Course Overview

In this course, you will obtain a fundamental understanding of the cash conversion cycle, learn about some of the most common drivers of business failure, prepare a standard 13-week cash flow model for a company facing insolvency and explore some of the tactics used when leveraging the model to evaluate the cash impact for purposes of developing a proposed turnaround plan incorporating the recommended strategic plan to be implemented.

Who is this Course for?

Motivated college students looking to master Cash Flow forecast

Professionals looking to prepare for the recruiting process and speak intelligently on the job.

Key Outcomes

Master 13-Week Cash Flow Modeling

This course teaches you how to prepare the 13-Week Cash Flow Model from scratch and how to leverage it as a tactical decision-making tool during a period of high stress for a company going through a turnaround process

Unlocking the Door to your Finance Career

An understanding of 13-Week Cash Flow Model is critical for careers in restructuring, investment banking, private equity, venture capital, and other finance related roles...

Boost Your Confidence and Earnings Potential

After you finish this course, you'll become an expert. You'll feel confident about reviewing or preparing a 13-Week Cash Flow forecast, which will increase your odds of earning a higher salary.

This course has helped our students and young professionals land and thrive at positions across all top Wall Street firms, including:

WHAT’S INCLUDED

A step-by-step course to help you master 13-Week Cash Flow Modeling

Module 1: Introduction

In this module, we introduce the course structure and objectives ... By the end of this course, you'll understand 13-Week Cash Flow Modeling, which is essential for any distressed business going through a turnaround

Module 2: The Big Picture

In this module, we break down the various situations where a 13-week cash flow model is applied, dive into the components and calculations of the Cash Conversion Cycle and illustrate a simple example of how the model can be applied in the context of even building out your own personal financial cash budget.

Module 3: Causes Of Business Failure

This module uses 5 video lessons that touch on some of the most common themes observed with distressed businesses, including various methods for detecting signs of business failure, such as the incubation period, cash shortage, financial insolvency, and total insolvency.

Module 4: Building The 13-Week Cash Flow Model

In this module, we break down key terminology, components of the 13-week cash flow model, specific data requests needed to prepare the model, and develop the build-out of the case study baseline 13-week cash flow model.

Module 5: Borrowing Base Introduction

In this module, we break down the components of a borrowing base model as part of the 13-week cash flow forecast when applied with an Asset-Based Loan, an overview of Asset-Based Loans, and a practice exercise on calculating borrowing base availability.

Module 6: Sensitizing a 13-Week Cash Flow Forecast

This module focuses on various liquidity enhancement and cash preservation tactics used by restructuring advisors, and then actually sensitizes the baseline 13-week cash flow model with various liquidity enhancement scenarios to identify if the distressed company’s cash flows can stabilize in the next quarter.

Don’t Take Our Word For It

Hear From Our Students

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

I'm an Econ major student, so I've never been taught how to properly do a model, and WSO's modeling course not only prepped me for modeling but also taught me a lot of tips and tricks that have saved me so much time while building up models. Also, it helped me to ace all my technical interviews.

For those who thinking about getting this course, do it now! You won't regret!

I am not sure how it compares to other LBO courses in terms of value for money (if there are even other LBO online courses out there), but I do want to emphasize that it is an extremely dense course compared to most other online/MOOC courses so the price (probably) scales accordingly compared to standard online course prices from other services.

The theory explanation is straight to the point and clear. I could understand all the concepts to build a complex financial modeling.

Currently I'm working at a M&A company in Brazil, and what I've learnt in this course is very useful for my daily tasks.

I do recommend this course.

The teacher explain complex topics in a simple way.

The teacher explain complex topics in a simple way.

There are questions at the end of each section that could be improved upon, but it's a modeling course not exam prep so it is understanable.

Overall, I would recommend this course to someone interested in learning LBOs.

A solid use of time and great value for money - especially if purchased within the bundles.

However, despite this being of second nature to me, I decided to check out the WSO financial statement modeling course as part of the Elite Modeling package while planning my move to investment advisory. Needless to say, like the other WSO courses, this was a well-planned out course from which even a seasoned professional like me could take away a lot. Knowing various standards that are used in the finance and investment community helps to blend in with the pros.

Would definitely recommend getting not just this but the whole elite modeling package if that's still on offer. Thanks WSO team! :)

Received this as part of a bundle (fantastic value, I might add), and this was the perfect walk through for someone that knows theoretically what an LBO is, but wants a nuts and bolts perspective. Very accessible and quickly brings you up to speed. A very high yield course.

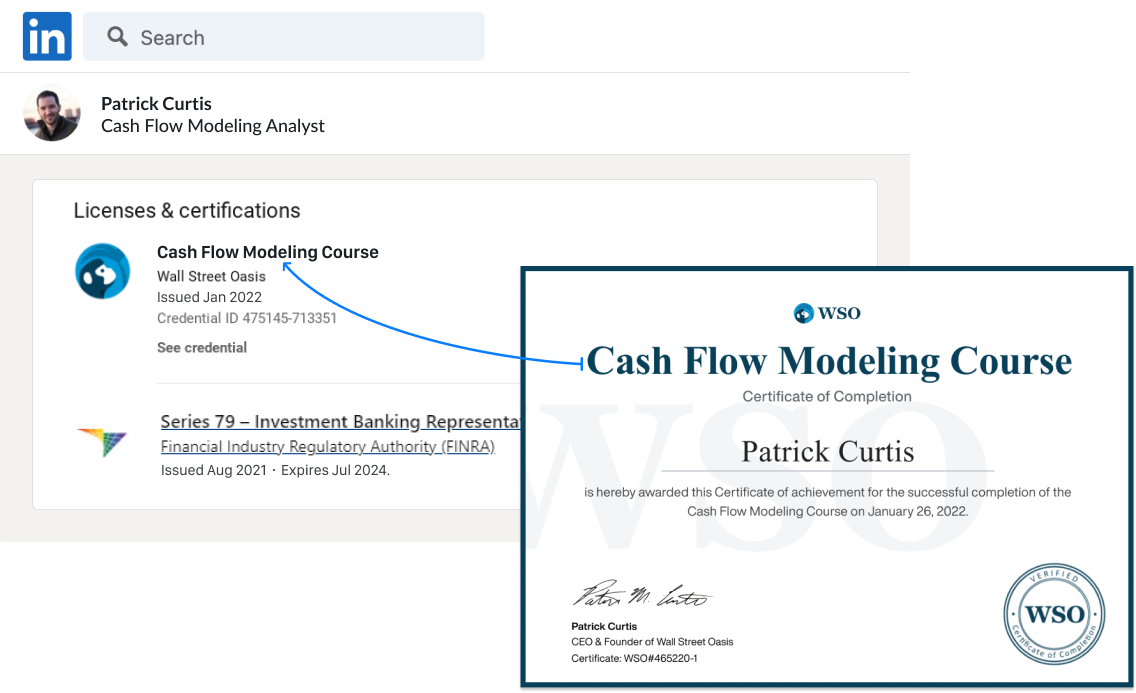

Certificates

Get 13-Week Cash Flow Modeling Course Certification

After completing the course, all students will be granted the WSO 13-Week Cash Flow Modeling Course Certification. Use this certificate as a signal to employers that you have the technical cash flow modeling skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to become a master in discounted cash flow modeling. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

Course Benefits

How much is the 13-Week Cash Flow Modeling Course Worth?

What You Get |

Value |

|---|---|

WSO 13-Week Cash Flow Modeling Course 40+ video lessons across 6 Modules taught by a top-bucket bulge bracket investment banker... |

$500 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. |

$300 |

Total Value |

$800 |

Consider this your first investment in a long career...

After all, you've likely already spent tens of thousands of dollars on college (and perhaps tens of thousands more on an MBA)...

When you start your coveted finance job, you'll be making well over $200,000...

...over $350,000 if you have an MBA...

And that's just the beginning of a long and very lucrative career that could easily net you millions...

Even at thousands of dollars and your ROI would still be huge…

At a fraction of that price, the ROI is even better... When you do the math, it's a no brainer.

And that doesn't include the time you'd have to spend figuring all of this out and the hours of sleep these courses will save you.

Even if you used the free info online, you'd still have to find it, organize it, vet it and test it to get it to work. That would take months… and at that point, you may have missed your window.

The WSO 13-Week Cash Flow Modeling Course gives you everything you need to be super-efficient in reviewing and preparing a TWCF forecast… quickly and easily.

But we're not going to charge you thousands...

We won't even ask for half of that...

Get Unlimited Lifetime Access To The 13-Week Cash Flow Modeling Course For

This offer (+bonuses) is limited-time only

12 Month Money-Back Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee -- easily the most generous in the market.

If, for any reason (or no reason), you don't think the WSO 13-Week Cash Flow Modeling Course is right for you, just do the following within 365 days of your enrollment:

- Email [email protected] letting us know

- That's it!

We'll refund every penny. No questions asked. We bear the risk and will eat the transaction fees because we're that confident you'll love it.

Course Reviews

Here’s what professionals like you think of the course.

FAQ

Answers to popular questions

About

Top professionals with many years of Bulge Bracket and/or Elite Boutique IB experience

- MBA Students and Business Undergraduates

- Current IB Analysts

- Corporate Finance Professionals

- Anyone trying to break into IB, PE, VC, HF, etc....

- Professionals looking to lateral into high finance

- Taught and vetted by actual industry professionals

- Course content continually reviewed and updated

- Learn to prepare a standard 13-week cash flow model

- Video-based self-study online courses from elite faculty (all current or previous finance professionals from top firms)

- Interactive quizzes

- Gamification to make more engaging

- 24 months elite support

ENQUIRIES

Any other questions?

We’re here to help.

We're confident you'll love the program and happy to answer any questions you have! E-mail [email protected] at any time and we'll get back to you within a few hours.