the most calculated investment decision.

Although a company may report poor investment in investment activities, it does not necessarily mean it will harm the business.

In the short term, the company has experienced a negative impact on revenue from purchasing goods, plants, and equipment. Still, in the long run, assets can help generate growth for the company's revenue.

Revenue from investment activities is significant because it shows how the company has been investing for longer. For example, a company might invest in fixed assets, such as real estate, plants, and equipment, to grow its business.

While this reflects poor cash flow from investment activities in the short term, it may help the company generate long-term cash flow. In addition, the company may also invest in short-term securities sold to help maximize profits.

Investment capital is helpful for many purposes. For example, you can use it to understand the sources of investment cash flow, understand the business long-term investment requirements of the business, and predict future cash flows.

Since investment proceeds also provide information about interest income and dividend profits, they can be used to evaluate the performance of unregistered companies and other investment companies.

And when used in conjunction with the profit and loss statement and the adequate cash flow, cash flows from investments help investors better understand the company's financial affairs.

To put it bluntly, investors should always look at the cash flow statements before making investment decisions.

In short, investment activities provide information on how a company keeps its assets up to date and invests in future growth.

Researched and authored by Falak Anjum | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?