Cash Flow from Financing Activities

Represents how a company raises capital and handles the return of capital to investors

What is Cash Flow from Financing Activities?

Cash from financing activities represents how a company raises capital and handles the return of capital to investors. Simply put, it monitors the net change in cash related to capital raising and related activities.

Examples of financing-related activities are - borrowing or repayment of the debt, issuing additional stock or buyback of existing stock, and paying dividends to investors. This section is crucial in the statement of cash flows, particularly for large companies, as it reflects significant cash inflows or outflows.

These activities can sometimes offset cash flows from the company's core operations. However, exceptions exist in the statement of cash flow format. For instance, small businesses that do not use leverage or pay dividends to their shareholders do not include cash flow from financing in the cash flow statement.

Investors traditionally examined the income statement and balance sheet for insights into the company's financial health. However, over time, investors have begun to examine each of these statements independently, placing more importance on the cash flow figures.

This increase in the importance of cash flows is primarily due to the increasing use of the discounted cash flow method (DCF) to evaluate companies and assets.

Understanding cash flow enables better comprehension of the business and facilitates informed investment decisions. In simple terms, cash flow statements tell us how efficiently a company converts its profits into real cash.

However, certain industries/companies are not cash-rich; hence, looking at their cash flow statements for investment decisions will not be appropriate. We will cover such companies later in this article.

Key Takeaways

- Cash from financing activities tracks how companies raise capital and handle investor returns, encompassing activities like debt repayment, stock issuance, and dividend payments.

- It is calculated by summing up changes in long-term liabilities and equity, including stock issuance, borrowings, buybacks, and dividend payments.

- It includes activities like issuing stock, buybacks, dividends, borrowings, and debt repayments, each affecting cash flow positively or negatively.

- Analyzing CFF goes beyond positive or negative numbers, examining factors like frequent capital raises, debt servicing, and shareholder returns.

- CFF differs from operating activities (daily business operations) and investing activities (investment-related transactions) by focusing on financing-related transactions.

Formula and Calculation for CFF

Knowing what comprises financing activities is the first step to calculating cash flow from financing activities. A generally followed rule of thumb is that all changes in the long-term liabilities and equity section of the balance sheet are due to financing activities.

For example, repayment or issue of long-term bonds, buyback of shares, and payment of dividends (reduction in retained earnings) are some examples of financing activities.

Exceptions to this rule exist, and it is advisable to exercise proper judgment while classifying cash flows. For example, the deferred tax might be a long-term liability, but taxes, in general, are accounted for under operating activities as they are considered crucial to a company’s operations.

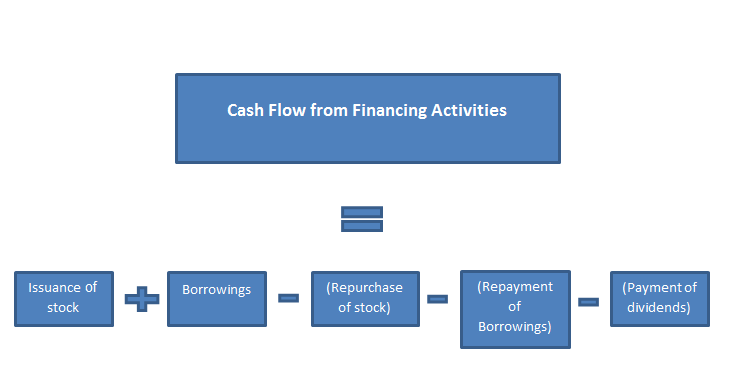

The formula to calculate it is given below:

Cash Flow From Financing Activities = Issuance of Stock + Borrowings - Repurchase of Stock - Repayment of Borrowings - Payment of Dividends

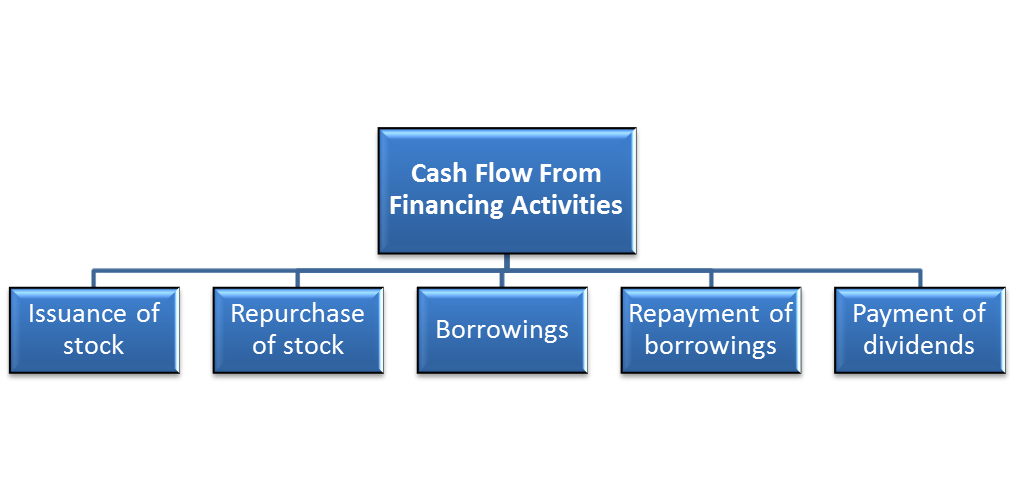

What’s Included in Cash Flow from Financing Activities?

CFF has various line items presented under it; to comprehensively understand the entire concept, we will have to study each line item.

| Activity | Description | Cash Effect |

|---|---|---|

| Issuance of stock | Companies issue additional stock/shares to receive cash from investors. Reasons include business expansion or debt repayment. Considered a positive change. | Positive inflow |

| Buyback/Repurchase | Companies use cash to repurchase shares from the market, typically to reduce dilution, signal confidence, or due to undervaluation. Considered a cash outflow. | Negative outflow |

| Dividends | Companies distribute surplus cash to shareholders as dividends, providing an incentive to hold shares. Considered a cash outflow. | Negative outflow |

| Borrowings | Companies borrow to finance various activities like working capital or capital expenditures, resulting in cash inflow. | Positive inflow |

| Repayment of borrowings | Surplus cash or healthy cash flow prompts companies to repay debt, involving cash outflow. | Negative outflow |

Example of Cash Flow from Financing Activities

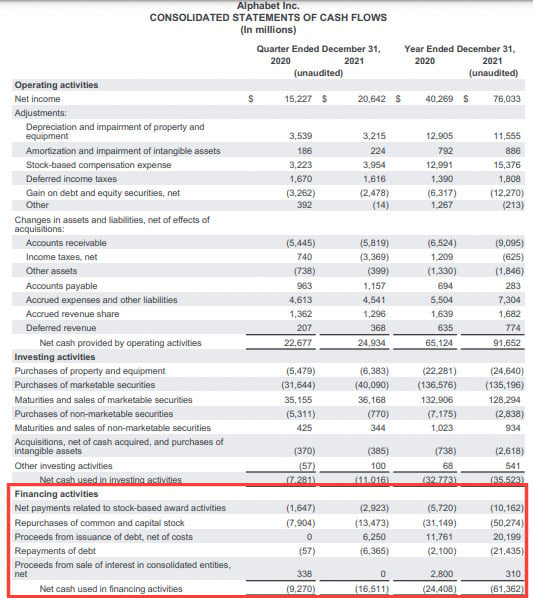

The following is an example from Alphabet’s 2021 annual report. The highlighted region is where you would find the cash flow from financing activities.

Alphabet’s cash flow statement shows a net cash outflow due to the company’s financing activities. The primary reason is that it spent a lot of cash on repurchasing its shares and repaying debt, which was not fully offset by the cash inflow from borrowings.

However, these figures in isolation mean nothing; it is crucial for investors to first look at the trend of cash flows by comparing it with cash flow statements of previous years.

Second, one has to analyze the transactions that lead to these cash flows, as they provide us with a better understanding of the underlying operations.

Example 2

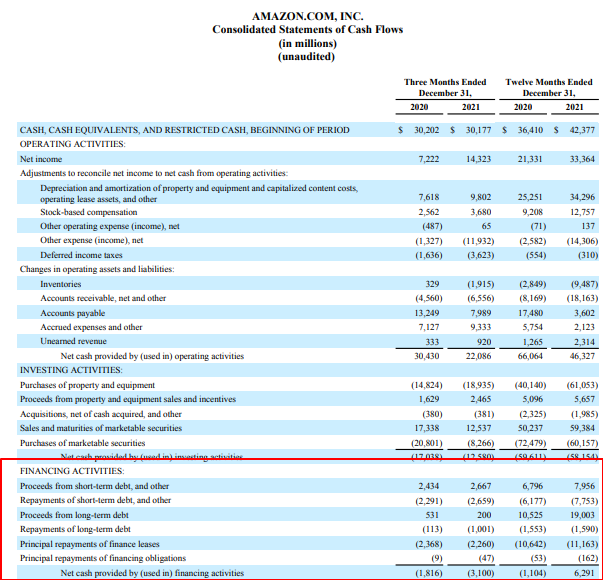

Let us take another example from a company that belongs to a completely different industry.

Amazon’s cash flow from financing activities looks significantly different than that of Alphabet. Here are some observations from its annual financial report (10-K):

- Amazon has been raising money recently by taking on short-term debt. This has resulted in an inflow of cash into the company

- Interestingly, it has also paid most of its short-term borrowings, which is a healthy sign. However, this has led to an outflow of cash from financing activities

- It has spent a lot of cash on repaying the principal amount of financial leases. This is a type of lease where a financial institution has legal control over a specific asset while the lessee company enjoys operating control of the asset

- It has shown a net positive cash flow from financing activities in fiscal year 2021, unlike the previous fiscal year, where there was a net outflow

While these two companies belong to two entirely different industries, the calculation and categorization of these cash flows remain the same.

Note

It must be noted that the cash flows must be interpreted differently for companies that operate in various industries.

Interpreting Cash Flows From Financing Activities

The net change in cash flow from financing activities of a company may either be positive or negative depending on various factors. However, one must look beyond whether the number is positive or negative, as various factors might lead to the final cash flow. Let us understand this in detail.

A company that frequently raises capital through debt or equity might show a positive cash flow from financing. However, this might indicate that the company's earnings are insufficient to support its operations or other plans.

Additionally, there might be cases where financial institutions (creditors) raise interest rates, resulting in higher debt-servicing charges for the company, which may not be adequately reflected in the financing activities section of the cash flow statement.

Another concerning indicator would be if the company consistently repurchases shares or pays dividends to its shareholders despite not generating sufficient profit. Companies make these attempts to keep their stock price intact.

Hence, investors should thoroughly investigate any significant changes in cash flow from financing.

Note

it is essential to check the other sections of the cash flow statement, such as cash flow from operating and investing activities, as these also depict a company's financial health.

Another crucial consideration in analyzing cash flows from financing is the frequency of cash inflows across various timeframes.

This is to understand if a company has been issuing additional stocks or borrowing from debtors frequently, which will result in a high cash inflow. However, this is a major red flag, implying that the firm cannot generate sufficient earnings to finance its core operations.

Therefore, investors must study the reasons behind unusual inflows or outflows of cash from financing activities.

CFF Vs. Other Types Of Cash Flows

There are typically three types of cash flows presented in a cash flow statement:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

Having talked about the financing activities, let us see how they differ from the other two.

A company's cash flow statement often presents cash flow from operating activities. It tracks the change in cash related to the daily operations of a business, such as - manufacturing, selling a good or service, etc., therefore focusing only on the core activities.

On the other hand, cash flow from investing activities presents the cash generated or used in investment-related activities of a business. These activities include purchasing or selling fixed assets (also known as capex), acquiring or selling other businesses, and buying or selling marketable securities.

The differences between them can be summarized as follows:

| Type Of Cash Flow | Description |

|---|---|

| Operating Activities | Tracks the change in cash related to the daily operations of a business, such as manufacturing, selling goods or services, payment collection. |

| Investing Activities | Presents the cash generated or used in investment-related activities, such as purchasing or selling fixed assets, acquiring or selling businesses. |

| Financing Activities | Focuses on transactions such as issuance or buyback of stocks, payment of cash dividends, borrowing or repayment of borrowings. |

Researched and authored by Aditya Das | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?